Report of Foreign Issuer (6-k)

August 13 2015 - 6:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of

1934

For the month of August 2015

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in

paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 13, 2015

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Yasuo Matsumoto |

| Name: |

|

Yasuo Matsumoto |

| Title: |

|

Chief Manager

Documentation & Corporate Secretary Department |

|

|

Corporate Administration Division |

English Translation of Excerpts from Quarterly Securities Report Filed in Japan

This document is an English translation of selected information included in the Quarterly Securities Report filed by

Mitsubishi UFJ Financial Group, Inc. (“MUFG” or “we”) with the Kanto Local Financial Bureau, the Ministry of Finance of Japan, on August 13, 2015 (the “Quarterly Securities Report”).

The Quarterly Securities Report has been prepared and filed in Japan in accordance with applicable Japanese disclosure requirements as

well as Japanese accounting standards. In addition, the Quarterly Securities Report is intended to update prior disclosures filed by MUFG in Japan and discusses selected recent developments in the context of those prior disclosures. Accordingly, the

Quarterly Securities Report may not contain all of the information that is important to you. For a more complete discussion of the background to information provided in the Quarterly Securities Report disclosure, please see our annual report on Form

20-F for the fiscal year ended March 31, 2015, filed on July 27, 2015, and the other reports filed with or submitted to the U.S. Securities and Exchange Commission by MUFG.

Business Segment Information

Information on Ordinary Income (Losses) and Net Income

(Losses) for Each Reporting Segment

Previous Year First Quarter Financial Reporting Period (from April 1, 2014 to June 30, 2014)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen) |

|

| |

|

BTMU |

|

|

MUTB |

|

|

MUSHD |

|

|

CFS |

|

|

Others |

|

|

Total |

|

|

Adjustments |

|

|

Consolidated |

|

| Ordinary Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Customers |

|

|

902,282 |

|

|

|

149,698 |

|

|

|

101,003 |

|

|

|

109,563 |

|

|

|

39,280 |

|

|

|

1,301,827 |

|

|

|

— |

|

|

|

1,301,827 |

|

| From Internal Transactions |

|

|

16,748 |

|

|

|

4,172 |

|

|

|

8,741 |

|

|

|

9,567 |

|

|

|

203,439 |

|

|

|

242,669 |

|

|

|

(242,669 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

919,031 |

|

|

|

153,871 |

|

|

|

109,744 |

|

|

|

119,130 |

|

|

|

242,719 |

|

|

|

1,544,497 |

|

|

|

(242,669 |

) |

|

|

1,301,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

184,788 |

|

|

|

32,688 |

|

|

|

9,109 |

|

|

|

15,264 |

|

|

|

229,932 |

|

|

|

471,783 |

|

|

|

(231,291 |

) |

|

|

240,491 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

| 1. |

Ordinary income used in the above table is equivalent to revenues generally used by non-financial companies in Japan. |

| 2. |

“Others” includes MUFG and other companies. |

| 3. |

Adjustments on net income include 262,041 million yen of elimination of inter-segment transactions and 30,749 million yen of net profit representing the

amounts that are not allocated among segments consisting of profits (losses) from investment in affiliates (equity method), amortization of goodwill, tax expenses and profits attributable to non-controlling interests. |

| 4. |

Net income for “Others” includes 230,340 million yen of dividends from MUFG’s subsidiaries and affiliates. |

| 5. |

Net income is adjusted from the profit attributable to owners of the parent company in the consolidated profit and loss statements for the quarterly financial reporting

period ended June 30, 2014. |

| 6. |

BTMU, MUTB, MUSHD and CFS stand for The Bank of Tokyo-Mitsubishi UFJ, Ltd., Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Securities Holdings Co., Ltd.,

and MUFG’s consumer finance subsidiaries*, respectively, on a consolidated basis. |

* Consumer finance

subsidiaries include Mitsubishi UFJ NICOS Co., Ltd. and ACOM CO., LTD.

First Quarter Financial Reporting Period (from April 1, 2015 to

June 30, 2015)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of yen) |

|

| |

|

BTMU |

|

|

MUTB |

|

|

MUSHD |

|

|

CFS |

|

|

Others |

|

|

Total |

|

|

Adjustments |

|

|

Consolidated |

|

| Ordinary Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Customers |

|

|

1,045,695 |

|

|

|

165,457 |

|

|

|

155,140 |

|

|

|

115,026 |

|

|

|

78,634 |

|

|

|

1,559,954 |

|

|

|

— |

|

|

|

1,559,954 |

|

| From Internal Transactions |

|

|

35,479 |

|

|

|

4,745 |

|

|

|

(1,829 |

) |

|

|

9,930 |

|

|

|

139,890 |

|

|

|

188,216 |

|

|

|

(188,216 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,081,175 |

|

|

|

170,202 |

|

|

|

153,310 |

|

|

|

124,956 |

|

|

|

218,524 |

|

|

|

1,748,171 |

|

|

|

(188,216 |

) |

|

|

1,559,954 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

192,984 |

|

|

|

33,728 |

|

|

|

18,080 |

|

|

|

18,616 |

|

|

|

204,907 |

|

|

|

468,316 |

|

|

|

(190,554 |

) |

|

|

277,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

| 1. |

Ordinary income used in the above table is equivalent to revenues generally used by non-financial companies in Japan. |

| 2. |

“Others” includes MUFG and other companies. |

| 3. |

Adjustments on net income include 259,139 million yen of elimination of inter-segment transactions and 68,584 million yen of net profit representing the

amounts that are not allocated among segments consisting of profits (losses) from investment in affiliates (equity method), amortization of goodwill, tax expenses and profits attributable to non-controlling interests. |

| 4. |

Net income for “Others” includes 205,327 million yen of dividends from MUFG’s subsidiaries and affiliates. |

| 5. |

Net income is adjusted from the profit attributable to owners of the parent company in the consolidated profit and loss statements for the quarterly financial reporting

period ended June 30, 2015. |

| 6. |

BTMU, MUTB, MUSHD and CFS stand for The Bank of Tokyo-Mitsubishi UFJ, Ltd., Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Securities Holdings Co., Ltd.,

and MUFG’s consumer finance subsidiaries*, respectively, on a consolidated basis. |

* Consumer finance

subsidiaries include Mitsubishi UFJ NICOS Co., Ltd. and ACOM CO., LTD.

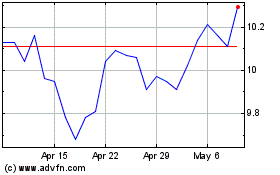

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

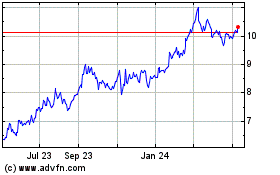

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024