By Saabira Chaudhuri And Tripp Mickle

Market leader Anheuser-Busch InBev NV went public with a

takeover proposal for SABMiller PLC that valued the company at up

to $104 billion after winning over its biggest shareholder, but the

world's No. 2 brewer said the price was too low.

A combination of the two companies would create a beer behemoth

with unrivaled scale and reach, bringing brands like Budweiser and

Stella Artois, which have been languishing in key markets, into new

corners of the globe.

SABMiller has a major presence in Africa and significant market

share in Colombia, Ecuador, Peru and Australia, while AB InBev is

strong in Canada, Mexico, Brazil, Argentina and parts of Western

Europe.

The deal faces many hurdles, from likely antitrust scrutiny to

tensions between SABMiller's two largest shareholders, which

together control 41% of the company.

U.S. tobacco group Altria Group Inc., the maker of Marlboro

cigarettes, owns more than 25% of the brewer and has said it would

support a deal at or above AB InBev's proposed price of GBP42.15

($64.2) a share--a 44% premium over SABMiller's Sept. 14 closing

price, the day media speculation about a potential takeover began

to circulate.

But Altria's three representatives on SABMiller's 16-member

board were the only ones not rejecting the proposal Wednesday,

which the board said "still very substantially undervalues

SABMiller, its unique and unmatched footprint, and its stand-alone

prospects."

The Santo Domingo family of Colombia, which owns about 15% of

the beer giant through its BevCo Ltd. investment vehicle, sided

with the rest of the board. BevCo didn't immediately respond to a

request for comment.

To make the proposal more palatable to SABMiller's top two

shareholders, AB InBev included an option that would let them be

paid mostly in stock, albeit at a lower valuation. This alternative

would offer tax and accounting advantages and give both Altria and

the Santo Domingos an opportunity to keep a stake in the combined

company.

Alejandro Santo Domingo, who is on the board of SABMiller, would

likely seek a board seat at the combined company, a person familiar

with the matter has said. One thing that could work in AB InBev's

favor, according to this person, is that Mr. Santo Domingo has ties

to Brazilian private-equity firm 3G Capital Partners LP, whose

founders played a key role in molding AB InBev into its current

form.

Wednesday's announcement marks the first time Belgium-based AB

InBev made public the terms of a proposal to acquire SABMiller,

which it has been eyeing for years. AB InBev said it has made two

prior written proposals in private--the first for GBP38 a share in

cash and the second, on Monday, for GBP40 a share in cash.

Under U.K. takeover rules, AB InBev has until Oct. 14 to make a

firm offer for SABMiller or walk away for at least six months. It

noted that Wednesday's proposal doesn't constitute a firm

offer.

The public proposal was designed to pressure SABMiller's board

into engaging in talks, AB InBev Chief Executive Carlos Brito told

analysts Wednesday. He encouraged SABMiller shareholders to review

the proposal and persuade SABMiller's board to engage.

Mr. Brito said AB InBev doesn't plan to pursue a hostile bid at

this point and would still prefer to secure a "recommended

transaction," but to achieve that, it needs SABMiller's board to

cooperate. To date, he said, "their board is going to great lengths

to avoid engagement."

For its part, SABMiller said AB InBev had timed its approach to

take advantage of SABMiller's recently depressed share price, that

the structure of the proposals discriminates against some SABMiller

shareholders, and that the company hadn't offered it comfort on the

significant regulatory hurdles in the U.S. and China.

Altria said Wednesday it supported the current proposal,

including the share alternative, and recommended that SABMiller's

management engage "promptly and constructively" in talks.

SABMiller shares closed 0.3% higher at GBP36.33 in London, while

AB InBev's shares rose by 0.6% in Brussels.

Combined, the two companies would generate annual revenue of $64

billion and earnings before interest, taxes, depreciation and

amortization of $24 billion.

Research firm Euromonitor estimates the combined company's

market share would be 29% after likely divestments, giving it a

20-percentage-point lead over the next-biggest brewer, Heineken

NV.

Because of their global reach, they likely will have to seek

antitrust clearance from jurisdictions around the world.

The biggest regulatory hurdle is likely to be the U.S., where AB

InBev already has a roughly 45% market share and London-based

SABMiller controls a further 25% through its MillerCoors LLC joint

venture with Molson Coors Brewing Co.

Another potential regulatory headache is China, where AB InBev

had a 14% market share last year, according to Euromonitor. Chinese

authorities could require the brewer to exit SABMiller's joint

venture with China Resources Enterprise Ltd., which controls 23% of

the market and produces the top-selling Snow brand.

AB InBev said that in the U.S. and China in particular it would

"seek to resolve any regulatory or contractual considerations

promptly and proactively."

In an appeal to the original home of the former South African

Breweries, AB InBev said a combined company would establish a

secondary listing on the Johannesburg stock exchange and have a

local board there.

AB InBev's last deal--a $20.1 billion deal for the Mexican

brewer Grupo Modelo in 2012--partly backfired on the company in the

U.S., its most profitable market. The U.S. Department of Justice

forced AB InBev to sell a Mexican brewery to Constellation Brands

Inc., along with permanent rights to peddle all of Modelo's beers

in the U.S.

The deal has helped boost AB InBev's presence in Mexico, where

it generated sales of $4.6 billion last year. But it also gave

birth to a formidable rival in the U.S.: Sales of Corona and Modelo

Especial have been growing at a double-digit pace in the country,

cutting into sales of AB InBev's leading brands Budweiser and Bud

Light.

Anupreeta Das contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Tripp Mickle at Tripp.Mickle@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 19:45 ET (23:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

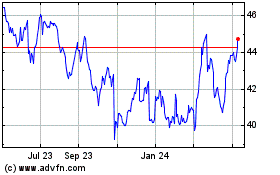

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

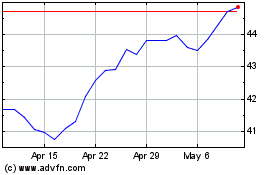

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024