ArcelorMittal S Africa Plans to Raise Up to $327 Million Via Equity Issue

November 06 2015 - 3:21AM

Dow Jones News

By Alex MacDonald

LONDON--ArcelorMittal South Africa Ltd (ACL.JO) said Friday it

plans to raise between 4 billion to 4.5 billion South African rand

($287 million to $323 million) via an equity issue in order to pay

down debt and fund its capital expenditure.

South Africa's largest steelmaker, which is 47% owned by

Luxembourg-based ArcelorMittal (MT), is restructuring its

operations after suffering four consecutive years of net losses and

suffering a decline in local steel consumption over the past two

years.

The company has been hit by cheap steel imports as China--the

world's largest steel-producing nation--continues to ramp up

steel-production capacity amid waning domestic demand at home, and

subdued steel demand globally. Meanwhile labor and energy costs in

South Africa have risen above inflation rates over the past few

years.

The parent company ArcelorMittal said it will fully underwrite

the share issue. The company plans to issue more details about the

rights issue in January before being put to a shareholder vote.

Write to Alex MacDonald at alex.macdonald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 06, 2015 03:06 ET (08:06 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

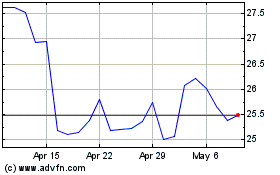

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

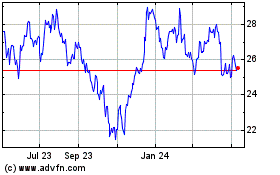

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024