UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

______________

FORM 8-K

______________

Current

Report

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): November 1, 2015

______________

MOLINA

HEALTHCARE, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

1-31719

|

13-4204626

|

|

(State of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

______________

|

200 Oceangate, Suite 100, Long Beach, California 90802

|

|

(Address of principal executive offices)

|

Registrant’s

telephone number, including area code: (562) 435-3666

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On November 1, 2015, the Company’s subsidiary Molina Healthcare of

Florida, Inc. closed on its previously announced agreement to assume

Integral Health Plan, Inc.’s Medicaid contract, certain provider

agreements, as well as other assets related to the operation of the

Medicaid business.

On November 2, 2015, the Company announced that it has closed on its

previously announced agreement to acquire all of the membership

interests held by The Providence Service Corporation and Ross Innovative

Employment Corp. in Providence Human Services, LLC and Providence

Community Services, LLC. The full text of the press release is included

as Exhibit 99.1 to this report.

Note: The information furnished herewith pursuant to Item 7.01 of this

current report shall not be deemed to be “filed” for the purpose of

Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that

section, and shall not be incorporated by reference into any

registration statement or other document filed by the Company under the

Securities Act of 1933, as amended, or the Exchange Act, except as shall

be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit

|

|

|

No.

|

Description

|

|

|

|

|

99.1

|

Press release of Molina Healthcare, Inc., issued November 2, 2015,

regarding the completion of its acquisition of Providence Human

Services, LLC and Providence Community Services, LLC.

|

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

MOLINA HEALTHCARE, INC.

|

|

|

|

|

|

Date:

|

November 2, 2015

|

By:

|

/s/ Jeff D. Barlow

|

|

|

|

Jeff D. Barlow

|

|

|

|

Chief Legal Officer and Secretary

|

EXHIBIT INDEX

|

Exhibit

|

|

|

No.

|

Description

|

|

|

|

|

99.1

|

Press release of Molina Healthcare, Inc., issued November 2, 2015,

regarding the completion of its acquisition of Providence Human

Services, LLC and Providence Community Services, LLC.

|

Exhibit 99.1

Molina

Healthcare Completes Acquisition of Providence Human Services and

Providence Community Services

LONG BEACH, Calif.--(BUSINESS WIRE)--November 2, 2015--Molina

Healthcare, Inc. (NYSE: MOH) announced today that it has completed the

acquisition of Providence Human Services, LLC (PHS) and Providence

Community Services, LLC (PCS), formerly part of The Providence Service

Corporation (NASDAQ: PRSC), expanding Molina’s capabilities in

behavioral and mental health services. The two entities, which will

operate as a wholly owned subsidiary of Molina Healthcare under the

brand name PathwaysSM, represent one of the largest national

providers of accessible, outcome-based behavioral and mental health

services with 6,800 employees and operations in 23 states and the

District of Columbia.

“We are excited to welcome our PHS and PCS colleagues to Molina. The

acquisition expands our ability to more closely integrate our members’

physical and behavioral health benefits and manage care in a more

effective manner, while directly influencing outcomes for the better,”

said J. Mario Molina, M.D., president and chief executive officer of

Molina Healthcare. “Molina and Pathways share a common strategic vision

and philosophy, making them well aligned to focus on delivering quality

health care services to people receiving government assistance.”

PathwaysSM is headquartered in Fredericksburg, Virginia, with

additional offices throughout the country. More information about

PathwaysSM is available at pathwayshealth.com.

About Molina Healthcare, Inc.

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed health

care services under the Medicaid and Medicare programs and through the

state insurance marketplaces. Through our locally operated health plans

in 11 states across the nation and in the Commonwealth of Puerto Rico,

Molina serves approximately 3.5 million members. Dr. C. David Molina

founded our company in 1980 as a provider organization serving

low-income families in Southern California. Today, we continue his

mission of providing high quality and cost-effective health care to

those who need it most. For more information about Molina Healthcare,

please visit our website at molinahealthcare.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995: This press release contains “forward-looking

statements” regarding the transaction between The Providence Service

Corporation and Molina Healthcare, Inc. All forward-looking statements

are based on current expectations that are subject to numerous risk

factors that could cause actual results to differ materially. Such risk

factors include, without limitation, risks related to: the ability of

Providence Human Services and Providence Community Services (together,

the “Acquired Companies”) to maintain relationships with customers and

employees following the closing of this transaction; the integration of

the operations and employees of the Acquired Companies’ businesses into

Molina Healthcare’s business; the retention and renewal of the Acquired

Companies’ business contracts; synergies from the proposed transaction;

and the Acquired Companies’ future financial condition and operating

results. Additional information regarding the risk factors to which

Molina Healthcare is subject is provided in greater detail in its

respective periodic reports and filings with the Securities and Exchange

Commission, including its most recent Annual Report on Form 10-K. These

reports can be accessed under the investor relations tab of the Molina

Healthcare website or on the SEC’s website at sec.gov. Given these risks

and uncertainties, Molina Healthcare can give no assurances that its

forward-looking statements will prove to be accurate, or that any other

results or events projected or contemplated by its forward-looking

statements will in fact occur, and Molina Healthcare cautions investors

not to place undue reliance on these statements. All forward-looking

statements in this release represent Molina Healthcare’s judgment as of

the date hereof, and Molina Healthcare disclaims any obligation to

update any forward-looking statements to conform the statement to actual

results or changes in its expectations that occur after the date of this

release.

CONTACT:

Molina Healthcare, Inc.

Investor Relations

Juan José

Orellana, 562-435-3666

or

Public Relations

Sunny Yu,

562-477-1608

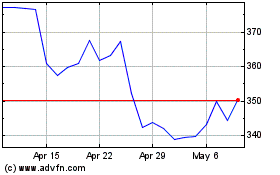

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

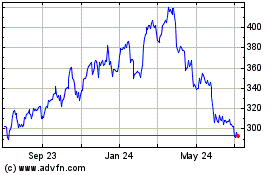

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024