UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________________________________________

FORM 8-K

________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 17, 2016

________________________________________________________________________________________________________________

ALTRIA GROUP, INC.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________________________________________

|

| | | | |

Virginia | | 1-08940 | | 13-3260245 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

6601 West Broad Street, Richmond, Virginia | | 23230 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (804) 274-2200

________________________________________________________________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

As Altria Group, Inc. (“Altria”) previously announced, its Chairman, Chief Executive Officer and President, Marty Barrington, and other members of Altria’s senior management will be giving a live presentation today, February 17, 2016, at the Consumer Analyst Group of New York (“CAGNY”) conference in Boca Raton, Florida. In connection with the presentation, Altria is furnishing the following documents attached as exhibits to and incorporated by reference in this Current Report on Form 8-K: the text of the remarks, attached as Exhibit 99.1, and the press release addressing aspects of the presentation, attached as Exhibit 99.2.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including the exhibits, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| |

99.1 | Remarks by Marty Barrington, Chairman, Chief Executive Officer and President, Altria Group, Inc., and other members of Altria’s senior management, dated February 17, 2016 (furnished under Item 7.01) |

99.2 | Altria Group, Inc. Press Release, dated February 17, 2016 (furnished under Item 7.01) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | ALTRIA GROUP, INC. |

| | |

| By: | /s/ W. HILDEBRANDT SURGNER, JR. |

| Name: | W. Hildebrandt Surgner, Jr. |

| Title: | Corporate Secretary and |

| | Senior Assistant General Counsel |

DATE: February 17, 2016

EXHIBIT INDEX

Exhibit No. Description

| |

99.1 | Remarks by Marty Barrington, Chairman, Chief Executive Officer and President, Altria Group, Inc., and other members of Altria’s senior management, dated February 17, 2016 (furnished under Item 7.01) |

| |

99.2 | Altria Group, Inc. Press Release, dated February 17, 2016 (furnished under Item 7.01) |

Exhibit 99.1

Remarks by Marty Barrington, Altria Group, Inc.’s (Altria) Chairman, CEO and President, and other members of Altria’s senior management team

2016 Consumer Analyst Group of New York (CAGNY) Conference

Boca Raton, Florida

February 17, 2016

Remarks by Marty Barrington

Good afternoon and thank you, Jane. I’m joined by several members of our management team this afternoon. With me here on stage to speak are Howard Willard, our COO, and Billy Gifford, our CFO. Denise Keane, our General Counsel, and Jim Dillard, who leads research, development, regulatory affairs and innovation, are also here and will be joining us for our breakout session. We’re very happy to be back at CAGNY and with all of you.

Before we begin, please review the Safe Harbor Statement in today’s presentation and the Forward-Looking and Cautionary Statements section in today’s press release, where we describe the various factors that could cause our actual results to differ materially from projections included in today’s remarks. Reconciliations and further explanations of the non-GAAP financial measures we discuss today are available on altria.com.

Altria had yet another year of excellent business results and outstanding shareholder returns in 2015. Adjusted diluted earnings per share (EPS) grew almost 9%, outpacing our five-year compounded annual growth rate of 8%. Our core businesses generated impressive and consistent income growth. We raised our dividend 8.7%. And we delivered a total shareholder return (TSR) of over 23%, outperforming the S&P 500 by more than 2100 basis points. And as a reminder, our TSR was 35% in 2014 and 29% in 2013.

We’re reminded that the U.S. tobacco categories represent approximately $82 billion annually in consumer spending in major retail channels and that the cigarette category, at $70 billion, is larger than U.S. beer and carbonated beverages sales combined. Marlboro sits atop the category with approximately $34 billion in sales in 2015. That’s a leadership position we don’t take lightly or for granted.

Our companies’ leadership in the core tobacco categories is anchored by four great premium brands: Marlboro in cigarettes, Copenhagen and Skoal in smokeless tobacco, and Black & Mild in machine-made large cigars. We complement this total tobacco platform with an excellent wine business in Ste. Michelle

1

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

Wine Estates (Ste. Michelle) and our large beer stake, today comprising an approximately 27% interest in SABMiller plc (SABMiller). We focus intently to maximize these assets to deliver consistent earnings and dividend growth in line with our long-term financial goals, which are:

| |

• | to grow adjusted diluted EPS at an average annual rate of 7% to 9%; and |

| |

• | to maintain a target dividend payout ratio of approximately 80% of adjusted diluted EPS. |

We do so by focusing on three strategies:

| |

• | first, to maximize income from the core tobacco businesses over the long term; |

| |

• | second, to grow new income streams with innovative tobacco products; and |

| |

• | third, to manage our diverse income streams and strong balance sheet to deliver consistent financial performance. |

These three strategies require vigilance in how we manage and improve each of our assets. Our beer position is a perfect example of how we have continually evaluated and enhanced our position, always seeking to maximize value. So, let’s take a moment to review that.

We’ve been involved in the beer category since 1970, when we acquired Miller Brewing for $230 million. We owned and operated Miller until 2002, when we merged it with South African Breweries plc, forming the world’s second-largest brewer, SABMiller. In that tax-efficient deal, Altria secured three board seats, shares valued at approximately $3.5 billion, representing a 36% economic interest, and approximately $2 billion in cash.

Thereafter, we supported SABMiller as it executed its growth strategy - both organically and through acquisitions - and our interest grew as well. In fact, the pre-tax market value of our interest in SABMiller grew from about $3.5 billion to approximately $19.5 billion as of September 2015. That was just before the announcement that Anheuser-Busch InBev SA/NV (AB InBev) had approached SABMiller to discuss a combination.

From 2002 through 2015, Altria received nearly $9 billion in equity earnings and nearly $4 billion in dividends from our interest in SABMiller. It’s been a strong contributor to our diverse business model.

Periodically, however, the question would be asked: what should Altria do with this very valuable asset? Our answer always was: whatever is best for the Altria shareholder. To assure that we accomplished that, we regularly evaluated our options with regard to the stake and, in considering whether to evolve from that position, we established objectives for any potential future transaction. These included:

2

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

| |

• | continued participation in the global beer profit pool; |

| |

• | receiving an appropriate premium; and |

| |

• | achieving appropriate board representation to assure that we maintained significant influence over the asset. |

As we all know, in November 2015 AB InBev and SABMiller announced their agreement to combine these great companies. When completed, this proposed transaction will, among other things:

| |

• | unite complementary geographies to create the first truly global beer company and one of the world’s largest CPG companies; |

| |

• | generate significant growth opportunities for a combined portfolio of leading brands; |

| |

• | build on the strengths of the world’s great beer operators, including AB InBev’s historical success at integrating companies; and |

| |

• | establish a well-capitalized new company with terrific future prospects including cost synergies. |

While this potential transaction means a lot for these great companies, it also meets our objectives, as upon closing, Altria expects to:

| |

• | continue participation in the global beer profit pool with an approximately 10.5% stake in the new company; |

| |

• | achieve continued tax efficiency; |

| |

• | have two seats on the new company’s board of directors; |

| |

• | continue the use of equity accounting for the asset’s contribution to Altria’s earnings; and |

| |

• | receive approximately $2.5 billion pre-tax in cash. |

And we will capture a significant premium. The size of the premium will ultimately depend on final closing prices, exchange rates and, as with the other expected benefits, is subject to any proration that may occur. But as an example, as of the date of the November agreement, the terms of the partial share alternative we have accepted represented an approximate 43% premium to SABMiller’s undisturbed share price.

3

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

Closing the transaction will be an exciting next step, and we’re pleased to be a part of it all.

In our core tobacco businesses, our most valuable asset is Philip Morris USA Inc.’s (PM USA) terrific Marlboro brand. Thanks to vision, innovation and careful stewardship, Marlboro has been the leading U.S. cigarette brand for 40 years. In fact, Marlboro has been on the top 10 list of the world’s most valuable global brands in each of the past 10 years.

Marlboro anchors our smokeable products segment, which includes cigarettes and machine-made large cigars. These businesses had terrific 2015 results:

| |

• | adjusted operating companies income (OCI) increased almost 11%; |

| |

• | PM USA’s cigarette volume was up modestly versus 2014, after adjusting for trade inventory changes and other factors, and John Middleton Co.’s cigar shipment volume increased over 4%; |

| |

• | PM USA’s retail share reached a record 51.3%; and |

| |

• | Marlboro grew its leading retail share two tenths to 44%, another record. |

As we move forward, PM USA is investing to capitalize on Marlboro’s strength in three areas:

| |

• | innovation to maintain Marlboro’s vibrancy; |

| |

• | scale and breadth at retail; and |

| |

• | our advantage in digital engagement. |

PM USA personified innovation at its core when it introduced the Marlboro architecture in 2012. We created four distinct flavor families, allowing Marlboro new ways to express its brand values and connect with a diverse base of adult smokers. Marlboro’s historic strength has been in the non-menthol segment; so maintaining that leadership continues to be very important. The non-menthol segment comprises nearly 70% of the cigarette category and Marlboro continues to be significantly over-indexed in the segment.

In addition, the architecture also allowed Marlboro to expand its product lineup and strengthen its position in the growing menthol segment. Over the past few years, PM USA expanded its menthol offerings including:

| |

• | Marlboro Black Menthol and Marlboro NXT; |

| |

• | Marlboro Menthol Rich Blue; and |

4

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

| |

• | the latest Black family offering, Marlboro Midnight Menthol. |

Marlboro Midnight offers bold menthol flavor, a novel soft-touch pack and is supported with vivid point-of-sale signage.

Today, Marlboro is the number two menthol brand and among the fastest growing menthol brands. Marlboro’s menthol retail share grew 0.5 points since 2012 to 7.2 percent.

In the U.S. cigarette category, Marlboro’s scale and brand loyalty are important to our trade partners. Four out of ten adult smokers enter a convenience store (c-store) seeking Marlboro and Marlboro is the most valuable brand of any category in c-store inside sales. So, we’ve invested in a strong sales team at Altria Group Distribution Company.

Our sales team has developed strong expertise in helping our trade partners build on Marlboro’s value and the value of our companies’ brands to enhance their profitability. Our sales coverage includes approximately 240,000 stores, representing 90% of tobacco industry volume and all major trade classes. This broad coverage differentiates Altria from our competitors.

Our trade partners work closely with PM USA thanks to the value of the Marlboro brand. Take digital innovation, for example. In 2015, we worked with our trade partners to launch and then expand mobile coupons for our adult smokers. This was a technological leap forward for branded CPGs, requiring integration across a wide variety of retailer platforms. And after just several months in market, adult smokers are increasingly turning to the convenience of mobile coupons and almost 100,000 retailers are accepting them. This is a terrific start, with plenty of opportunity for growth.

Digital engagement is key to PM USA’s marketing efforts. PM USA has been engaging with adult smokers on a one-to-one basis with broad scale since the 1990s, when the company began building a database of age-verified smokers 21 and older. Since then, PM USA has developed one-to-one relationships with millions of smokers 21 and older through direct mail, website and mobile platforms, all while limiting the reach of its marketing to unintended audiences. The approach is responsible, efficient and effective.

As we’re about to show you, our digital engagement capability is rapidly accelerating and one of the strongest among CPGs. [VIDEO] Notably, Marlboro has twice the number of mobile visits than the next largest CPG website according to comScore. Marlboro connected with smokers 21 and over through digital tools more than a hundred million times in 2015 including coupons, website, email and apps,

5

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

representing growth of almost 160% in digital interactions since 2012. So, look for further digital innovation from PM USA in the future.

As we continue to invest in Marlboro to maintain a vibrant franchise, we monitor the effectiveness of those investments across various measures of brand leadership and performance. Today, let’s discuss Marlboro’s equity, demographics and share.

First, adult smokers continue to confirm Marlboro’s strong brand equity. Since 2010, we’ve commissioned an annual independent brand equity review that measures equity across numerous dimensions and as an overall composite. The results? Marlboro’s overall equity scores among adult smokers have strengthened since 2010, rising about one point per year off an already high base. And Marlboro’s overall equity score continues to significantly exceed any other competitive brand. That’s also true among adult smokers 21-29. Marlboro’s overall equity score now stands more than 14 points higher than the leading competitive brands.

Second, investments in Marlboro’s strong equity have helped strengthen its demographics. When looking at adult smoker share trends since the introduction of the architecture, overall Marlboro share has grown and Marlboro’s share among smokers 21-29 remains at or slightly above its overall share. In fact, Marlboro’s share among smokers 21-29 remains significantly larger than key competitive brands. Importantly, the trajectory of Marlboro’s share among smokers 21-29, which was in decline prior to 2012, has stabilized.

Finally, Marlboro’s superior equity and strong demographics continue to translate to remarkable retail share performance. At 44 points, Marlboro’s retail share for 2015 was larger than the next 10 brands combined and, in the past three years, Marlboro was the retail share leader in every state. 2015 marked the fourth consecutive year of market share growth for Marlboro, in line with its strategy.

So, across a number of key measures, we are confident in Marlboro’s strength and leadership.

With that, Howard will discuss our strategies for smokeless and innovative tobacco products.

Remarks by Howard Willard

Thanks, Marty. Our strategy for the smokeless products segment is to grow income by growing volume at or ahead of the category and to maintain modest share momentum on Copenhagen and Skoal combined. Following our 2009 acquisition, U.S. Smokeless Tobacco Company LLC (USSTC) has returned these brands to combined retail share growth -- reversing a 15-year retail share decline in its brand portfolio and growing 3.4 retail share points since 2010. And our smokeless segment has grown adjusted operating

6

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

companies income since 2010 at a compounded annual rate of 6%. The segment contributes adjusted operating companies income of more than $1.1 billion.

To do that, USSTC has invested in different ways to achieve profitability and grow its brands, and we’ve learned a lot. First, Copenhagen has lots of room to grow. With over seven retail share points of growth over the past five years, we think Copenhagen is just getting started. In 2015, according to IRI, Copenhagen was both the retail share leader at 31.6 points and the fastest-growing smokeless brand. It grew 0.9 share points just in 2015.

Over the past several years, USSTC has significantly strengthened Copenhagen’s product platform and brand equity. As a result, Copenhagen Long-Cut Wintergreen is the fastest growing wintergreen product and Copenhagen has the strongest equity among all adult dippers and those age 21-29, according to our third-party equity review. It is a relevant and powerful brand with outstanding momentum and opportunities for growth.

Second, the right combination of investments in Skoal can be effective. We’ve invested in Skoal’s equity through the “A Pinch Better” campaign, which has helped stabilize the brand among its core consumers, dippers age 30 and over.

Third, we’ve found that smokers 21-29 who are interested in smokeless products appreciate Skoal’s innovative forms and varieties -- historical strengths for the brand. Thus, we consider Skoal’s blend products to be in a unique position to reach adult smokers interested in the smokeless category.

With two premium brands in a segment with adjusted operating companies income margins over 60%, we continue to invest in the combined growth of Copenhagen and Skoal. In 2016, we expect our plans will result in:

| |

• | ongoing equity investment in both brands; |

| |

• | adjustments in retail promotions to focus on the highest return opportunities; |

| |

• | continued competition between Copenhagen and Skoal; and |

| |

• | overall, a stronger smokeless portfolio in an environment where adult tobacco consumers have more product options. |

Next month, USSTC will expand Copenhagen Mint nationally, allowing the brand to compete in all major smokeless segments. “Coming Soon” point-of-sale materials are already in stores. And USSTC has a

7

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

strong awareness and trial-generating plan, including print and digital communications, and the “Make a Mint” daily-win sweepstakes.

On Skoal, USSTC supports Skoal Classic products with discipline where the brand is best positioned for growth and supports Skoal’s blend products to encourage adult tobacco consumer trial of these more approachable products. USSTC is also investing modestly in Skoal Snus, to help grow share in this growing segment.

We expect this combination of investments to propel further growth for Copenhagen, a brand with truly remarkable potential. We also expect to better differentiate Skoal and invest more efficiently in the brand. Thus, we’ll be well positioned to enhance income from our smokeless products segment, while growing combined Copenhagen and Skoal share in line with our strategy.

Of course, many adult tobacco consumers are seeking alternatives to traditional tobacco products. Just as we lead in the traditional tobacco categories, our goal is to offer a leading portfolio of innovative tobacco products that meet changing adult tobacco consumer preferences - particularly those that hold the potential of reduced risk. Our portfolio includes a range of product technologies. Let’s begin with e-vapor.

After two years of rapid growth in e-vapor, trial has not led to meaningful adoption and category growth slowed in 2015. Nu Mark LLC, our e-vapor company, estimates that total e-vapor consumer expenditures in 2015 reached approximately $2.5 billion, although most of the category growth occurred in the first half. And Nu Mark estimates that the total number of past 30-day adult vapers decreased versus 2014.

So, while today’s products are not fully meeting adult smoker and vaper expectations, opportunity remains. We continue to believe that meaningful category growth hinges on product innovation. Additionally, we continue to advocate for regulation and tax policies that recognize a continuum of risk for different tobacco products and support providing clear, science-based communications about these products to consumers.

Given the market dynamics, we’re approaching the category with discipline - improving elements along the way to maximize our e-vapor investments. We’re focused primarily on MarkTen e-vapor products, which have improved considerably in the past year. MarkTen XL represents our latest generation product and is currently available through select chains across the U.S.

We’ve been listening closely to adult consumers and customers as we’ve phased the expansion of MarkTen XL. So far, the response is quite positive. Adult smokers and vapers tell us MarkTen XL offers

8

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

a familiar draw and great flavor, with more vapor volume and a longer battery life. And, while we don’t focus unduly on market share in this dynamic category, MarkTen XL has delivered significantly stronger share performance than the original MarkTen. So, with an improved product in MarkTen XL, Nu Mark continues to expand distribution into stores with a significant e-vapor business.

Additionally, in 2014, Nu Mark acquired Green Smoke, adding strong e-commerce, customer service, technology and supply chain expertise. We also continue to test different approaches to maximize the incremental contribution of the Green Smoke brand in the marketplace.

That said, future e-vapor products are likely to be much improved from those of today. This is a technology-based category. Nu Mark has a full and exciting e-vapor pipeline and expects to bring more news to the category. In 2015, we further accelerated our e-vapor research and development (R&D) by partnering with Philip Morris International Inc. (PMI). We’re very pleased to bring two world class R&D organizations together to innovate the future of e-vapor.

While e-vapor represents product innovation, there are other promising innovative technologies for adult tobacco consumers. One is PMI’s heated tobacco product, to which Altria has the exclusive rights in the United States. As you know, PMI introduced this technology in the fourth quarter of 2014 under the iQOS brand into pilot markets in Nagoya, Japan, and Milan, Italy, to test marketing concepts and understand adult tobacco consumer acceptance. Since then, PMI has expanded distribution of iQOS in Japan and Italy and rolled out city launches in Switzerland, Romania, Russia and Portugal. PMI is also conducting extensive non-clinical and clinical research to substantiate reduced-exposure and reduced-risk claims. We are encouraged by both the marketplace and research results to date.

We are actively working on commercialization plans for this product platform in the U.S. We also are supporting PMI on a U.S. Food and Drug Administration (FDA) application to designate this technology as a modified risk tobacco product. We expect that application to be filed towards the end of this year. We’re extremely excited about our team’s go-to-market strategies on this innovative technology and look forward to sharing more details in due course.

So, whether it’s e-vapor, heated tobacco or other ideas we have in development, we’re focused on delivering a portfolio of leading products that meet adult tobacco consumer preferences into the future.

Now, I’ll turn the podium over to Billy to discuss our diverse business model.

9

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

Remarks by Billy Gifford

Thank you, Howard. Let’s begin with a quick review of the macro environment for our adult tobacco consumers. 2015 was a unique year in the tobacco industry. The economy strengthened, modest excise tax increases were implemented and, most importantly, significantly lower gas prices provided welcome support to U.S. adult tobacco consumers. These factors supported strong cigarette volumes, which were outside of historical norms for the category.

As we head into 2016, we believe the adult tobacco consumer will continue to respond favorably to the economic environment. Consumer confidence has steadily improved and is hovering near pre-recession peaks. The unemployment rate continues to decline. The U.S. government continues to forecast lower gasoline prices in 2016. Therefore, while we may have many of the same favorable conditions, the year-over-year effect is unlikely to be as significant. And of course, the macro environment is important, so any significant negative developments would matter.

The economics of the domestic tobacco industry remain very attractive. The U.S. tobacco manufacturers profit pool grew 10% in 2015 to $17 billion and 6% on a compounded annual basis since 2010. Altria, with its leading positions and our companies’ premium brands, captured the majority of it. And Altria’s net income and free cash flow margins outperformed companies in the S&P food and beverage sectors by roughly two to four times.

The focus we have on our two long-term financial goals and our track record for achieving them is strong. From 2010 through 2015, a period of considerable earnings volatility for many global CPG peers, we delivered adjusted diluted EPS growth over 8% and corresponding annualized dividend growth. During the same period, we also maintained a dividend payout ratio of 80%, near the top of the S&P Food, Beverage & Tobacco Index, and paid out nearly $4.2 billion in dividends in 2015. Our diverse income streams and strong balance sheet have enabled consistent performance in achieving these goals.

In the smokeable products segment, our strategy is to maximize income while maintaining modest share momentum on Marlboro over time. This requires a thoughtful balance of pricing, cost management, retail share performance, equity-building activities and product innovation. From 2010 to 2015, the smokeable segment’s adjusted OCI grew at a compounded annual rate of almost 6% to over $7.5 billion. During that time, Marlboro’s retail share grew 0.4 points and Black & Mild further solidified its strong position within the profitable tipped cigars segment.

In addition, the smokeable products segment has increased list prices and managed special price promotions, growing net revenues per thousand units at a compounded annual rate of 4.2% since 2010.

10

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

Likewise, the smokeless products segment has grown OCI, margins, volume, retail share and pricing, while carefully balancing investments in brand equity and managing costs. Since 2010, adjusted OCI grew at a compounded annual rate of 6% to over $1.1 billion and adjusted OCI margins expanded more than 6 percentage points to 63.7%. Smokeless products reported shipment volume increased at a five-year compounded annual rate of approximately 2.5%. And, in 2015, Copenhagen and Skoal achieved 51.3% combined retail share, an increase of nearly three-and-a-half points since 2010.

Cost discipline remains an important part of our model, helping to enable investments needed for the long term. As you may recall, between 2007 and 2013, Altria delivered $2 billion in cost savings. In January, we announced a new productivity initiative designed to help maintain our operating companies’ leadership and cost competitiveness. We expect to achieve approximately $300 million in annual savings by the end of 2017 through reduced spending on certain SG&A infrastructure and a leaner organization. We expect to reinvest some of the productivity savings in important initiatives such as brand building, harm reduction and regulatory capabilities, and you’ve already heard today about some of the possibilities there.

Over the past five years, our core tobacco businesses accounted for more than 85% in earnings contribution on average. Income from our alcohol assets and our financial services business, Philip Morris Capital Corporation (PMCC), complement our strong and growing tobacco businesses. Since 2010, Ste. Michelle has grown adjusted OCI almost 13% on a compounded annual basis, primarily by increasing volume and distribution of its premium wine portfolio. From 2010 to 2015, wine volume increased approximately 6% annually. Ste. Michelle maintains a fantastic suite of wine assets that sustain high acclaim. In 2015, Ste. Michelle received 250 ratings of 90 or better for its wines, a 40% increase over 2014.

We continue to unwind our financial services business in a disciplined fashion. Since the end of 2010, net finance receivables decreased by $3.4 billion, with $1.3 billion remaining. While PMCC manages its remaining assets to maximize financial contributions to Altria, we continue to expect variability in its income contribution. We believe it is realistic for the company to depart the remaining leases with financial discipline within three to four years.

As Marty described, our large economic interest in beer also remains an important component of our balance sheet. Since 2002, our share of equity earnings from SABMiller grew from over $100 million to more than $1 billion in 2014. Since 2010, earnings from our equity investment in SABMiller grew at a five-year compounded annual rate of approximately 4%. While foreign currency translation and special items challenged SABMiller’s earnings contribution in 2015, Altria still benefited from over $750 million in equity earnings and nearly $500 million in cash dividends.

11

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

For many years, a strong balance sheet has served us well. We’re committed to retaining our current investment grade credit ratings, enabling us to access both the short- and long-term debt markets as needed. And a strong balance sheet and cash flow supports our businesses, shareholder dividends and debt service.

We’ve taken advantage of favorable credit markets to enhance our capital structure. In 2015, Altria completed a debt tender offer to purchase over $790 million of high-coupon notes and repaid $1 billion of debt upon maturity. As a result of its capital markets activities, Altria has reduced its weighted average coupon rate to 5.5% at year-end 2015 from its peak of over 9% at year-end 2009.

Dividends remain our priority vehicle for capital distribution. In August 2015, Altria increased its quarterly dividend by 8.7% to an annualized rate of $2.26 per common share, representing a remarkable 49th dividend increase in the past 46 years (1).

We also repurchase shares when we believe it is the best use of cash. The company repurchased approximately $550 million in shares in 2015. At year end, we had approximately $965 million remaining in our current $1 billion share repurchase program, which we expect to complete by the end of this year. From 2010 through 2015, the combination of dividends paid and shares repurchased totaled nearly $26 billion.

In summary, we have a clear, simple and proven business model. First, we maximize income from our core tobacco businesses. Second, we benefit from our diverse income streams, including our stake in a growing beer profit pool. Together, these components have allowed us to deliver against our long-term aspiration of 7% to 9% adjusted diluted EPS growth and maintain a strong, growing dividend. It’s a formula that has served Altria and our shareholders well with total shareholder return of more than 200% since the end of 2010, far outpacing our benchmarks.

In line with our financial objectives, we reaffirm our expectation to deliver 2016 adjusted diluted EPS growth in a range of $3.00 to $3.05, representing a growth rate of 7% to 9% from our adjusted diluted EPS base of $2.80 in 2015. Subject to shareholder and regulatory approval, AB InBev expects to close its proposed transaction with SABMiller in the second half of 2016. Our guidance does not include any impact from the proposed transaction. And at the appropriate time, we expect to provide further details on any impact of the transaction to Altria’s 2016 earnings guidance and the potential use of cash proceeds. By now we hope it’s clear: we strategically manage and grow a powerful set of assets -- our companies’ brands, including Marlboro, Copenhagen, Skoal and Black & Mild, and a large stake in SABMiller that is

_______________________________________________________________________________________________________________________________________________________________________________

1 Dividends and share repurchases remain subject to the discretion of Altria’s Board of Directors.

12

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

poised for major transformation -- to deliver outstanding returns for our shareholders. In fact, a recent Wall Street Journal commentary placed Altria in elite company as one of the best U.S. stocks over the past 30 years, among a select number of companies with cumulative total returns of 10,000% or more.

We firmly believe that:

| |

• | our tobacco companies’ portfolio of iconic, premium brands is positioned to continue to lead the tobacco categories; |

| |

• | our disciplined approach will deliver a winning portfolio of innovative tobacco products over the long term; and |

| |

• | our diverse business model and strong balance sheet position us well to produce the kind of performance our shareholders have come to expect from Altria. |

We appreciate your attention and your interest in Altria. Now, I’ll turn the podium back to Marty and we’ll be happy to take your questions.

Altria’s Profile

Altria’s wholly-owned subsidiaries include PM USA, USSTC, Middleton, Nu Mark, Ste. Michelle and PMCC. Altria holds a continuing economic and voting interest in SABMiller.

The brand portfolios of Altria’s tobacco operating companies include Marlboro®, Black & Mild®, Copenhagen®, Skoal®, MarkTen® and Green Smoke®. Ste. Michelle produces and markets premium wines sold under various labels, including Chateau Ste. Michelle®, Columbia Crest®, 14 Hands® and Stag’s Leap Wine Cellars™, and it imports and markets Antinori®, Champagne Nicolas Feuillatte™, Torres® and Villa Maria Estate™ products in the United States. Trademarks and service marks related to Altria referenced in this release are the property of Altria or its subsidiaries or are used with permission. More information about Altria is available at altria.com and on the Altria Investor app.

Forward-Looking and Cautionary Statements

Today’s remarks contain projections of future results and other forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Important factors that may cause actual results and outcomes to differ materially from those contained in the projections and forward-looking statements included in today’s remarks are described in Altria’s publicly filed reports, including its Annual Report on Form 10-K for the year ended December 31, 2014 and its quarterly report on Form 10-Q for the period ended September 30, 2015.

13

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

These factors include the following: significant competition; changes in adult consumer preferences and demand for Altria’s operating companies’ products; fluctuations in raw material availability, quality and price; reliance on key facilities and suppliers; reliance on critical information systems, many of which are managed by third-party service providers; fluctuations in levels of customer inventories; the effects of global, national and local economic and market conditions; changes to income tax laws; federal, state and local legislative activity, including actual and potential federal and state excise tax increases; increasing marketing and regulatory restrictions; the effects of price increases related to excise tax increases and concluded tobacco litigation settlements on trade inventories, consumption rates and consumer preferences within price segments; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; privately imposed smoking restrictions; and, from time to time, governmental investigations.

Furthermore, the results of Altria’s tobacco businesses are dependent upon their continued ability to promote brand equity successfully; to anticipate and respond to evolving adult consumer preferences; to develop, manufacture, market and distribute products that appeal to adult tobacco consumers (including, where appropriate, through arrangements with, and investments in, third parties); to improve productivity; and to protect or enhance margins through cost savings and price increases.

Altria and its tobacco businesses are also subject to federal, state and local government regulation, including broad-based regulation of PM USA and USSTC by the FDA. Altria and its subsidiaries continue to be subject to litigation, including risks associated with adverse jury and judicial determinations, courts reaching conclusions at variance with the companies’ understanding of applicable law, bonding requirements in the limited number of jurisdictions that do not limit the dollar amount of appeal bonds and certain challenges to bond cap statutes.

In addition, the factors related to AB InBev’s proposed transaction to effect a business combination with SABMiller include the following: the risk that one or more conditions to closing the proposed transaction may not be satisfied; the risk that a shareholder or regulatory approval required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; AB InBev’s inability to achieve the contemplated synergies and value creation from the proposed transaction; the fact that Altria’s election to receive transaction consideration in the form of equity is subject to proration, which may result in a reduced percentage ownership of the combined company, additional tax liabilities and/or changes in our accounting treatment of the investment; the fact that the equity securities to be received by Altria as transaction consideration will be subject to restrictions on transfer lasting five years from completion of the proposed transaction; the risk that AB InBev’s share price, which affects the value of Altria’s transaction consideration, will fluctuate based on a variety of factors that are beyond Altria’s control; the fact that the strengthening of the U.S. dollar against the British pound would

14

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

adversely affect Altria’s cash consideration as the British pound would translate into fewer U.S. dollars; the risk that the tax treatment of Altria’s transaction consideration is not guaranteed; and that the tax treatment of the dividends Altria receives from the new company may not be as favorable as dividends from SABMiller.

Altria cautions that the foregoing list of important factors is not complete and does not undertake to update any forward-looking statements that it may make except as required by applicable law. All subsequent written and oral forward-looking statements attributable to Altria or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements referenced above.

Non-GAAP Financial Measures

Altria reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Altria’s management reviews OCI, which is defined as operating income before general corporate expenses and amortization of intangibles, to evaluate the performance of, and allocate resources to, the segments. Altria’s management also reviews certain financial results, including OCI, operating margins and diluted EPS, on an adjusted basis, which exclude certain income and expense items that management believes are not part of underlying operations. These items may include, for example, loss on early extinguishment of debt, restructuring charges, SABMiller special items, certain tax items, charges associated with tobacco and health litigation items, and settlements of, and determinations made in connection with, certain non-participating manufacturer (NPM) adjustment disputes (such settlements and determinations are referred to collectively as NPM Adjustment Items). Altria’s management does not view any of these special items to be part of Altria’s sustainable results as they may be highly variable, are difficult to predict and can distort underlying business trends and results. Altria’s management believes that adjusted financial measures provide useful insight into underlying business trends and results and provide a more meaningful comparison of year-over-year results. Altria’s management uses adjusted financial measures for planning, forecasting and evaluating business and financial performance, including allocating resources and evaluating results relative to employee compensation targets. These adjusted financial measures are not consistent with GAAP and may not be calculated the same as similarly titled measures used by other companies. These adjusted financial measures should thus be considered as supplemental in nature and not considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. Reconciliations of historical adjusted financial measures to corresponding GAAP measures are provided below.

15

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

Altria’s full-year adjusted diluted EPS guidance excludes the impact of certain income and expense items, including those items noted above. Altria’s management cannot estimate on a forward-looking basis the impact of these items on Altria’s reported diluted EPS because these items, which could be significant, are difficult to predict and may be highly variable. As a result, Altria does not provide a corresponding GAAP measure for, or reconciliation to, its adjusted diluted EPS guidance. Notwithstanding the foregoing, Altria expects to record a charge of $0.05 per share, substantially all of which will be recorded in the first quarter of 2016, for restructuring charges in connection with the productivity initiative announced in January 2016. This charge is excluded from Altria’s full-year adjusted diluted EPS guidance for 2016.

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Full-Year Adjusted Earnings Per Share Results |

| | Full Year Ended December 31, |

| | 2015 | | 2014 | | Growth Rate |

Reported diluted EPS | | $ | 2.67 |

| | $ | 2.56 |

| | |

NPM Adjustment Items | | (0.03 | ) | | (0.03 | ) | | |

Tobacco and health litigation items | | 0.05 |

| | 0.01 |

| | |

SABMiller special items | | 0.04 |

| | 0.01 |

| | |

Loss on early extinguishment of debt | | 0.07 |

| | 0.02 |

| | |

Asset impairment, exit, integration and acquisition-related costs | | — |

| | 0.01 |

| | |

Tax items | | — |

| | (0.01 | ) | | |

Adjusted diluted EPS | | $ | 2.80 |

| | $ | 2.57 |

| | 8.9 | % |

| | | | | | |

|

| | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Full-Year Adjusted Earnings Per Share Results |

| Full Year Ended December 31, |

| 2015 | | 2010 | | Compounded Annual Growth Rate |

Reported diluted EPS | $ | 2.67 |

| | $ | 1.87 |

| | |

NPM Adjustment Items | (0.03 | ) | | — |

| | |

Tobacco and health litigation items | 0.05 |

| | — |

| | |

SABMiller special items | 0.04 |

| | 0.03 |

| | |

Loss on early extinguishment of debt | 0.07 |

| | — |

| | |

Asset impairment, exit, integration, implementation and acquisition-related costs | — |

| | 0.05 |

| | |

Tax items | — |

| | (0.05 | ) | | |

Adjusted diluted EPS | $ | 2.80 |

| | $ | 1.90 |

| | 8.1 | % |

| | | | | |

16

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Smokeable Products |

($ in millions) | | | | | | |

| | Full Year Ended December 31, |

| | 2015 | | 2014 | | Growth Rate |

Net Revenues | | $ | 22,792 |

| | $ | 21,939 |

| | |

Excise taxes | | (6,423 | ) | | (6,416 | ) | | |

Revenues net of excise taxes | | 16,369 |

| | 15,523 |

| | |

| | | | | | |

Reported OCI | | $ | 7,569 |

| | $ | 6,873 |

| | |

NPM Adjustment Items | | (97 | ) | | (43 | ) | | |

Asset impairment and exit costs | | — |

| | (6 | ) | | |

Tobacco and health litigation items | | 127 |

| | 27 |

| | |

Adjusted OCI | | $ | 7,599 |

| | $ | 6,851 |

| | 10.9 | % |

Adjusted OCI margins1 | | 46.4 | % | | 44.1 | % | | |

Adjusted OCI margin change (2015 vs. 2014) | | 2.3pp |

| | | | |

| | | | | | |

1 Adjusted OCI margins are calculated as adjusted OCI divided by revenues net of excise taxes. |

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Smokeless Products |

($ in millions) | | | | | | |

| | Full Year Ended December 31, |

| | 2015 | | 2010 | | Compounded Annual Growth Rate |

Net revenues | | $ | 1,879 |

| | $ | 1,552 |

| | |

Excise taxes | | (133 | ) | | (105 | ) | | |

Revenues net of excise taxes | | $ | 1,746 |

| | $ | 1,447 |

| | |

| | | | | | |

Reported OCI | | $ | 1,108 |

| | $ | 803 |

| | |

Asset impairment, exit, integration and acquisition-related costs | | 4 |

| | 24 |

| | |

Tobacco and health litigation items | | — |

| | 5 |

| | |

Adjusted OCI | | $ | 1,112 |

| | $ | 832 |

| | 6.0 | % |

Adjusted OCI margins1 | | 63.7% |

| | 57.5% |

| | |

Adjusted OCI margin change (2015 vs. 2010) | | 6.2pp |

| | | | |

1 Adjusted OCI margins are calculated as adjusted OCI divided by revenues net of excise taxes. |

17

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

|

| | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Free Cash Flow and Net Income as a % of Revenues Net of Excise Taxes |

($ in millions) | | |

| | Twelve Months Ended |

| | December 31, 2015 |

Net cash provided by operating activities | | $ | 5,810 |

|

Capital expenditures | | (229 | ) |

Free cash flow | | $ | 5,581 |

|

| | |

Net Revenues | | $ | 25,434 |

|

Excise taxes | | (6,580 | ) |

Revenues net of excise taxes | | $ | 18,854 |

|

| | |

Net Income | | $ | 5,241 |

|

| | |

Free cash flow margin1 | | 29.6 | % |

Net Income margin2 | | 27.8 | % |

| | |

1Free cash flow margin is calculated as free cash flow divided by revenues net of excise taxes. |

2Net income margin is calculated as net income divided by revenues net of excise taxes. | | |

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Smokeable Products |

($ in millions) | | | | | | |

| | Full Year Ended December 31, |

| | 2015 | | 2010 | | Compounded Annual Growth Rate |

Net Revenues | | $ | 22,792 |

| | $ | 22,191 |

| | |

Excise taxes | | (6,423 | ) | | (7,348 | ) | | |

Revenues net of excise taxes | | 16,369 |

| | 14,843 |

| | |

| | | | | | |

Reported OCI | | $ | 7,569 |

| | $ | 5,618 |

| | |

NPM Adjustment Items | | (97 | ) | | — |

| | |

Asset impairment, exit, integration and implementation costs | | — |

| | 101 |

| | |

Tobacco and health litigation items | | 127 |

| | 11 |

| | |

Adjusted OCI | | $ | 7,599 |

| | $ | 5,730 |

| | 5.8 | % |

Adjusted OCI margins1 | | 46.4 | % | | 38.6 | % | | |

Adjusted OCI margin change (2015 vs. 2010) | | 7.8pp |

| | | | |

| | | | | | |

1 Adjusted OCI margins are calculated as adjusted OCI divided by revenues net of excise taxes. |

18

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Smokeable Products |

($ in millions) | | | | | | |

| | Full Year Ended December 31, |

| | 2015 | | 2010 | | Compounded Annual Growth Rate |

Net revenues | | $ | 22,792 |

| | $ | 22,191 |

| | |

Excise taxes | | (6,423 | ) | | (7,348 | ) | | |

Revenues net of excise taxes | | $ | 16,369 |

| | $ | 14,843 |

| | |

| | | | | | |

Shipment volume (units in millions)1 | | 127,343 |

| | 142,084 |

| | |

| | | | | | |

Revenues net of excise taxes per 1000 units2 | | $ | 128.54 |

| | $ | 104.47 |

| | 4.2 | % |

| | | | | | |

1 Cigarettes volume includes units sold as well as promotional units, but excludes units sold for distribution to and in Puerto Rico, and units sold in U.S. Territories, to overseas military and by Philip Morris Duty Free Inc., none of which, individually or in aggregate, is material to the smokeable products segment. |

2 Revenues net of excise taxes per 1000 units are calculated as revenues net of excise taxes divided by shipment volume multiplied by 1000. |

|

| | | | | | | | | | | |

Altria Group, Inc. and Consolidated Subsidiaries, Selected Financial Data for Wine | | |

($ in millions) | | | | | | |

| | Full Year Ended December 31, |

| | 2015 | | 2010 | | Compounded Annual Growth Rate |

Reported OCI | | $ | 152 |

| | $ | 61 |

| | |

Integration and acquisition-related costs | | — |

| | 22 |

| | |

Adjusted OCI | | $ | 152 |

| | $ | 83 |

| | 12.9 | % |

| | | | | | |

Source: Altria Group, Inc.

19

Remarks by Altria’s Chairman, CEO and President, and other members of Altria’s senior management team at CAGNY Conference, February 17, 2016

ALTRIA PRESENTS AT THE CONSUMER ANALYST GROUP OF NEW YORK CONFERENCE; REAFFIRMS 2016 ADJUSTED DILUTED EPS GUIDANCE

RICHMOND, Va. - February 17, 2016 - Altria Group, Inc. (Altria) (NYSE: MO) is participating in the Consumer Analyst Group of New York Conference in Boca Raton, Fla. today. Marty Barrington, Altria’s Chairman, Chief Executive Officer and President, and other members of Altria’s senior management team will highlight the strengths of Altria’s diverse business model, its companies’ strong brands and strategies to create long-term value for shareholders.

2016 Full-Year EPS Guidance

Altria reaffirms its 2016 full-year guidance for adjusted diluted earnings per share (EPS) to be in a range of $3.00 to $3.05, representing a growth rate of 7% to 9% from an adjusted diluted EPS base of $2.80 in 2015, as shown in Schedule 1.

In 2016, Altria expects to record a charge of $0.05 per share, substantially all of which will be recorded in the first quarter, for restructuring charges in connection with the productivity initiative announced in January 2016. This charge is excluded from Altria’s full-year adjusted diluted EPS guidance for 2016.

The factors described in the Forward-Looking and Cautionary Statements section of this release represent continuing risks to this forecast.

Remarks and Presentation

The presentation is being webcast live at altria.com in a listen-only mode, beginning at approximately 12:30 p.m. Eastern Time. A copy of the business presentation and remarks, and a replay of the audio webcast of the remarks, will be available at altria.com or through the Altria Investor app. The free app is available for download at www.altria.com/irapp or through the Apple App Store or Google Play.

Altria’s Profile

Altria’s wholly-owned subsidiaries include Philip Morris USA Inc. (PM USA), U.S. Smokeless Tobacco Company LLC (USSTC), John Middleton Co., Nu Mark LLC, Ste. Michelle Wine Estates Ltd. (Ste. Michelle) and Philip Morris Capital Corporation. Altria holds a continuing economic and voting interest in SABMiller plc (SABMiller).

The brand portfolios of Altria’s tobacco operating companies include Marlboro®, Black & Mild®, Copenhagen®, Skoal®, MarkTen® and Green Smoke®. Ste. Michelle produces and markets premium wines sold under various labels, including Chateau Ste. Michelle®, Columbia Crest®, 14 Hands® and Stag’s Leap Wine Cellars™, and it imports and markets Antinori®, Champagne Nicolas Feuillatte™, Torres® and Villa Maria Estate™ products in the United States. Trademarks and service marks related to Altria referenced in this release are the property of Altria or its subsidiaries or are used with permission. More information about Altria is available at altria.com and on the Altria Investor app.

6601 West Broad Street, Richmond, VA 23230

Forward-Looking and Cautionary Statements

This press release contains projections of future results and other forward-looking statements that involve a number of risks and uncertainties and are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Important factors that may cause actual results and outcomes to differ materially from those contained in the projections and forward-looking statements included in today’s remarks are described in Altria’s publicly filed reports, including its Annual Report on Form 10-K for the year ended December 31, 2014 and its quarterly report on Form 10-Q for the period ended September 30, 2015.

These factors include the following: significant competition; changes in adult consumer preferences and demand for Altria’s operating companies’ products; fluctuations in raw material availability, quality and price; reliance on key facilities and suppliers; reliance on critical information systems, many of which are managed by third-party service providers; fluctuations in levels of customer inventories; the effects of global, national and local economic and market conditions; changes to income tax laws; federal, state and local legislative activity, including actual and potential federal and state excise tax increases; increasing marketing and regulatory restrictions; the effects of price increases related to excise tax increases and concluded tobacco litigation settlements on trade inventories, consumption rates and consumer preferences within price segments; health concerns relating to the use of tobacco products and exposure to environmental tobacco smoke; privately imposed smoking restrictions; and, from time to time, governmental investigations.

Furthermore, the results of Altria’s tobacco businesses are dependent upon their continued ability to promote brand equity successfully; to anticipate and respond to evolving adult consumer preferences; to develop, manufacture, market and distribute products that appeal to adult tobacco consumers (including, where appropriate, through arrangements with, and investments in, third parties); to improve productivity; and to protect or enhance margins through cost savings and price increases.

Altria and its tobacco businesses are also subject to federal, state and local government regulation, including broad-based regulation of PM USA and USSTC by the U.S. Food and Drug Administration. Altria and its subsidiaries continue to be subject to litigation, including risks associated with adverse jury and judicial determinations, courts reaching conclusions at variance with the companies’ understanding of applicable law, bonding requirements in the limited number of jurisdictions that do not limit the dollar amount of appeal bonds and certain challenges to bond cap statutes.

In addition, the factors related to Anheuser-Busch InBev SA/NV’s (AB InBev) proposed transaction to effect a business combination with SABMiller include the following: the risk that one or more conditions to closing the proposed transaction may not be satisfied; the risk that a shareholder or regulatory approval required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; AB InBev’s inability to achieve the contemplated synergies and value creation from the proposed transaction; the fact that Altria’s election to receive transaction consideration in the form of equity is subject to proration, which may result in a reduced percentage ownership of the combined company, additional tax liabilities and/or changes in our accounting treatment of the investment; the fact that the equity securities to be received by Altria as transaction consideration will be subject to restrictions on transfer lasting five years from completion of the proposed transaction; the risk that AB InBev’s share price, which affects the value of Altria’s transaction consideration, will fluctuate based on a variety of factors that are beyond Altria’s control; the fact that the strengthening of the U.S. dollar against the British pound would adversely affect Altria’s cash consideration as the British pound would translate into fewer

U.S. dollars; the risk that the tax treatment of Altria’s transaction consideration is not guaranteed; and that the tax treatment of the dividends Altria receives from the new company may not be as favorable as dividends from SABMiller.

Altria cautions that the foregoing list of important factors is not complete and does not undertake to update any forward-looking statements that it may make except as required by applicable law. All subsequent written and oral forward-looking statements attributable to Altria or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements referenced above.

Source: Altria Group, Inc.

|

| | |

Altria Client Services | | Altria Client Services |

Investor Relations | | Media Relations |

(804) 484-8222 | | (804) 484-8897 |

Schedule 1

ALTRIA GROUP, INC.

and Subsidiaries

|

| | | |

Reconciliation of Altria’s 2015 Adjusted Results |

| |

| Full Year |

| 2015 |

Reported diluted EPS | $ | 2.67 |

|

NPM Adjustment Items | (0.03 | ) |

Tobacco and health litigation items | 0.05 |

|

SABMiller special items | 0.04 |

|

Loss on early extinguishment of debt | 0.07 |

|

Adjusted diluted EPS | $ | 2.80 |

|

Altria reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Altria’s management reviews operating companies income (OCI), which is defined as operating income before general corporate expenses and amortization of intangibles, to evaluate the performance of, and allocate resources to, the segments. Altria’s management also reviews certain financial results, including OCI, operating margins and diluted EPS, on an adjusted basis, which exclude certain income and expense items that management believes are not part of underlying operations. These items may include, for example, loss on early extinguishment of debt, restructuring charges, SABMiller special items, certain tax items, charges associated with tobacco and health litigation items, and settlements of, and determinations made in connection with, certain non-participating manufacturer (NPM) adjustment disputes (such settlements and determinations are referred to collectively as NPM Adjustment Items). Altria’s management does not view any of these special items to be part of Altria’s sustainable results as they may be highly variable, are difficult to predict and can distort underlying business trends and results. Altria’s management believes that adjusted financial measures provide useful insight into underlying business trends and results and provide a more meaningful comparison of year-over-year results. Altria’s management uses adjusted financial measures for planning, forecasting and evaluating business and financial performance, including allocating resources and evaluating results relative to employee compensation targets. These adjusted financial measures are not consistent with GAAP and may not be calculated the same as similarly titled measures used by other companies. These adjusted financial measures should thus be considered as supplemental in nature and not considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP.

Altria’s full-year adjusted diluted EPS guidance excludes the impact of certain income and expense items, including those items noted above. Altria’s management cannot estimate on a forward-looking basis the impact of these items on Altria’s reported diluted EPS because these items, which could be significant, are difficult to predict and may be highly variable. As a result, Altria does not provide a corresponding GAAP measure for, or reconciliation to, its adjusted diluted EPS guidance.

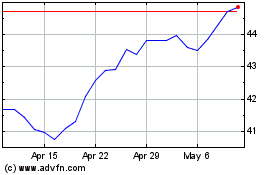

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

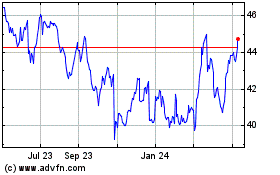

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024