UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2015

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-32327 | | 20-1026454 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

3033 Campus Drive Suite E490 Plymouth, Minnesota | | 55441 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

Furnished herewith as Exhibit 99.1 and incorporated by reference herein is the text of The Mosaic Company’s (“Mosaic”) announcement regarding its earnings and results of operations for the quarter ended June 30, 2015 as presented in a press release issued on August 4, 2015.

Furnished herewith as Exhibit 99.2 and incorporated by reference herein is certain performance data for the period ended June 30, 2015 to be published on Mosaic’s website.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made to the Exhibit Index hereto with respect to the exhibits furnished herewith. The exhibits listed in the Exhibit Index hereto are being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | THE MOSAIC COMPANY |

| | | |

Date: August 4, 2015 | | | | By: | | /s/ Mark J. Isaacson |

| | | | Name: | | Mark J. Isaacson |

| | | | Title: | | Vice President, General Counsel |

| | | | | | and Corporate Secretary |

EXHIBIT INDEX

|

| | | |

Exhibit No. | | Description |

| |

99.1 |

| | Press release, dated August 4, 2015, of The Mosaic Company regarding its earnings and results of operations for quarter ended June 30, 2015 |

| |

99.2 |

| | Performance data for the period ended June 30, 2015 |

Exhibit 99.1

|

| | | | |

| | | | |

| | | | The Mosaic Company 3033 Campus Drive, Suite E490 Plymouth, MN 55441 www.mosaicco.com |

|

| | | | |

| | | | |

Media Ben Pratt The Mosaic Company 763-577-6102 benjamin.pratt@mosaicco.com | | Investors Laura Gagnon The Mosaic Company 763-577-8213 investor@mosaicco.com | | |

FOR IMMEDIATE RELEASE

THE MOSAIC COMPANY REPORTS SECOND QUARTER 2015 RESULTS

Net earnings up 57 percent to $391 million

Earnings per share up 69 percent to $1.08

Joc O’Rourke to assume CEO role on August 5, 2015

PLYMOUTH, MN, August 4, 2015 - The Mosaic Company (NYSE: MOS) today reported second quarter 2015 net earnings of $391 million, compared to $248 million in the second quarter of 2014. Earnings per diluted share were $1.08 in the quarter compared to $0.64 last year. Notable items positively impacted current quarter earnings per share by $0.03. Mosaic’s net sales in the second quarter were $2.5 billion, up from $2.4 billion in sales last year. Operating earnings during the quarter were $510 million, up from $403 million a year ago. The year-over-year change was driven by higher phosphates operating earnings primarily as a result of higher sales volumes, and higher potash operating earnings as a result of higher realized prices and benefits from lower operating costs, partially offset by higher Canadian resource taxes.

“Our second quarter results demonstrate the earnings leverage we’ve created,” said Jim Prokopanko, President and Chief Executive Officer. “Over the course of the last two years, we have transformed Mosaic’s operations to become more efficient and made great progress in optimizing our balance sheet. This quarter we generated higher earnings per share than two years ago, notwithstanding lower potash and phosphates prices since then.”

As previously announced, James C. “Joc” O’Rourke, currently Mosaic’s Executive Vice President and Chief Operating Officer, will succeed Mr. Prokopanko as President and CEO on August 5, 2015. Mr. Prokopanko will remain in an advisory role until his planned retirement in January 2016.

Cash flow from operating activities in the second quarter of 2015 was $583 million which is down from $796 million in the prior year as a result of favorable working capital trends last year. Capital expenditures totaled $227 million in the quarter.

Mosaic’s total cash and cash equivalents were $2.2 billion and long-term debt was $3.8 billion as of June 30, 2015.

“We are pleased with the performance of each of our segments during the second quarter,” said Rich Mack, Executive Vice President and Chief Financial Officer. “Demand from the export markets, combined with continued healthy fertilizer application rates in North America, led to good volumes and prices during the quarter. Cost reduction efforts and focused execution helped drive margin rates higher, resulting in a significant improvement in earnings compared to a year ago.”

Business Highlights - Second Quarter 2015

| |

• | The Company’s progress against strategic priorities is positively impacting financial results. During the second quarter Mosaic delivered: |

| |

◦ | Higher margin rates in both Potash and Phosphates, driven by: |

| |

▪ | Significantly lower MOP cash production costs of $89 per tonne, including $18 per tonne of brine management expenses. |

| |

▪ | Lower phosphate rock costs and improvements in finished phosphate conversion costs per tonne. |

| |

◦ | Flat Selling, General and Administrative expenses with an expanded business footprint compared to last year. |

| |

• | Integration of Archer Daniels Midland’s fertilizer distribution business in Brazil and Paraguay is largely completed and the Company is on track to achieve targeted benefits. |

| |

• | Mosaic’s growth initiatives in Canada and Florida continue to be on time and on budget. |

| |

• | The Company’s joint venture phosphate project, Wa’ad Al Shamal Phosphate Company, is projecting a capital cost of approximately $8.0 billion, or seven percent higher than initial capital estimates. |

| |

• | Subsequent to the end of the second quarter, the Company completed its previously announced $500 million accelerated share repurchase program. |

| |

• | Mosaic continues to maintain a strong balance sheet and generate attractive operating cash flow, ending the quarter with $2.2 billion of cash and cash equivalents on the balance sheet. |

Phosphates

|

| | |

Phosphates Results | 2Q 2015 Actual | 2Q 2015 Guidance |

Average DAP Selling Price | $450 | $425 to $450 |

Sales Volume | 2.8 million tonnes | 2.3 to 2.7 million tonnes |

Phosphate Production | 86% of operational capacity | 80-85% of operational capacity |

“Our Phosphates business is driving earnings growth for Mosaic,” Mr. Prokopanko said. “In fact, during the second quarter and year-to-date the business accounted for half of Mosaic’s operating earnings. As we look ahead, strong global demand and relatively stable raw material costs bode well for our Phosphates business.”

Net sales in the Phosphates segment were $1.4 billion for the second quarter, up from $1.3 billion last year with higher sales volumes partially offset by lower finished product prices. Gross margin was $296 million, or 21 percent of net sales, compared to $271 million, or 20 percent of net sales, for the same period a year ago. The year-over-year improvement in gross margin rate primarily reflects lower phosphate rock costs, partially offset by lower finished product selling prices. Operating earnings were $259 million, up from $219 million in the same quarter last year.

The second quarter average DAP selling price, FOB plant, was $450 per tonne, compared to $465 per tonne a year ago. Total sales volumes in the Phosphates’ segment were 2.8 million tonnes in the second quarter, up from 2.6 million tonnes last year.

Mosaic’s North American finished phosphate production was 2.5 million tonnes, or 86 percent of operational capacity, compared to 84 percent a year ago.

Potash

|

| | |

Potash Results | 2Q 2015 Actual | 2Q 2015 Guidance |

Average MOP Selling Price | $280 | $265 to $290 |

Sales Volume | 2.3 million tonnes | 2.0 to 2.4 million tonnes |

Potash Production | 90% of operational capacity | 85-90% of operational capacity |

“For the third quarter in a row, our Potash business delivered outstanding results, with consistent production and low operating costs,” Mr. Prokopanko said. “Our three world-scale Canadian mines provide operating efficiencies and flexibility needed to respond to global demand with significantly lower cash production costs. Mosaic expects robust global shipments in the second half of 2015.”

Net sales in the Potash segment totaled $730 million for the second quarter, down from $762 million last year, driven by lower sales volumes, partially offset by higher average realized prices. Gross margin was $295 million, or 40 percent of net sales, compared to $226 million, or 30 percent of net sales a year ago. The year-over-year increase in gross margin rate was driven by higher realized prices combined with lower costs of production as a result of higher operating rates,

cost savings initiatives and a weaker Canadian dollar, partially offset by an increase in Canadian resource taxes and royalties.

The second quarter average MOP selling price, FOB plant, was $280 per tonne, up from $267 per tonne a year ago. The Potash segment’s total sales volumes for the second quarter were 2.3 million tonnes, compared to 2.5 million tonnes a year ago.

Potash production was 2.4 million tonnes, or 90 percent of operational capacity, up from 2.0 million tonnes, or 76 percent of operational capacity, a year ago. The higher operating rate in the second quarter is because of planned turnarounds in the third quarter and expected strong potash demand for the remainder of 2015.

International Distribution (ID)

|

| | |

ID Results | 2Q 2015 Actual | 2Q 2015 Guidance |

Sales Volume | 1.5 million tonnes | 1.4 to 1.7 million tonnes |

Gross Margin per Tonne | $19 per tonne | $18 to $25 per tonne |

“Integration of our acquisition in Brazil and Paraguay is largely completed and Mosaic is on track to realize the strategic value,” Mr. Prokopanko said. “Brazilian real volatility and delayed availability of farm credit resulted in delayed fertilizer demand in the region. With our expanded footprint and product placement ahead of the season, Mosaic is well positioned for the second half of 2015 in Brazil.”

Net sales in the International Distribution segment were $637 million for the second quarter, up from $542 million last year, driven by higher sales volumes as a result of the ADM acquisition. Gross margin was $29 million, or 4 percent of net sales, compared to $34 million, or 6 percent of net sales for the same period a year ago. The year-over-year change in gross margin rate primarily reflects the impact of declining prices and delayed fertilizer demand in Brazil, partially offset by the impact of the weaker local currency on expenses. Operating earnings were $8 million, down from $16 million in the same quarter last year.

The second quarter average selling price was $427 per tonne, compared to $452 per tonne a year ago. International Distribution segment total sales volumes were 1.5 million tonnes, up from 1.2 million tonnes last year, benefiting from the ADM acquisition.

Other

SG&A expenses were $89 million for the second quarter, roughly flat with last year, notwithstanding an expanded business footprint resulting from the ADM acquisition.

Financial Guidance

“Despite the recent swings in grain and oilseed prices, we remain confident in our second half outlook,” said Joc O’Rourke, Executive Vice President and Chief Operating Officer. “Stable farm economics, combined with the benefits of our strategic initiatives, position Mosaic to generate attractive returns for our shareholders.”

Total sales volumes for the Phosphates segment are expected to range from 2.1 to 2.4 million tonnes for the third quarter of 2015, compared to 2.2 million tonnes last year. Mosaic’s realized DAP price, FOB plant, is estimated to range from $435 to $455 per tonne for the third quarter of 2015. The segment gross margin rate is estimated to be in the low-20 percent range and the operating rate is expected to be in the mid-80 percent range.

Total sales volumes for the Potash segment are expected to range from 1.6 to 2.0 million tonnes for the third quarter of 2015, compared to 1.8 million tonnes last year. Mosaic’s realized MOP price, FOB plant, is estimated to range from $260 to $280 per tonne. Mosaic’s gross margin rate in the segment is expected to be in the low-20 percent range during the third quarter of 2015, while the seasonally low operating rate is expected to be in the mid-60 percent range, both reflecting traditional summer maintenance downtime.

Total sales volumes for the International Distribution segment are expected to range from 1.9 to 2.2 million tonnes for the third quarter of 2015, compared to 1.4 million tonnes last year. The segment gross margin per tonne is estimated to be in the range of $20 to $26 per tonne.

For the 2015 full year guidance, Mosaic updates the following estimates:

| |

• | Canadian resource taxes and royalties to be in the range of $310 to $350 million, compared to prior guidance of $325 to $375 million. |

| |

• | Capital expenditures and investments to be in the range of $1.1 to $1.3 billion, compared to $1.1 to $1.4 billion. |

| |

• | Phosphates sales volumes to be in the range of 9.5 to 10.0 million tonnes, compared to 9.0 to 10.0 million tonnes. |

| |

• | Potash sales volumes to be in the range of 8.2 to 8.6 million tonnes, compared to 8.5 to 9.0 million tonnes. |

| |

• | International Distribution sales volumes to be in the range of 6.0 to 6.5 million tonnes, compared to 6.0 to 7.0 million tonnes. |

The remaining 2015 full year guidance is unchanged:

| |

• | SG&A expenses to range from $360 to $380 million, inclusive of costs from the recently acquired distribution business in Brazil and Paraguay. |

| |

• | Brine management costs to be in the range of $180 to $200 million. |

| |

• | The effective tax rate to be in the high teens. |

About The Mosaic Company

The Mosaic Company is one of the world's leading producers and marketers of concentrated phosphate and potash crop nutrients. Mosaic is a single source provider of phosphate and potash fertilizers and feed ingredients for the global agriculture industry. More information on the Company is available at www.mosaicco.com.

Mosaic will conduct a conference call on Tuesday, August 4, 2015, at 9:00 a.m. EDT to discuss second quarter earnings results as well as global markets and trends. Presentation slides and a simultaneous webcast of the conference call may be accessed through Mosaic’s website at www.mosaicco.com/investors. This webcast will be available up to one year from the time of the earnings call.

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the Wa’ad Al Shamal Phosphate Company (also known as the Ma’aden joint venture), the acquisition and assumption of certain related liabilities of the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply agreements with CF; repurchases of stock; other proposed or pending future transactions or strategic plans and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the ability of the Ma’aden joint venture to obtain additional planned funding in acceptable amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future success of current plans for the Ma’aden joint venture and any future changes in those plans; difficulties with realization of the benefits of the long term ammonia supply agreements with CF, including the risk that the cost savings from the agreements may not be fully realized or that the price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of these agreements becomes disadvantageous to Mosaic; customer defaults; the effects of Mosaic’s decisions to exit business operations or locations; the predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other governmental regulation, including expansion of the types and extent of water resources regulated under federal law, greenhouse gas regulation, implementation of numeric water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms, business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes, excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement, environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the Ma’aden joint venture, its existing or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/or available debt capacity to fund share repurchases, financial assurance requirements and strategic investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals; and risks associated with cyber security, including reputational loss, as well as other

risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

###

For the three months ended June 30, 2015, the Company reported the following notable items which, combined, positively impacted earnings per share by $0.03:

|

| | | | | | | | | | | | | | | | |

| | | | | | Amount | | Tax effect | | EPS impact |

Description | | Segment | | Line item | | (in millions) | | (in millions) | | (per share) |

Foreign currency transaction (loss) gain | | Consolidated | | Foreign currency transaction (loss) gain | | $ | (16 | ) | | $ | 3 |

| | $ | (0.04 | ) |

Unrealized gain (loss) on derivatives | | Corporate & Other | | Cost of goods sold | | 27 |

| | (5 | ) | | 0.06 |

|

Discrete tax items | | Consolidated | | Provision for income taxes | | — |

| | 10 |

| | 0.03 |

|

Write down of equity investment | | Corporate & Other | | Other non-operating expense | | (8 | ) | | — |

| | (0.02 | ) |

Total Notable Items | | | | | | $ | 3 |

| | $ | 8 |

| | $ | 0.03 |

|

For the three months ended June 30, 2014, the Company reported the following notable items which, combined, negatively impacted earnings per share by $0.06:

|

| | | | | | | | | | | | | | | | |

| | | | | | Amount | | Tax effect | | EPS impact |

Description | | Segment | | Line item | | (in millions) | | (in millions) | | (per share) |

Share repurchase | | Consolidated | | Loss in value of share repurchase agreement | | $ | (5 | ) | | $ | — |

| | $ | (0.01 | ) |

Severance | | Corporate & Other | | Other operating expense | | (4 | ) | | 1 |

| | (0.01 | ) |

Severance | | Phosphates | | Other operating expense | | (10 | ) | | 3 |

| | (0.02 | ) |

Foreign currency transaction (loss) gain | | Consolidated | | Foreign currency transaction (loss) gain | | (39 | ) | | 11 |

| | (0.07 | ) |

Unrealized gain (loss) on derivatives | | Corporate & Other | | Cost of goods sold | | 24 |

| | (6 | ) | | 0.04 |

|

Asset disposition (loss on Chile) | | Corporate & Other | | Other operating expense | | (6 | ) | | — |

| | (0.01 | ) |

Other | | Phosphates | | Selling, general & administrative & other operating expense | | (5 | ) | | 1 |

| | (0.01 | ) |

Discrete tax items | | Consolidated | | Provision for income taxes | | — |

| | 14 |

| | 0.03 |

|

Total Notable Items | | | | | | $ | (45 | ) | | $ | 24 |

| | $ | (0.06 | ) |

Condensed Consolidated Statements of Earnings

(in millions, except per share amounts)

|

| | |

| | |

The Mosaic Company | | (unaudited) |

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Net sales | | $ | 2,487.5 |

| | $ | 2,440.2 |

| | $ | 4,626.6 |

| | $ | 4,426.5 |

|

Cost of goods sold | | 1,879.6 |

| | 1,919.1 |

| | 3,599.5 |

| | 3,493.7 |

|

Gross margin | | 607.9 |

| | 521.1 |

| | 1,027.1 |

| | 932.8 |

|

Selling, general and administrative expenses | | 89.3 |

| | 87.5 |

| | 189.8 |

| | 207.4 |

|

Other operating expense | | 8.6 |

| | 30.4 |

| | 8.8 |

| | 55.6 |

|

Operating earnings | | 510.0 |

| | 403.2 |

| | 828.5 |

| | 669.8 |

|

Loss in value of share repurchase agreement | | — |

| | (5.5 | ) | | — |

| | (65.5 | ) |

Interest expense, net | | (23.5 | ) | | (24.6 | ) | | (54.8 | ) | | (51.3 | ) |

Foreign currency transaction (loss) gain | | (16.0 | ) | | (38.7 | ) | | 29.1 |

| | 4.7 |

|

Other expense | | (7.8 | ) | | (1.3 | ) | | (13.4 | ) | | (6.2 | ) |

Earnings from consolidated companies before income taxes | | 462.7 |

| | 333.1 |

| | 789.4 |

| | 551.5 |

|

Provision for income taxes | | 72.6 |

| | 82.7 |

| | 103.3 |

| | 80.1 |

|

Earnings from consolidated companies | | 390.1 |

| | 250.4 |

| | 686.1 |

| | 471.4 |

|

Equity in net earnings (loss) of nonconsolidated companies | | 0.9 |

| | (2.2 | ) | | (0.5 | ) | | (5.5 | ) |

Net earnings including noncontrolling interests | | 391.0 |

| | 248.2 |

| | 685.6 |

| | 465.9 |

|

Less: Net earnings (loss) attributable to noncontrolling interests | | 0.4 |

| | (0.2 | ) | | 0.2 |

| | (0.1 | ) |

Net earnings attributable to Mosaic | | $ | 390.6 |

| | $ | 248.4 |

| | $ | 685.4 |

| | $ | 466.0 |

|

Diluted net earnings per share attributable to Mosaic | | $ | 1.08 |

| | $ | 0.64 |

| | $ | 1.88 |

| | $ | 1.18 |

|

Diluted weighted average number of shares outstanding | | 363.3 |

| | 376.2 |

| | 365.5 |

| | 377.5 |

|

Condensed Consolidated Balance Sheets

(in millions, except per share amounts)

|

| | |

The Mosaic Company | | (unaudited) |

|

| | | | | | | | |

| | June 30, 2015 | | December 31, 2014 |

Assets | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 2,209.9 |

| | $ | 2,374.6 |

|

Receivables, net | | 626.6 |

| | 754.4 |

|

Inventories | | 1,612.2 |

| | 1,718.3 |

|

Deferred income taxes | | 148.2 |

| | 148.7 |

|

Other current assets | | 503.2 |

| | 368.2 |

|

Total current assets | | 5,100.1 |

| | 5,364.2 |

|

Property, plant and equipment, net | | 9,041.2 |

| | 9,313.9 |

|

Investments in nonconsolidated companies | | 930.5 |

| | 849.8 |

|

Goodwill | | 1,709.6 |

| | 1,806.5 |

|

Deferred income taxes | | 423.0 |

| | 394.4 |

|

Other assets | | 572.5 |

| | 554.2 |

|

Total assets | | $ | 17,776.9 |

| | $ | 18,283.0 |

|

Liabilities and Equity | | | | |

Current liabilities: | | | | |

Short-term debt | | $ | 27.0 |

| | $ | 13.5 |

|

Current maturities of long-term debt | | 57.1 |

| | 41.0 |

|

Accounts payable | | 858.2 |

| | 797.3 |

|

Accrued liabilities | | 940.7 |

| | 726.1 |

|

Deferred income taxes | | — |

| | 3.7 |

|

Accrued income taxes | | — |

| | 18.8 |

|

Total current liabilities | | 1,883.0 |

| | 1,600.4 |

|

Long-term debt, less current maturities | | 3,761.8 |

| | 3,778.0 |

|

Deferred income taxes | | 968.8 |

| | 984.0 |

|

Other noncurrent liabilities | | 1,011.5 |

| | 1,200.0 |

|

Equity: | | | | |

Preferred Stock, $0.01 par value, 15,000,000 shares authorized, none issued and outstanding as of June 30, 2015 and December 31, 2014 | | — |

| | — |

|

Class A Common Stock, $0.01 par value, 194,203,987 shares authorized, 17,176,046 shares issued and outstanding as of June 30, 2015 and December 31, 2014 | | 0.2 |

| | 0.2 |

|

Class B Common Stock, $0.01 par value, 87,008,602 shares authorized, none issued and outstanding as of June 30, 2015 and December 31, 2014 | | — |

| | — |

|

Common Stock, $0.01 par value, 1,000,000,000 shares authorized, 370,193,546 shares issued and 339,676,389 shares outstanding as of June 30, 2015, 369,987,783 shares issued and 350,364,236 shares outstanding as of December 31, 2014 | | 3.4 |

| | 3.5 |

|

Capital in excess of par value | | 9.2 |

| | 4.2 |

|

Retained earnings | | 11,065.4 |

| | 11,168.9 |

|

Accumulated other comprehensive income (loss) | | (941.4 | ) | | (473.7 | ) |

Total Mosaic stockholders' equity | | 10,136.8 |

| | 10,703.1 |

|

Noncontrolling interests | | 15.0 |

| | 17.5 |

|

Total equity | | 10,151.8 |

| | 10,720.6 |

|

Total liabilities and equity | | $ | 17,776.9 |

| | $ | 18,283.0 |

|

Condensed Consolidated Statements of Cash Flows

(in millions, except per share amounts)

|

| | |

| | |

The Mosaic Company | | (unaudited) |

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Cash Flows from Operating Activities: | | | | |

Net cash provided by operating activities | | 583.1 |

| | 796.3 |

| | $ | 1,238.6 |

| | $ | 1,423.3 |

|

Cash Flows from Investing Activities: | | | | | | | | |

Capital expenditures | | (227.4 | ) | | (214.0 | ) | | (456.9 | ) | | (488.9 | ) |

Acquisition of business | | — |

| | — |

| | — |

| | (1,353.6 | ) |

Proceeds from adjustment to acquisition of business | | — |

| | — |

| | 47.9 |

| | — |

|

Investments in nonconsolidated companies | | (122.0 | ) | | (143.8 | ) | | (125.0 | ) | | (149.6 | ) |

Other | | 6.0 |

| | (2.5 | ) | | 7.7 |

| | (2.5 | ) |

Net cash used in investing activities | | (343.4 | ) | | (360.3 | ) | | (526.3 | ) | | (1,994.6 | ) |

Cash Flows from Financing Activities: | | | | | | | | |

Payments of short-term debt | | (112.1 | ) | | (65.5 | ) | | (144.8 | ) | | (123.9 | ) |

Proceeds from issuance of short-term debt | | 129.1 |

| | 36.9 |

| | 158.5 |

| | 102.8 |

|

Payments of long-term debt | | (1.8 | ) | | (0.7 | ) | | (2.4 | ) | | (1.0 | ) |

Proceeds from issuance of long-term debt | | 3.8 |

| | 3.9 |

| | 3.8 |

| | 4.1 |

|

Proceeds from stock option exercises | | 1.3 |

| | 1.1 |

| | 4.2 |

| | 1.3 |

|

Repurchases of stock | | (500.1 | ) | | (454.8 | ) | | (634.5 | ) | | (2,132.7 | ) |

Cash dividends paid | | (98.1 | ) | | (95.1 | ) | | (189.5 | ) | | (194.8 | ) |

Other | | 0.7 |

| | (0.3 | ) | | 0.5 |

| | (0.6 | ) |

Net cash used in financing activities | | (577.2 | ) | | (574.5 | ) | | (804.2 | ) | | (2,344.8 | ) |

Effect of exchange rate changes on cash | | 30.0 |

| | 14.8 |

| | (72.8 | ) | | (10.0 | ) |

Net change in cash and cash equivalents | | (307.5 | ) | | (123.7 | ) | | (164.7 | ) | | (2,926.1 | ) |

Cash and cash equivalents - beginning of period | | 2,517.4 |

| | 2,490.7 |

| | 2,374.6 |

| | 5,293.1 |

|

Cash and cash equivalents - end of period | | $ | 2,209.9 |

| | $ | 2,367.0 |

| | $ | 2,209.9 |

| | $ | 2,367.0 |

|

Potash Gross Margin, Excluding Resource Taxes and Royalties, Calculation

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Sales | | $ | 730.2 |

| | $ | 762.3 |

| | $ | 1,383.0 |

| | $ | 1,495.5 |

|

Gross margin | | 295.0 |

| | 226.3 |

| | 536.9 |

| | 442.3 |

|

Canadian resource taxes | | 54.9 |

| | 44.8 |

| | 133.0 |

| | 75.1 |

|

Canadian royalties | | 9.0 |

| | 7.2 |

| | 20.2 |

| | 13.1 |

|

Gross margin, excluding Canadian resource taxes and royalties (CRT) | | $ | 358.9 |

| | $ | 278.3 |

| | $ | 690.1 |

| | $ | 530.5 |

|

Gross margin percentage, excluding CRT | | 49.2 | % | | 36.5 | % | | 49.9 | % | | 35.5 | % |

The Company has presented above gross margin excluding Canadian resource taxes and royalties (“CRT”) for Potash which is a non-GAAP financial measure. Generally, a non-GAAP financial measure is a supplemental numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Gross margin excluding CRT is not a measure of financial performance under GAAP. Because not all companies use identical calculations, investors should consider that Mosaic’s calculation may not be comparable to other similarly titled measures presented by other companies.

Gross margin excluding CRT provides a measure that the Company believes enhances the reader’s ability to compare the Company’s gross margin with that of other companies which incur CRT expense and classify it in a manner different than the Company in their statement of earnings. Because securities analysts, investors, lenders and others use gross margin excluding CRT, the Company’s management believes that Mosaic’s presentation of gross margin excluding CRT for Potash affords them greater transparency in assessing Mosaic’s financial performance against competitors. Gross margin excluding CRT, should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

Earnings Per Share Calculation

|

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Net earnings attributed to Mosaic | | $ | 390.6 |

| | $ | 248.4 |

| | $ | 685.4 |

| | $ | 466.0 |

|

Undistributed earnings attributable to participating securities | | — |

| | (6.3 | ) | | — |

| | (19.5 | ) |

Numerator for basic and diluted earnings available to common stockholders | | $ | 390.6 |

| | $ | 242.1 |

| | $ | 685.4 |

| | $ | 446.5 |

|

Basic weighted average number of shares outstanding | | 361.3 |

| | 384.0 |

| | 363.6 |

| | 392.5 |

|

Shares subject to forward contract | | — |

| | (9.8 | ) | | — |

| | (16.4 | ) |

Basic weighted average number of shares outstanding attributable to common stockholders | | 361.3 |

| | 374.2 |

| | 363.6 |

| | 376.1 |

|

Dilutive impact of share-based awards | | 2.0 |

| | 2.0 |

| | 1.9 |

| | 1.4 |

|

Diluted weighted average number of shares outstanding | | 363.3 |

| | 376.2 |

| | 365.5 |

| | 377.5 |

|

Basic net earnings per share | | $ | 1.08 |

| | $ | 0.65 |

| | $ | 1.89 |

| | $ | 1.19 |

|

Diluted net earnings per share | | $ | 1.08 |

| | $ | 0.64 |

| | $ | 1.88 |

| | $ | 1.18 |

|

The Mosaic Company Exhibit 99.2

Selected Calendar Quarter Financial Information

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2013 | | Q4 2013 | | Q1 2014 | | Q2 2014 | | Q3 2014 | | Q4 2014 | | Q1 2015 | | Q2 2015 |

Consolidated data (in millions, except per share) | | | | | | | | | | | | | | | | |

Diluted net earnings per share | | $ | 0.29 |

| | $ | 0.30 |

| | $ | 0.54 |

| | $ | 0.64 |

| | $ | 0.54 |

| | $ | 0.97 |

| | $ | 0.80 |

| | $ | 1.08 |

|

Diluted weighted average # of shares outstanding(a) | | 427.1 |

| | 415.5 |

| | 379.6 |

| | 376.2 |

| | 375.9 |

| | 372.0 |

| | 367.9 |

| | 363.3 |

|

Total Net Sales | | $ | 1,909 |

| | $ | 2,182 |

| | $ | 1,986 |

| | $ | 2,440 |

| | $ | 2,251 |

| | $ | 2,379 |

| | $ | 2,139 |

| | $ | 2,488 |

|

Gross Margin | | $ | 387 |

| | $ | 322 |

| | $ | 412 |

| | $ | 521 |

| | $ | 415 |

| | $ | 579 |

| | $ | 419 |

| | $ | 608 |

|

As % of Sales | | 20 | % | | 15 | % | | 21 | % | | 21 | % | | 18 | % | | 24 | % | | 20 | % | | 24 | % |

SG&A | | 94 |

| | 91 |

| | 120 |

| | 88 |

| | 84 |

| | 91 |

| | 100 |

| | 89 |

|

Consolidated Foreign Currency Gain/(Loss) | | (30 | ) | | 25 |

| | 43 |

| | (39 | ) | | 27 |

| | 47 |

| | 45 |

| | (16 | ) |

Effective Tax Rate(b) | | (6 | )% | | 51 | % | | (1 | )% | | 25 | % | | 27 | % | | 7 | % | | 9 | % | | 16 | % |

Net Income | | $ | 124 |

| | $ | 129 |

| | $ | 218 |

| | $ | 248 |

| | $ | 202 |

| | $ | 361 |

| | $ | 295 |

| | $ | 391 |

|

As % of Sales | | 7 | % | | 6 | % | | 11 | % | | 10 | % | | 9 | % | | 15 | % | | 14 | % | | 16 | % |

EBITDA(c) | | | | | | | | | | | | | | | | |

Potash | | $ | 155 |

| | $ | 173 |

| | $ | 257 |

| | $ | 281 |

| | $ | 158 |

| | $ | 316 |

| | $ | 283 |

| | $ | 341 |

|

Phosphate | | 136 |

| | 143 |

| | 221 |

| | 309 |

| | 275 |

| | 261 |

| | 282 |

| | 358 |

|

International Distribution | | 38 |

| | 12 |

| | 10 |

| | 18 |

| | 32 |

| | 24 |

| | 6 |

| | 13 |

|

Corporate and Other(d) | | (16 | ) | | 23 |

| | (50 | ) | | (13 | ) | | (2 | ) | | (36 | ) | | (71 | ) | | (10 | ) |

Consolidated EBITDA(c) | | $ | 313 |

| | $ | 351 |

| | $ | 438 |

| | $ | 595 |

| | $ | 463 |

| | $ | 565 |

| | $ | 500 |

| | $ | 702 |

|

Total Debt | | $ | 1,027 |

| | $ | 3,032 |

| | $ | 3,051 |

| | $ | 3,026 |

| | $ | 3,816 |

| | $ | 3,833 |

| | $ | 3,827 |

| | $ | 3,846 |

|

Cash & cash equivalents | | 3,339 |

| | 5,293 |

| | 2,491 |

| | 2,367 |

| | 2,971 |

| | 2,375 |

| | 2,517 |

| | 2,210 |

|

Net debt | | $ | (2,312 | ) | | $ | (2,261 | ) | | $ | 560 |

| | $ | 659 |

| | $ | 845 |

| | $ | 1,458 |

| | $ | 1,310 |

| | $ | 1,636 |

|

Cash flow from operations | | $ | (45 | ) | | $ | 503 |

| | $ | 627 |

| | $ | 796 |

| | $ | 489 |

| | $ | 382 |

| | $ | 656 |

| | $ | 583 |

|

Cash flow from investments | | (466 | ) | | (370 | ) | | (1,634 | ) | | (360 | ) | | (158 | ) | | (586 | ) | | (183 | ) | | (343 | ) |

Cash flow from financing | | (89 | ) | | 1,842 |

| | (1,770 | ) | | (575 | ) | | 323 |

| | (319 | ) | | (227 | ) | | (577 | ) |

Effect of exchange rate changes on cash | | 23 |

| | (20 | ) | | (25 | ) | | 15 |

| | (50 | ) | | (73 | ) | | (103 | ) | | 30 |

|

Net cash flow | | $ | (577 | ) | | $ | 1,955 |

| | $ | (2,802 | ) | | $ | (124 | ) | | $ | 604 |

| | $ | (596 | ) | | $ | 143 |

| | $ | (307 | ) |

Cash dividends paid | | $ | (107 | ) | | $ | (107 | ) | | $ | (100 | ) | | $ | (95 | ) | | $ | (94 | ) | | $ | (94 | ) | | $ | (91 | ) | | $ | (98 | ) |

Operating Earnings | | | | | | | | | | | | | | | | |

Potash | | $ | 69 |

| | $ | 89 |

| | $ | 170 |

| | $ | 189 |

| | $ | 69 |

| | $ | 229 |

| | $ | 204 |

| | $ | 259 |

|

Phosphates | | 61 |

| | 64 |

| | 146 |

| | 219 |

| | 188 |

| | 157 |

| | 190 |

| | 259 |

|

International Distribution | | 36 |

| | 10 |

| | 8 |

| | 16 |

| | 30 |

| | 22 |

| | 3 |

| | 8 |

|

Corporate and Other(d) | | (22 | ) | | 16 |

| | (57 | ) | | (21 | ) | | (10 | ) | | (43 | ) | | (78 | ) | | (16 | ) |

Consolidated Operating Earnings | | $ | 144 |

| | $ | 179 |

| | $ | 267 |

| | $ | 403 |

| | $ | 277 |

| | $ | 365 |

| | $ | 319 |

| | $ | 510 |

|

Segment data (in millions, except per tonne) | | | | | | | | | | | | | | | | |

Phosphates | | | | | | | | | | | | | | | | |

Sales volumes ('000 tonnes)(e)(f) | | 1,754 |

| | 2,395 |

| | 2,051 |

| | 2,637 |

| | 2,176 |

| | 2,392 |

| | 2,297 |

| | 2,788 |

|

Realized average DAP price/tonne(g) | | $ | 436 |

| | $ | 370 |

| | $ | 413 |

| | $ | 465 |

| | $ | 463 |

| | $ | 447 |

| | $ | 458 |

| | $ | 450 |

|

Revenue | | $ | 893 |

| | $ | 1,072 |

| | $ | 959 |

| | $ | 1,333 |

| | $ | 1,133 |

| | $ | 1,212 |

| | $ | 1,172 |

| | $ | 1,385 |

|

Segment Gross Margin | | $ | 129 |

| | $ | 134 |

| | $ | 200 |

| | $ | 271 |

| | $ | 236 |

| | $ | 231 |

| | $ | 222 |

| | $ | 296 |

|

As % of Sales | | 14 | % | | 13 | % | | 21 | % | | 20 | % | | 21 | % | | 19 | % | | 19 | % | | 21 | % |

Potash | | | | | | | | | | | | | | | | |

Sales volumes ('000 tonnes)(f) | | 1,380 |

| | 1,862 |

| | 2,355 |

| | 2,500 |

| | 1,808 |

| | 2,309 |

| | 2,027 |

| | 2,342 |

|

Realized average MOP price/tonne(g) | | $ | 342 |

| | $ | 303 |

| | $ | 267 |

| | $ | 267 |

| | $ | 291 |

| | $ | 295 |

| | $ | 288 |

| | $ | 280 |

|

Revenue | | $ | 523 |

| | $ | 652 |

| | $ | 733 |

| | $ | 762 |

| | $ | 593 |

| | $ | 763 |

| | $ | 653 |

| | $ | 730 |

|

Segment Gross Margin | | $ | 162 |

| | $ | 135 |

| | $ | 216 |

| | $ | 226 |

| | $ | 154 |

| | $ | 327 |

| | $ | 242 |

| | $ | 295 |

|

As % of Sales | | 31 | % | | 21 | % | | 29 | % | | 30 | % | | 26 | % | | 43 | % | | 37 | % | | 40 | % |

International Distribution | | | | | | | | | | | | | | | | |

Sales volumes ('000 tonnes) | | 1,282 |

| | 1,133 |

| | 870 |

| | 1,185 |

| | 1,398 |

| | 1,113 |

| | 976 |

| | 1,477 |

|

Realized average Blend price/tonne(g) | | $ | 505 |

| | $ | 466 |

| | $ | 438 |

| | $ | 452 |

| | $ | 481 |

| | $ | 427 |

| | $ | 444 |

| | $ | 427 |

|

Revenue | | $ | 665 |

| | $ | 549 |

| | $ | 393 |

| | $ | 542 |

| | $ | 684 |

| | $ | 516 |

| | $ | 439 |

| | $ | 637 |

|

Segment Gross Margin | | $ | 50 |

| | $ | 29 |

| | $ | 22 |

| | $ | 34 |

| | $ | 51 |

| | $ | 41 |

| | $ | 21 |

| | $ | 29 |

|

As % of Sales | | 8 | % | | 5 | % | | 6 | % | | 6 | % | | 7 | % | | 8 | % | | 5 | % | | 4 | % |

The Mosaic Company - Potash Segment

Selected Calendar Quarter Financial Information

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2013 | | Q4 2013 | | Q1 2014 | | Q2 2014 | | Q3 2014 | | Q4 2014 | | Q1 2015 | | Q2 2015 |

Net Sales and Gross Margin (in millions, except per tonne) | | | | | | | | | | | | | | | | |

Segment income statement | | | | | | | | | | | | | | | | |

North America | | $ | 279 |

| | $ | 470 |

| | $ | 506 |

| | $ | 435 |

| | $ | 371 |

| | $ | 467 |

| | $ | 345 |

| | $ | 372 |

|

International | | 244 |

| | 182 |

| | 227 |

| | 327 |

| | 222 |

| | 296 |

| | 308 |

| | 358 |

|

Net Sales | | $ | 523 |

| | $ | 652 |

| | $ | 733 |

| | $ | 762 |

| | $ | 593 |

| | $ | 763 |

| | $ | 653 |

| | $ | 730 |

|

Cost of Goods Sold | | 361 |

| | 517 |

| | 517 |

| | 536 |

| | 439 |

| | 436 |

| | 411 |

| | 435 |

|

Gross Margin | | $ | 162 |

| | $ | 135 |

| | $ | 216 |

| | $ | 226 |

| | $ | 154 |

| | $ | 327 |

| | $ | 242 |

| | $ | 295 |

|

As % of Sales | | 31 | % | | 21 | % | | 29 | % | | 30 | % | | 26 | % | | 43 | % | | 37 | % | | 40 | % |

Freight included in revenue & cost of goods sold (in millions)(h) | | $ | 28 |

| | $ | 61 |

| | $ | 73 |

| | $ | 57 |

| | $ | 51 |

| | $ | 69 |

| | $ | 47 |

| | $ | 47 |

|

Net sales less freight | | $ | 495 |

| | $ | 591 |

| | $ | 660 |

| | $ | 705 |

| | $ | 542 |

| | $ | 694 |

| | $ | 606 |

| | $ | 683 |

|

Cost of Goods Sold less freight | | $ | 333 |

| | $ | 456 |

| | $ | 444 |

| | $ | 479 |

| | $ | 388 |

| | $ | 367 |

| | $ | 364 |

| | $ | 388 |

|

Resources Taxes | | $ | 31 |

| | $ | 57 |

| | $ | 30 |

| | $ | 45 |

| | $ | 46 |

| | $ | 48 |

| | $ | 78 |

| | $ | 55 |

|

Royalties | | 11 |

| | 9 |

| | 6 |

| | 7 |

| | 6 |

| | 8 |

| | 11 |

| | 9 |

|

Total Resources Taxes & Royalties | | $ | 42 |

| | $ | 66 |

| | $ | 36 |

| | $ | 52 |

| | $ | 52 |

| | $ | 56 |

| | $ | 89 |

| | $ | 64 |

|

Gross Margin (excluding Resources Taxes & Royalties)(i) | | $ | 204 |

| | $ | 201 |

| | $ | 252 |

| | $ | 278 |

| | $ | 206 |

| | $ | 383 |

| | $ | 331 |

| | $ | 359 |

|

As % of Sales | | 39 | % | | 31 | % | | 34 | % | | 36 | % | | 35 | % | | 50 | % | | 51 | % | | 49 | % |

Segment Operating Earnings | | $ | 69 |

| | $ | 89 |

| | $ | 170 |

| | $ | 189 |

| | $ | 69 |

| | $ | 229 |

| | $ | 204 |

| | $ | 259 |

|

Depreciation, Depletion and Amortization | | 86 |

| | 84 |

| | 87 |

| | 92 |

| | 89 |

| | 87 |

| | 79 |

| | 82 |

|

EBITDA(c) | | $ | 155 |

| | $ | 173 |

| | $ | 257 |

| | $ | 281 |

| | $ | 158 |

| | $ | 316 |

| | $ | 283 |

| | $ | 341 |

|

Cost of Goods Sold Detail (in millions) | | | | | | | | | | | | | | | | |

COGS additional detail | | | | | | | | | | | | | | | | |

Resource Taxes | | $ | 31 |

| | $ | 57 |

| | $ | 30 |

| | $ | 45 |

| | $ | 46 |

| | $ | 48 |

| | $ | 78 |

| | $ | 55 |

|

Royalties | | 11 |

| | 9 |

| | 6 |

| | 7 |

| | 6 |

| | 8 |

| | 11 |

| | 9 |

|

Brine Inflow Expenses | | 48 |

| | 50 |

| | 44 |

| | 46 |

| | 44 |

| | 47 |

| | 44 |

| | 45 |

|

Depreciation, Depletion and Amortization | | 86 |

| | 84 |

| | 87 |

| | 92 |

| | 89 |

| | 87 |

| | 79 |

| | 82 |

|

Total | | $ | 176 |

| | $ | 200 |

| | $ | 167 |

| | $ | 190 |

| | $ | 185 |

| | $ | 190 |

| | $ | 212 |

| | $ | 191 |

|

Operating Data | | | | | | | | | | | | | | | | |

Sales volumes ('000 tonnes) | | | | | | | | | | | | | | | | |

Crop Nutrients North America(f) | | 417 |

| | 933 |

| | 1,111 |

| | 873 |

| | 691 |

| | 964 |

| | 572 |

| | 641 |

|

Crop Nutrients International(f) | | 781 |

| | 744 |

| | 1,065 |

| | 1,427 |

| | 919 |

| | 1,228 |

| | 1,248 |

| | 1,544 |

|

Non-Agricultural | | 182 |

| | 185 |

| | 179 |

| | 200 |

| | 198 |

| | 117 |

| | 207 |

| | 157 |

|

Total(f) | | 1,380 |

| | 1,862 |

| | 2,355 |

| | 2,500 |

| | 1,808 |

| | 2,309 |

| | 2,027 |

| | 2,342 |

|

Production Volumes ('000 tonnes) | | | | | | | | | | | | | | | | |

Production Volume | | 1,957 |

| | 1,741 |

| | 1,871 |

| | 2,044 |

| | 1,666 |

| | 2,584 |

| | 2,451 |

| | 2,362 |

|

Operating Rate(j) | | 73 | % | | 65 | % | | 70 | % | | 76 | % | | 62 | % | | 91 | % | | 93 | % | | 90 | % |

Realized prices (FOB plant, $/tonne) | | | | | | | | | | | | | | | | |

MOP - North America crop nutrients(g)(k) | | $ | 364 |

| | $ | 332 |

| | $ | 300 |

| | $ | 308 |

| | $ | 344 |

| | $ | 355 |

| | $ | 362 |

| | $ | 345 |

|

MOP - International(g) | | $ | 294 |

| | $ | 225 |

| | $ | 209 |

| | $ | 225 |

| | $ | 232 |

| | $ | 239 |

| | $ | 245 |

| | $ | 244 |

|

MOP - Average(g) | | $ | 342 |

| | $ | 303 |

| | $ | 267 |

| | $ | 267 |

| | $ | 291 |

| | $ | 295 |

| | $ | 288 |

| | $ | 280 |

|

Brine inflow cost/production tonne | | $ | 25 |

| | $ | 29 |

| | $ | 24 |

| | $ | 23 |

| | $ | 26 |

| | $ | 18 |

| | $ | 18 |

| | $ | 19 |

|

Cash COGS/sales tonne | | $ | 149 |

| | $ | 164 |

| | $ | 136 |

| | $ | 134 |

| | $ | 137 |

| | $ | 97 |

| | $ | 97 |

| | $ | 103 |

|

EBITDA(c)/sales tonne(l) | | $ | 112 |

| | $ | 93 |

| | $ | 109 |

| | $ | 112 |

| | $ | 87 |

| | $ | 137 |

| | $ | 140 |

| | $ | 146 |

|

Potash CAPEX (in millions) | | $ | 199 |

| | $ | 197 |

| | $ | 144 |

| | $ | 94 |

| | $ | 92 |

| | $ | 141 |

| | $ | 95 |

| | $ | 88 |

|

The Mosaic Company - Phosphates Segment

Selected Calendar Quarter Financial Information

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2013 | | Q4 2013 | | Q1 2014 | | Q2 2014 | | Q3 2014 | | Q4 2014 | | Q1 2015 | | Q2 2015 |

Net Sales and Gross Margin (in millions, except per tonne) | | | | | | | | | | | | | | | | |

Segment income statement | | | | | | | | | | | | | | | | |

North America | | $ | 417 |

| | $ | 721 |

| | $ | 559 |

| | $ | 725 |

| | $ | 636 |

| | $ | 714 |

| | $ | 668 |

| | $ | 705 |

|

International | | 476 |

| | 351 |

| | 400 |

| | 608 |

| | 497 |

| | 498 |

| | 504 |

| | 680 |

|

Net Sales | | $ | 893 |

| | $ | 1,072 |

| | $ | 959 |

| | $ | 1,333 |

| | $ | 1,133 |

| | $ | 1,212 |

| | $ | 1,172 |

| | $ | 1,385 |

|

Cost of Goods Sold | | 764 |

| | 938 |

| | 759 |

| | 1,062 |

| | 897 |

| | 981 |

| | 950 |

| | 1,089 |

|

Gross Margin | | $ | 129 |

| | $ | 134 |

| | $ | 200 |

| | $ | 271 |

| | $ | 236 |

| | $ | 231 |

| | $ | 222 |

| | $ | 296 |

|

As % of Sales | | 14 | % | | 13 | % | | 21 | % | | 20 | % | | 21 | % | | 19 | % | | 19 | % | | 21 | % |

Freight included in revenue & cost of goods sold (in millions) | | $ | 74 |

| | $ | 112 |

| | $ | 81 |

| | $ | 100 |

| | $ | 88 |

| | $ | 103 |

| | $ | 82 |

| | $ | 98 |

|

Net sales less freight | | $ | 819 |

| | $ | 960 |

| | $ | 878 |

| | $ | 1,233 |

| | $ | 1,045 |

| | $ | 1,109 |

| | $ | 1,090 |

| | $ | 1,287 |

|

Cost of Goods Sold less freight | | $ | 690 |

| | $ | 826 |

| | $ | 678 |

| | $ | 962 |

| | $ | 809 |

| | $ | 878 |

| | $ | 868 |

| | $ | 991 |

|

PhosChem sales of other member | | $ | 15 |

| | $ | 23 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Segment Operating Earnings | | $ | 61 |

| | $ | 64 |

| | $ | 146 |

| | $ | 219 |

| | $ | 188 |

| | $ | 157 |

| | $ | 190 |

| | $ | 259 |

|

Depreciation, Depletion and Amortization | | 72 |

| | 75 |

| | 79 |

| | 93 |

| | 91 |

| | 97 |

| | 94 |

| | 99 |

|

Equity Earnings (Loss) | | 3 |

| | 4 |

| | (4 | ) | | (3 | ) | | (4 | ) | | 7 |

| | (2 | ) | | — |

|

EBITDA(c) | | $ | 136 |

| | $ | 143 |

| | $ | 221 |

| | $ | 309 |

| | $ | 275 |

| | $ | 261 |

| | $ | 282 |

| | $ | 358 |

|

Operating Data | | | | | | | | | | | | | | | | |

Sales volumes ('000 tonnes) | | | | | | | | | | | | | | | | |

North America - DAP/MAP | | 515 |

| | 1,116 |

| | 747 |

| | 948 |

| | 805 |

| | 837 |

| | 951 |

| | 895 |

|

International - DAP/MAP(f) | | 687 |

| | 577 |

| | 650 |

| | 1,040 |

| | 878 |

| | 882 |

| | 754 |

| | 1,224 |

|

MicroEssentials®(f) | | 407 |

| | 541 |

| | 510 |

| | 481 |

| | 357 |

| | 502 |

| | 440 |

| | 516 |

|

Feed and Other | | 145 |

| | 161 |

| | 144 |

| | 168 |

| | 136 |

| | 171 |

| | 152 |

| | 153 |

|

Total(e) | | 1,754 |

| | 2,395 |

| | 2,051 |

| | 2,637 |

| | 2,176 |

| | 2,392 |

| | 2,297 |

| | 2,788 |

|

Production Volumes ('000 tonnes) | | | | | | | | | | | | | | | | |

Total tonnes produced(m) | | 2,123 |

| | 1,960 |

| | 1,971 |

| | 2,458 |

| | 2,480 |

| | 2,364 |

| | 2,299 |

| | 2,504 |

|

Operating Rate | | 88 | % | | 81 | % | | 79 | % | | 84 | % | | 85 | % | | 81 | % | | 79 | % | | 86 | % |

Realized prices ($/tonne) | | | | | | | | | | | | | | | | |

DAP (FOB plant)(g) | | $ | 436 |

| | $ | 370 |

| | $ | 413 |

| | $ | 465 |

| | $ | 463 |

| | $ | 447 |

| | $ | 458 |

| | $ | 450 |

|

Realized costs ($/tonne) | | | | | | | | | | | | | | | | |

Ammonia (tonne)(n) | | $ | 486 |

| | $ | 422 |

| | $ | 374 |

| | $ | 473 |

| | $ | 508 |

| | $ | 544 |

| | $ | 519 |

| | $ | 417 |

|

Sulfur (long ton)(o) | | $ | 167 |

| | $ | 123 |

| | $ | 96 |

| | $ | 128 |

| | $ | 148 |

| | $ | 154 |

| | $ | 145 |

| | $ | 161 |

|

Blended rock | | $ | 58 |

| | $ | 62 |

| | $ | 64 |

| | $ | 68 |

| | $ | 60 |

| | $ | 58 |

| | $ | 61 |

| | $ | 61 |

|

Average Market prices ($/tonne) | | | | | | | | | | | | | | | | |

Ammonia (tonne)(p) | | $ | 489 |

| | $ | 467 |

| | $ | 455 |

| | $ | 557 |

| | $ | 547 |

| | $ | 625 |

| | $ | 497 |

| | $ | 462 |

|

Sulfur (long ton)(q) | | $ | 111 |

| | $ | 77 |

| | $ | 104 |

| | $ | 131 |

| | $ | 135 |

| | $ | 131 |

| | $ | 141 |

| | $ | 135 |

|

Natural Gas(r) | | $ | 3.6 |

| | $ | 3.9 |

| | $ | 4.7 |

| | $ | 4.6 |

| | $ | 4.0 |

| | $ | 3.9 |

| | $ | 2.8 |

| | $ | 2.7 |

|

Full production conversion cost/production tonne | | $ | 76 |

| | $ | 81 |

| | $ | 89 |

| | $ | 87 |

| | $ | 82 |

| | $ | 90 |

| | $ | 91 |

| | $ | 83 |

|

EBITDA(c)/sales tonne(l) | | $ | 78 |

| | $ | 60 |

| | $ | 108 |

| | $ | 117 |

| | $ | 126 |

| | $ | 100 |

| | $ | 123 |

| | $ | 128 |

|

Phosphates CAPEX (in millions) | | $ | 114 |

| | $ | 135 |

| | $ | 116 |

| | $ | 104 |

| | $ | 85 |

| | $ | 98 |

| | $ | 129 |

| | $ | 118 |

|

The Mosaic Company - International Distribution Segment

Selected Calendar Quarter Financial Information

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2013 | | Q4 2013 | | Q1 2014 | | Q2 2014 | | Q3 2014 | | Q4 2014 | | Q1 2015 | | Q2 2015 |

Net Sales and Gross Margin (in millions, except per tonne) | | | | | | | | | | | | | | | | |

Segment income statement | | | | | | | | | | | | | | | | |

Net Sales | | $ | 665 |

| | $ | 549 |

| | $ | 393 |

| | $ | 542 |

| | $ | 684 |

| | $ | 516 |

| | $ | 439 |

| | $ | 637 |

|

Cost of Goods Sold | | 615 |

| | 520 |

| | 371 |

| | 508 |

| | 633 |

| | 475 |

| | 418 |

| | 608 |

|

Gross Margin | | $ | 50 |

| | $ | 29 |

| | $ | 22 |

| | $ | 34 |

| | $ | 51 |

| | $ | 41 |

| | $ | 21 |

| | $ | 29 |

|

As % of Sales | | 8 | % | | 5 | % | | 6 | % | | 6 | % | | 7 | % | | 8 | % | | 5 | % | | 4 | % |

Per tonne | | $ | 39 |

| | $ | 26 |

| | $ | 25 |

| | $ | 29 |

| | $ | 36 |

| | $ | 37 |

| | $ | 21 |

| | $ | 19 |

|

SG&A and Other Operating Expenses | | $ | 14 |

| | $ | 19 |

| | $ | 14 |

| | $ | 18 |

| | $ | 21 |

| | $ | 19 |

| | $ | 18 |

| | $ | 21 |

|

Segment Operating Earnings | | $ | 36 |

| | $ | 10 |

| | $ | 8 |

| | $ | 16 |

| | $ | 30 |

| | $ | 22 |

| | $ | 3 |

| | $ | 8 |

|

Depreciation, Depletion and Amortization | | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 2 |

| | 3 |

| | 5 |

|

EBITDA(c) | | $ | 38 |

| | $ | 12 |

| | $ | 10 |

| | $ | 18 |

| | $ | 32 |

| | $ | 24 |

| | $ | 6 |

| | $ | 13 |

|

Operating Data | | | | | | | | | | | | | | | | |

Sales volumes ('000 tonnes) | | | | | | | | | | | | | | | | |

Total | | 1,282 |

| | 1,133 |

| | 870 |

| | 1,185 |

| | 1,398 |

| | 1,113 |

| | 976 |

| | 1,477 |

|

Realized prices ($/tonne) | | | | | | | | | | | | | | | | |

Average selling price (FOB destination) | | $ | 505 |

| | $ | 466 |

| | $ | 438 |

| | $ | 452 |

| | $ | 481 |

| | $ | 456 |

| | $ | 444 |

| | $ | 427 |

|

Purchases ('000 tonnes) | | | | | | | | | | | | | | | | |

DAP/MAP from Mosaic | | 220 |

| | 212 |

| | 93 |

| | 290 |

| | 331 |

| | 214 |

| | 138 |

| | 363 |

|

MicroEssentials® from Mosaic | | 161 |

| | 131 |

| | 147 |

| | 168 |

| | 83 |

| | 56 |

| | 125 |

| | 198 |

|

Potash from Mosaic/Canpotex | | 205 |

| | 340 |

| | 269 |

| | 484 |

| | 261 |

| | 334 |

| | 249 |

| | 769 |

|

International Distribution CAPEX (in millions) | | $ | 6 |

| | $ | 8 |

| | $ | 8 |

| | $ | 11 |

| | $ | 7 |

| | $ | 9 |

| | $ | 4 |

| | $ | 17 |

|

Working Capital (in millions)(s) | | $ | 103 |

| | $ | 87 |

| | $ | 38 |

| | $ | (35 | ) | | $ | 43 |

| | $ | 170 |

| | $ | 37 |

| | $ | (117 | ) |

EBITDA(c)/sales tonne(l) | | $ | 30 |

| | $ | 11 |

| | $ | 11 |

| | $ | 15 |

| | $ | 23 |

| | $ | 22 |

| | $ | 6 |

| | $ | 9 |

|

The Mosaic Company - Corporate and Other Segment

Selected Calendar Quarter Financial Information

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2013 | | Q4 2013 | | Q1 2014 | | Q2 2014 | | Q3 2014 | | Q4 2014 | | Q1 2015 | | Q2 2015 |

Net Sales and Gross Margin (in millions) | | | | | | | | | | | | | | | | |

Segment income statement | | | | | | | | | | | | | | | | |

Net Sales | | $ | (172 | ) | | $ | (91 | ) | | $ | (99 | ) | | $ | (197 | ) | | $ | (159 | ) | | $ | (112 | ) | | $ | (125 | ) | | $ | (265 | ) |

Cost of Goods Sold | | (218 | ) | | (115 | ) | | (73 | ) | | (187 | ) | | (133 | ) | | (92 | ) | | (60 | ) | | (253 | ) |

Gross Margin (loss) | | $ | 46 |

| | $ | 24 |

| | $ | (26 | ) | | $ | (10 | ) | | $ | (26 | ) | | $ | (20 | ) | | $ | (65 | ) | | $ | (12 | ) |

Elimination of profit in inventory (income) loss included in COGS | | $ | (30 | ) | | $ | (30 | ) | | $ | 9 |

| | $ | 29 |

| | $ | (3 | ) | | $ | (18 | ) | | $ | 18 |

| | $ | 34 |

|

Unrealized (gain) loss on derivatives included in COGS | | $ | (24 | ) | | $ | 3 |

| | $ | 4 |

| | $ | (26 | ) | | $ | 23 |

| | $ | 31 |

| | $ | 38 |

| | $ | (27 | ) |

Segment Operating Earnings | | $ | (22 | ) | | $ | 16 |

| | $ | (57 | ) | | $ | (21 | ) | | $ | (10 | ) | | $ | (43 | ) | | $ | (78 | ) | | $ | (16 | ) |

Depreciation, Depletion and Amortization | | 6 |

| | 6 |

| | 6 |

| | 7 |

| | 8 |

| | 7 |

| | 6 |

| | 5 |

|

Equity Earnings (Loss) | | — |

| | 1 |

| | 1 |

| | 1 |

| | — |

| | — |

| | 1 |

| | 1 |

|

EBITDA(c) | | $ | (16 | ) | | $ | 23 |

| | $ | (50 | ) | | $ | (13 | ) | | $ | (2 | ) | | $ | (36 | ) | | $ | (71 | ) | | $ | (10 | ) |

Footnotes

| |

(a) | For Q4 2013 through Q4 2014, diluted weighted average number of shares reflects the impact of shares subject to the forward contract for our contractual share repurchase obligations. |

| |

(b) | Includes a discrete income tax benefit of approximately $45 million in Q3 2013, $63 million in Q1 2014, $14 million in Q2 2014, $29 million in Q3 2014, $100 million in Q4 2014, $28 million in Q1 2015, $10 million in Q2 2015 and a discrete income tax expense of approximately $104 million in Q4 2013. |

| |

(c) | The Company defines EBITDA as operating earnings plus depreciation, depletion and amortization plus equity earnings in nonconsolidated companies. EBITDA is a non-GAAP financial measure. Generally, a non-GAAP financial measure is a supplemental numerical measure of a company's performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with U.S. generally accepted accounting principles ("GAAP"). A reconciliation of EBITDA to the nearest comparable GAAP measure and an explanation of why we include EBITDA appear below under "Non-GAAP Reconciliation". |

| |

(d) | Includes elimination of intersegment sales. |

| |

(e) | Excludes tonnes sold by PhosChem for its other member. Effective December 31, 2013, we and PhosChem's other member each assumed responsibility for PhosChem's former activities as they related to our respective products. We subsequently dissolved PhosChem. |

| |

(f) | Sales volumes include intersegment sales. |

| |

(g) | FOB Plant, sales to unrelated parties. |

| |

(h) | Includes inbound freight, outbound freight and warehousing costs on domestic MOP sales. |

| |

(i) | The Company has presented gross margin excluding Canadian resource taxes and royalties (“CRT”) for Potash which is a non-GAAP financial measure. Generally, a non-GAAP financial measure is a supplemental numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Gross margin excluding CRT provides a measure that we believe enhances the reader’s ability to compare our gross margin with that of other companies which incur CRT expense and classify it in a manner different than the Company in their statement of earnings. Because securities analysts, investors, lenders and others use gross margin excluding CRT, the Company’s management believes that the Company's presentation of gross margin excluding CRT for Potash affords them greater transparency in assessing the Company’s financial performance against competitors. Because not all companies use identical calculations, investors should consider that the Company's calculation may not be comparable to other similarly titled measures presented by other companies. Gross margin excluding CRT, should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. |

| |

(j) | Q4 2014 operating rate includes an additional 600 thousand metric tonnes of annual capacity from our Colonsay expansion. |

| |

(k) | This price excludes industrial and feed sales. |

| |

(l) | Calculated as EBITDA divided by sales tonnes. |

| |

(m) | Includes crop nutrient dry concentrates and animal feed ingredients. |

| |

(n) | Amounts are representative of our average ammonia costs in cost of goods sold. |

| |

(o) | Amounts are representative of our average sulfur cost in cost of goods sold. |

| |

(p) | Three point quarterly average (Fertecon). |

| |

(q) | Three point quarterly average (Green Markets). |

| |

(r) | Three point quarterly average (NYMEX). |

| |

(s) | Calculated as current assets less cash and liabilities for the International Distribution segment. |

The Mosaic Company

Selected Calendar Quarter Financial Information

(Unaudited)

Non-GAAP Reconciliation

EBITDA is provided to assist securities analysts, investors, lenders and others in their comparisons of operational performance, valuation and debt capacity across companies with differing capital, tax and legal structures. EBITDA should not be considered as an alternative to, or more meaningful than, net income as a measure of operating performance. Since EBITDA is not a measure determined in accordance with GAAP and is thus susceptible to varying interpretations and calculations, EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. A reconciliation of net income to EBITDA is included below.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2013 | | Q4 2013 | | Q1 2014 | | Q2 2014 | | Q3 2014 | | Q4 2014 | | Q1 2015 | | Q2 2015 |

Potash EBITDA(c) | | $ | 155 |

| | $ | 173 |

| | $ | 257 |

| | $ | 281 |

| | $ | 158 |

| | $ | 316 |

| | $ | 283 |

| | $ | 341 |

|

Phosphates EBITDA(c) | | 136 |

| | 143 |

| | 221 |

| | 309 |

| | 275 |

| | 261 |

| | 282 |

| | 358 |

|

ID EBITDA(c) | | 38 |

| | 12 |

| | 10 |

| | 18 |

| | 32 |

| | 24 |

| | 6 |

| | 13 |

|

Corporate EBITDA(c) | | (16 | ) | | 23 |

| | (50 | ) | | (13 | ) | | (2 | ) | | (36 | ) | | (71 | ) | | (10 | ) |

Consolidated EBITDA(c) | | $ | 313 |

| | $ | 351 |

| | $ | 438 |

| | $ | 595 |

| | $ | 463 |

| | $ | 565 |

| | $ | 500 |

| | $ | 702 |

|

Consolidated Foreign Currency Gain/(Loss) | | (30 | ) | | 25 |

| | 43 |

| | (39 | ) | | 27 |

| | 47 |

| | 45 |

| | (16 | ) |

Consolidated Gain (Loss) in Value of Share Repurchase Agreement | | — |

| | 73 |

| | (60 | ) | | (5 | ) | | 5 |

| | — |

| | — |

| | — |

|

Consolidated Interest Income/(Expense) | | 2 |

| | (12 | ) | | (27 | ) | | (25 | ) | | (25 | ) | | (31 | ) | | (31 | ) | | (24 | ) |

Consolidated Depreciation, Depletion & Amortization | | (166 | ) | | (167 | ) | | (174 | ) | | (194 | ) | | (190 | ) | | (193 | ) | | (182 | ) | | (191 | ) |

Consolidated Non-Controlling Interest | | (1 | ) | | (1 | ) | | — |

| | — |

| | (1 | ) | | (1 | ) | | — |

| | — |

|

Consolidated Provision from/(Benefit for)Income Taxes | | 6 |

| | (131 | ) | | 3 |

| | (83 | ) | | (78 | ) | | (27 | ) | | (31 | ) | | (73 | ) |

Consolidated Other Income (Expense) | | — |

| | (9 | ) | | (5 | ) | | (1 | ) | | 1 |

| | 1 |

| | (6 | ) | | (7 | ) |

Consolidated Net Income | | $ | 124 |

| | $ | 129 |

| | $ | 218 |

| | $ | 248 |

| | $ | 202 |

| | $ | 361 |

| | $ | 295 |

| | $ | 391 |

|

Cash COGS/sales tonne is defined for the Potash segment as [Cost of Goods Sold per sales tonne less depreciation, depletion, amortization, Canadian royalties and resource taxes and freight included in revenue and cost of goods sold]. Cash COGS/sales tonne is a non-GAAP financial measure provided to assist securities analysts, lenders and others in their comparisons of operational performance but should not be considered as an alternative to, or more meaningful than, Potash Cost of Goods Sold as a measure of operating performance. Since Cash COGS/sales tonne is not a measure determined in accordance with GAAP and is thus susceptible to varying interpretations and calculations, it may, as presented, not be comparable to other similarly titled measures of other companies. A reconciliation of Cash COGS/sales tonne to Potash Cost of Goods Sold is included below.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in millions, except sales tonnes) | | Q3 2013 | | Q4 2013 | | Q1 2014 | | Q2 2014 | | Q3 2014 | | Q4 2014 | | Q1 2015 | | Q2 2015 |

Cash COGS/sales tonne | | $ | 149 |

| | $ | 164 |

| | $ | 136 |

| | $ | 134 |

| | $ | 137 |

| | $ | 97 |

| | $ | 97 |

| | $ | 103 |

|

Sales tonnes (in thousands) | | 1,380 |

| | 1,862 |

| | 2,355 |

| | 2,500 |

| | 1,808 |

| | 2,309 |

| | 2,027 |

| | 2,342 |

|

Cash Cost of Goods Sold | | $ | 205 |

| | $ | 306 |

| | $ | 321 |

| | $ | 335 |

| | $ | 247 |

| | $ | 224 |

| | $ | 196 |

| | $ | 242 |

|

Potash Depreciation, Depletion & Amortization | | 86 |

| | 84 |

| | 87 |

| | 92 |

| | 89 |

| | 87 |

| | 79 |

| | 82 |

|

Royalties | | 11 |

| | 9 |

| | 6 |

| | 7 |

| | 6 |

| | 8 |

| | 11 |

| | 9 |

|

Resources Taxes | | 31 |

| | 57 |

| | 30 |

| | 45 |

| | 46 |

| | 48 |

| | 78 |

| | 55 |

|

Freight included in revenue & cost of goods sold (in millions)(h) | | 28 |

| | 61 |

| | 73 |

| | 57 |

| | 51 |

| | 69 |

| | 47 |

| | 47 |

|

Potash Cost of Goods Sold | | 361 |

| | 517 |

| | 517 |

| | 536 |

| | 439 |

| | 436 |

| | 411 |

| | 435 |

|

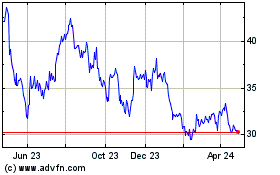

Mosaic (NYSE:MOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

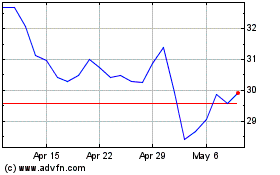

Mosaic (NYSE:MOS)

Historical Stock Chart

From Apr 2023 to Apr 2024