UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2015

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-32327 | | 20-1026454 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3033 Campus Drive Suite E490 Plymouth, Minnesota | | 55441 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

On November 3, 2015, The Mosaic Company hosted a conference call discussing its financial results for the quarter ended September 30, 2015. Furnished herewith as Exhibits 99.1 and 99.2 and incorporated by reference herein are copies of the transcript of the conference call and slides that were shown during the webcast of the conference call.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibits furnished herewith. The exhibits listed in the Exhibit Index hereto are being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | THE MOSAIC COMPANY |

| | | |

Date: November 5, 2015 | | | | By: | | /s/ Mark J. Isaacson |

| | | | Name: | | Mark J. Isaacson |

| | | | Title: | | Senior Vice President, General Counsel |

| | | | | | and Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| |

99.1 | | Transcript of conference call of The Mosaic Company held on November 3, 2015 |

| |

99.2 | | Slides shown during the webcast of the conference call of The Mosaic Company held on November 3, 2015 |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

PARTICIPANTS

Corporate Participants

Laura C. Gagnon – Vice President Investor Relations, The Mosaic Co.

James O’Rourke – President and Chief Executive Officer, The Mosaic Co.

Richard L. Mack – Executive Vice President and Chief Financial Officer, The Mosaic Co.

Richard N. McLellan – Senior Vice President-Commercial, The Mosaic Co.

Michael Rahm – VP-Market Analysis & Strategic Planning, The Mosaic Co.

Walter F. Precourt – Senior Vice President-Potash Operations, The Mosaic Co.

Other Participants

Andrew Wong – Analyst, RBC Capital Markets

Ben Isaacson – Analyst, Scotiabank Global Banking and Markets

Joel Jackson – Analyst, BMO Capital Markets (Canada)

Jacob Bout – Analyst, CIBC World Markets, Inc.

Adam Samuelson – Analyst, Goldman Sachs & Co.

Sandy Klugman – Analyst, Vertical Research Partners

Stephen Byrne – Analyst, Bank of America Merrill Lynch

Don Carson – Analyst, Susquehanna Financial Group LLLP

Jeffrey J. Zekauskas – Analyst, JPMorgan Securities LLC

Yonah Weisz – Analyst, HSBC Bank Plc (Tel Aviv Branch)

Daniel Jester – Analyst, Citigroup Global Markets, Inc. (Broker)

Neel Kumar – Analyst, Morgan Stanley & Co. LLC

Jonas Oxgaard – Analyst, Sanford C. Bernstein & Co. LLC

MANAGEMENT DISCUSSION SECTION

Operator: Good morning, ladies and gentlemen, and welcome to The Mosaic Company’s Third Quarter 2015 Earnings Conference Call. At this time, all participants have been placed in a listen-only mode. After the company completes their prepared remarks, the lines will be opened to take your questions.

Your host for today’s call is Laura Gagnon, Vice President, Investor Relations of The Mosaic Company. Ms. Gagnon, you may begin.

Laura C. Gagnon, Vice President Investor Relations

Thank you and welcome to our third quarter 2015 earnings call. Presenting today will be Joc O’Rourke, President and Chief Executive Officer; and Rich Mack, Executive Vice President and Chief Financial Officer. We also have other members of the senior leadership team available to answer your questions after our prepared remarks. The presentation slides we are using during the call are available on our website at mosaicco.com.

1

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

We will be making forward-looking statements during this conference call. The statements include but are not limited to statements about future financial and operating results. They are based on management’s beliefs and expectations as of today’s date, and are subject to significant risks and uncertainties. Actual results may differ materially from projected results. Factors that could cause actual results to differ materially from those in the forward-looking statements are included in our press release issued this morning and in our reports filed with the Securities and Exchange Commission.

Now, I’d like to turn it over to Joc.

James O’Rourke, President and Chief Executive Officer

Good morning and thank you for joining our third quarter earnings conversation. This morning, I will discuss current market conditions, and then Rich Mack will review our financials and provide our guidance. Before we take your questions, I will provide closing remarks.

Mosaic delivered solid results in our seasonally slow third quarter despite a variety of market based challenges. There are three points I want you to know. First, demand for our products remains strong in most parts of the world. We understand investor concerns regarding future potash supply and I will address the supply and demand picture for you shortly. Second, Mosaic continues to execute at a very high level and effectively allocate capital. We are focused on capturing the value of our investments. To put it simply, we believe Mosaic is in an excellent position with significant upside when market sentiments and conditions improve. And third, Mosaic has displayed market leadership and a thoughtful production philosophy for many years. We will continue to pursue a strategy to maximize value.

For the quarter Mosaic earned $160 million on net sales of $2.1 billion, compared with earnings of $202 million on net sales of $2.3 billion in the third quarter of 2014. We reported earnings per share of $0.45 this quarter compared to $0.54 a year ago.

Adjusted for notable items, primarily the non-cash impact of foreign exchange rates, Mosaic’s earnings increased over 10% to $0.62 per share, compared to $0.56 per share last year. Our higher year-over-year adjusted earnings per share despite tougher markets reflect successful cost control efforts, the lower share count resulting from our active share repurchase activities and a lower effective tax rate.

So let me turn to the markets, which are quite different from country-to-country, and from product-to-product. The one constant around the world however, for both potash and phosphate is that demand remains strong. We expect total global phosphate shipments to set a new record, and total global potash shipments to decline slightly this year compared with last year’s record. That is an important point, demand for fertilizer is underpinned by demand for food and we have no doubt that this demand will continue to grow along with world population.

Even if supply outpaces demand for a short period of time, demand will continue its steady upward trajectory. We’re seeing this now in the day-to-day operations of farmers all around the world.

Going into each of the last several application seasons, market sentiment has been negative with forecasters expecting significant lower fertilizer applications and each season has exceeded expectations for several reasons.

2

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

First, high nutrient removal rates from the recent record global harvests have required growers to replenish their soils. Second, grain and oilseed prices have remained stable. And third, fertilizers remain necessary and affordable.

In addition, challenging macroeconomic factors are not having significant impacts on demand. For example, in Brazil, where the economic and political situation remains volatile, 2015 is expected to be the second best year in history for fertilizer demand.

Demand has also remained strong in other key countries, including China and India. Currency devaluation against the dollar have both positive and negative impacts on agribusiness. A strong dollar is a net positive for agricultural regions like Brazil that are large exporters. Growers can pay for many imports in local currency and sell their grains and oilseeds in dollars.

In North America, the fall application season is meeting our expectations. Potash shipments to North America in 2015 are expected to be lower than last year, mostly because of built up in retail inventories we saw at the end of 2014. Retailers are working through inventories now, and we are seeing evidence that inventories are reaching low levels.

Supply is a different story, and we realize that concerns about future oversupply are driving current equity valuations. We have maintained and we continue to maintain our philosophy to match supply with expected demand, as our decision to curtail production at our Colonsay potash mine demonstrates. It is also worth noting that most of the additional potash supply that is expected to come to market is still years away, so demand will have some time to catch up.

Let’s put this into context for Mosaic. We have two attractive businesses that are of similar size in markets expected to experience long-term secular growth. In Potash, we’ve taken actions to right-size our operations and reduce cost. We are confident in our ability to manage through, if not take advantage of, the current market dynamics.

In Phosphates, we’ve also taken out cost and made significant investments that solidify our leadership position. We believe these investments will continue to drive growth in the years to come. The Phosphates business continues to generate attractive margins and demand is strong.

We are ahead of schedule in our work to achieve $500 million in cost savings across the company. And this work is visible on our bottom line. This slide tells the story. Third quarter adjusted earnings per share were higher this year than in 2014, despite lower product prices and overall revenue. Our strategic initiatives, including acquisitions, capacity enhancements, decisions to exit or curtail underperforming assets, and substantial capital returned to shareholders, are delivering the benefits we anticipated.

While macroeconomic and agricultural market conditions remain challenging, Mosaic remains in an excellent position to continue to reap the benefits of these initiatives, and has significant leverage to the upside when this market turns more positive.

Now I will ask Rich to provide more insights into our results and our guidance for the fourth quarter.

Richard L. Mack, Executive Vice President and Chief Financial Officer

Thank you, Joc. I’ll begin today with an overview of our three operating segments. The Phosphates segment continued to generate good results and strong margins. Mosaic’s phosphates shipment volumes for the quarter fell slightly below our expectations with delayed Brazilian demand and cautious buying behavior in North America being a big part of the story. As Joc noted, the global

3

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

phosphate market remains balanced, and the relatively stable margins support that statement. Cost control, including low cash rock mining costs, continues to be a margin driver.

In the Potash segment, our results reflect lower production levels during a seasonally slow demand period when we traditionally take maintenance shutdowns. Having said that, our 20% gross margin rate in this segment reflects excellent cost control. Despite an operating rate of 67%, we produced MOP at a cash cost per tonne of just $105 including $20 per tonne in brine management costs, down 21% from a year ago.

In the International Distribution segment, results were better than expected, especially in light of the difficult political and economic situation in Brazil. Gross margin per tonne was $30, which is $4 per tonne above the high end of our guidance range. This quarter we sold more tonnes of product than last year at higher than expected margins capturing time-place utility and leveraging our fixed costs.

Now, I’d like to address our capital management. We have repurchased roughly $700 million of Mosaic stock or 15 million shares since the beginning of the year. We repurchased $75 million of our shares during the third quarter in the open market, have over $900 million remaining under our share repurchase authorization, and will continue to be prudent about our share repurchases in the future.

We will continue to manage capital carefully and embrace a balanced approach in our allocation across growth initiatives both organic and inorganic as well as shareholder distributions. This is a cyclical business, and the most compelling opportunities present themselves at the bottom of the cycle. With that said, our share price in the mid-$30 range creates a high bar for investments other than our own stock.

Now let’s move on to our guidance for the fourth quarter. You can clearly see the guidance on the current slide, so unlike prior quarters, I won’t go through the details and instead focus on assumptions, risks and opportunities. In Phosphates we anticipate that both the upside and the downside on sales volumes will come from North America, which will represent a higher proportion of expected sales in the fourth quarter compared to the third quarter.

If you recall, earlier in the year, we diverted tonnes that were destined for North America to the export market, which Mosaic and our size, has the ability to do. As the fall season progresses, our guidance assumes more tonnes will be needed here domestically. We expect relatively stable margins in the fourth quarter as lower realized prices are largely offset by lower raw material costs.

In our International Distribution business, Brazilian credit availability is the swing factor in our volume assumptions for the fourth quarter. Because of the relatively high proportion of fixed costs, higher volumes positively impact margins per tonne, as does a higher proportion of MicroEssentials® in our sales. Finally, swings in the Brazilian real have an impact on local currency costs. Our forecasted margins do not anticipate any appreciable strengthening in the real.

In Potash, our volume guidance is below last year’s levels because, unlike last year, we do not expect dealers in North America to build inventories late in the year. Similar to Phosphates, albeit to a lesser extent, we expect higher sales volumes domestically compared to the quarter we just finished. These assumptions are incorporated into our pricing guidance.

Margins are expected to be in the mid-20% range, reflecting both lower realized prices and our decision to hold back production to match market demand. The mechanical failure at our Esterhazy K1 shaft is expected to take three weeks to four weeks to repair, and we have accelerated other work that was originally planned to occur during a maintenance shutdown in December. As a result, we don’t expect this event to impact our sales in the fourth quarter or impact our ability to meet expected demand in early 2016.

4

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

For the remainder of 2015, our annual guidance ranges are as follows: Canadian resource taxes and royalties are expected to be in the range of $265 million to $295 million, down from $310 million to $350 million. Brine management costs have also been revised down to the range of $170 million to $180 million from $180 million to $200 million.

Capital expenditures and investments are now expected to range from $1.1 billion to $1.2 billion, down from $1.1 billion to $1.3 billion. Our SG&A expense range is now estimated to be $350 million to $370 million, down from $360 million to $380 million. And our effective tax rate expectations were lowered to be in the mid to high teens range.

Our outlook for 2016 includes the expectation of stability in our markets based on growing demand. Demand for our products is not predicated upon construction of bridges and roads in China, but on the need to eat. We expect demand for our products to grow. The rate of growth will vary from year-to-year, but over time, we are confident in a 2% to 3% average annual growth rate. Our first look at 2016 producer shipments is yet another example of this trend.

The issues we face are not demand driven, as demand in 2016 is expected to be the second highest on record. The concern we hear about, the new supply many investors worry about, is fairly limited until 2017. During the next two years, we expect demand to continue to grow and over a longer period of time we expect demand to consume much of the excess supply.

In the meantime, Mosaic will continue to embrace our operating philosophy of producing only what is needed by our customers.

So, I would like to summarize my comments by reiterating Joc’s main point earlier. There is no doubt that markets are challenging on several fronts, but Mosaic has made and will continue to make notable progress. We have a realistic market outlook and are taking actions to position the company to excel.

With that, I’ll return the call back to Joc for his closing comments. Joc?

James O’Rourke, President and Chief Executive Officer

Thank you, Rich. Over the past several years, we have experienced a wide array of challenges from the external environments. Agriculture, specifically, and commodities in general, are currently facing headwinds from several sources. Mosaic’s growth story is driven by the execution of our strategy and reaping the benefits of investments we’ve made and continue to make. We believe it is a compelling growth story.

At Mosaic, we have worked to optimize our business portfolio, reduced our costs, invested in additional capacity the market will demand, and returned significant capital to shareholders. We have also maintained a strong balance sheet that gives us the ability to take advantage of compelling opportunities that arise at the low part of the cycle. We understand that success in this business requires an operating foundation that will not crack when times are tough, but Mosaic is not just resilient. The moves we have made over the past decade and increasingly during the last two years, have also constructed a powerful engine for growth.

Mosaic is in a great position. We believe we have the strongest combination of talent, assets, financial strength, and global reach in our industry. We intend to use that strength to our advantage, now, and as business and economic conditions improve. We intend to maintain our discipline, build on our leadership and continue to execute at the highest level possible.

5

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

In my three months as Mosaic’s CEO, I’ve traveled to meet with a wide range of our stakeholders, customers, shareholders, employees and others in our industry. I’ve heard a lot of concern about the current markets and the short-term. But I’ll say this, I’ve also seen and heard a lot of reasons to be optimistic, for the industry, and especially for Mosaic. The short-term situation is not as nearly as dire as market sentiment seems to expect and the long-term remains extremely compelling.

Demand for our product will continue to grow and we’re managing this company to meet that demand efficiently. And don’t forget, Mosaic has many advantages, from our industry-leading premium products portfolio to the earnings leverage our recent strategic moves will provide in better markets, the CF and ADM acquisitions, the Ma’aden joint venture, the decisions we made to exit higher cost businesses and the capital we’ve returned to shareholders, all provide real opportunities to grow our bottom line. From my perspective we’re executing very well and our future looks great.

Now we would be happy to take your questions.

6

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: [Operator Instructions] Your first question comes from Andrew Wong from RBC Capital Markets. Your line is open.

<Q – Andrew Wong – RBC Capital Markets>: On your production curtailments, could this have an impact on your market share in other phosphates or potash markets, and – or do you expect similar production curtailments from other producers globally? And then, longer term, how do you think about the economics of curtailments, having lower volumes versus better pricing compared to like a volume over pricing kind of strategy? Thanks.

<A – Joc O’Rourke – The Mosaic Co.>: Thank you, Andrew. I’m going to start by making a couple of comments, and then I’m going to hand it over to Rick McLellan to talk. But let me talk first about market share. I wouldn’t say that Mosaic gets too focused on market share. What we focus on is serving our customers well and optimizing the value from the tonnes that we sell. So I don’t like to be characterized as either pushing for market share or pushing for price. I think they’re interchangeable in many respects, and you’re really pushing for value.

What we have done, as you’ve seen, is we’ve looked at what the market needs from our perspective and we’ve aligned our production to that level. In the short term, that’s things like the shutdown of Colonsay for a temporary shutdown. In the long term, it’s the permanent moves we’ve made such as curtailing production of MOP at Carlsbad and selling our Hersey operations. So we’ve really positioned from a perspective of developing a long-term view of where the market is going to go and serving that market well.

In terms of where we sit next year, I’m just going to leave that for Rick for a second.

<A – Rick McLellan – The Mosaic Co.>: Okay. Thanks, Joc. As we look at our planning, we don’t just look at the quarters. We look forward at least 18 months, and Joc’s done a good job of describing what we do with our customer base, both globally and in North America, and we plan our production to meet their needs. And we do several things to make sure that – there’s a lot of times where people try and shoot ducks when there’s none flying or sell into a vacuum. We take the point of we’d rather match up when people are buying to when we’re producing, and we’ve done that so far this year. And as we look forward for 2016, everything we’re doing today is on a look of being sure that we can provide our customers the products when they need it and produce it to optimize our returns.

Operator: Your next question comes from Ben Isaacson from Scotiabank. Your line is open.

<Q – Ben Isaacson – Scotiabank Global Banking and Markets>: Thank you very much. Just a couple of questions on your North American Potash strategy. Joc, can you remind us of the advantages of the consignment strategy that you employ? And do others follow a similar strategy, or is there a potential competitive risk there? And then my second question is, is there a possibility to start securing long-term MOUs with U.S. customers, and if not, why not? Thank you.

<A – Joc O’Rourke – The Mosaic Co.>: Okay. So first of all, we do not use a consignment – sorry. Thanks, Ben. Good to hear you. We don’t use a consignment process. What we use is what we call FPD, which is future price deferred. So what we’re doing to allow for the efficient logistics, we use customer space for our best customers, we ship to them and then decide on price when the product is actually getting used.

Others may use other strategies, and I really wouldn’t talk to their strategies. I believe our strategy is a good balance between making the product available in the market to give us the time-place

7

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

utility that we need to be efficient while still giving us good economic results. I’ll ask Rick to go further.

<A – Rick McLellan – The Mosaic Co.>: Yeah. Good morning, Ben. I think part of the question you asked was on MOUs with customers. And I just – I’ll spend a couple of minutes there and then I’ll go back and add a couple of points to where Joc, to Joc’s points. Right now, we have three-year planning agreements with our top customers. Those aren’t contracts, but they are agreements and we build in incentives against those agreements, we build in the portfolio of products we offer. So rather than have formalized MOUs, we have three-year planning agreements with most of our main customers. We think that better reflects a way for us to go to market.

The second piece is – and Joc talked about, you asked whether it put us at a competitive disadvantage versus other programs like price protection that are being offered out there. Frankly, with the customers we work with, what we recognize in a quarter is what we’ve revenue recognized, not what we’ve shipped and billed at provisional prices. And we think that’s a much better way for us to operate a business and our customers to make sure they take advantage of the use of their space.

Operator: Your next question comes from Joel Jackson from BMO Capital Markets. Your line is open.

<Q – Joel Jackson – BMO Capital Markets (Canada)>: Good morning, guys. I want to stay in North America so, looking at your guidance for 2016, your numbers for 2015, potash demand will be down 3 million tonnes this year and you’ve lost about 1 million tonnes of share, all in North America, your Canpotex partner, PotashCorp is about flat. So my question is who else lost market share in 2015? You guys took a big hit of it. Why was that the right strategy? And looking to 2016, do you see gaining 3 million tonnes back in the global market. Do you think you’ll be able to gain back that 1 million tonnes and where will those 3 million tonnes come from? Thanks.

<A – Joc O’Rourke – The Mosaic Co.>: Again, this will be another one I’m going to put over to – sorry, hi, Joel, good to hear you. I’ll put this back to Rick as well. I think there are a couple things I want to point out before I give it to Rick though, and the first is we saw this in the first half of the year where in the slower part, first quarter it appeared that our market share was behind. And I think that’s got something to do with how we revenue rec[recognized] as opposed to our competitors. And then, in the second quarter what we found is that that was basically made up. We expect we’ll see similar things in this year, so in the second half of the year.

So ultimately, I don’t think it’s quite legitimate to look at quarter-by-quarter market shares. I think they vary, and again, we’ve got long term plans with our customers. And as long we’re meeting those long-term plans with our customers, we expect that we’ll do fine.

And I guess the other aspect is where are those imports would be the other aspect of market that we have to look at. And frankly, the imports are playing a bit of a disruptive role, and we’ll have to look at how we manage that in the next year. We’ll be pushing that out.

<A – Rick McLellan – The Mosaic Co.>: And Joel, I think Joc’s done a good job of it. You need to separate revenue recognized sales from shipments. And that’s where things will get corrected in the fourth quarter.

<A – Joc O’Rourke – The Mosaic Co.>: And can I ask Mike Rahm just to give us a view on where the 2016 mark is going for potash? I think that’s also important here.

<A – Mike Rahm – The Mosaic Co.>: Sure. Yeah. We’re projecting a point estimate of about 62 million tonnes, and that’s up roughly 3 million tonnes from our 59.1 million point estimate. And I

8

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

guess I would characterize the growth as not getting a grand slam from anyone, but just very consistent singles from all of the major buyers.

I think we’ve laid out in terms of the big five importers, China, India, Malaysia, Indonesia and Brazil, we expect moderate increases in all of those. And I think that really has tied into our view of Ag commodity prices. We see a very balanced global agricultural outlook. We think acreage and the technology applied to crops will need to continue to increase and underpin decent demand prospects.

Operator: Your next question comes from Jacob Bout from CIBC. Your line is open.

<Q – Jacob Bout – CIBC World Markets, Inc.>: Had a question here on Esterhazy, and maybe talk a bit about some of the operational issues you have there. It sounds like you have some problems with the skip there. And maybe you can talk also as well a bit on K3, how that is working, what do you have left to spend, and does it make sense at this point to either speed that up or, the development of that, or to slow it down?

<A – Joc O’Rourke – The Mosaic Co.>: Thank you, Jacob. Okay. I’m going to hand over the details of the Esterhazy skip to Walt Precourt, who’s on the call here today. But before I do, again, I’ll say, as Rich said in his comments, this is a – we had a failure of a skip in – a mechanical failure of the skip at Esterhazy’s K1. We have accelerated some maintenance work, and we were looking at lower production rates to make sure our inventories were in line anyway. So we don’t see any impact to speak of either in this quarter or in the first quarter of next year. So that’s the first point.

In terms of K3 spend, I just want to say today we are pushing K3 at the reasonable safe rate we can. You have to realize, we’re sinking shaft and you only have approximately 20 feet of working area, 20 feet of diameter, and we’re sinking that shaft. So there’s very little opportunity to accelerate at this stage beyond that. But once we get into K3, we’ll certainly be accelerating the development. So with that, I’m going to ask Walt to just talk a little bit more about the skip mechanical failure.

<A – Walt Precourt – The Mosaic Co.>: Hi, Jacob. So as you pointed out, we did have a mechanical issue with one of the Esterhazy K1 skips last week. And although the skip itself was damaged, there was minimal infrastructure damage, so we’re very confident that we’ll resume full K1 production later this month. And we do expect that the repair cost will really be de minimis.

In terms of your question with respect to K3, we have about US$1.7 billion left to spend on that entire project.

Operator: Your next question comes from Adam Samuelson from Goldman Sachs. Your line is open.

<Q – Adam Samuelson – Goldman Sachs & Co.>: Hi. Good morning. Sorry. So I guess my question is on Phosphates, and hoping to get a little bit of color on some of the uncertainty you have about the North American market in the fourth quarter, and generally as you think about 2016, provide some high level comments on different demand outlooks, India in particular, an area that seems to be a bit of a wild card today. Thank you.

<A – Joc O’Rourke – The Mosaic Co.>: Yeah. I’m just going to hand that straight to Mike Rahm to talk about the markets, and then Rick to add color.

<A – Mike Rahm – The Mosaic Co.>: In terms of fourth quarter shipments in North America, I think we’ve been pleasantly surprised and pleased with the anecdotal reports that we’re getting in from the field that the fall application season has met or exceeded expectations. And obviously, that’s not a shocker in the sense that we’ve had a great crop come off, so lots of nutrients have been

9

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

removed. We’ve had a fairly long open application window to get fertilizer down. So we think a fair number of tonnes of P and K are going down this fall. Then I guess while you’re talking about phosphate, I think what’s really important on the potash side of things, we think we’re working down the increase in channel inventories that we saw last year.

Shifting to 2016, you’ve seen our projections. For phosphates, we expect that shipments will increase from about 65.5 million tonnes this year to a range of 66 million tonnes to 68 million tonnes and our point estimate is right smack dab in the middle of that at 66.9 million tonnes.

And in terms of some of the markets, yeah, we do expect a decent rebound, particularly in those markets that saw a little bit of a channel build last year in Brazil. We see continued growth in India. We think over the past several years, their channel has been pulled down to very low levels, and we’re talking about the channel primarily at the small retail shop, the tens of thousands of shops across India that have 30, 40 bags in the back storage room. So we think that has been drawn down, and they’re going to buy the amount that they actually use as opposed to rely on inventory.

And I guess similar to the comment we made earlier, I think we see lots of singles in 2016 as opposed to a grand slam or strikeouts in some of these markets. And as a consequence, the growth that we’re projecting is made up of moderate increases in most of the main markets.

Operator: Your next question comes from Sandy Klugman from Vertical Research Partners. Your line is open.

<Q – Sandy Klugman – Vertical Research Partners>: Good morning. A question on industry supply discipline. We’ve definitely been seeing signs of it in the potash industry, but what are your expectations for how competitors in the phosphate industry will manage production? In particular, I’m thinking about levels out of China and how you expect OCP to manage supply given the increases to their granulation capacity?

<A – Joc O’Rourke – The Mosaic Co.>: So, I’m going to start off. Thank you, Sandy. I’m going to start off just a couple of comments, and then again hand it to Mike to give a bit of a world S and D discussion. But what I would say on phosphates though, certainly, China has continued to increase their exports, probably beyond what either we or some of the major analysis firms like CRU would have expected. But having said that, the demand has required it.

I believe China has increased their exports by about 1.6 million tonnes, and India has taken up all that as excess for there. So that’s the first step of it. If I look forward going in P, we don’t see a huge amount of new production coming on for the next year or two, and yet the market continues to grow at 1.5 million or so tonnes per year. So we continue to see that market as very constructive and a very good market to be in.

Mike, can you give more color?

<A – Mike Rahm – The Mosaic Co.>: Sure. Just – let me just start by talking about China. Joc mentioned those numbers, and I think those are from July or August. I took a look at numbers this morning. When you look at year-to-date exports from China, they’re up 3.3 million tonnes, and we think for the year, China will probably export somewhere in that 9.5 million to 10 million tonne mark.

And while that’s a big increase, as Joc mentioned, the market really is requiring that. And in particular, if you look at India and their increase in DAP imports, those have increased 3.1 million tonnes during the same period, so – and particularly, if you look at China’s phosphate exports and look at just the DAP component, DAP exports have increased 2.7 million tonnes, Indian DAP imports have increased 3.1 million tonnes. So there is a draw coming from India that China is meeting.

10

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

The other thing I think that we’ve said before is that on the demand side, we see very steady growth in phosphate demand. And on the supply side, there are really some very interesting dynamics taking place. While China has increased their exports, if you look at other major producers, there have been some real significant declines in supply.

So, in North America, we’ve had two facilities close down, so we’ve had the full impact of the closure of Mississippi Phosphates this year, so another 700,000 tonnes lost there. We’ve had the – a full-year impact of the White Springs plant closing. And then if you look around the world, there have been outages or hiccups in many different countries, whether it’s Tunisia with some of the political unrest there that has disrupted production, whether it’s in – just some hiccups in places like Jordan, South Africa, Senegal, Mexico, you name it. There have been supply disruptions.

And then, in terms of the bigger players like Ma’aden, Ma’aden I, continues to ramp up. It still hasn’t reached full capacity. So it’s sort of leveled off at two-thirds of capacity, if you will. And the Moroccans are bringing on capacity but at a much slower rate than expected. Whether that’s planned or unplanned, who knows. But the bottom line is, their first hub just started up a few months ago. And as we understand, the granulation plant is not running there yet.And secondly, if you look at some of the other hubs, they’re not scheduled to come on for several months or even years.

And I think all of that is evident when you look at margins. In this business, we’re focused on what we call the stripping margin.And the difference between the price of DAP and the price of sulfur and ammonia in a tonne of DAP – and if you look at that, margins in the fourth quarter, and if you calculate them based on current spot prices that are published, they’re up about $40 from a year ago. And if you look at margins throughout calendar year 2015, they have been incredibly constant at between about $265 and $275 per tonne. So I think the best proof in terms of the positive or constructive phosphate fundamentals is in what stripping margins have done and they’ve reflected the stronger fundamentals in phosphate.

Operator: Your next question comes from Stephen Byrne from BoA Merrill Lynch. Your line is open.

<Q – Stephen Byrne – Bank of America Merrill Lynch>: Thank you. When you look at heterogeneity of P and K nutrient levels within North American cultivated fields, how do you look at the potential impact of variable rate fertilizer applications of P and K on demand? Do you think that there could be a net increase in demand or net reduction in demand as growers focus more on that heterogeneity?

<A – Joc O’Rourke – The Mosaic Co.>: I’m going to hand that over to Mike right away, but I’m going to first just say that, look, we see technical advances like variable rate application and precision agriculture as ultimately a very good thing. We believe the demand for our fertilizer in the plant is all about – if you get too technical, about the sociometric needs of the plant and the fertility of the soil. So if we can have that fertility of the soil be more exact, then we believe overall, it will neither hurt nor help our overall consumption but will ensure the best productivity for the farmer.

<A – Mike Rahm – The Mosaic Co.>: And I think that’s the only comment I would have, if you look at the numbers, shipments in North America of both the main phosphate and potash products have really been pretty consistent over time in big round numbers. About 9 million metric tonnes of MOP and about 9 million metric tonnes of the main solid phosphate fertilizers get shipped every year. And there might be some swings from year-to-year in the pipeline and so forth, but on average, that’s more or less what goes down.

So, I think that the widespread use of variable rate technologies, which have been around now for 10 years, 15 years, I think have been to optimize that on farm fields. So, I think more of it gets

11

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

spread on the better land that has upside in terms of yield potential, less probably gets spread on the sandy hillsides. But the bottom-line is net-net, shipments have remained about the same.

Rick, do you have any comments?

<A – Rick McLellan – The Mosaic Co.>: The only thing I would add is that this technology, the variable rate technology has been around for a while. And frankly, it has been helpful to getting the right nutrients in the right place for the growing crop. And we see, as the adoption rates get higher going forward, that being very positive for both P and K application rates overall across North America.

Operator: Your next question comes from Don Carson from Susquehanna. Your line is open.

<Q – Don Carson – Susquehanna Financial Group LLLP>: Yes, I want to go to your slide 12 where you talk about your potash shipment outlook. You’ve got an increase in 2016 to 61 million to 63 million tonnes from 59 million this year. What’s your price assumption there? Are we finally seeing some price elasticity benefit from lower potash prices, I mean, you’re down about $100 domestically and presumably you’re forecasting lower offshore pricing next year as well. So I’m just wondering if you can comment on the price elasticity dynamic and the impact on demand?

<A – Joc O’Rourke – The Mosaic Co.>: So I’m going to hand it to Mike in a second, but on the price elasticity, I think we’ve probably been a bit surprised that there is more elasticity than we might have expected. And in terms of price, I think it’s a little early to come up with an exact price for next year. But I would say, first of all, the potash oversupply concerns, I believe are a bit overblown. I mean, this year, we started with high inventory. As the shipments go up next year, we start with a little lower inventory. I believe that market is going to be a lot better balanced and I don’t believe the downward pressure people are talking about will really be there.

So I’m going to let Mike give a little more of the detail of that and how we came up with our forecast. But I think it is a good story.

<A – Mike Rahm – The Mosaic Co.>: And in terms of the underlying price assumptions there, Don, I think we’re beginning to see some stabilization in potash prices. They have come down a great deal, and our expectation is that they will stabilize. And I guess how they play out in 2016 will depend on a lot of factors, I think the most important of which is agricultural commodity prices.

And I guess the reason why we see prices stabilizing here is that we are working through those large channel inventories from last year. As you see in the numbers, gosh, we had a 9 million tonne increase in shipments. And I think, you’re probably familiar with all the reasons for that, but when you go back and take a look at what was happening in 2014, we ended 2013 with virtually an empty pipeline, given the announcement on July 30, 2013. Everyone was waiting for prices to move where advertised. And eventually, people stopped buying, and the pipeline was pulled down.

Then we got into 2014 with all of the weather and shipment concerns in North America. Prices began to increase, and everyone jumped back into the market. Net result, big increase in channel inventories, especially in North America, Brazil, and even Indonesia and Malaysia. We’re working through those right now. So, I think we’ll start 2016 with the pipeline in much better shape than certainly a year ago.

And then in addition to that, I think – we’ve been saying what has really pressured potash prices this year are two factors: one, being the channel inventories; the second, being the collapse of key potash currencies. And hopefully in 2016, we’ll see a little bit greater stability on the macroeconomic front, and we think that will be constructive. And then, if these forecasts are on target, we should see about a 3 million tonne rebound, we think, in shipments. Put that all together, and I think it

12

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

points to a situation where prices begin to stabilize a bit and we see a very balanced situation between what’s required to ship and the actual demand out there.

Operator: Your next question comes from Jeff Zekauskas from JPMorgan. Your line is open.

<Q – Jeff Zekauskas – JPMorgan Securities LLC>: Good morning. I think I have a question for Rich Mack. The operating cash flow through the nine months has been $1.5 billion this year versus $1.8 billion last year, and the cash flow from operating activities this quarter was only $184 million, even though D&A plus net income is about $340 million. What’s going on with your working capital that’s leading to such a large cash drain? And how do you see your operating cash flow for the year versus last year or your free cash flow for the year versus last year, this year?

<A – Rich Mack – The Mosaic Co.>: Hi, Jeff. Well, for the year, we don’t expect any difference really between our performance in operating cash flow this year compared to last. For the quarter, we had some just movement in working capital when you compare it to last year. We had some strong trends in working capital movements when you compare it to this year.

But in the end, our operating cash flow performance for the nine months is very strong for Mosaic, and we continue to be a cash generator in both of our businesses. And I think that’s going to be part of our story going forward in terms of continuing strong operating cash flow, a reduction in our capital expenditure profile over time, and an increasing free cash flow story.

Operator: Your next question comes from Yonah Weisz from HSBC. Your line is open.

<Q – Yonah Weisz – HSBC Bank Plc (Tel Aviv Branch)>: Yes. Hello. Good morning. A question for Joc. In your comments at the start of this call, you talked about Mosaic’s balance sheet and ability to use the balance sheet, thinking about new opportunities at the low point in the cycle. Earlier on this year at Mosaic’s Investor Day, your predecessor, Jim, was asked I think a similar question about use of balance sheet and perhaps M&A, and he implied that really no chance for M&A in potash and maybe here or there a few bolt-on acquisitions in phosphates.

On other hand, if you’re talking about use of balance sheet, I’m wondering is there a change in philosophy at Mosaic with regards to M&A? And if so, could you talk a bit about what you’d be interested in? Thank you very much.

<A – Joc O’Rourke – The Mosaic Co.>: Sure. Look, our capital philosophy, Yonah, has not changed in the last year. We’re certainly looking first at making sure we maintain a reasonable liquidity buffer, that we keep our credit rating in really good shape, that we meet our debt ratios that we have set, the 1.5 times to 2 times EBITDA to debt. So none of that has changed. And as we’ve probably said, at the bottom of cycles, that really opens up, let’s say, more opportunities. There are more things out there that look like they might be well-priced for the people who have the balance sheet to take advantage of it.

But as Rich said in his comments, I would emphasize that when we trade – when our stock is trading low like this, our bar becomes even higher because we have to measure any expenditure against the benefit of buying back our own shares. So we’ve been very disciplined about that, and we will continue to be very disciplined about it.

But if there is a great opportunity for our shareholders, we’re going to explore it carefully. And if it makes sense and adds value long term, we will certainly be looking at that. In terms of specifics, we don’t like to talk about specifics. But be known that the general philosophy has not changed, the discipline has not changed, but our opportunities may be higher.

Operator: Your next question comes from P.J. Juvekar from Citi. Your line is open.

13

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Dan Jester – Citigroup Global Markets, Inc. (Broker)>: It’s Dan Jester on for P.J. If you look at realized prices for potash over time, it seems like the premium in the North America market maybe has come down a bit compared to the rest of the world. So I’m just wondering if structurally the North American market is going to get more competitive from here?

And if I can sneak a second one in, maybe, Mike, can you just comment about the longer-term ability of Chinese phosphate exports to be maintained at this high level? Thanks.

<A – Joc O’Rourke – The Mosaic Co.>: Okay, Dan. I’m going to hand this over to Mike pretty quick. But I’ll say, look, we live in a competitive market. And from time to time, if the competition is higher, those – if you call it a premium, they’re all about, again, time-place, utility, cost to serve that market. And so, from time-to- time, that premium, as you call it, will change based on free market dynamics.

I think the structural reasons for a higher price in North America, being it’s a granular market, being that there is some logistics challenges to get into the mid-U.S., justify the difference in price. But that won’t always be there day-to-day. And so with that, I’m going to hand it to Mike to give some...

<Q – Dan Jester – Citigroup Global Markets, Inc. (Broker)>: Sure.

<A – Mike Rahm – The Mosaic Co.>: And I think – Hi, P.J. or P.J.’s substitute here. I think we’ve said in the past, I mean, the fair comparison is looking at the blend grade price delivered to the U.S. Gulf as well as Brazil. And if you look at current spot prices, you’re exactly right that that differential has more or less dissipated. In particular, if you look at a NOLA barge price of $270 per short tonne versus a Brazil C&F price of roughly $290. For the Russian or Belarusian supplier, Brazil actually gives them a little bit better netback.

So, I would say that, yes, we’ve seen some adjustments in that – in prices to sort of turn off the beacon in terms of attracting tonnes to North America. And I think that’s certainly evident in terms of our price – our import forecast. If you look at the 2014-2015 fertilizer year, the U.S. imported about 1.7 million metric tonnes of MOP from offshore sources. And not only Russians, but every potash producer around the globe seemed to place a few tonnes in the U.S. We think that’s going to drop about 600,000 tonnes to 1.1 million, 1.0 million tonnes this year.

And one of the main reasons for that is the dissipation of that differential. And if you look at the numbers for the first three months of our fertilizer year, namely the third calendar quarter, imports are down about 150,000 tonnes from last year. So we’re on a pace to reduce imports from offshore sources by the amount that we have. And then, again, if global shipments increase 3 million tonnes, there’s going to be kind of a natural pull of some of these tonnes that have come into North America into other markets that are better markets for them.

And then your second question in terms of long-term Chinese exports: obviously, we’ve seen a big surge this year, driven largely by the rebound in Indian demand as well as the supply problems that we talked about earlier. I think longer term, we expect that those are not going to be in that 10 million tonne range, but probably something closer to 6 million, 7 million tonnes.

We think there will be structural adjustments that take place in the Chinese phosphate industry. Chinese producers are very heterogeneous in the sense that there are some very efficient low-cost players, there are some medium-cost players, and there are some high-cost players. So we think that they will see some restructuring, and that longer term 10 million tonnes is not the number.

Operator: Your next question comes from Vincent Andrews from Morgan Stanley. Your line is open.

14

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Neel Kumar – Morgan Stanley & Co. LLC>: Hi. This is Neel Kumar calling in for Vincent. I just wanted to talk a little bit about what’s going on in India and China on potash. We’ve been reading about Indian buyers looking for a contract discount. Do you see that as a possibility? And in regards to China, how has the reimplementation of VAT affected domestic consumption?

<A – Joc O’Rourke – The Mosaic Co.>: Sorry, Neel. I missed the second part of your question. It broke up a little bit. Oh, the VAT. Okay. I think I got it. It sounds like somebody’s got that. Okay. Well, I’m going to hand that straight over to Rick to answer. I think that’s probably right up his alley. So Rick, why don’t you just take that?

<A – Rick McLellan – The Mosaic Co.>: Yeah. Good morning, Neel. If you are asking about the Indian and Chinese contracts, frankly it’s a bit too early to talk about those, but we do see good demand. If you look overall, we’ve seen increased demand or solid demand, 14 million tonnes in China for product. So the product that is being shipped is going to the ground.

And indications on the impact of VAT have been frankly de minimis from what we’ve been able to pick up. They have to work through inventory. There was a transitional VAT cost for inventory. And so, overall, we think it’ll take a little bit of time to work through. But where potash is priced versus other nutrients, there’s high inclusion rates on – in NPKs for potash.

<A – Mike Rahm – The Mosaic Co.>: And, Rick, can I just add one thing? If you look at grain prices in China, I mean, the government supports them at extraordinarily high levels. There had been a lot of, I think, focus on their September 18 announcement that they were going to reduce the corn support price by 10%. They’ve reduced it to RMB 2,000 per metric tonne. That’s the equivalent of about $8.70 per bushel.

So their support price is still more than double what current prices are. So in terms of a 13% VAT, while it certainly increases the pain for the Chinese farmers to buy phosphate and other fertilizers, the farm economics there are very good, and we really don’t see that denting demand all that much.

Operator: Your next question comes from Jonas Oxgaard from Bernstein. Your line is open.

<Q – Jonas Oxgaard – Sanford C. Bernstein & Co. LLC>: Hi. And congratulations on starting out on such a nice note. Good first quarter, say, for a new CEO.

<A – Joc O’Rourke – The Mosaic Co.>: Thank you, Jonas.

<Q – Jonas Oxgaard – Sanford C. Bernstein & Co. LLC>: Pleasure. Question, I think it’s been asked but I want to phrase a little bit differently, when you’re thinking about Colonsay what would the world look like for you to restart it, when will you restart it?

<A – Joc O’Rourke – The Mosaic Co.>: Okay. So, thank you, Jonas, and again, thank you for the comment. But just before I do this, I think this will be probably our – either our last or second to last question as we get to the end of the hour but – so Colonsay, look, what we will be looking at is I have to take a step back. We have a very comprehensive process for doing what we call integrated business planning. And that integrated business planning looks at our production capabilities, it looks at where we make the product, what product we’re making, so it’s done on a site-by-site basis for production. It’s done on a product-by-product basis for production. We also look at the markets that we’re serving and how those look on the quarter all the way out to multi-year.

So with both of those – and then you have the logistics in between but that very comprehensive process we take a look at how we’re going to add the next – the most value over the next period of time. Now clearly, if the market requires it and we see it as adding real value to our shareholders, we will add production. But as Rick said earlier today on one of the earlier questions, there is very

15

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

The Mosaic Co. | MOS | Q3 2015 Earnings Call | Nov. 3, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

little value in selling into a market when there’s no demand. And in the third quarter, it’s just refilling, it’s just getting ready for the fall application season. So what we find in general is if you try and stuff product into that market, all you do is destroy price and value. So we would rather wait until there really is the demand out there.

James O’Rourke, President and Chief Executive Officer

So, I think it’s probably – as we are at the hour, it’s time for a wrap up. And all I’m going to say in the wrap up is, look, we see the future long-term as extremely bright. We do believe in the food story. We believe in the secular long-term trend of higher population, greater wealth around the world leading to higher demand for food which leads to higher demand for our product.

And with that, I think Mosaic is extremely well-positioned to take advantage of that, and we will continue to focus on operational excellence, on delivering to our customers, and making sure we execute against our strategy.

So thank you very much for listening, and we’ll hear from you again in a quarter. Thanks.

Operator: This concludes today’s conference call. You may now disconnect.

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2015. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

16

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

The Mosaic Company Earnings Conference Call – Third Quarter 2015 November 3, 2015 Joc O’Rourke, President and Chief Executive Officer Rich Mack, Executive Vice President and Chief Financial Officer Laura Gagnon, Vice President Investor Relations

Safe Harbor Statement This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the long term ammonia supply agreements with CF, including the risk that the cost savings from the agreements may not be fully realized or that the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of these agreements becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for Mosaic’s products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements. 2

Inherent Seasonality and Cyclicality Mosaic’s Actions: Controlling costs and executing well Effectively allocating capital Maintaining leadership and discipline Macro Environment: Challenges across geographies FX headwinds Import tariffs Cyclicality presents opportunities Positive Secular Trend Underpins Long-Term Demand Growth 3

Visible Strategic Progress $0.56 $0.62 $0.03 $0.02 $0.02 $0.03 $0.04 $0.35 $0.40 $0.45 $0.50 $0.55 $0.60 $0.65 $0.70 2014 Q3 Adjusted EPS K Costs International Distribution SG&A Share Count All Other 2015 Q3 Adjusted EPS Q3 2014 vs. Q3 2015 Adjusted EPS Benefit of Mosaic’s Strategic Initiatives: $0.10/share • Adjusted EPS Reconciliation in the Appendix. • All other includes impact of lower potash sales volumes and prices, lower tax rate and excludes the impact of disclosed notable items 4

Financial Results Review

Phosphates Segment Highlights Key Drivers: • The year-over-year decrease in net sales is driven by lower sales volumes and lower average selling prices. • The year-over-year decrease in operating earnings reflects lower finished product selling prices and lower operating rates, partially offset by lower ammonia costs. $ In millions, except DAP price Q3 2015 Q2 2015 Q3 2014 Net sales $1,032 $1,385 $1,133 Gross margin $199 $296 $236 Percent of net sales 19% 21% 21% Operating earnings $157 $259 $188 Sales volumes 2.1 2.8 2.2 NA production volume(a) 2.4 2.5 2.5 Finished product operating rate 83% 86% 85% Avg DAP selling price $451 $450 $463 (a) Includes crop nutrient dry concentrates and animal feed ingredients 0 50 100 150 200 250 300 Q3 2014 OE Sales price Sales volumes Raw materials Other Q3 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS 6

Potash Segment Highlights $ In millions, except MOP price Q3 2015 Q2 2015 Q3 2014 Net sales $492 $730 $593 Gross margin $97 $295 $154 Percent of net sales 20% 40% 26% Operating earnings $66 $259 $69 Sales volumes 1.6 2.3 1.8 Production volume 1.8 2.4 1.7 Production operating rate 67% 90% 62% Avg MOP selling price $265 $280 $291 0 20 40 60 80 100 Q3 2014 OE Sales price Sales volumes Production and other Resource taxes & royalties Q3 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS Key Drivers: • The decrease in net sales compared to last year was driven by lower sales volumes and lower average selling prices. • The year-over-year decrease in gross margin rate was primarily driven by lower realized prices. Higher Canadian resource taxes and royalties were partially offset by lower costs as a result of the weaker Canadian dollar and expense management initiatives. 7

International Distribution Segment Highlights $ In millions, except Blends price Q3 2015 Q2 2015 Q3 2014 Net sales $825 $637 $684 Gross margin $61 $29 $51 Percent of net sales 7% 4% 7% Operating earnings $44 $8 $30 Sales volumes 2.0 1.5 1.4 Margin per tonne $30 $19 $36 Average realized price (FOB destination) $400 $427 $481 0 50 100 150 200 250 Q3 2014 OE Sales volumes & mix Product cost Sales price Other Q3 2015 OE OPERATING EARNINGS BRIDGE $ IN MILLIONS Key Drivers: • The increase in net sales was driven by higher sales volumes, partially offset by lower average realized prices. • Operating earnings were $15 million higher than last year, reflecting a larger business footprint in Latin America. 8

Meaningful Share Repurchases; Unchanged Capital Priorities Lower Share Price = Higher Bar for Investments * Q4’12 through Q3’15 ($ in billions) 18% 13% 29% 40% Capital Allocation: Three Year Summary* Maintenance Organic Growth Investment Commitments Return to Shareholders (dividends & repurchases) Total: $11.6 Billion 9

Financial Guidance Summary Phosphates 2015 Q4 Sales volumes 1.9 to 2.2 million tonnes Q4 DAP selling price $410 to $440 per tonne Q4 Gross margin rate High Teens Q4 Operating rate Around 80 percent International Distribution 2015 Q4 Sales volumes 1.3 to 1.6 million tonnes Q4 Gross margin per tonne $23 to $28 per tonne 10

Financial Guidance Summary Potash 2015 Q4 Sales volumes 1.8 to 2.1 million tonnes Q4 MOP selling price $235 to $255 per tonne Q4 Gross margin rate Mid 20 percent range Q4 Operating rate Around 70 percent Full year Canadian Resources Taxes and Royalties $265 to $295 million Full year brine management costs $170 to $180 million Consolidated Full Year 2015 Total SG&A $350 to $370 million Capital Expenditures and Equity Investments $1.1 to $1.2 billion Effective Tax Rate Mid to high teens 11

Manageable Outlook for Potash; Compelling Phosphates Dynamics 12 59.1 61-63 25 30 35 40 45 50 55 60 65 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 16F Global Potash Shipments Mil Tonnes KCl Source: CRU and Mosaic 65.5 66-68 30 35 40 45 50 55 60 65 70 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15E 16F Global Phosphate Shipments MMT Product DAP/MAP/NPS/TSP Source: CRU and Mosaic

Closing Commentary

Compelling Free Cash Flow Growth Even at Today’s Nutrient Prices 14 Free cash flow* positive even at current low prices Benefits of investments expected to drive meaningful growth in 2017 Significant upside leverage to higher prices • Free cash flow reconciliation in the appendix.

Thank You The Mosaic Company Earnings Conference Call – Third Quarter 2015 November 3, 2015

Appendix

Q3 2015 Percent Ammonia ($/tonnes) Realized in COGS $418 Average Purchase Price $448 Sulfur ($/ton) Realized in COGS $151 Average Purchase Price $152 Phosphate rock (realized in COGS) ('000 tonnes) U.S. mined rock 3,427 95% Purchased Miski Mayo Rock 154 4% Other Purchased Rock 23 1% Total 3,604 100% Average cost / tonne consumed rock $61 Raw Material Cost Detail 17

(a) These factors do not change in isolation; actual results could vary from the above estimates (b) Assumes no change to KMAG pricing 2015 Q3 Actual Change 2015 Q3 Margin % Actual % Impact on Segment Margin Pre-Tax Impact EPS Impact Marketing MOP Price ($/tonne)(b) $265 $50 20% 15% $74 $0.17 Potash Volume (thousand tonnes) 1,626 500 20% 14% $71 $0.17 DAP Price ($/tonne) $451 $50 19% 10% $102 $0.24 Phosphate Volume (thousand tonnes) 2,049 500 19% 7% $72 $0.17 Raw Materials Sulfur ($/lt) $151 $50 19% 4% $45 $0.11 Ammonia ($/tonne) $418 $50 19% 2% $24 $0.06 Earnings Sensitivity to Key Drivers(a) 18

0 100 200 300 400 500 600 700 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015F Realized Costs Market Prices 0 25 50 75 100 125 150 175 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015F Realized Costs Market Prices Phosphate Raw Material Trends Ammonia Sulfur ($/tonne) ($/tonne) 1. Market ammonia prices are average prices based upon Tampa C&F as reported by Fertecon 2. Market sulfur prices are average prices based upon Tampa C&F as reported by Green Markets 3. Realized raw material costs include: ~$20/tonne of transportation, transformation and storage costs for sulfur ~$30/tonne of transportation and storage costs for ammonia 19

Reconciliation: Adjusted EPS and Free Cash Flow In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company has presented adjusted earnings per share and free cash flow, each of which is a non-GAAP financial measure. Generally, a non-GAAP financial measure is a supplemental numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Neither adjusted diluted earnings per share nor free cash flow is a measure of financial performance under GAAP. Because not all companies use identical calculations, investors should consider that Mosaic’s calculations may not be comparable to other similarly titled measures presented by other companies. Adjusted diluted earnings per share and free cash flow should not be considered as substitutes for, or superior to, measures of financial performance prepared in accordance with GAAP. Management believes that adjusted diluted earnings per share provides securities analysts, investors and others, in addition to management, with useful supplemental information regarding our performance by excluding certain items that may not be indicative of or are unrelated to our core operating results. Management utilizes adjusted diluted earnings per share in analyzing and assessing the Company’s overall performance, for financial and operating decision-making, and to forecast and plan for future periods. Adjusted diluted earnings per share also assists our management in comparing our and our competitors’ operating results. Free cash flow provides a metric that the Company believes is helpful to investors in evaluating the Company’s ability to generate cash. Free cash flow should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Adjusted Diluted Earnings Per Share 2015 2014 Diluted earnings per share, as reported $0.45 $0.54 Items included in EPS: Foreign currency transaction (gain) loss 0.12 (0.06) Unrealized (gain) loss on derivatives 0.05 0.04 Discrete tax items (0.01) - Write-off of fixed assets 0.02 - Consumption tax refund (0.01) - Share repurchase - (0.01) Severance - 0.01 Adjustments to Argentine assets held for sale - (0.03) Gain on sale of Hersey - (0.03) Carlsbad restructuring expense - 0.10 Diluted earnings per share, as adjusted $0.62 $0.56 Three months ended September 30, Free Cash Flow Nine months ended September 30, US$ Million 2015 Net cash provided by operating activities $ 1,521 Less: Capital expenditures (702) Free cash flow $ 819 20

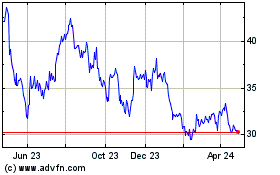

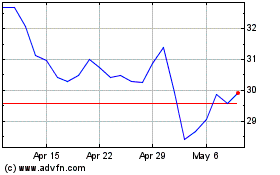

Mosaic (NYSE:MOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mosaic (NYSE:MOS)

Historical Stock Chart

From Apr 2023 to Apr 2024