ArcelorMittal Net Loss Seen Narrowing Friday - Earnings Preview

May 05 2016 - 12:32PM

Dow Jones News

By Alex MacDonald

LONDON--ArcelorMittal (MT), the world's largest steelmaker by

volume, is scheduled to report third-quarter earnings on Friday.

Here's what you need to know:

EARNINGS FORECAST: The steelmaker is forecast to narrow its net

loss to $319 million in the first quarter compared with a net loss

of $728 million in the same quarter a year ago, according to a

Factset poll of six analysts. This takes into account a collapse in

the iron ore price and weaker steel prices due to increased

competition from Chinese steel imports.

EBITDA FORECAST: First-quarter earnings before interest, taxes,

depreciation and amortization, or Ebitda, are forecast to fall 34%

on the year to $914 million, according to a Factset poll of 11

analysts. All of the company's geographical divisions, with the

exception of North America, are forecast to post a fall in

year-on-year earnings as a result of regionally weaker iron ore and

steel prices. North America is an exception since it was hit hard

by a stronger dollar and influx of cheap steel imports in the first

quarter last year.

REVENUE FORECAST: First-quarter revenue is forecast to fall 18%

on the year to $14.1 billion, according to a Factset poll of ten

analysts.

What to Watch:

PRICE OUTLOOK: Steel prices in China, the U.S. and Europe have

started to pick up in the second quarter, thanks to an increase in

raw material prices, depleted steel inventories and lower import

pressure. RBC Capital Markets analyst Ioannis Masvoulas forecasts

steel imports into Europe and the U.S. to ebb in coming months

since an increase in Chinese steel prices makes it more attractive

to sell domestically than ship the product abroad. Analysts will be

interested to find out whether these current steel price hikes are

sustainable or not in coming quarters.

EARNINGS GUIDANCE: The Luxembourg-based steelmaker forecast in

February that it would generate in excess of $4.5 billion in

earnings before interest, taxes, depreciation and amortization or

Ebitda this year, assuming market conditions don't improve. Since

then, steel prices globally have started to pick up, prompting

analysts to wonder whether the earnings guidance is now too

conservative and therefore susceptible to upgrade.

ACQUISITIONS: ArcelorMittal surprised investors by announcing a

$3 billion rights issue in February. Since steel prices and demand

in the steelmaker's key market has picked up, prompting some

analysts to wonder whether the steelmaker may have surplus cash to

spend on acquisitions. ArcelorMittal a year ago reaffirmed its

interest in buying Italy's privately owned Ilva which is currently

held under special administration by the Italian government and

which owns Europe's largest steelworks in the southern Italian city

of Taranto.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

May 05, 2016 12:17 ET (16:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

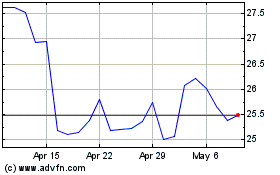

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

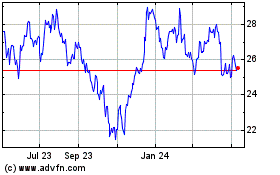

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024