Real Estate Executives Receive Record Pay In 2011

May 29 2012 - 6:16PM

Dow Jones News

Compensation for executives at public real estate companies grew

faster than the stock performance of their companies last year,

leading some shareholders and proxy governance firms to complain

about excessive pay packages.

A new study by FPL Associates, a Chicago compensation

consultancy, found that the median total compensation for top

executives at the 100 largest real estate companies increased 14%

in 2011 from the prior year to $8.65 million. That was the highest

level of compensation since the study's inception a decade ago and

nearly double the average gains of real-estate company stocks. FPL

includes as compensation an executive's base salary, bonus and the

value of long-term incentive awards at the time granted.

For example, the median return of the 100 real estate companies

tracked by FPL was roughly 6%, below the growth in average

compensation.

The FPL study, which pulled compensation data from federal

filings, found that much of the rise in total compensation came

from bonuses and lucrative long-term incentive awards, which on

average increased 24% to a median of $4.65 million. The study

looked at the pay packages of chief executives, chief operating

officers, chief financial officers and general counsels.

Executive base salaries, which held relatively flat between 2008

and 2010, increased 10% last year. That was the largest salary

increase on a year-over-year basis since FPL started the study in

2002 and contrasts to that of executive salaries in most other

industries which have remained flat for years.

"It was a great year for [real estate] executives from a

compensation perspective," said FPL Senior Managing Director Jeremy

Banoff. He noted that many boards wanted to reward executives for

good results, even though some gave rewards that outmatched

returns.

The highest-paid executive in the FPL survey is Michael Farrell,

chief executive of Annaly Capital Management Inc. (NLY), a New

York-based REIT that invests in mortgage securities and manages a

portfolio worth more than $100 billion. Farrell received a

compensation package worth $35 million, of which $32 million was a

cash bonus, according to FPL. That was up 48% from 2010 and far

exceeded the 7% return to shareholders over the past 12 months, as

of Friday's close.

Annaly didn't return calls seeking comment. But Daniel Furtado,

an analyst at Jefferies & Co., said investors so far don't seem

perturbed about Farrell's pay package in part because the company's

overall expenses, including compensation, are relatively low.

"Michael Farrell and the Annaly management team is the envy of the

REIT space," Furtado said.

David Simon, the chief executive of Simon Property Group Inc.

(SPG), the nation's largest shopping mall landlord, was the

second-highest-compensated real estate executive in the study.

Simon was awarded a compensation package valued at roughly $32

million in 2011, up 159% from 2010. (The CEO actually was given

retention stock awards worth $120 million in 2011 but paid out over

eight years. FPL included just one-eighth of the value of the award

when calculating 2011 compensation.)

Simon and his company were put on the defensive last week after

shareholders, in a nonbinding vote, rejected the CEO's eight-year

contract, which in addition to the retention award includes $12

million a year in performance-based stock awards.

Glass Lewis & Co., a proxy governance firm, advised

investors to reject the Simon plan partly because they questioned

the validity of giving Simon--whose father and uncle founded the

company 52 years ago--such a large retention package. The proxy

governance firm also was troubled that Simon would benefit from

those awards regardless of the company's performance and even if he

departed before his eight-year contract expired.

But Simon Property defended its CEO's pay package. "David

Simon's leadership of SPG has produced an increase in shareholders'

equity of over $40 billion and cumulative shareholder returns of

597% over the last 10 years," a company spokeswoman said. "This

outstanding performance places SPG as the 6th best performing

company in the S&P 500 while Mr. Simon was the 6th lowest paid

CEO in the S&P 500 for the same period."

Lukas Hartwich, an analyst at Green Street Advisors, said that

while Simon Property has posted strong performance over the past

few years, the compensation package was too large based on the size

and performance of the company and shouldn't be used as a blueprint

for the industry. "We hope it doesn't set a precedent," he

said.

Shareholders also gave a nonbinding no vote two weeks ago to the

compensation package of John Kilroy, CEO of Kilroy Realty Corp.

(KRC), whose compensation was valued around $18 million, according

to FPL. It was the second year in a row that Kilroy's executive

compensation failed to pass shareholder muster.

Analysts and investors long have argued that Kilroy's executive

pay packages are too generous considering the company's size.

Kiloy's market capitalization, at $3 billion, is one-twentieth the

size of Simon Property's.

"It's a large dollar amount," Hartwich, of Green Street

Advisors, said, adding that he believes Kilroy's executives are

overpaid considering the company's market capitalization.

He noted that excessive compensation has a bigger impact on

smaller companies because executives take home a greater proportion

of profits.

A Kilroy spokesman declined to comment.

-By A.D. Pruitt, Dow Jones Newswires; 212-416-2197;

angela.pruitt@dowjones.com

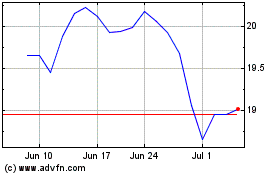

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

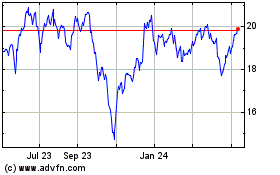

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024