GE Nears $4.7 Billion Deal to Sell Japan Unit to SMFG

December 09 2015 - 12:10AM

Dow Jones News

TOKYO—General Electric Co. is close to a deal to sell its

Japanese commercial-lending business to Sumitomo Mitsui Financial

Group's leasing arm for $4.7 billion, according to people familiar

with the situation.

GE had winnowed the bidders to SMFG's leasing arm and Japanese

lender Shinsei Bank in November, a person familiar with the

situation said earlier. The price tag for the business is 575

billion Japanese yen ($4.7 billion) including debt, the people

said. The deal is expected to be announced in the near future, they

said.

SMFG, Japan's second-largest bank by market capitalization after

Mitsubishi UFJ Financial Group Inc., bought GE's European

private-equity financing business for about $2.2 billion in July.

The financial group's leasing operation is known as Sumitomo Mitsui

Finance and Leasing.

As part of its global plan to unwind its GE Capital financing

business, GE put the Japanese business up for sale this year, and

several Japanese financial institutions expressed interest.

GE's commercial-finance operations in Japan comprise several

divisions, including direct lending to industrial companies

purchasing big-ticket equipment such as heavy machinery. It also

offers vendor financing, helping manufacturers provide smaller

businesses with financing.

One particularly attractive business is a fleet-management

operation that helps large Japanese companies, such as trucking and

logistics operations, finance and manage ownership of trucks and

automobiles. GE's aviation financing business isn't included in the

sale.

Write to Rick Carew at rick.carew@wsj.com and Atsuko Fukase at

atsuko.fukase@wsj.com

(END) Dow Jones Newswires

December 08, 2015 23:55 ET (04:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

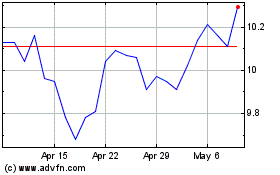

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

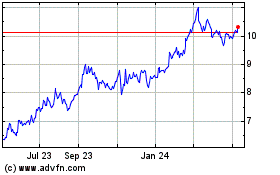

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024