Big US Home Builders Could See Big Refund Checks

November 06 2009 - 2:28PM

Dow Jones News

Some of nation's large home builders could be due millions of

dollars - thanks to a tax break signed into law by U.S. President

Barack Obama - boosting the cash hoards builders are tapping as

they limp toward recovery.

Businesses would be able to apply current losses against profits

made five years ago - instead of two years - resulting in refunds

that could come sometime next year. The measure isn't expected to

be a game-changer for home builders, given that the major pubic

players have been conserving cash for several quarters. The 10

companies JP Morgan covers have an average $1.2 billion, compared

to $616 million as the market soured in late 2007.

Credit Suisse predicts Lennar Corp. (LEN) could see a boost

between $200 million and $300 million. Meritage Homes Corp. (MTH)

expects about $60 million. "That's obviously a substantial number,

but I'm not certain it would change our growth prospects that

much," CFO Larry Seay said during a quarterly conference call last

week.

Smaller private builders, who have been battered in the housing

downturn without access to construction financing, would receive

less money, but a bigger benefit. "They can take a breath,

survive," said Bill Killmer, vice president of advocacy with the

National Association of Home Builders. "Many of these guys would

have to shutter and close their doors. They'll be able to

survive."

The Washington-based trade group estimates about 30,000

construction-related jobs will be saved. That's good news, given

construction unemployment was 18.7% in October, according to the

Laborers' International Union of North America, well above the

national rate.

The building industry's bigger names were disappointed to see

the break pulled from the government's $787-billion economic

stimulus plan signed earlier this year. But it is not without

controversy: The NAHB previously fretted that large builders might

use the tax break to unload land at a discount to generate a tax

loss and then buy the land back, potentially putting smaller

players at a disadvantage. Killmer said the builder group is now

glad a "broad swath" of the industry will benefit.

Such concerns are less of an issue now because builders have

purged some of their less desirable land. Plus, the land-related

charges they'd take to use the NOLs – primarily through selling

bulk land at distressed prices – would be more of a negative, given

they aren't as desperate for cash, said JP Morgan analyst Michael

Rehaut.

The tax break is part of a hard-lobbied package that would also

extend the first-time home-buyer tax credit for several months and

expand it to some existing homeowners. Builders, who say the credit

delivered much-needed sales, warn the market will resume its slide

without continued incentives for buyers.

-By Dawn Wotapka, Dow Jones Newswires; 212-416-2193;

dawn.wotapka@dowjones.com

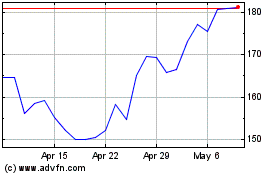

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

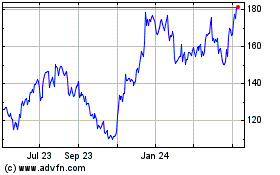

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Apr 2023 to Apr 2024