Current Report Filing (8-k)

February 17 2017 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 17, 2017 (February 15, 2017)

______________

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

______________

|

|

|

|

|

|

|

|

|

Delaware

(State of Incorporation)

|

|

1-31719

(Commission

File Number)

|

|

13-4204626

(IRS Employer

Identification Number)

|

200 Oceangate, Suite 100, Long Beach, CA 90802

(Address of principal executive offices)

Registrant’s telephone number, including area code: (562) 435-3666

______________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

o

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

Existing Credit Agreement

Molina Healthcare, Inc. (the “Company”) previously entered into that certain Credit Agreement, dated as of June 12, 2015 (as amended by that certain First Amendment to Credit Agreement dated as of January 3, 2017, the “Credit Agreement”), by and among the Company, the guarantors identified therein, the lenders identified therein and SunTrust Bank, in its capacities as Administrative Agent, Issuing Bank and Swingline Lender (“Administrative Agent”), with respect to an unsecured revolving credit facility in the aggregate principal amount of $500.0 million. A copy of the Credit Agreement was filed by the Company with the Securities and Exchange Commission on January 3, 2017 as Exhibit 10.1 to the Company’s Current Report on Form 8-K. Capitalized terms used herein and not otherwise defined have the meanings given to them in the Credit Agreement, as amended by the Second Amendment (as defined below).

Second Amendment to Credit Agreement

On February 15, 2017, the Company entered into that certain Second Amendment to Credit Agreement (the “Second Amendment”) by and among the Company, the Guarantors party thereto, the Lenders party thereto and Administrative Agent. The Second Amendment modifies the definition of Consolidated Adjusted EBITDA to (a) allow the Company and its Restricted Subsidiaries to receive credit for risk corridor payments owed to, but not received or accrued by, the Company or any of its Restricted Subsidiaries during 2016 and (b) account for the difference between the amount of actual risk adjustment payments made or accrued by the Company and its Restricted Subsidiaries during 2016 and the amount of risk adjustment payments that would have been due by the Company and its Restricted Subsidiaries under the federal government’s proposed 2018 risk adjustment payment transfer formula.

The Second Amendment also provides for a waiver by the Required Lenders of the Company’s inability, without giving effect to the above-referenced modifications of the definition of Consolidated Adjusted EBITDA, to comply with each of the financial covenants set forth in Sections 6.1 and 6.2 of the Credit Agreement, for the fiscal quarter ended December 31, 2016, which non-compliance would have constituted Events of Default under Section 8.1(d) of the Credit Agreement.

Foregoing Summary Not Intended to be Complete

The foregoing summary of the Second Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Second Amendment. A copy of the Second Amendment is being filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

Second Amendment to Credit Agreement, dated as of February 15, 2017, by and among Molina Healthcare, Inc., the Guarantors party thereto, the Lenders party thereto and SunTrust Bank, in its capacities as Administrative Agent, Issuing Bank and Swingline Lender.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

MOLINA HEALTHCARE, INC.

|

|

|

|

|

|

Date:

|

February 17, 2017

|

By:

|

/s/ Jeff D. Barlow

|

|

|

|

|

Jeff D. Barlow

|

|

|

|

|

Chief Legal Officer and Secretary

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

Second Amendment to Credit Agreement, dated as of February 15, 2017, by and among Molina Healthcare, Inc., the Guarantors party thereto, the Lenders party thereto and SunTrust Bank, in its capacities as Administrative Agent, Issuing Bank and Swingline Lender.

|

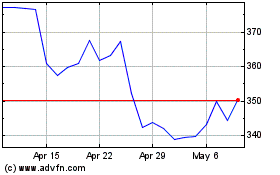

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

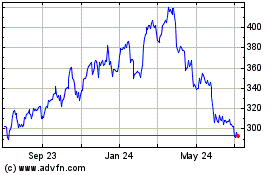

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024