Nike Squeezed by Rivals, Old and New, as Athleisure Spreads

September 28 2016 - 5:26PM

Dow Jones News

By Sara Germano

The Olympics may be over, but Nike Inc.'s competition is just

heating up.

For years, Nike has held the dominant position as the world's

largest sportswear maker. But results from the company's latest

quarter, released Tuesday, fanned some fears that Nike's

stranglehold on the athletic apparel and footwear market could

slip.

Lower than expected orders from wholesale partners, along with

recent retail data which shows Under Armour Inc. and Adidas AG

gaining share in key categories, as well as a broad influx of

upstart athletic brands all combined to send rattles through the

market about Nike's progress.

The company reported fiscal first-quarter revenue and earnings

growth, but fell below Wall Street's expectations on future

wholesale orders and gross margins. Several brokerage analysts

downgraded their price targets on Nike's stock, which closed down

3.8% at $53.25 on Wednesday. The shares are now down 15% on the

year.

Among those lowering their targets were Credit Suisse analysts,

who wrote early Wednesday that "we are becoming increasingly

concerned that the quality of results is deteriorating, as top-line

trends in key markets look shaky, gross margin pressure is

persistent, and the company is reducing disclosure."

Nike executives acknowledged Tuesday they faced increasing

competition but said growth in the sportswear and footwear markets

continues to outpace the global economy. "It's a great time to be

in the business of sports and as the market leader, this is a great

time to be Nike," CEO Mark Parker said on a conference call.

New research shows the strength of the so-called athleisure

market, broadly referring to clothes and shoes intended for fashion

rather than sport. For the year through August, less than one-third

of activewear sales were intended for actual athletic activity, the

lowest such proportion in four years, according to consumer

tracking firm NPD Group.

"Because activewear is so broadly used, available, and defined

by the sports and fashion industries, some of the bigger, authentic

brands are feeling pressure," said NPD analyst Matt Powell. On the

low end, Nike is competing with mass-market chains such as Old Navy

that sell $15 yoga pants, while Savile Row tailors are now making

bespoke tracksuits.

A Nike spokesman said the company's relationships with elite

athletes as well as insight to consumer trends helps it create

products that appeal "to a wide audience, while also infusing

sportswear with performance benefits."

Jay Sole, an analyst for Morgan Stanley, said it's "an open, and

very important question" as to whether Nike can stop rival Adidas

from taking share in the casual category, which has been driving

growth in the overall athletic sector. "Lately [Adidas's] efforts

have been more successful and the new stuff hitting stores for

holiday may continue to beat Nike's despite best efforts," he

said.

Meanwhile, Under Armour has begun selling high-end athletic gear

at Barneys New York and has announced plans to stock shelves at

Kohl's Corp. stores beginning early next year. Both retailers have

been important Nike accounts.

Nike, for its part, has been working to separate itself from the

pack. The company is betting it can expand its direct sales to $16

billion by 2020, or roughly a third of revenue, lessening its

reliance on wholesale partners. In the fiscal year ended May 31,

direct-to-consumer revenue was $7.8 billion, or roughly 25%, of

Nike brand revenue.

To underscore those efforts, Nike said Tuesday it would change

the way it reports wholesale orders. Chief Financial Officer Andy

Campion said the company would limit its reporting of so-called

futures orders -- which measures growth in shipments due to

wholesale partners over the next six months -- to guidance on

earnings calls and details in its regulatory filings.

Nike has also worked to develop products that appeal to both

workout junkies and the athleisure crowd. On Tuesday, Mr. Parker

called out the company's newly released LunarEpic running shoe,

which he said "is also translating extremely well to a style

audience and it's selling through well beyond expectations."

Write to Sara Germano at sara.germano@wsj.com

(END) Dow Jones Newswires

September 28, 2016 17:11 ET (21:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

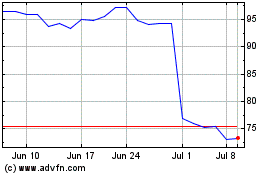

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

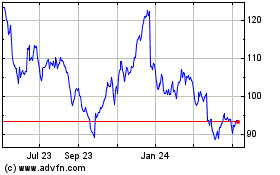

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024