Current Report Filing (8-k)

July 31 2015 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 28, 2015

MOOG INC.

(Exact name of registrant as specified in its charter)

|

| | |

New York | 1-5129 | 16-0757636 |

(State or Other Jurisdiction | (Commission | (I.R.S. Employer |

of Incorporation) | File Number) | Identification No.) |

|

| |

East Aurora, New York | 14052-0018 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (716) 652-2000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On July 28, 2015, Moog Inc. (the “Company”) entered into an amendment (“Amendment 1”) to the Moog Inc. Supplemental Retirement Plan (amended and restated, effective January 1, 2013) (the “SERP”). Amendment 1, effective July 31, 2015, amends the SERP to (i) clarify that an accrual offset rule that is currently applicable only to benefits commencing after age 65 would apply to all benefits paid out while participants are still employed and receiving pay (vacation or otherwise) and (ii) provide that Warren C. Johnson will become 100% fully vested in and eligible for Benefits under Articles 3 and 4 of the Plan as of July 31, 2015. As reported in a Current Report on Form 8-K filed on June 5, 2015, Mr. Johnson will retire from his position with the Company as President of the Company’s Aircraft Group effective July 31, 2015.

The foregoing description of Amendment 1 does not purport to be complete and is subject to, and qualified in its entirety by, the full text of Amendment 1, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

| |

Item 9.01 | Financial Statements and Exhibits.

|

(d) Exhibits.

|

| |

10.1 | Amendment 1 to the Moog Inc. Supplemental Retirement Plan, as amended and restated, effective January 1, 2013. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | MOOG INC. | |

| | | |

Dated: July 31, 2015 | By: | /s/ Jennifer Walter | |

| Name: | Jennifer Walter | |

| | Controller | |

EXHIBIT INDEX

|

| |

Exhibit | Description |

10.1 | Amendment 1 to the Moog Inc. Supplemental Retirement Plan, as amended and restated, effective January 1, 2013.

|

Exhibit 10.1

AMENDMENT 1

TO THE

MOOG INC. SUPPLEMENTAL RETIREMENT PLAN

(As amended and restated, effective January 1, 2013)

WHEREAS, the Moog Inc. Supplemental Retirement Plan (the “Plan”) was amended and restated effective January 1, 2013; and

WHEREAS, the Company now wishes to amend the Plan.

NOW, THEREFORE, the Plan is hereby amended, effective July 31, 2015, as follows:

1. Section 2.3 is amended by adding the following subsection (d) to the end thereof:

(d) Warren Johnson will become 100% fully vested in and eligible for Benefits under Articles 3 and 4 of the Plan as of July 31, 2015.

2. Article 3 is amended by deleting the last sentence of Section 3.4 and adding the following Section 3.9 to the end thereof:

Section 3.9. In-Service Distributions of Benefits. If distribution of Benefits under the Plan with respect to a Participant who is still employed by the Company has commenced as of the end of any fiscal year, then, regardless of the Participant’s age, any additional accruals to which the Participant may be entitled under the Plan by virtue of his or her continued employment will be reduced (but not below zero) by the actuarial equivalent of the in-service distributions of Benefits.

|

| | | | | |

Dated: | July 28, 2015 | | Moog Inc. | | |

| | | By: | Gary A. Szakmary | |

| | | | Vice President | |

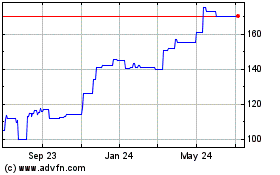

Moog (NYSE:MOG.B)

Historical Stock Chart

From Aug 2024 to Sep 2024

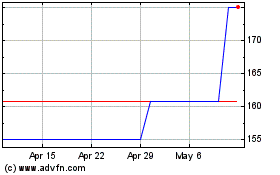

Moog (NYSE:MOG.B)

Historical Stock Chart

From Sep 2023 to Sep 2024