Mercer’s latest analysis of compensation for CEOs in the S&P

500 reveals that total direct compensation declined from a median

of $10.6 million in 2014 to $10.3 million in 2015. This decrease –

the first in at least five years – is primarily attributable to

lower short-term incentives, which fell from $2.0 million in 2014

to $1.9 million in 2015, the smallest payout relative to target

since 2011. The lower pay also tracks a decrease in median revenue

among the companies, from $9.7 billion in 2014 to $9.4 billion in

2015.

“When revenue goes down, profit metrics are likely to be

affected,” said Ted Jarvis, Mercer’s Global Director of Executive

Rewards Data, Research and Publications. “Since virtually all

companies incorporate profit in some form in their short-term

incentives, it stands to reason that payouts associated with these

metrics would be reduced.”

According to Mercer’s analysis, long-term incentives barely

budged in 2015, up just 1% to $7.4 million. The growth came from

smaller companies in the S&P 500, namely those companies not in

the S&P 100 (Other 400). Companies in the S&P 100, the

largest companies in the S&P 500, reduced long-term incentives

by 4% to $11.1 million.

“The S&P 100 companies reined in many key areas of pay last

year. For this group, median base salaries were unchanged from 2014

levels, whereas salaries for the Other 400 went up just more than

1%,” said Mr. Jarvis. “Also, the short-term incentive payout for

CEOs of the S&P 100 fell significantly, from 131% of target

last year to 111% in 2015. These incentives for the Other 400

experienced a sharp decline in 2015, as well – to 108% of target

from 118% in 2014.” According to Mr. Jarvis, the disparity between

larger and smaller companies may be due to the Energy sector, which

has higher representation in the S&P 100 than the Other 400,

and the skid in oil prices, which delivered an economic blow to the

industry.

Use of stock options continues to decline

The past five years witnessed an inverse usage of long-term

incentive vehicles as the prevalence of stock options among S&P

500 companies shrank to 57% in 2015 from 72% in 2011. Over the same

period, performance share usage increased from 76% to 87% and

time-vesting shares remained steady at 59%. “These disparities

between the S&P 100 and the Other 400 in usage may be explained

by the recent ascent of performance shares among the Other 400

companies, whereas the S&P 100 companies have been a

consistently strong user of these vehicles between 2011 and 2015,”

said Mr. Jarvis.

Additionally, the S&P 100 has notably reduced its reliance

on both service-vesting shares and stock options. In 2011,

companies in the S&P 100 granted service-vesting restricted

stock at a rate of 59% and stock options at a rate of 73%. In the

most recently completed fiscal year, 46% of these companies granted

time-based stock and 50% granted stock options. “If these trends

continue, grants of stock options will become a minority practice

among this group in the future,” said Mr. Jarvis.

According to Jack Connell, a Partner with Mercer specializing in

executive compensation, “Stock options lead to the biggest burn

rate and overall dilution given their lengthy timeframe. As

third-party proxy advisors push companies to manage burn rate and

overhang, option use will decline relative to full-value shares.”

Time-vesting options, the most common type, can also cause an

irreversible hit to the income, which is not the case for some

performance-based awards. “The growth in full-value,

performance-based share awards and diminishment in option usage

reflects a rational bias towards the most efficient use of shares

from an accounting perspective and in response to the views of

proxy advisory firms,” said Mr. Connell.

Longtime industry pay ranks disrupted

Mercer’s analysis finds that CEOs in the Consumer Discretionary

sector received the highest compensation, with median total direct

compensation of $12.3 million; the Utilities sector had the lowest

pay with median total direct compensation of $9.2 million.

Healthcare – the highest-paying sector in 2014 – declined to $11.8

million in 2015 from $12.4 million in 2014. “The Consumer

Discretionary sector paid the highest base salaries for each of the

past five years, and its 2015 target bonus opportunity at 170% of

base was second only to the Financial Services sector,” said Mr.

Jarvis. “Actual payouts were relatively generous at 117% of target,

which raised the median value of short-term incentives to $2.8

million and median total cash to $4.0 million.”

Short- and long-term incentives were sharply delineated across

sectors. “Primarily in response to the nosedive in oil prices,

short-term bonuses in the Energy industry swooned from a five-year

high of $2.2 million in 2014 to $1.4 million in 2015,” said Mr.

Jarvis. “CEOs in the Healthcare and Financial Services industries,

which confronted regulatory pressure in 2015, saw bonuses rise –

especially within Healthcare, increasing to $2.2 million from $1.9

million in 2014.” Long-term incentives reached or approached

all-time highs in the Consumer Discretionary, Consumer Staples,

Energy and Utilities industries, but fell in the Financial

Services, Healthcare, Industrials, Information Technology and

Materials sectors.

“Proxy advisory firms and governance watchdogs are mainly

concerned about pay for performance and advocates for effective

target setting and responsible long-term incentive granting

practices,” said Mr. Connell. “These organizations exert pressure

on companies to create a rational alignment of pay to performance.

In 2015, revenues in the Energy sector fell 45%, showing linkage at

a high level. For the S&P 500, however, the portion of

companies that paid above-target bonuses is not necessarily

justified by revenue growth or profit.”

Is pay for performance working?

Mercer’s analysis shows inconsistent evidence of a linkage

between pay and performance. CEOs heading companies in the bottom

quartiles of one-year revenue growth or one-year total shareholder

return received the lowest bonuses, confirming a strong

correlation. However, these CEOs have the highest salaries on the

basis of three-year compound annual growth in revenue and total

shareholder return, and the highest long-term incentives on the

basis of three-year compound annual growth in revenue and one-year

total shareholder return. Additionally, at $12.4 million the median

total direct compensation far exceeds the $10.3 million earned by

the top-quartile contenders in three-year compound annual growth of

revenue.

“Compensation committees should pay compensation higher than the

median for higher than median performance and lower than the median

for lower than median performance,” said Mr. Connell. “It comes

down to the quality of the goal setting. If projected revenue and

income growth are not at median, it is tough to justify median

targeted pay. If the goals are unrealistic – either too high or too

low – the balance of the whole incentive is thrown off.”

Mercer’s analysis is based on compensation data from 93

companies in the S&P 100 and 362 other companies in the S&P

500 (Other 400). In 2015, median revenue for these companies was

$9,474 million.

About Mercer

Mercer is a global consulting leader in talent, health,

retirement and investments. Mercer helps clients around the world

advance the health, wealth and performance of their most vital

asset – their people. Mercer’s more than 20,000 employees are based

in 43 countries and the firm operates in over 140 countries. Mercer

is a wholly owned subsidiary of Marsh & McLennan Companies

(NYSE: MMC), a global professional services firm offering clients

advice and solutions in the areas of risk, strategy and people.

With 60,000 employees worldwide and annual revenue exceeding $13

billion, Marsh & McLennan Companies is also the parent company

of Marsh, a global leader in insurance broking and risk management;

Guy Carpenter, a leader in providing risk and reinsurance

intermediary services; and Oliver Wyman, a leader in management

consulting. For more information, visit www.mercer.com. Follow

Mercer on Twitter @Mercer.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160808005908/en/

MercerStacy Bronstein, +

1-215-982-8025Stacy.Bronstein@mercer.com

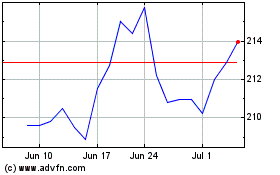

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024