Mercer’s 21st annual Cost of Living Survey finds African, Asian,

and European cities dominating the list of most expensive locations

for employees working abroad

New York is the top-ranked city in the United States,

Winston-Salem, NC ranks lowest

Just as foreign exchange costs create headwinds for many

multinational organizations, currency fluctuations – driven by

economic and political unrest – are contributing to the cost of

expatriate packages for those on the front line of globalization of

their organizations. Mercer’s 21st annual Cost of Living Survey

finds that factors including instability of housing markets and

inflation for goods and services impacts significantly the overall

cost of doing business in a global environment.

“As the global economy has become increasingly interconnected,

close to 75% of multinational organizations are expecting long-term

expatriate assignments to remain stable or increase over the next

two years to address business needs,” said Ilya Bonic, Senior

Partner and President of Mercer’s Talent business. “Sending

employees abroad is necessary to compete in markets and for

critical talent, and employers need a reliable and accurate

reflection of the cost to their bottom line.”

According to Mercer’s 2015 Cost of Living Survey, Asian and

European cities – particularly Hong Kong (2), Zurich (3), Singapore

(4), and Geneva (5) – top the list of most expensive cities for

expatriates. The costliest city for the third consecutive year is

Luanda (1), the capital of Angola. Despite being recognized as a

relatively inexpensive city, the cost of imported goods and safe

living conditions in this country are available at a steep

price.

Other cities appearing in the top 10 of Mercer’s costliest

cities for expatriates are Shanghai (6), Beijing (7), and Seoul (8)

in Asia; Bern (9); and N’Djamena (10). The world’s least expensive

cities for expatriates, according to Mercer’s survey, are Bishkek

(207), Windhoek (206), and Karachi (205).

Mercer's authoritative survey is one of the world’s most

comprehensive, and is designed to help multinational companies and

governments determine compensation allowances for their expatriate

employees. New York is used as the base city, and all cities are

compared against it. Currency movements are measured against the US

dollar.

The survey includes 207 cities across five continents and

measures the comparative cost of more than 200 items in each

location, including housing, transportation, food, clothing,

household goods, and entertainment.

“Aligning workforce and mobility strategies by ensuring the

right employees are in the right places is more critical than ever

to manage globalization,” said Mr. Bonic. “Properly compensating

employees on international assignments is as important as it is

costly.”

According to Mr. Bonic, this is especially important for

emerging mobility programs with smaller pools of candidates and

higher business needs for sending employees on international

assignments. It is essential that these organizations have accurate

and transparent data as they consider how to compensate fairly and

in line with market demands.

The Americas

Cities in the United States climbed dramatically in the cost of

living ranking due to the strengthening of the US dollar against

other major currencies. While New York (16), the highest-ranked

city in the region, remained the same as last year, cities on the

West Coast, including Los Angeles (36) and Seattle (106) climbed 26

and 47 places, respectively. Among other major US cities, Chicago

(42) moved up 43 places, Washington, DC (50) moved up 42 places,

Honolulu (52) moved up 45 places, and Houston (92) moved up 51

places. Cleveland (133) and Winston Salem (157) were among the less

expensive cities in the US surveyed for expatriates.

Steve Nurney, Partner and Mercer’s North America Global Mobility

business leader, said, “The sweeping rise in the rankings of US

cities this year is due unquestionably to the strength of the US

dollar compared to the other currencies around the world.”

In South America, Buenos Aires (19) climbed 67 places to rank as

the costliest city this year due to a strong price increase for

goods and services. The Argentina capital and financial hub is

followed by São Paolo (40) and Rio de Janeiro (67). Other cities in

South America that rose on the list of costliest cities for

expatriates include Santiago (70) and Managua (199). Caracas in

Venezuela has been excluded from the ranking due to the complex

currency situation; its ranking would have varied greatly depending

on the official exchange rate selected.

Canadian cities dropped in this year’s ranking with the

country’s highest-ranked city, Vancouver (119), falling 23 places.

Toronto (126) dropped 25 spots, while Montreal (140) and Calgary

(146) fell 17 and 21 spots, respectively. “The Canadian dollar

continues to weaken against the US dollar, triggering major slips

in this year’s ranking,” explained Mr. Nurney.

Europe, the Middle East, and Africa

Three European cities exist in the list of top 10 most expensive

cities for expatriates. Zurich (3), the most costly European city,

is followed by Geneva (5) and Bern (9). Switzerland remains one of

the most expensive locations for expatriates due to the surge of

the Swiss franc against the EUR. Moscow (50) and St. Petersburg

(152) dropped 41 and 117 spots, respectively, as a result of

Russia’s ruble losing significant value against the US dollar,

lower oil prices, and a lack of confidence in the currency

following Western sanctions over the crisis in Ukraine.

Aside from cities in the United Kingdom, Western European cities

dropped in the rankings mainly due to the weakening of local

currencies against the US dollar. While London (12) remained

steady, Aberdeen (82) and Birmingham (80) rose in the ranking.

Paris (46), Vienna (56), and Rome (59) fell in the ranking by 19,

24, and 28 spots, respectively. The German cities of Munich (87),

Frankfurt (98), and Berlin (106) dropped significantly as did

Dusseldorf (114) and Hamburg (124).

“Despite moderate price increases in most of the European

cities, European currencies have weakened against the US dollar

which pushed most Western European cities down in the ranking,”

explained Nathalie Constantin-Métral, Principal at Mercer with

responsibility for compiling the survey ranking. “Additionally,

other factors like the Eurozone’s economy, falling interest rates,

and increasing unemployment have impacted these cities.”

As a result of local currencies depreciating against the US

dollar, most cities in Eastern and Central Europe fell in the

ranking, as well. Prague (142), Budapest (170), and Minsk (200)

dropped 50, 35, and 9 spots, respectively, despite stable

accommodations in these locations.

Tel Aviv (18) continues to be the most expensive city in the

Middle East for expatriates, followed by Dubai (23), Abu Dhabi

(33), and Beirut (44), which have all climbed in this year’s

ranking. Jeddah (151) continues to be the least expensive city in

the region despite rising 24 places. “Many currencies in the Middle

East are pegged to the US dollar, which pushed the cities up in the

ranking. Steep increase for expatriate rental accommodations

particularly in Abu Dhabi and Dubai also contributed to the

increase of the cities in the ranking,” said Ms.

Constantin-Métral.

Several cities in Africa continue to rank among the most

expensive, reflecting high living costs and high prices of goods

for expatriates. Luanda (1) remains the most costly city in Africa

and globally, followed by N’Djamena (10), Victoria (17), and

Libreville (30). Despite climbing 5 spots, Cape Town (200) in South

Africa continues to rank as the least expensive city in the region

reflecting the weak South African rand against the US dollar.

Asia Pacific

Five of the top 10 cities in this year’s ranking are in Asia.

Hong Kong (2) is the most expensive city as a result of its

currency pegged to the US dollar and driving up the cost of living

locally. This global financial center is followed by Singapore (4),

Shanghai (6), Beijing (7), and Seoul (8) – all climbing in the

ranking with the exception of Singapore which remained steady.

Tokyo (11) dropped four places.

“Japanese cities have continued to drop in the ranking this year

as a result of the Japanese yen weakening against the US dollar,”

said Ms. Constantin-Métral. “However, Chinese cities jumped in the

ranking due to the strengthening of the Chinese yuan along with the

high costs of expatriate consumer goods.”

Australian cities have continued to fall in the ranking due to

the depreciation of the local currency against the US dollar.

Sydney (31), Australia’s most expensive city for expatriates

dropped 5 places in the ranking along with Melbourne (47) and Perth

(48) which fell 14 and 11 spots, respectively.

India’s most expensive city, Mumbai (74), climbed 66 places in

the ranking due to its rapid economic growth, inflation on the

goods and services basket, and a stable currency against the US

dollar. This most populous city in India is followed by New Delhi

(132) and Chennai (157) which rose in the ranking by 25 and 28

spots, respectively. Bangalore (183) and Kolkata (193), the least

expensive Indian cities, climbed in the ranking, as well.

Elsewhere in Asia, Bangkok (45) jumped 43 places from last year.

Hanoi (86) and Jakarta (99) also rose in the ranking, up 45 and 20

places, respectively. Karachi (205) and Bishkek (207) remain the

region’s least expensive cities for expatriates.

Mercer produces individual cost of living and rental

accommodation cost reports for each city surveyed. For more

information on city rankings, visit www.mercer.com/col. To purchase

copies of individual city reports, visit

https://www.imercer.com/products/cost-of-living.aspx or call Mercer

Client Services in Warsaw on +48 22 434 5383.

Notes for editors

Multinational expatriate assignment data in Mr. Bonic’s quote is

derived from early findings in Mercer’s 2015 Worldwide

International Assignment Policies and Practices Survey due to be

released in full in September 2015.

The list of rankings is provided to journalists for reference

and should not be published in full. The top 10 and bottom 10

cities may be reproduced in a table.

The figures for Mercer’s cost of living and rental accommodation

costs comparisons are derived from a survey conducted in March

2015. Exchange rates from that time and Mercer’s international

basket of goods and services

have been used as base measurements.

Governments and major companies use data from this survey to

protect the purchasing power of their employees when transferred

abroad; rental accommodation costs data is used to assess local

expatriate housing allowances. The choice of cities surveyed is

based on the demand for data.

About Mercer

Mercer is a global consulting leader in health, wealth and

careers. Mercer helps clients around the world advance the health,

wealth and performance of their most vital asset – their people.

Mercer’s more than 20,000 employees are based in more than 40

countries and the firm operates in over 130 countries. Mercer is a

wholly owned subsidiary of Marsh & McLennan Companies

(NYSE:MMC), a global professional services firm offering clients

advice and solutions in the areas of risk, strategy and people.

With 57,000 employees worldwide and annual revenue exceeding $13

billion, Marsh & McLennan Companies is also the parent company

of Marsh, a leader in insurance broking and risk management; Guy

Carpenter, a leader in providing risk and reinsurance intermediary

services; and Oliver Wyman, a leader in management consulting. For

more information, visit www.mercer.com. Follow Mercer on Twitter

@Mercer.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150617005357/en/

MercerMiriam Siscovick, + 1 206 356

8549miriam.siscovick@mercer.com

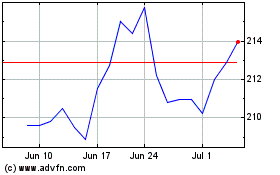

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marsh and McLennan Compa... (NYSE:MMC)

Historical Stock Chart

From Apr 2023 to Apr 2024