UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: February 11, 2016

NATIONAL RETAIL PROPERTIES, INC.

(exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Maryland | | 001-11290 | | 56-1431377 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employment Identification No.) |

450 South Orange Avenue, Suite 900, Orlando, Florida 32801

(Address of principal executive offices, including zip code)

(407) 265-7348

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

On February 11, 2016, National Retail Properties, Inc. (the "Company"), issued a press release announcing its results of operations and financial condition for the quarter and year ended December 31, 2015. The press release is attached hereto as Exhibit 99.1 to this report and the supplemental data is attached hereto as Exhibit 99.2 to this report. The press release and the supplemental data are available on the Company's website.

The information in this Form 8-K is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of such section, nor shall such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

|

| | | |

| | |

99.1 |

| | Press Release, dated February 11, 2016, of National Retail Properties, Inc. |

99.2 |

| | Supplemental Data for the quarter and year ended December 31, 2015, of National Retail Properties, Inc. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | National Retail Properties, Inc. |

| | |

Dated: February 11, 2016 | | By: | | /s/ Kevin B. Habicht |

| | | | Kevin B. Habicht |

| | | | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | | |

| | |

Exhibit No. | | Description |

| |

99.1 |

| | Press Release, dated February 11, 2016, of National Retail Properties, Inc. |

99.2 |

| | Supplemental Data, dated February 11, 2016, of National Retail Properties, Inc. |

NEWS RELEASE

For information contact:

Kevin B. Habicht

Chief Financial Officer

(407) 265-7348 FOR IMMEDIATE RELEASE

February 11, 2016

RECORD ANNUAL RESULTS AND INCREASED 2016 GUIDANCE

ANNOUNCED BY NATIONAL RETAIL PROPERTIES, INC.

Orlando, Florida, February 11, 2016 – National Retail Properties, Inc. (NYSE: NNN), a real estate investment trust, today announced operating results for the quarter and year ended December 31, 2015. Highlights include:

Operating Results:

| |

• | Revenues and net earnings, FFO, Recurring FFO and AFFO available to common stockholders and diluted per share amounts: |

|

| | | | | | | | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (in thousands, except per share data) |

Revenues | $ | 126,377 |

| | $ | 115,315 |

| | $ | 482,914 |

| | $ | 434,847 |

|

| | | | | | | |

Net earnings available to common stockholders | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

Net earnings per common share | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.20 |

| | $ | 1.24 |

|

| | | | | | | |

FFO available to common stockholders | $ | 67,319 |

| | $ | 72,202 |

| | $ | 289,193 |

| | $ | 260,902 |

|

FFO per common share | $ | 0.49 |

| | $ | 0.56 |

| | $ | 2.15 |

| | $ | 2.09 |

|

| | | | | | | |

Recurring FFO available to common stockholders | $ | 76,661 |

| | $ | 70,410 |

| | $ | 299,171 |

| | $ | 259,366 |

|

Recurring FFO per common share | $ | 0.56 |

| | $ | 0.55 |

| | $ | 2.22 |

| | $ | 2.08 |

|

| | | | | | | |

AFFO available to common stockholders | $ | 77,953 |

| | $ | 71,895 |

| | $ | 304,772 |

| | $ | 263,968 |

|

AFFO per common share | $ | 0.57 |

| | $ | 0.56 |

| | $ | 2.27 |

| | $ | 2.12 |

|

| |

• | Portfolio occupancy was 99.1% at December 31, 2015 and September 30, 2015, as compared to 98.6% at December 31, 2014 |

2015 Highlights:

| |

• | Increased annual Recurring FFO per common share 6.7% |

| |

• | Increased annual AFFO per common share 7.1% |

| |

• | Dividend yield of 4.3% at December 31, 2015 |

| |

• | Dividends per common share increased to $1.71 marking the 26th consecutive year of annual dividend increases - making the company one of only four equity REITs and one of only 99 public companies with 26 or more consecutive annual dividend increases |

| |

• | Maintained high occupancy levels above 98.5% for the entire year with a weighted average remaining lease term of 11.4 years |

2015 Highlights (continued):

| |

• | Invested $726.3 million in 221 properties with an aggregate gross leasable area of approximately 2,706,000 square feet at an initial cash yield of 7.2% |

| |

• | Sold 19 properties for $39.1 million, producing $10.4 million of gains on sale, net of income tax and noncontrolling interest at a cap rate of 5.9% |

| |

• | Raised $723.6 million of new long-term capital at attractive pricing |

| |

◦ | Raised $328.2 million in net proceeds from the issuance of 8,770,117 common shares |

| |

◦ | Raised $395.4 million in net proceeds from the issuance of 4.00% senior unsecured notes due 2025 |

| |

• | Paid off $150 million principal amount of 6.15% senior unsecured notes due 2015 |

| |

• | Full $650 million availability on bank credit facility at December 31, 2015 |

| |

• | 99.2% of properties are unencumbered with secured mortgage debt |

| |

• | Total shareholder return of 6.4% for 2015 exceeds peers, industry averages and general equity averages |

| |

• | Total average annual shareholder return of 14.8% over the past 25 years exceeds peers, industry averages and general equity averages |

Selected Highlights for the quarter ended December 31, 2015:

| |

◦ | $159.5 million in property investments, including the acquisition of 31 properties with an aggregate gross leasable area of approximately 524,000 square feet at an initial cash yield of 7.3% |

| |

◦ | Five properties sold with net proceeds of $5.5 million, producing $1.3 million of gains on sales, net of income tax at a cap rate of 8.4% |

| |

◦ | Raised $202.6 million in net proceeds from the issuance of 5,517,001 common shares |

| |

◦ | Raised $395.4 million in net proceeds from the issuance of 4.00% senior unsecured notes due 2025 |

| |

• | Revoked taxable REIT subsidiary status for certain subsidiaries, which resulted in a one-time non-cash charge of $9.6 million, with projected future annual income tax expense savings |

FFO guidance for 2016 was increased from a range of $2.28 to $2.34 to a range of $2.29 to $2.35 per share before any impairment expense. The 2016 AFFO is estimated to be $2.34 to $2.40 per share. The FFO guidance equates to net earnings before any gains or losses from the sale of real estate of $1.31 to $1.37 per share, plus $0.98 per share of expected real estate depreciation, amortization and impairments. The guidance is based on current plans and assumptions and subject to risks and uncertainties more fully described in this press release and the company's reports filed with the Securities and Exchange Commission.

Craig Macnab, Chief Executive Officer, commented: "2015 was another terrific year for National Retail Properties. For the past four years, we have grown recurring FFO per share by 9.0% per annum. Over the same timeframe, we have simultaneously strengthened our balance sheet and decreased our use of debt. With our fortress-like balance sheet and our differentiated ability to source retail properties that meet our underwriting and yield standards, I am optimistic that 2016 will be another stellar year for NNN."

National Retail Properties invests primarily in high-quality retail properties subject generally to long-term, net leases. As of December 31, 2015, the company owned 2,257 properties in 47 states with a gross leasable area of approximately 25.0 million square feet and with a weighted average remaining lease term of 11.4 years. For more information on the company, visit www.nnnreit.com.

Management will hold a conference call on February 11, 2016, at 10:30 a.m. ET to review these results. The call can be accessed on the National Retail Properties web site live at http://www.nnnreit.com. For those unable to listen to the live broadcast, a replay will be available on the company’s web site. In addition, a summary of any earnings guidance given on the call will be posted to the company’s web site.

Statements in this press release that are not strictly historical are “forward-looking” statements. These statements generally are

characterized by the use of terms such as "believe," "expect," "intend," "may," "estimated," or other similar words or expressions. Forward-looking statements involve known and unknown risks, which may cause the company’s actual future results to differ materially from expected results. These risks include, among others, general economic conditions, local real estate conditions, changes in interest rates, increases in operating costs, the preferences and financial condition of the company's tenants, the availability of capital, risks related to the company's status as a REIT and the profitability of the company’s taxable subsidiary. Additional information concerning these and other factors that could cause actual results to differ materially from these forward-looking statements is contained from time to time in the company’s

Securities and Exchange Commission (the “Commission”) filings, including, but not limited to, the company’s Annual Report on Form 10-K. Copies of each filing may be obtained from the company or the Commission. Such forward-looking statements should be regarded solely as reflections of the company’s current operating plans and estimates. Actual operating results may differ materially from what is expressed or forecast in this press release. National Retail Properties, Inc. undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

The reported results are preliminary and not final and there can be no assurance that the results will not vary from the final information filed on Form 10-K with the Commission for the quarter and year ended December 31, 2015. In the opinion of management, all adjustments considered necessary for a fair presentation of these reported results have been made.

Funds From Operations, commonly referred to as FFO, is a relative non-GAAP financial measure of operating performance of an equity REIT in order to recognize that income-producing real estate historically has not depreciated on the basis determined under GAAP. FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) and is used by the company as follows: net earnings (computed in accordance with GAAP) plus depreciation and amortization of assets unique to the real estate industry, excluding gains (or including losses), any applicable taxes and noncontrolling interests on the disposition of certain assets, the company’s share of these items from the company’s unconsolidated partnerships and any impairment charges on a depreciable real estate asset.

FFO is generally considered by industry analysts to be the most appropriate measure of performance of real estate companies. FFO does not necessarily represent cash provided by operating activities in accordance with GAAP and should not be considered an alternative to net earnings as an indication of the company’s performance or to cash flow as a measure of liquidity or ability to make distributions. Management considers FFO an appropriate measure of performance of an equity REIT because it primarily excludes the assumption that the value of the real estate assets diminishes predictably over time, and because industry analysts have accepted it as a performance measure. The company’s computation of FFO may differ from the methodology for calculating FFO used by other equity REITs, and therefore, may not be comparable to such other REITs. A reconciliation of net earnings (computed in accordance with GAAP) to FFO, as defined by NAREIT, is included in the financial information accompanying this release.

Adjusted Funds From Operations (“AFFO”) is a non-GAAP financial measure of operating performance used by many companies in the REIT industry. AFFO adjusts FFO for certain non-cash items that reduce or increase net income in accordance with GAAP. AFFO should not be considered an alternative to net earnings as an indication of the company's performance or to cash flow as a measure of liquidity or ability to make distributions. Management considers AFFO a useful supplemental measure of the company’s performance.

The company’s computation of AFFO may differ from the methodology for calculating AFFO used by other equity REITs, and therefore, may not be comparable to such other REITs. A reconciliation of net earnings (computed in accordance with GAAP) to AFFO is included in the financial information accompanying this release.

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Income Statement Summary | | | | | | | | |

| | | | | | | | |

Revenues: | | | | | | | | |

Rental and earned income | | $ | 121,106 |

| | $ | 110,248 |

| | $ | 465,282 |

| | $ | 416,842 |

|

Real estate expense reimbursement from tenants | | 4,561 |

| | 4,093 |

| | 14,868 |

| | 13,875 |

|

Interest and other income from real estate transactions | | 264 |

| | 510 |

| | 986 |

| | 2,296 |

|

Interest income on commercial mortgage residual interests | | 446 |

| | 464 |

| | 1,778 |

| | 1,834 |

|

| | 126,377 |

| | 115,315 |

| | 482,914 |

| | 434,847 |

|

| | | | | | | | |

Operating expenses: | | | | | | | | |

General and administrative | | 9,657 |

| | 7,712 |

| | 34,736 |

| | 32,518 |

|

Real estate | | 5,575 |

| | 5,236 |

| | 19,774 |

| | 18,905 |

|

Depreciation and amortization | | 34,848 |

| | 30,376 |

| | 134,798 |

| | 116,162 |

|

Impairment – commercial mortgage residual interests valuation | | 51 |

| | — |

| | 531 |

| | 256 |

|

Impairment losses and other charges, net of recoveries | | 708 |

| | 198 |

| | 4,420 |

| | 760 |

|

| | 50,839 |

| | 43,522 |

| | 194,259 |

| | 168,601 |

|

| | | | | | | | |

Other expenses (revenues): | | | | | | | | |

Interest and other income | | (42 | ) | | (113 | ) | | (109 | ) | | (357 | ) |

Interest expense | | 24,548 |

| | 21,830 |

| | 90,008 |

| | 85,510 |

|

Real estate acquisition costs | | 33 |

| | 202 |

| | 927 |

| | 1,391 |

|

| | 24,539 |

| | 21,919 |

| | 90,826 |

| | 86,544 |

|

| | | | | | | | |

Income tax benefit (expense) | | (9,827 | ) | | 797 |

| | (10,318 | ) | | 75 |

|

| | | | | | | | |

Earnings from continuing operations | | 41,172 |

| | 50,671 |

| | 187,511 |

| | 179,777 |

|

| | | | | | | | |

Earnings from discontinued operations, net of income tax expense | | — |

| | — |

| | — |

| | 124 |

|

| | | | | | | | |

Earnings before gain on disposition of real estate, net of income tax expense | | 41,172 |

| | 50,671 |

| | 187,511 |

| | 179,901 |

|

| | | | | | | | |

Gain on disposition of real estate, net of income tax expense | | 1,305 |

| | 3,103 |

| | 10,450 |

| | 11,269 |

|

| | | | | | | | |

Earnings including noncontrolling interests | | 42,477 |

| | 53,774 |

| | 197,961 |

| | 191,170 |

|

| | | | | | | | |

Earnings from continuing operations attributable to noncontrolling interests: | | (6 | ) | | (17 | ) | | (125 | ) | | (569 | ) |

| | | | | | | | |

Net earnings attributable to NNN | | 42,471 |

| | 53,757 |

| | 197,836 |

| | 190,601 |

|

Series D preferred stock dividends | | (4,762 | ) | | (4,762 | ) | | (19,047 | ) | | (19,047 | ) |

Series E preferred stock dividends | | (4,097 | ) | | (4,097 | ) | | (16,387 | ) | | (16,387 | ) |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | |

Basic | | 137,111 |

| | 128,332 |

| | 133,999 |

| | 124,258 |

|

Diluted | | 137,623 |

| | 128,813 |

| | 134,489 |

| | 124,710 |

|

| | | | | | | | |

Net earnings per share available to common stockholders: | | | | | | | | |

Basic: | | | | | | | | |

Continuing operations | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.21 |

| | $ | 1.24 |

|

Net earnings | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.21 |

| | $ | 1.24 |

|

| | | | | | | | |

Diluted: | | | | | | | | |

Continuing operations | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.20 |

| | $ | 1.24 |

|

Net earnings | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.20 |

| | $ | 1.24 |

|

| | | | | | | | |

| | | | | | | | |

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Funds From Operations (FFO) Reconciliation: | | | | | | | | |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

Real estate depreciation and amortization: | | | | | | | | |

Continuing operations | | 34,754 |

| | 30,284 |

| | 134,380 |

| | 115,888 |

|

Discontinued operations | | — |

| | — |

| | — |

| | 3 |

|

Gain on disposition of real estate, net of income tax and noncontrolling interest | | (1,305 | ) | | (3,103 | ) | | (10,397 | ) | | (10,904 | ) |

Impairment losses – depreciable real estate, net of recoveries and income tax | | 258 |

| | 123 |

| | 2,808 |

| | 748 |

|

Total FFO adjustments | | 33,707 |

| | 27,304 |

| | 126,791 |

| | 105,735 |

|

FFO available to common stockholders | | $ | 67,319 |

| | $ | 72,202 |

| | $ | 289,193 |

| | $ | 260,902 |

|

| | | | | | | | |

FFO per common share: | | | | | | | | |

Basic | | $ | 0.49 |

| | $ | 0.56 |

| | $ | 2.16 |

| | $ | 2.10 |

|

Diluted | | $ | 0.49 |

| | $ | 0.56 |

| | $ | 2.15 |

| | $ | 2.09 |

|

| | | | | | | | |

Recurring Funds from Operations Reconciliation: | | | | | | | | |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

Total FFO adjustments | | 33,707 |

| | 27,304 |

| | 126,791 |

| | 105,735 |

|

FFO available to common stockholders | | 67,319 |

| | 72,202 |

| | 289,193 |

| | 260,902 |

|

| | | | | | | | |

Impairment – commercial mortgage residual interests valuation | | 51 |

| | — |

| | 531 |

| | 256 |

|

Impairment losses – non-depreciable real estate | | — |

| | — |

| | 156 |

| | — |

|

Income tax benefit | | (316 | ) | | (1,792 | ) | | (316 | ) | | (1,792 | ) |

Taxable REIT subsidiary revocation election | | 9,607 |

| | — |

| | 9,607 |

| | — |

|

Total Recurring FFO adjustments | | 9,342 |

| | (1,792 | ) | | 9,978 |

| | (1,536 | ) |

Recurring FFO available to common stockholders | | $ | 76,661 |

| | $ | 70,410 |

| | $ | 299,171 |

| | $ | 259,366 |

|

| | | | | | | | |

Recurring FFO per common share: | | | | | | | | |

Basic | | $ | 0.56 |

| | $ | 0.55 |

| | $ | 2.23 |

| | $ | 2.09 |

|

Diluted | | $ | 0.56 |

| | $ | 0.55 |

| | $ | 2.22 |

| | $ | 2.08 |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Adjusted Funds From Operations (AFFO) Reconciliation: | | | | | | | | |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

Total FFO adjustments | | 33,707 |

| | 27,304 |

| | 126,791 |

| | 105,735 |

|

Total Recurring FFO adjustments | | 9,342 |

| | (1,792 | ) | | 9,978 |

| | (1,536 | ) |

Recurring FFO available to common stockholders | | 76,661 |

| | 70,410 |

| | 299,171 |

| | 259,366 |

|

| | | | | | | | |

Straight-line accrued rent | | (529 | ) | | (318 | ) | | (368 | ) | | (1,731 | ) |

Net capital lease rent adjustment | | 331 |

| | 356 |

| | 1,277 |

| | 1,369 |

|

Below market rent amortization | | (671 | ) | | (692 | ) | | (3,046 | ) | | (2,631 | ) |

Stock based compensation expense | | 2,461 |

| | 2,450 |

| | 9,671 |

| | 9,224 |

|

Capitalized interest expense | | (750 | ) | | (311 | ) | | (2,383 | ) | | (1,629 | ) |

Loss on sale of mortgage receivable | | 450 |

| | — |

| | 450 |

| | — |

|

Total AFFO adjustments | | 1,292 |

| | 1,485 |

| | 5,601 |

| | 4,602 |

|

AFFO available to common stockholders | | $ | 77,953 |

| | $ | 71,895 |

| | $ | 304,772 |

| | $ | 263,968 |

|

| | | | | | | | |

AFFO per common share: | | | | | | | | |

Basic | | $ | 0.57 |

| | $ | 0.56 |

| | $ | 2.27 |

| | $ | 2.12 |

|

Diluted | | $ | 0.57 |

| | $ | 0.56 |

| | $ | 2.27 |

| | $ | 2.12 |

|

| | | | | | | | |

Other Information: | | | | | | | | |

Percentage rent | | $ | 802 |

| | $ | 585 |

| | $ | 1,430 |

| | $ | 1,074 |

|

Amortization of debt costs | | $ | 773 |

| | $ | 716 |

| | $ | 2,915 |

| | $ | 2,782 |

|

Scheduled debt principal amortization (excluding maturities) | | $ | 378 |

| | $ | 326 |

| | $ | 1,587 |

| | $ | 1,151 |

|

Non-real estate depreciation expense | | $ | 77 |

| | $ | 98 |

| | $ | 418 |

| | $ | 297 |

|

National Retail Properties, Inc. (in thousands) (unaudited)

|

| | | | | | | | |

| | December 31, 2015 | | December 31, 2014 |

Balance Sheet Summary | | | | |

| | | | |

Assets: | | | | |

Cash and cash equivalents | | $ | 14,260 |

| | $ | 10,604 |

|

Receivables, net of allowance | | 3,344 |

| | 3,013 |

|

Mortgages, notes and accrued interest receivable, net of allowance | | 8,688 |

| | 11,075 |

|

Real estate: | | | | |

Accounted for using the operating method, net of accumulated depreciation and amortization | | 5,256,274 |

| | 4,685,001 |

|

Accounted for using the direct financing method | | 14,518 |

| | 16,974 |

|

Real estate held for sale | | 32,666 |

| | 38,074 |

|

Commercial mortgage residual interests | | 11,115 |

| | 11,626 |

|

Accrued rental income, net of allowance | | 25,529 |

| | 25,659 |

|

Debt costs, net of accumulated amortization | | 4,003 |

| | 5,290 |

|

Other assets | | 89,647 |

| | 108,235 |

|

Total assets | | $ | 5,460,044 |

| | $ | 4,915,551 |

|

| | | | |

Liabilities: | | | | |

Mortgages payable, including unamortized premium and net of unamortized debt cost | | 23,964 |

| | 26,182 |

|

Notes payable, net of unamortized discount and unamortized debt costs | | 1,951,980 |

| | 1,703,709 |

|

Accrued interest payable | | 20,113 |

| | 17,396 |

|

Other liabilities | | 121,594 |

| | 85,172 |

|

Total liabilities | | 2,117,651 |

| | 1,832,459 |

|

| | | | |

Stockholders’ equity of NNN | | 3,342,134 |

| | 3,082,515 |

|

Noncontrolling interests | | 259 |

| | 577 |

|

Total equity | | 3,342,393 |

| | 3,083,092 |

|

| | | | |

Total liabilities and equity | | $ | 5,460,044 |

| | $ | 4,915,551 |

|

| | | | |

Common shares outstanding | | 141,008 |

| | 132,010 |

|

| | | | |

Gross leasable area, Property Portfolio (square feet) | | 24,964 |

| | 22,479 |

|

| | | | |

|

| | | | | | | | | | | | | | |

National Retail Properties, Inc Debt Summary As of December 31, 2015 (in thousands) (unaudited) |

Unsecured Debt | | Principal | | Principal, Net of Unamortized Discount | | Stated Rate | | Effective Rate | | Maturity Date |

Line of credit payable | | $ | — |

| | $ | — |

| | L + 92.5 bps | | — | | January 2019 |

| | | | | | | | | | |

Unsecured notes payable: | | | | | | | | | | |

| | | | | | | | | | |

2017 | | 250,000 |

| | 249,796 |

| | 6.875% | | 6.924% | | October 2017 |

2021 | | 300,000 |

| | 297,344 |

| | 5.500% | | 5.689% | | July 2021 |

2022 | | 325,000 |

| | 321,452 |

| | 3.800% | | 3.985% | | October 2022 |

2023 | | 350,000 |

| | 348,025 |

| | 3.300% | | 3.388% | | April 2023 |

2024 | | 350,000 |

| | 349,389 |

| | 3.900% | | 3.924% | | June 2024 |

2025 | | 400,000 |

| | 399,052 |

| | 4.000% | | 4.029% | | November 2025 |

Total | | 1,975,000 |

| | 1,965,058 |

| | | | | | |

| | | | | | | | | | |

Total unsecured debt (1) | | $ | 1,975,000 |

| | $ | 1,965,058 |

| | | | | | |

| | | | | | | | | | |

Debt costs | | (19,100 | ) | | | | | | |

Accumulated amortization | | 6,022 |

| | | | | | |

Debt costs, net of accumulated amortization | | (13,078 | ) | | | | | | |

Notes payable, net of unamortized discount and unamortized debt costs | | $ | 1,951,980 |

| | | | | | |

| | | | | | | | | | |

(1) Unsecured notes payable have a weighted average interest rate of 4.5% and a weighted average maturity of 7 years |

|

| | | | | | | | |

Mortgages Payable | | Principal Balance | | Interest Rate | | Maturity Date |

Mortgage(1) | | $ | 14,555 |

| | 5.230% | | July 2023 |

Mortgage(1) | | 5,890 |

| | 5.750% | | April 2016 |

Mortgage(1) | | 2,804 |

| | 6.400% | | February 2017 |

Mortgage | | 848 |

| | 6.900% | | January 2017 |

| | 24,097 |

| (2) | | | |

|

Debt costs | | (226 | ) | | | | |

Accumulated amortization | | 93 |

| | | | |

Debt costs, net of accumulated amortization | | (133 | ) | | | | |

Mortgages payable, including unamortized premium and net of unamortized debt costs | | $ | 23,964 |

| | | | |

| | | | | | |

(1) Includes unamortized premium | | | | | | |

(2) Mortgages payable have a weighted average interest rate of 5.4% and a weighted average maturity of 5 years |

National Retail Properties, Inc.

Property Portfolio

Top 20 Lines of Trade

|

| | | | | | | | |

| | | | As of December 31, |

| | Line of Trade | | 2015(1) | | 2014(2) |

1. | | Convenience stores | | 16.7 | % | | 18.0 | % |

2. | | Restaurants - full service | | 11.0 | % | | 9.1 | % |

3. | | Restaurants - limited service | | 7.2 | % | | 6.5 | % |

4. | | Automotive service | | 7.0 | % | | 7.2 | % |

5. | | Family entertainment centers | | 5.6 | % | | 5.1 | % |

6. | | Theaters | | 5.2 | % | | 5.2 | % |

7. | | Automotive parts | | 4.2 | % | | 4.7 | % |

8. | | Health and fitness | | 3.8 | % | | 3.9 | % |

9. | | Recreational vehicle dealers, parts and accessories | | 3.6 | % | | 3.1 | % |

10. | | Banks | | 3.4 | % | | 3.7 | % |

11. | | Sporting goods | | 3.3 | % | | 3.5 | % |

12. | | Wholesale clubs | | 2.6 | % | | 2.9 | % |

13. | | Drug stores | | 2.3 | % | | 2.5 | % |

14. | | Consumer electronics | | 2.2 | % | | 2.4 | % |

15. | | Medical service providers | | 2.2 | % | | 2.0 | % |

16. | | Travel plazas | | 2.1 | % | | 2.3 | % |

17. | | General merchandise | | 1.9 | % | | 1.6 | % |

18. | | Home furnishings | | 1.9 | % | | 1.9 | % |

19. | | Home improvement | | 1.8 | % | | 2.1 | % |

20. | | Grocery | | 1.7 | % | | 1.6 | % |

| | Other | | 10.3 | % | | 10.7 | % |

| | Total | | 100.0 | % | | 100.0 | % |

Top 10 States

|

| | | | | | | | | | | | |

| State | | | % of Total(1) | | | State | | | % of Total(1) |

1. | Texas | | | 19.7 | % | | 6. | Georgia | | | 4.5 | % |

2. | Florida | | | 9.3 | % | | 7. | Virginia | | | 3.8 | % |

3. | Ohio | | | 5.2 | % | | 8. | Indiana | | | 3.8 | % |

4. | North Carolina | | | 5.2 | % | | 9. | Alabama | | | 3.2 | % |

5. | Illinois | | | 4.9 | % | | 10. | Tennessee | | | 3.0 | % |

| |

(1) | Based on the annualized base rent for all leases in place as of December 31, 2015. |

| |

(2) | Based on the annualized base rent for all leases in place as of December 31, 2014. |

National Retail Properties, Inc.

Property Portfolio

Top Tenants (>2.0%)

|

| | | | | |

| | | Properties | | % of Total (1) |

| Sunoco | | 125 | | 5.9% |

| Mister Car Wash | | 90 | | 4.4% |

| LA Fitness | | 25 | | 3.7% |

| Couche-Tard (Pantry) | | 86 | | 3.6% |

| Camping World | | 32 | | 3.6% |

| 7-Eleven | | 77 | | 3.5% |

| SunTrust | | 121 | | 3.3% |

| AMC Theatre | | 16 | | 3.0% |

| Chuck E. Cheese's | | 53 | | 2.7% |

| BJ's Wholesale Club | | 7 | | 2.6% |

| Frisch's Restaurant | | 74 | | 2.4% |

| Gander Mountain | | 12 | | 2.4% |

| Bell American (Taco Bell) | | 78 | | 2.2% |

| Best Buy | | 19 | | 2.1% |

| | | | | |

Lease Expirations(2)

|

| | | | | | | | | | | | | | | | |

| | % of

Total(1) | | # of

Properties | | Gross Leasable

Area (3) | | | | % of

Total(1) | | # of

Properties | | Gross Leasable Area (3) |

2016 | | 1.0% | | 27 | | 363,000 |

| | 2022 | | 5.6% | | 96 | | 1,143,000 |

|

2017 | | 3.0% | | 52 | | 1,084,000 |

| | 2023 | | 2.5% | | 55 | | 903,000 |

|

2018 | | 6.3% | | 183 | | 1,645,000 |

| | 2024 | | 2.6% | | 49 | | 767,000 |

|

2019 | | 3.4% | | 80 | | 1,109,000 |

| | 2025 | | 5.3% | | 132 | | 996,000 |

|

2020 | | 4.3% | | 137 | | 1,550,000 |

| | 2026 | | 5.8% | | 162 | | 1,624,000 |

|

2021 | | 4.7% | | 116 | | 1,271,000 |

| | Thereafter | | 55.5% | | 1,140 | | 12,089,000 |

|

| |

(1) | Based on the annual base rent of $487,410,000, which is the annualized base rent for all leases in place as of December 31, 2015. |

| |

(2) | As of December 31, 2015, the weighted average remaining lease term is 11.4 years. |

Exhibit 99.2

ANNUAL SUPPLEMENTAL DATA

As of December 31, 2015

TABLE OF CONTENTS

|

| |

| PAGE REFERENCE |

Financial Summary | |

Income Statement Summary | |

Funds From Operations (FFO) | |

Recurring Funds From Operation | |

Adjusted Funds From Operations (AFFO) | |

Other Information | |

Balance Sheet | |

Debt Summary | |

Credit Metrics | |

Credit Facility and Note Covenants | |

Long-Term Dividend History | |

Transaction Summary | |

Property Acquisitions | |

Property Dispositions | |

Property Portfolio | |

Lease Expirations | |

Top 20 Lines of Trade | |

Top 10 States | |

Portfolio By Region | |

Top Tenants | |

Same Store Rental Income | |

Leasing Data | |

Other Property Portfolio Data | |

Earnings Guidance | |

Statements in this supplemental that are not strictly historical are “forward-looking” statements. These statements generally are characterized by the use of terms such as "believe," "expect," "intend," "may," "estimated," or other similar words or expressions. Forward-looking statements involve known and unknown risks, which may cause the company’s actual future results to differ materially from expected results. These risks include, among others, general economic conditions, local real estate conditions, changes in interest rates, increases in operating costs, the preferences and financial condition of the company's tenants, the availability of capital, risks related to the company's status as a REIT and the profitability of the company’s taxable subsidiary. Additional information concerning these and other factors that could cause actual results to differ materially from these forward-looking statements is contained from time to time in the company’s Securities and Exchange Commission (the “Commission”) filings, including, but not limited to, the company’s Annual Report on Form 10-K. Copies of each filing may be obtained from the company or the Commission. Such forward-looking statements should be regarded solely as reflections of the company’s current operating plans and estimates. Actual operating results may differ materially from what is expressed or forecast in this press release. National Retail Properties, Inc. undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

|

| | | | | | | | | | | | | | | | |

INCOME STATEMENT SUMMARY |

(in thousands, except per share data) |

(unaudited) |

| | | | |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | | |

Rental and earned income | | $ | 121,106 |

| | $ | 110,248 |

| | $ | 465,282 |

| | $ | 416,842 |

|

Real estate expense reimbursement from tenants | | 4,561 |

| | 4,093 |

| | 14,868 |

| | 13,875 |

|

Interest and other income from real estate transactions | | 264 |

| | 510 |

| | 986 |

| | 2,296 |

|

Interest income on commercial mortgage residual interests | | 446 |

| | 464 |

| | 1,778 |

| | 1,834 |

|

| | 126,377 |

| | 115,315 |

| | 482,914 |

| | 434,847 |

|

| | | | | | | | |

Operating expenses: | | | | | | | | |

General and administrative | | 9,657 |

| | 7,712 |

| | 34,736 |

| | 32,518 |

|

Real estate | | 5,575 |

| | 5,236 |

| | 19,774 |

| | 18,905 |

|

Depreciation and amortization | | 34,848 |

| | 30,376 |

| | 134,798 |

| | 116,162 |

|

Impairment – commercial mortgage residual interests valuation | | 51 |

| | — |

| | 531 |

| | 256 |

|

Impairment losses and other charges, net of recoveries | | 708 |

| | 198 |

| | 4,420 |

| | 760 |

|

| | 50,839 |

| | 43,522 |

| | 194,259 |

| | 168,601 |

|

| | | | | | | | |

Other expenses (revenues): | | | | | | | | |

Interest and other income | | (42 | ) | | (113 | ) | | (109 | ) | | (357 | ) |

Interest expense | | 24,548 |

| | 21,830 |

| | 90,008 |

| | 85,510 |

|

Real estate acquisition costs | | 33 |

| | 202 |

| | 927 |

| | 1,391 |

|

| | 24,539 |

| | 21,919 |

| | 90,826 |

| | 86,544 |

|

| | | | | | | | |

Income tax benefit (expense) | | (9,827 | ) | | 797 |

| | (10,318 | ) | | 75 |

|

| | | | | | | | |

Earnings from continuing operations | | 41,172 |

| | 50,671 |

| | 187,511 |

| | 179,777 |

|

| | | | | | | | |

Earnings from discontinued operations, net of income tax expense | | — |

| | — |

| | — |

| | 124 |

|

| | | | | | | | |

Earnings before gain on disposition of real estate, net of income tax expense | | 41,172 |

| | 50,671 |

| | 187,511 |

| | 179,901 |

|

| | | | | | | | |

Gain on disposition of real estate, net of income tax expense | | 1,305 |

| | 3,103 |

| | 10,450 |

| | 11,269 |

|

Earnings including noncontrolling interests | | 42,477 |

| | 53,774 |

| | 197,961 |

| | 191,170 |

|

| | | | | | | | |

Earnings from continuing operations attributable to noncontrolling interests: | | (6 | ) | | (17 | ) | | (125 | ) | | (569 | ) |

Net earnings attributable to NNN | | 42,471 |

| | 53,757 |

| | 197,836 |

| | 190,601 |

|

|

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

INCOME STATEMENT SUMMARY |

(in thousands, except per share data) |

(unaudited) |

| | | | | | | | |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Net earnings attributable to NNN | | 42,471 |

| | 53,757 |

| | 197,836 |

| | 190,601 |

|

Series D preferred stock dividends | | (4,762 | ) | | (4,762 | ) | | (19,047 | ) | | (19,047 | ) |

Series E preferred stock dividends | | (4,097 | ) | | (4,097 | ) | | (16,387 | ) | | (16,387 | ) |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

| | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | |

Basic | | 137,111 |

| | 128,332 |

| | 133,999 |

| | 124,258 |

|

Diluted | | 137,623 |

| | 128,813 |

| | 134,489 |

| | 124,710 |

|

| | | | | | | | |

Net earnings per share available to common stockholders: | | | | | | | | |

Basic: | | | | | | | | |

Continuing operations | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.21 |

| | $ | 1.24 |

|

Net earnings | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.21 |

| | $ | 1.24 |

|

| | | | | | | | |

Diluted: | | | | | | | | |

Continuing operations | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.20 |

| | $ | 1.24 |

|

Net earnings | | $ | 0.24 |

| | $ | 0.35 |

| | $ | 1.20 |

| | $ | 1.24 |

|

|

| | | | | | | | | | | | | | | | |

FUNDS FROM OPERATIONS (FFO) |

(in thousands, except per share data) |

(unaudited) | | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

Real estate depreciation and amortization: | | | | | | | | |

Continuing operations | | 34,754 |

| | 30,284 |

| | 134,380 |

| | 115,888 |

|

Discontinued operations | | — |

| | — |

| | — |

| | 3 |

|

Gain on disposition of real estate, net of income tax and noncontrolling interest | | (1,305 | ) | | (3,103 | ) | | (10,397 | ) | | (10,904 | ) |

Impairment losses – depreciable real estate, net of recoveries and income tax | | 258 |

| | 123 |

| | 2,808 |

| | 748 |

|

Total FFO adjustments | | 33,707 |

| | 27,304 |

| | 126,791 |

| | 105,735 |

|

FFO available to common stockholders | | $ | 67,319 |

| | $ | 72,202 |

| | $ | 289,193 |

| | $ | 260,902 |

|

| | | | | | | | |

FFO per common share: | | | | | | | | |

Basic | | $ | 0.49 |

| | $ | 0.56 |

| | $ | 2.16 |

| | $ | 2.10 |

|

Diluted | | $ | 0.49 |

| | $ | 0.56 |

| | $ | 2.15 |

| | $ | 2.09 |

|

|

| | | | | | | | | | | | | | | | |

RECURRING FUNDS FROM OPERATIONS |

(in thousands, except per share data) |

(unaudited) | | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

Total FFO adjustments | | 33,707 |

| | 27,304 |

| | 126,791 |

| | 105,735 |

|

FFO available to common stockholders | | 67,319 |

| | 72,202 |

| | 289,193 |

| | 260,902 |

|

| | | | | | | | |

Impairment – commercial mortgage residual interests valuation | | 51 |

| | — |

| | 531 |

| | 256 |

|

Impairment losses – non-depreciable real estate | | — |

| | — |

| | 156 |

| | — |

|

Income tax benefit | | (316 | ) | | (1,792 | ) | | (316 | ) | | (1,792 | ) |

Taxable REIT subsidiary revocation election(1) | | 9,607 |

| | — |

| | 9,607 |

| | — |

|

Total Recurring FFO adjustments | | 9,342 |

| | (1,792 | ) | | 9,978 |

| | (1,536 | ) |

Recurring FFO available to common stockholders | | $ | 76,661 |

| | $ | 70,410 |

| | $ | 299,171 |

| | $ | 259,366 |

|

| | | | | | | | |

Recurring FFO per common share: | | | | | | | | |

Basic | | $ | 0.56 |

| | $ | 0.55 |

| | $ | 2.23 |

| | $ | 2.09 |

|

Diluted | | $ | 0.56 |

| | $ | 0.55 |

| | $ | 2.22 |

| | $ | 2.08 |

|

(1) At the close of business on December 31, 2015, NNN elected to revoke its election to classify the TRS as taxable REIT subsidiaries. This TRS revocation election resulted in an additional tax expense of approximately $9,607 for 2015.

|

| | | | | | | | | | | | | | | | |

ADJUSTED FUNDS FROM OPERATIONS (AFFO) |

(in thousands, except per share data) |

(unaudited) |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Net earnings available to common stockholders | | $ | 33,612 |

| | $ | 44,898 |

| | $ | 162,402 |

| | $ | 155,167 |

|

Total FFO adjustments | | 33,707 |

| | 27,304 |

| | 126,791 |

| | 105,735 |

|

Total Recurring FFO adjustments | | 9,342 |

| | (1,792 | ) | | 9,978 |

| | (1,536 | ) |

Recurring FFO available to common stockholders | | 76,661 |

| | 70,410 |

| | 299,171 |

| | 259,366 |

|

| | | | | | | | |

Straight-line accrued rent | | (529 | ) | | (318 | ) | | (368 | ) | | (1,731 | ) |

Net capital lease rent adjustment | | 331 |

| | 356 |

| | 1,277 |

| | 1,369 |

|

Below market rent amortization | | (671 | ) | | (692 | ) | | (3,046 | ) | | (2,631 | ) |

Stock based compensation expense | | 2,461 |

| | 2,450 |

| | 9,671 |

| | 9,224 |

|

Capitalized interest expense | | (750 | ) | | (311 | ) | | (2,383 | ) | | (1,629 | ) |

Loss on sale of mortgage receivable | | 450 |

| | — |

| | 450 |

| | — |

|

Total AFFO adjustments | | 1,292 |

| | 1,485 |

| | 5,601 |

| | 4,602 |

|

AFFO available to common stockholders | | $ | 77,953 |

| | $ | 71,895 |

| | $ | 304,772 |

| | $ | 263,968 |

|

| | | | | | | | |

AFFO per common share: | | | | | | | | |

Basic | | $ | 0.57 |

| | $ | 0.56 |

| | $ | 2.27 |

| | $ | 2.12 |

|

Diluted | | $ | 0.57 |

| | $ | 0.56 |

| | $ | 2.27 |

| | $ | 2.12 |

|

|

| | | | | | | | | | | | | | | | |

OTHER INFORMATION |

(in thousands) |

(unaudited) |

| | Quarter Ended | | Year Ended |

| | December 31, | | December 31, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Percentage rent | | $ | 802 |

| | $ | 585 |

| | $ | 1,430 |

| | $ | 1,074 |

|

Amortization of debt costs | | $ | 773 |

| | $ | 716 |

| | $ | 2,915 |

| | $ | 2,782 |

|

Scheduled debt principal amortization (excluding maturities) | | $ | 378 |

| | $ | 326 |

| | $ | 1,587 |

| | $ | 1,151 |

|

Non-real estate depreciation expense | | $ | 77 |

| | $ | 98 |

| | $ | 418 |

| | $ | 297 |

|

|

|

BALANCE SHEET |

(in thousands) |

(unaudited) |

|

|

| | | | | | | | |

| | December 31, 2015 | | December 31, 2014 |

Assets: | | | | |

Cash and cash equivalents | | $ | 14,260 |

| | $ | 10,604 |

|

Receivables, net of allowance | | 3,344 |

| | 3,013 |

|

Mortgages, notes and accrued interest receivable, net of allowance | | 8,688 |

| | 11,075 |

|

Real estate: | | | | |

Accounted for using the operating method, net of accumulated depreciation and amortization | | 5,256,274 |

| | 4,685,001 |

|

Accounted for using the direct financing method | | 14,518 |

| | 16,974 |

|

Real estate held for sale | | 32,666 |

| | 38,074 |

|

Commercial mortgage residual interests | | 11,115 |

| | 11,626 |

|

Accrued rental income, net of allowance | | 25,529 |

| | 25,659 |

|

Debt costs, net of accumulated amortization | | 4,003 |

| | 5,290 |

|

Other assets | | 89,647 |

| | 108,235 |

|

Total assets | | $ | 5,460,044 |

| | $ | 4,915,551 |

|

| | | | |

Liabilities: | | | | |

Mortgages payable, including unamortized premium and net of unamortized debt cost | | 23,964 |

| | 26,182 |

|

Notes payable, net of unamortized discount and unamortized debt costs | | 1,951,980 |

| | 1,703,709 |

|

Accrued interest payable | | 20,113 |

| | 17,396 |

|

Other liabilities | | 121,594 |

| | 85,172 |

|

Total liabilities | | 2,117,651 |

| | 1,832,459 |

|

| | | | |

Stockholders’ equity of NNN | | 3,342,134 |

| | 3,082,515 |

|

Noncontrolling interests | | 259 |

| | 577 |

|

Total equity | | 3,342,393 |

| | 3,083,092 |

|

| | | | |

Total liabilities and equity | | $ | 5,460,044 |

| | $ | 4,915,551 |

|

| | | | |

Common shares outstanding | | 141,008 |

| | 132,010 |

|

| | | | |

Gross leasable area, Property Portfolio (square feet) | | 24,964 |

| | 22,479 |

|

|

|

DEBT SUMMARY |

(in thousands) |

As of December 31, 2015 |

|

| | | | | | | | | | | | | | |

Unsecured Debt | | Principal | | Principal, Net of Unamortized Discount | | Stated Rate | | Effective Rate | | Maturity Date |

Line of credit payable | | $ | — |

| | $ | — |

| | L + 92.5 bps | | — | | January 2019 |

| | | | | | | | | | |

Unsecured notes payable: | | | | | | | | | | |

2017 | | 250,000 |

| | 249,796 |

| | 6.875% | | 6.924% | | October 2017 |

2021 | | 300,000 |

| | 297,344 |

| | 5.500% | | 5.689% | | July 2021 |

2022 | | 325,000 |

| | 321,452 |

| | 3.800% | | 3.985% | | October 2022 |

2023 | | 350,000 |

| | 348,025 |

| | 3.300% | | 3.388% | | April 2023 |

2024 | | 350,000 |

| | 349,389 |

| | 3.900% | | 3.924% | | June 2024 |

2025 | | 400,000 |

| | 399,052 |

| | 4.000% | | 4.029% | | November 2025 |

Total | | 1,975,000 |

| | 1,965,058 |

| | | | | | |

| | | | | | | | | | |

Total unsecured debt (1) | | $ | 1,975,000 |

| | $ | 1,965,058 |

| | | | | | |

| | | | | | | | | | |

Debt costs | | (19,100 | ) | | | | | | |

Accumulated amortization | | 6,022 |

| | | | | | |

Debt costs, net of accumulated amortization | | (13,078 | ) | | | | | | |

Notes payable, net of unamortized discount and unamortized debt costs | | $ | 1,951,980 |

| | | | | | |

| | | | | | | | | | |

(1) Unsecured notes payable have a weighted average interest rate of 4.5% and weighted average maturity of 7.0 years. |

|

| | | | | | | | | | |

Mortgages Payable | | Interest Rate | | Maturity Date | | Principal Balance | |

Mortgage(1) | | 5.230 | % | | July 2023 | | $ | 14,555 |

| |

Mortgage(1) | | 5.750 | % | | April 2016 | | 5,890 |

| |

Mortgage(1) | | 6.400 | % | | February 2017 | | 2,804 |

| |

Mortgage | | 6.900 | % | | January 2017 | | 848 |

| |

| | | | | | $ | 24,097 |

| (2) |

| | | | | | | |

Debt costs | | | | | | (226 | ) | |

Accumulated amortization | | 93 |

| |

Debt costs, net of accumulated amortization | | (133 | ) | |

Mortgages payable, including unamortized premium and net of unamortized debt costs | | $ | 23,964 |

| |

| | | | | | | |

(1) Includes unamortized premium | | | |

(2) Mortgages payable have a weighted average interest rate of 5.4% and weighted average maturity of 4.8 years. | |

|

| | | | | | | | | | | | | | |

CREDIT METRICS |

Ratings: Moody’s Baa1; S&P BBB+; Fitch BBB+

| | | | | | | | | |

| 2011 | | 2012 | | 2013 | | 2014 | | 2015 |

Debt / Total assets (gross book) | 37.0 | % | | 37.5 | % | | 32.9 | % | | 32.6 | % | | 33.2 | % |

Debt + preferred / Total assets (gross book) | 39.5 | % | | 44.3 | % | | 44.9 | % | | 43.3 | % | | 42.9 | % |

Market cap leverage | 33.3 | % | | 31.0 | % | | 28.2 | % | | 24.2 | % | | 25.4 | % |

Debt / EBITDA (last quarter annualized) | 5.3 |

| | 5.1 |

| | 4.3 |

| | 4.2 |

| | 4.4 |

|

Debt / EBITDA (last four quarters) | 5.9 |

| | 5.3 |

| | 4.5 |

| | 4.5 |

| | 4.6 |

|

EBITDA / Interest expense (cash) | 3.2 |

| | 3.7 |

| | 4.1 |

| | 4.4 |

| | 4.6 |

|

EBITDA / Fixed charges (cash) | 2.9 |

| | 3.0 |

| | 3.1 |

| | 3.1 |

| | 3.3 |

|

|

| | | | | | | | | |

CREDIT FACILITY AND NOTES COVENANTS |

The following is a summary of key financial covenants for the company's unsecured credit facility and notes, as defined and calculated per the terms of the facility's credit agreement and the notes' governing documents, respectively, which are included in the company's filings with the Commission. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show that as of December 31, 2015, the company believes it is in compliance with the covenants.

|

| | | | |

Unsecured Credit Facility Key Covenants | | Required | | December 31, 2015 |

Maximum leverage ratio | | 0.60 to 1.00 | | 0.32 |

Minimum fixed charge coverage ratio | | > 1.50 | | 3.29 |

Maximum secured indebtedness ratio | | 0.40 to 1.00 | | 0.004 |

Unencumbered asset value ratio | | > 1.67 | | 3.25 |

Unencumbered interest ratio | | > 1.75 | | 4.74 |

| | | | |

Unsecured Notes Key Covenants | | Required | | December 31, 2015 |

Limitation on incurrence of total debt | | ≤ 60% | | 32.4% |

Limitation on incurrence of secured debt | | ≤ 40% | | 0.4% |

Debt service coverage ratio | | ≥ 1.50 | | 4.62 |

Maintenance of total unencumbered assets | | ≥ 150% | | 309.6% |

|

|

LONG-TERM DIVIDEND HISTORY |

(dollars in thousands)

|

| | | | | | | | |

| | Year Ended December 31, |

| | 2015 | | 2014 |

Total dollars invested | | $ | 726,303 |

| | $ | 618,145 |

|

Number of Properties | | 221 |

| | 221 |

|

Gross leasable area (square feet) | | 2,706,000 |

| | 2,417,000 |

|

Cash cap rate | | 7.2 | % | | 7.5 | % |

(dollars in thousands)

|

| | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2015 | | 2014 |

| Occupied |

| Vacant |

| Total |

| | Occupied |

| Vacant |

| Total |

|

Number of properties | 11 |

| 8 |

| 19 |

| | 17 |

| 10 |

| 27 |

|

Gross leasable area (square feet) | 106,000 |

| 126,000 |

| 232,000 |

| | 235,000 |

| 82,000 |

| 317,000 |

|

Acquisition costs | $ | 28,092 |

| $ | 11,264 |

| $ | 39,356 |

| | $ | 39,980 |

| $ | 18,524 |

| $ | 58,504 |

|

Net book value | $ | 24,535 |

| $ | 3,892 |

| $ | 28,427 |

| | $ | 32,000 |

| $ | 11,786 |

| $ | 43,786 |

|

Net sale proceeds | $ | 35,030 |

| $ | 4,086 |

| $ | 39,116 |

| | $ | 41,522 |

| $ | 13,856 |

| $ | 55,378 |

|

Cash cap rate | 5.9 | % | — |

| 5.9 | % | | 7.2 | % | — |

| 7.2 | % |

|

| | | | | | | | | | | | | | | | | | | | |

| | % of

Total(1) | | # of

Properties | | Gross Leasable

Area (2) | | | | % of

Total(1) | | # of

Properties | | Gross Leasable Area (2) |

2016 | | 1.0 | % | | 27 |

| | 363,000 |

| | 2022 | | 5.6 | % | | 96 |

| | 1,143,000 |

|

2017 | | 3.0 | % | | 52 |

| | 1,084,000 |

| | 2023 | | 2.5 | % | | 55 |

| | 903,000 |

|

2018 | | 6.3 | % | | 183 |

| | 1,645,000 |

| | 2024 | | 2.6 | % | | 49 |

| | 767,000 |

|

2019 | | 3.4 | % | | 80 |

| | 1,109,000 |

| | 2025 | | 5.3 | % | | 132 |

| | 996,000 |

|

2020 | | 4.3 | % | | 137 |

| | 1,550,000 |

| | 2026 | | 5.8 | % | | 162 |

| | 1,624,000 |

|

2021 | | 4.7 | % | | 116 |

| | 1,271,000 |

| | Thereafter | | 55.5 | % | | 1,140 |

| | 12,089,000 |

|

| |

(1) | Based on the annual base rent of $487,410,000, which is the annualized base rent for all leases in place as of December 31, 2015. |

|

| | | | | | | | |

| | | | As of December 31, |

| | Line of Trade | | 2015(1) | | 2014(2) |

1. | | Convenience stores | | 16.7 | % | | 18.0 | % |

2. | | Restaurants - full service | | 11.0 | % | | 9.1 | % |

3. | | Restaurants - limited service | | 7.2 | % | | 6.5 | % |

4. | | Automotive service | | 7.0 | % | | 7.2 | % |

5. | | Family entertainment centers | | 5.6 | % | | 5.1 | % |

6. | | Theaters | | 5.2 | % | | 5.2 | % |

7. | | Automotive parts | | 4.2 | % | | 4.7 | % |

8. | | Health and fitness | | 3.8 | % | | 3.9 | % |

9. | | Recreational vehicle dealers, parts and accessories | | 3.6 | % | | 3.1 | % |

10. | | Banks | | 3.4 | % | | 3.7 | % |

11. | | Sporting goods | | 3.3 | % | | 3.5 | % |

12. | | Wholesale clubs | | 2.6 | % | | 2.9 | % |

13. | | Drug stores | | 2.3 | % | | 2.5 | % |

14. | | Consumer electronics | | 2.2 | % | | 2.4 | % |

15. | | Medical service providers | | 2.2 | % | | 2.0 | % |

16. | | Travel plazas | | 2.1 | % | | 2.3 | % |

17. | | General merchandise | | 1.9 | % | | 1.6 | % |

18. | | Home furnishings | | 1.9 | % | | 1.9 | % |

19. | | Home improvement | | 1.8 | % | | 2.1 | % |

20. | | Grocery | | 1.7 | % | | 1.6 | % |

| | Other | | 10.3 | % | | 10.7 | % |

| | Total | | 100.0 | % | | 100.0 | % |

(1) Based on the annualized base rent for all leases in place as of December 31, 2015.

(2) Based on the annualized base rent for all leases in place as of December 31, 2014.

|

| | | | | | | | | | | | |

| State | | | % of Total(1) | | | State | | | % of Total(1) |

1. | Texas | | | 19.7 | % | | 6. | Georgia | | | 4.5 | % |

2. | Florida | | | 9.3 | % | | 7. | Virginia | | | 3.8 | % |

3. | Ohio | | | 5.2 | % | | 8. | Indiana | | | 3.8 | % |

4. | North Carolina | | | 5.2 | % | | 9. | Alabama | | | 3.2 | % |

5. | Illinois | | | 4.9 | % | | 10. | Tennessee | | | 3.0 | % |

| | | | | | | | | | |

(1) Based on the annualized base rent for all leases in place as of December 31, 2015.

|

As a percentage of annual base rent - December 31, 2015

Creditworthy Retailers

| |

▪ | 21% of annual base rent is from tenants with investment grade rated debt |

| |

▪ | 67% of annual base rent is from tenants that are publicly traded and/or have rated debt |

| |

▪ | Top 25 tenants (60% of annual base rent) operate an average of over 1,300 stores each |

|

| | | | | | |

Top Tenants (>2.0%) | | Properties | | % of Total (1) |

Sunoco | | 125 |

| | 5.9 | % |

Mister Car Wash | | 90 |

| | 4.4 | % |

LA Fitness | | 25 |

| | 3.7 | % |

Couche-Tard (Pantry) | | 86 |

| | 3.6 | % |

Camping World | | 32 |

| | 3.6 | % |

7-Eleven | | 77 |

| | 3.5 | % |

SunTrust | | 121 |

| | 3.3 | % |

AMC Theatre | | 16 |

| | 3.0 | % |

Chuck E. Cheese's | | 53 |

| | 2.7 | % |

BJ's Wholesale Club | | 7 |

| | 2.6 | % |

Frisch's Restaurant | | 74 |

| | 2.4 | % |

Gander Mountain | | 12 |

| | 2.4 | % |

Bell American (Taco Bell) | | 78 |

| | 2.2 | % |

Best Buy | | 19 |

| | 2.1 | % |

|

| | | |

| Rent Coverage (With Corp. Overhead) | | Fixed Charge Coverage |

Range | 1.6x - 6.6x | | 1.3x - 5.1x |

Average | 3.3x | | 2.4x |

Weighted average | 3.6x | | 2.5x |

| | | |

(1) Based on the annual base rent of $487,410,000, which is the annualized base rent for all leases in place as of December 31, 2015.

(dollars in thousands)

|

| | | |

Same Store Rental Income (1) | Cash |

Number of leases | 1,787 |

|

Year ended December 31, 2015 | $ | 384,580 |

|

Year ended December 31, 2014 | $ | 380,273 |

|

Increase (in dollars) | $ | 4,307 |

|

Increase (percent) | 1.1 | % |

(1) Includes all properties owned for current and prior year period excluding any vacant properties or properties under development or re-development. | |

(dollars in thousands)

|

| | | | | | | | | | | | |

Year Ended December 31, 2015 | Renewals With Same Tenant(1) | | Re-Lease To New Tenant | | Releasing Totals | |

Number of leases | 40 |

| | 21 |

| | 61 |

| |

Prior cash rents | $ | 6,018 |

| | $ | 3,383 |

| | $ | 9,401 |

| |

New cash rents | $ | 6,015 |

| | $ | 2,634 |

| | $ | 8,649 |

| (2) |

Releasing spread | 100 | % | | 78 | % | | 92 | % | |

| | | | | | |

Tenant improvements | $ | — |

| | $ | 1,213 |

| | $ | 1,213 |

| |

| |

(2) | Represents 1.8% of total annualized base rent as of December 31, 2015 |

|

|

OTHER PROPERTY PORTFOLIO DATA |

As of December 31, 2015

Tenant Financials

|

| | | | | | |

| | # of Properties | | % of Annual Base Rent |

Property Level Financial Information | | 1,693 |

| | 75 | % |

Tenant Corporate Financials | | 1,580 |

| | 74 | % |

|

| | | | | | | | | | | |

Rent Increases | % of Annual Base Rent |

| Annual |

| | Five Year |

| | Other |

| | Total |

|

CPI | 32 | % | | 39 | % | | 2 | % | | 73 | % |

Fixed | 5 | % | | 13 | % | | 3 | % | | 21 | % |

No increases | — |

| | — |

| | 6 | % | | 6 | % |

| 37 | % | | 52 | % | | 11 | % | | 100 | % |

Lease Structure

| |

▪ | 89% of the company's annual base rent is from NNN leases |

| |

▪ | 93% of the company's annual base rent is from NNN leases and NN leases (with roof warranty) |

FFO guidance for 2016 was increased from a range of $2.28 to $2.34 to a range of $2.29 to $2.35 per share before any impairment expense. The 2016 AFFO is estimated to be $2.34 to $2.40 per share. The FFO guidance equates to net earnings before any gains or losses from the sale of real estate of $1.31 to $1.37 per share, plus $0.98 per share of expected real estate depreciation, amortization and impairments. The guidance is based on current plans and assumptions and subject to risks and uncertainties more fully described in this press release and the company's reports filed with the Commission.

|

| |

| 2016 Guidance |

Net earnings per common share before any gains (losses) on sale of real estate | $1.31 - $1.37 per share |

Real estate depreciation and amortization per share | $0.98 |

FFO per share | $2.29 - $2.35 per share |

AFFO per share | $2.34 - $2.40 per share |

G&A expenses | $35.5 Million |

Real estate expenses, net of tenant reimbursements | $0.9 Million |

Acquisition volume | $400 - $500 Million |

Disposition volume | $75 - $100 Million |

This regulatory filing also includes additional resources:

ex99112312015r83.pdfex99212312015r59.pdf

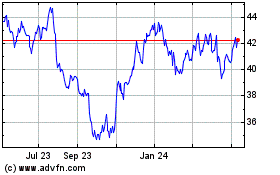

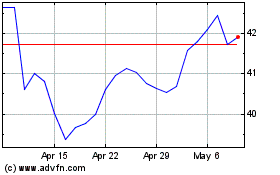

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Apr 2023 to Apr 2024