Foot Locker Says Irving and Curry Are Heating Up Shoe Market

November 20 2015 - 2:51PM

Dow Jones News

By Sara Germano

LeBron James may be king of basketball shoe sales, but perhaps

not for long.

Newer NBA stars like Kyrie Irving and Stephen Curry are heating

up the footwear market, with nimble, athletic styles of play

exciting new audiences and signature shoes at more affordable price

points.

That is the phenomenon being witnessed at Foot Locker Inc.

stores and by athletic shoe analysts, at least. On a call with

analysts Friday, the retailer name-checked Mr. Irving and Mr. Curry

as players who are resonating with customers more readily these

days.

Regarding models for legacy NBA stars like Mr. James and Kevin

Durant, Foot Locker CEO Dick Johnson said feedback from customers

suggests "that we need a little bit more innovation, a little bit

better price value relationship" on their products.

Price points for Mr. Irving's Nike Inc.-made signature shoe on

FootLocker.com hovered around $110 on Friday, while Mr. Curry's

Curry 2 from Under Armour Inc. are selling for about $130. Prices

for recent signature models of shoes for Mr. Durant and Mr. James

are closer to $200 on Foot Locker's website.

Neil Schwartz, vice president of business development for

industry tracker SportsOneSource, said there are a few reasons for

the shift, including the lower price points and that younger

consumers are relating better to younger players. "These shoes are

less about collectors and the Sneakerheads and more about the real

fans and players," he said.

While Mr. James and Mr. Durant have dominated the market for

signature basketball shoes for active players in recent years,

signature shoes for Mr. Irving and Mr. Curry, last year's MVP, have

each been introduced within the past year.

Matt Powell, sports industry analyst for NPD Group, said the

market isn't yet tired of LeBron or KD shoes, both of which are

made by Nike. Both are still strong sellers, he said, "It's just

that the new guys are new and fresh."

Asked if the new stars could dethrone sales of their more

established rivals, he said, it is "certainly possible for Curry

and Irving to sell at high levels, but it will take time."

On Friday, Foot Locker said sales at existing stores jumped 8.7%

in its latest quarter, outpacing the performance of fellow

sports-retailers Dick's Sporting Goods Inc. and Hibbett Sports Inc.

"We are heading into the holidays with very fresh and distinctive

assortments to drive full-price selling," said Chief Financial

Officer Lauren Peters.

For the quarter, Foot Locker reported a profit of $80 million,

down from $120 million a year earlier. Excluding a legal charge

stemming from a pension-related suit that shaved 43 cents a share

from earnings, profit rose to $1 a share from 83 cents a share.

Revenue increased 3.6% to $1.79 billion.

Lisa Beilfus contributed to this article.

Write to Sara Germano at sara.germano@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 14:36 ET (19:36 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

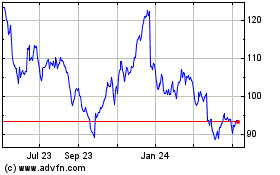

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

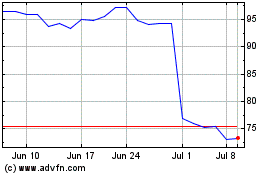

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024