- Third-quarter net income of $1.2

billion, or $1.08 per diluted share

- Third-quarter net revenue increase

of 14%, to $2.9 billion

- Third-quarter gross dollar volume up

7%, or 11% adjusting for the impact of recent EU regulatory

changes

- Third-quarter purchase volume up 5%,

or 9% adjusting for the impact of recent EU regulatory

changes

Mastercard Incorporated (NYSE:MA) today announced financial

results for the third quarter of 2016. The company reported net

income of $1.2 billion, an increase of 21% versus the year-ago

period, or 15% excluding a special item related to the termination

of the U.S. employee pension plan taken in last year’s third

quarter. Earnings per diluted share were $1.08, up 26%, or 19%

excluding the special item. There was no currency impact on the

reported growth rates for the third quarter, except where noted

below.

Net revenue for the third quarter of 2016 was $2.9 billion, a

14% increase versus the same period in 2015. Net revenue growth was

driven by the impact of the following:

- An increase in processed transactions

of 18%, to 14.5 billion;

- An increase in cross-border volumes of

12%; and

- An 11% increase in gross dollar volume,

on a local currency basis and adjusting for the impact of recent EU

regulatory changes, to $1.2 trillion.

These factors were partially offset by an increase in rebates

and incentives, primarily due to increased volumes and new and

renewed agreements.

As a result of the June 2016 implementation of new EU

regulations, the company no longer charges fees on domestic EEA

co-badged volume and thus excludes that volume from its metrics.

The impact on net revenue is de minimis (see page 11 for

explanation of adjusted growth rates).

Worldwide purchase volume during the quarter was up 9% on a

local currency basis, adjusting for the impact of recent EU

regulatory changes, versus the third quarter of 2015, to $882

billion. As of September 30, 2016, the company’s customers had

issued 2.3 billion Mastercard and Maestro-branded cards.

“Our business continues to perform well, and we are pleased with

our strong growth in revenue and earnings per share this quarter,”

said Ajay Banga, Mastercard president and CEO. “We are executing on

our strategy, deepening issuer relationships and delivering our

customers and partners digital-first solutions. As a result,

consumers benefit from seamless and secure purchase experiences

everywhere and every way they shop.”

Total operating expenses increased 4%, or 5% on a

currency-neutral basis, to $1.2 billion during the third quarter of

2016 compared to the same period in 2015. Excluding the special

item taken in the year-ago period, total operating expenses

increased 12%. The increase was primarily due to continued

investments in strategic initiatives, foreign exchange activity and

higher data processing expenses.

Operating income for the third quarter of 2016 increased 22%

versus the year-ago period. Compared to the third quarter of 2015

and excluding that quarter’s special item, operating income for the

third quarter of 2016 increased 15%. The company delivered an

operating margin of 58.0%.

Mastercard reported other expense of $37 million in the third

quarter of 2016, versus $17 million in the third quarter of 2015.

The increase was mainly due to an impairment charge taken on an

investment.

Mastercard’s effective tax rate was 27.5% in the third quarter

of 2016, versus a rate of 27.7% in the comparable period in 2015,

or 28.2% excluding last year’s special item. The decrease was

primarily due to the recognition of discrete tax benefits during

the quarter, partially offset by a lower repatriation benefit.

During the third quarter of 2016, Mastercard repurchased

approximately 6 million shares of Class A common stock at a

cost of $591 million. Quarter-to-date through October 25, the

company repurchased an additional 2.6 million shares at a cost of

$263 million, which leaves $1.8 billion remaining under the current

repurchase program authorization.

Year-to-Date 2016 Results

For the nine months ended September 30, 2016, Mastercard

reported net income of $3.1 billion, an increase of 7%, or 9% on a

currency-neutral basis, and earnings per diluted share of $2.83, up

11%, or 12% on a currency-neutral basis, versus the year-ago

period. Excluding special items taken in the second quarters of

both 2015 and 2016 related to separate U.K. merchant litigations,

as well as the third quarter 2015 special item related to the U.S.

pension plan termination, net income was $3.2 billion, up 6%, or 8%

on a currency-neutral basis. Earnings per diluted share were $2.90,

up 10%, or 12% on a currency-neutral basis, compared to the same

period in 2015.

Net revenue for the nine months ended September 30, 2016 was

$8.0 billion, an increase of 12%, or 14% on a currency-neutral

basis, versus the same period in 2015. Processed transactions

growth of 15%, cross-border volume growth of 12% and gross dollar

volume growth of 12%, on a local currency basis and adjusting for

the impact of recent EU regulatory changes, contributed to the net

revenue growth in the year-to-date period. These factors were

partially offset by an increase in rebates and incentives.

Total operating expenses were $3.6 billion, an increase of 14%,

or 16% on a currency-neutral basis, for the nine months ended

September 30, 2016, compared to the same period in 2015. Excluding

special items, total operating expenses were $3.5 billion, an

increase of 16%, or 17% on a currency-neutral basis, compared to

the same period in 2015. The increase was primarily due to

continued investments to support strategic initiatives in digital,

services, data analytics and geographic expansion, as well as

higher legal costs. Also, the impact from foreign exchange activity

and balance sheet remeasurement had a negative impact of

approximately 4 percentage points on operating expense growth,

compared to the same period in 2015.

Operating income for the nine months ended September 30, 2016

was $4.4 billion, an increase of 11%, or 13% on a currency-neutral

basis, versus the same period in 2015. Excluding special items,

operating income was $4.5 billion, an increase of 10%, or 11% on a

currency-neutral basis, compared to the same period in 2015. The

company delivered an operating margin of 54.8%, or 56.2% excluding

this year’s special item.

Mastercard’s effective tax rate was 27.9% for nine months ended

September 30, 2016, versus a rate of 25.8% in the comparable period

in 2015, or 26.0% excluding special items. The increase was

primarily due to the recognition of larger discrete benefits in

2015 and lower repatriation benefits in 2016, partially offset by a

more favorable geographic mix of taxable earnings in 2016.

Third-Quarter Financial Results Conference Call

Details

At 9:00 a.m. ET today, the company will host a conference call

to discuss its third-quarter financial results.

The dial-in information for this call is 877-201-0168 (within

the U.S.) and 647-788-4901 (outside the U.S.), and the passcode is

89677548. A replay of the call will be available for 30 days and

can be accessed by dialing 855-859-2056 (within the U.S.) and

404-537-3406 (outside the U.S.), and using passcode 89677548.

This call can also be accessed through the Investor Relations

section of the company’s website at www.mastercard.com/investor.

Presentation slides used on this call are also available on the

website.

Non-GAAP Financial Information

The company has presented certain financial data that are

considered non-GAAP financial measures that are reconciled to their

most directly comparable GAAP measures in the accompanying

tables.

The presentation of growth rates on a currency-neutral basis

represent a non-GAAP measure and are calculated by remeasuring the

prior period’s results using the current period’s exchange rates

for both the translational and transactional impacts in our

operating results.

About Mastercard Incorporated

Mastercard (NYSE: MA), www.mastercard.com, is a technology

company in the global payments industry. We operate the world’s

fastest payments processing network, connecting consumers,

financial institutions, merchants, governments and businesses in

more than 210 countries and territories. Mastercard products and

solutions make everyday commerce activities - such as shopping,

traveling, running a business and managing finances - easier, more

secure and more efficient for everyone. Follow us on Twitter

@MastercardNews, join the discussion on the Beyond the Transaction

Blog and subscribe for the latest news on the Engagement

Bureau.

Forward-Looking Statements

This press release contains forward-looking statements pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. All statements other than statements of

historical facts may be forward-looking statements. When used in

this press release, the words “believe”, “expect”, “could”, “may”,

“would”, “will”, “trend” and similar words are intended to identify

forward-looking statements. Examples of forward-looking statements

include, but are not limited to, statements that relate to the

Mastercard’s future prospects, developments and business

strategies. We caution you to not place undue reliance on these

forward-looking statements, as they speak only as of the date they

are made. Except for the company’s ongoing obligations under the

U.S. federal securities laws, the company does not intend to update

or otherwise revise the forward-looking information to reflect

actual results of operations, changes in financial condition,

changes in estimates, expectations or assumptions, changes in

general economic or industry conditions or other circumstances

arising and/or existing since the preparation of this press release

or to reflect the occurrence of any unanticipated events.

Many factors and uncertainties relating to our operations and

business environment, all of which are difficult to predict and

many of which are outside of our control, influence whether any

forward-looking statements can or will be achieved. Any one of

those factors could cause our actual results to differ materially

from those expressed or implied in writing in any forward-looking

statements made by Mastercard or on its behalf, including, but not

limited to, the following factors:

- payments system-related legal and

regulatory challenges (including interchange fees, surcharging and

the extension of current regulatory activity to additional

jurisdictions or products);

- the impact of preferential or

protective government actions;

- regulation to which we are subject

based on our participation in the payments industry;

- regulation of privacy, data protection

and security;

- the impact of competition in the global

payments industry (including disintermediation and pricing

pressure);

- the challenges relating to rapid

technological developments and changes;

- the impact of information security

failures, breaches or service disruptions on our business;

- issues related to our relationships

with our customers (including loss of substantial business from

significant customers, competitor relationships with our customers

and banking industry consolidation);

- the impact of our relationships with

stakeholders, including issuers and acquirers, merchants and

governments;

- exposure to loss or illiquidity due to

settlement guarantees and other significant third-party

obligations;

- the impact of global economic and

political events and conditions, including global financial market

activity, declines in cross-border activity; negative trends in

consumer spending and the effect of adverse currency

fluctuation;

- reputational impact, including impact

related to brand perception, account data breaches and fraudulent

activity;

- issues related to acquisition

integration, strategic investments and entry into new businesses;

and

- potential or incurred liability and

limitations on business resulting from litigation.

For additional information on these and other factors that could

cause Mastercard’s actual results to differ materially from

expected results, please see the company’s filings with the

Securities and Exchange Commission, including the company’s Annual

Report on Form 10-K for the year ended December 31, 2015 and

any subsequent reports on Forms 10-Q and 8-K.

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENT OF

OPERATIONS

(UNAUDITED)

Three Months Ended September 30, Nine Months Ended

September 30, 2016 2015 2016

2015 (in millions, except per share

data) Net Revenue $ 2,880 $ 2,530 $ 8,020 $ 7,150

Operating Expenses General and administrative 933 883 2,731

2,343 Advertising and marketing 184 184 503 502 Depreciation and

amortization 93 94 281 273 Provision for litigation settlements —

— 107 61 Total operating expenses 1,210

1,161 3,622 3,179 Operating income

1,670 1,369 4,398 3,971

Other Income (Expense) Investment

income 12 5 32 20 Interest expense (23 ) (15 ) (65 ) (49 ) Other

income (expense), net (26 ) (7 ) (30 ) (9 ) Total other income

(expense) (37 ) (17 ) (63 ) (38 ) Income before income taxes 1,633

1,352 4,335 3,933 Income tax expense 449 375 1,209

1,015

Net Income $ 1,184 $ 977 $

3,126 $ 2,918

Basic Earnings per Share

$ 1.08 $ 0.86 $ 2.84 $ 2.57 Basic

Weighted-Average Shares Outstanding 1,096 1,130 1,101

1,136

Diluted Earnings per Share $ 1.08

$ 0.86 $ 2.83 $ 2.56 Diluted Weighted-Average

Shares Outstanding 1,099 1,133 1,104 1,139

MASTERCARD INCORPORATED

CONSOLIDATED BALANCE SHEET

(UNAUDITED)

September 30, 2016 December 31, 2015 (in

millions, except per share data) ASSETS Cash and cash

equivalents $ 5,205 $ 5,747 Restricted cash for litigation

settlement 543 541 Investments 1,774 991 Accounts receivable 1,298

1,079 Settlement due from customers 1,137 1,068 Restricted security

deposits held for customers 997 895 Prepaid expenses and other

current assets 822 663

Total Current Assets

11,776 10,984 Property, plant and equipment, net of accumulated

depreciation of $585 and $491, respectively 698 675 Deferred income

taxes 327 317 Goodwill 1,814 1,891 Other intangible assets, net of

accumulated amortization of $952 and $816, respectively 747 803

Other assets 1,961 1,580

Total Assets $ 17,323

$ 16,250

LIABILITIES AND EQUITY Accounts

payable $ 437 $ 472 Settlement due to customers 1,052 866

Restricted security deposits held for customers 997 895 Accrued

litigation 716 709 Accrued expenses 3,214 2,763 Other current

liabilities 705 564

Total Current Liabilities

7,121 6,269 Long-term debt 3,326 3,268 Deferred income taxes 82 79

Other liabilities 545 572

Total Liabilities

11,074 10,188

Commitments and Contingencies Stockholders’

Equity

Class A common stock, $0.0001 par value;

authorized 3,000 shares, 1,373 and 1,370 shares issued

and 1,072 and 1,095 outstanding, respectively

— —

Class B common stock, $0.0001 par value;

authorized 1,200 shares, 20 and 21 issued and

outstanding, respectively

— — Additional paid-in-capital 4,135 4,004 Class A treasury stock,

at cost, 301 and 275 shares, respectively (15,921 ) (13,522 )

Retained earnings 18,722 16,222 Accumulated other comprehensive

income (loss) (717 ) (676 )

Total Stockholders’ Equity 6,219

6,028 Non-controlling interests 30 34

Total

Equity 6,249 6,062

Total Liabilities and

Equity $ 17,323 $ 16,250

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENT OF CASH

FLOWS

(UNAUDITED)

Nine Months Ended September 30, 2016

2015 (in millions) Operating Activities

Net income $ 3,126 $ 2,918 Adjustments to reconcile net income to

net cash provided by operating activities: Amortization of customer

and merchant incentives 629 560 Depreciation and amortization 281

273 Share-based payments 15 1 Deferred income taxes (1 ) 18 Other

(24 ) 33

Changes in operating assets and liabilities:

Accounts receivable (190 ) (27 ) Income taxes receivable 4 (83 )

Settlement due from customers (53 ) 78 Prepaid expenses (818 ) (704

) Accrued litigation and legal settlements 12 (60 ) Accounts

payable (33 ) (31 ) Settlement due to customers 171 (192 ) Accrued

expenses 247 1 Net change in other assets and liabilities 126

219 Net cash provided by operating activities 3,492

3,004

Investing Activities Purchases of

investment securities available-for-sale (751 ) (862 ) Purchases of

investments held-to-maturity (729 ) (868 ) Proceeds from sales of

investment securities available-for-sale 164 666 Proceeds from

maturities of investment securities available-for-sale 247 476

Proceeds from maturities of investments held-to-maturity 240 576

Acquisition of businesses, net of cash acquired — (584 ) Purchases

of property, plant and equipment (156 ) (125 ) Capitalized software

(124 ) (124 ) Increase in restricted cash for litigation settlement

(2 ) (1 ) Other investing activities (14 ) (7 ) Net cash used in

investing activities (1,125 ) (853 )

Financing Activities

Purchases of treasury stock (2,410 ) (2,725 ) Dividends paid (630 )

(548 ) Tax benefit for share-based payments 44 40 Cash proceeds

from exercise of stock options 31 25 Other financing activities (3

) (8 ) Net cash used in financing activities (2,968 ) (3,216 )

Effect of exchange rate changes on cash and cash equivalents 59

(195 ) Net decrease in cash and cash equivalents (542 )

(1,260 ) Cash and cash equivalents - beginning of period 5,747

5,137 Cash and cash equivalents - end of period $

5,205 $ 3,877

Non-Cash Investing and

Financing Activities Fair value of assets acquired, net of cash

acquired $ — $ 625 Fair value of liabilities assumed

related to acquisitions $ — $ 41

MASTERCARD INCORPORATED OPERATING

PERFORMANCE

For the 3 Months Ended September 30, 2016

GDV(Bil.)

Growth(USD)

Growth(Local)

PurchaseVolume(Bil.)

Growth(Local)

PurchaseTrans.(Mil.)

CashVolume(Bil.)

Growth(Local)

CashTrans(Mil.)

Accounts(Mil.)

Cards(Mil.)

All Mastercard Credit, Charge and Debit

Programs

APMEA $ 381 8.8 % 10.0 % $ 256 8.3 % 3,763 $ 125 13.7 % 1,298 565

601 Canada 36 9.8 % 9.4 % 34 10.1 % 528 2 -1.4 % 6 43 50 Europe 338

1.7 % 5.4 % 214 -2.4 % 4,880 124 22.1 % 920 420 434 Latin America

83 7.5 % 14.3 % 51 15.5 % 1,652 32 12.5

% 252 148 166 Worldwide less United States 838 5.7 %

8.5 % 555 4.6 % 10,822 283 17.0 % 2,475 1,177 1,251 United States

383 4.8 % 4.8 % 327 4.8 % 6,058 57 4.7

% 351 344 380 Worldwide 1,221 5.4 % 7.3 % 882 4.7 %

16,880 339 14.7 % 2,827 1,521 1,631

Mastercard Credit and Charge

Programs

Worldwide less United States 465 4.1 % 6.4 % 426 7.0 % 6,438 39 0.8

% 188 527 582 United States 182 3.9 % 3.9 % 174 3.8 %

2,019 8 7.0 % 10 164 196 Worldwide 648

4.0 % 5.7 % 600 6.0 % 8,457 47 1.8 % 198 691 778

Mastercard Debit Programs

Worldwide less United States 373 7.8 % 11.1 % 129 -2.5 % 4,384 243

20.0 % 2,287 650 668 United States 201 5.6 % 5.6 % 152

5.9 % 4,039 49 4.4 % 342 180 184

Worldwide 573 7.0 % 9.1 % 281 1.9 % 8,423 292 17.1 % 2,629 830 852

For the 9 Months Ended September 30, 2016

GDV(Bil.)

Growth(USD)

Growth(Local)

PurchaseVolume(Bil.)

Growth(Local)

PurchaseTrans.(Mil.)

CashVolume(Bil.)

Growth(Local)

CashTrans(Mil.)

Accounts(Mil.)

Cards(Mil.)

All Mastercard Credit, Charge and Debit

Programs

APMEA $ 1,102 7.6 % 11.9 % $ 736 10.3 % 10,594 $ 366 15.3 % 3,765

565 601 Canada 102 4.8 % 9.7 % 96 10.1 % 1,484 5 2.7 % 17 43 50

Europe 1,005 7.2 % 11.9 % 665 6.6 % 14,895 340 24.1 % 2,600 420 434

Latin America 235 -0.9 % 14.6 % 140 15.3 % 4,699

95 13.7 % 739 148 166 Worldwide less

United States 2,444 6.4 % 12.1 % 1,638 9.1 % 31,672 806 18.5 %

7,121 1,177 1,251 United States 1,147 7.3 % 7.3 % 978

7.6 % 18,002 169 5.5 % 1,040 344 380

Worldwide 3,591 6.7 % 10.5 % 2,616 8.6 % 49,674 975 16.1 % 8,161

1,521 1,631

Mastercard Credit and Charge

Programs

Worldwide less United States 1,345 2.4 % 7.6 % 1,231 8.2 % 18,432

114 1.7 % 554 527 582 United States 536 7.3 % 7.3 % 513

7.1 % 5,879 23 10.0 % 28 164 196

Worldwide 1,881 3.7 % 7.5 % 1,744 7.9 % 24,311 137 3.0 % 582 691

778

Mastercard Debit Programs

Worldwide less United States 1,099 11.8 % 18.0 % 407 12.0 % 13,240

692 21.9 % 6,567 650 668 United States 611 7.4 % 7.4 % 465

8.2 % 12,124 146 4.8 % 1,013 180

184 Worldwide 1,710 10.2 % 14.0 % 872 9.9 % 25,364 838 18.5 % 7,580

830 852

For the 3 months ended September 30, 2015

GDV(Bil.)

Growth(USD)

Growth(Local)

PurchaseVolume(Bil.)

Growth(Local)

PurchaseTrans.(Mil.)

CashVolume(Bil.)

Growth(Local)

CashTrans(Mil.)

Accounts(Mil.)

Cards(Mil.)

All Mastercard Credit, Charge and Debit

Programs

APMEA $ 350 2.6 % 14.0 % $ 237 14.5 % 3,125 $ 113 12.9 % 1,136 498

531 Canada 33 -2.1 % 17.8 % 31 19.2 % 468 2 -2.5 % 6 40 46 Europe

332 -5.9 % 16.9 % 228 14.8 % 4,637 104 21.9 % 791 379 397 Latin

America 77 -15.2 % 16.7 % 45 18.0 % 1,444 32

14.9 % 231 142 161 Worldwide less United

States 793 -3.2 % 15.6 % 541 15.2 % 9,674 252 16.6 % 2,163 1,059

1,135 United States 366 7.8 % 7.8 % 312 7.9 % 5,673

54 6.9 % 340 330 363 Worldwide 1,159 —

% 13.0 % 853 12.4 % 15,347 306 14.8 % 2,503 1,389 1,498

Mastercard Credit and Charge

Programs

Worldwide less United States 447 -6.0 % 10.7 % 407 11.7 % 5,785 40

1.7 % 189 512 573 United States 176 8.7 % 8.7 % 168

8.2 % 1,909 8 22.3 % 9 156 186

Worldwide 623 -2.2 % 10.2 % 575 10.7 % 7,694 48 4.5 % 198 668 760

Mastercard Debit Programs

Worldwide less United States 346 0.6 % 22.7 % 134 27.3 % 3,889 212

19.9 % 1,974 547 561 United States 190 6.9 % 6.9 % 144

7.6 % 3,764 47 4.7 % 331 174 177

Worldwide 536 2.8 % 16.6 % 278 16.3 % 7,653 258 16.9 % 2,305 721

738

For the 9 Months ended September 30, 2015

GDV(Bil.)

Growth(USD)

Growth(Local)

PurchaseVolume(Bil.)

Growth(Local)

PurchaseTrans.(Mil.)

CashVolume(Bil.)

Growth(Local)

CashTrans(Mil.)

Accounts(Mil.)

Cards(Mil.)

All Mastercard Credit, Charge and Debit

Programs

APMEA $ 1,024 6.2 % 14.8 % $ 689 15.1 % 8,714 $ 335 14.0 % 3,234

498 531 Canada 97 1.2 % 16.8 % 92 18.6 % 1,314 5 -6.9 % 17 40 46

Europe 938 -7.1 % 16.2 % 648 14.4 % 12,967 289 20.6 % 2,219 379 397

Latin America 237 -9.3 % 15.6 % 140 18.5 % 4,169

97 11.8 % 668 142 161 Worldwide less

United States 2,296 -1.5 % 15.5 % 1,569 15.3 % 27,164 727 16.0 %

6,138 1,059 1,135 United States 1,069 7.2 % 7.2 % 909

7.4 % 16,371 160 6.1 % 1,009 330 363

Worldwide 3,365 1.1 % 12.7 % 2,478 12.2 % 43,535 887 14.1 % 7,147

1,389 1,498

Mastercard Credit and Charge

Programs

Worldwide less United States 1,314 -3.6 % 11.0 % 1,195 12.2 %

16,491 119 -0.1 % 557 512 573 United States 500 6.9 % 6.9 %

479 6.9 % 5,353 21 8.0 % 25 156

186 Worldwide 1,814 -0.9 % 9.8 % 1,673 10.7 % 21,844 140 1.1 % 582

668 760

Mastercard Debit Programs

Worldwide less United States 982 1.6 % 22.2 % 374 26.3 % 10,672 608

19.8 % 5,581 547 561 United States 569 7.3 % 7.3 % 430

7.9 % 11,018 139 5.8 % 985 174

177 Worldwide 1,551 3.6 % 16.3 % 804 15.7 % 21,691 747 16.9 % 6,565

721 738 APMEA = Asia Pacific / Middle East / Africa Note

that the figures in the preceding tables may not sum due to

rounding; growth represents change from the comparable year-ago

period

Footnote

The tables set forth the gross dollar volume (“GDV”), purchase

volume, cash volume and the number of purchase transactions, cash

transactions, accounts and cards on a regional and global basis for

Mastercard™-branded cards. Growth rates over prior periods are

provided for volume-based data.

Debit transactions on Maestro® and Cirrus®-branded cards

and transactions involving brands other than Mastercard are not

included in the preceding tables.

For purposes of the table: GDV represents purchase volume plus

cash volume and includes the impact of balance transfers and

convenience checks; “purchase volume” means the aggregate dollar

amount of purchases made with Mastercard-branded cards for the

relevant period; and “cash volume” means the aggregate dollar

amount of cash disbursements obtained with Mastercard-branded cards

for the relevant period. The number of cards includes virtual

cards, which are Mastercard-branded payment accounts that do not

generally have physical cards associated with them.

The Mastercard payment product is comprised of credit, charge

and debit programs, and data relating to each type of program is

included in the tables. Debit programs include Mastercard-branded

debit programs where the primary means of cardholder validation at

the point of sale is for cardholders either to sign a sales receipt

or enter a PIN. The tables include information with respect to

transactions involving Mastercard-branded cards that are not

processed by Mastercard and transactions for which Mastercard does

not earn significant revenues.

Information denominated in U.S. dollars is calculated by

applying an established U.S. dollar/local currency exchange rate

for each local currency in which Mastercard volumes are reported.

These exchange rates are calculated on a quarterly basis using the

average exchange rate for each quarter. Mastercard reports

period-over-period rates of change in purchase volume and cash

volume on the basis of local currency information, in order to

eliminate the impact of changes in the value of foreign currencies

against the U.S. dollar in calculating such rates of change.

The data set forth in the GDV, purchase volume, purchase

transactions, cash volume and cash transactions columns is provided

by Mastercard customers and is subject to verification by

Mastercard and partial cross-checking against information provided

by Mastercard’s transaction processing systems. The data set forth

in the accounts and cards columns is provided by Mastercard

customers and is subject to certain limited verification by

Mastercard. A portion of the data set forth in the accounts and

cards columns reflects the impact of routine portfolio changes

among customers and other practices that may lead to over counting

of the underlying data in certain circumstances. All data is

subject to revision and amendment by Mastercard’s customers

subsequent to the date of its release.

Performance information for prior periods can be found in the

“Investor Relations” section of the Mastercard website at

www.mastercard.com/investor.

Non-GAAP Reconciliations

($ in millions, except per share data)

Three Months Ended September 30, Percent

Increase/(Decrease) 2016 2015

Actual Actual

SpecialItem

Non-GAAP 1

Actual

SpecialItem

Non-GAAP 1

Total operating expenses $ 1,210 $ 1,161 $ (79 ) $ 1,082 4% (8)%

12% Operating income $ 1,670 $ 1,369 $ 79 $ 1,448 22% 7% 15%

Operating Margin 58.0 % 54.1 % 57.2 % Income tax expense $ 449 $

375 $ 29 $ 404 20% 9% 11% Effective Tax Rate 27.5 % 27.7 % 28.2 %

Net Income $ 1,184 $ 977 $ 50 $ 1,027 21% 6% 15%

Diluted

Earnings per Share $ 1.08 $ 0.86 $ 0.04 $ 0.91 26% 7% 19%

Nine Months Ended September

30, Percent Increase/(Decrease) 2016

2015 Actual

SpecialItem

Non-GAAP 2

Actual

Special Items

Non-GAAP 1,2

Actual

SpecialItems

Non-GAAP 1,2

Total operating expenses $ 3,622 $ (107 ) $ 3,515 $ 3,179 $ (140 )

$ 3,039 14% (2)% 16% Operating income $ 4,398 $ 107 $ 4,505 $ 3,971

$ 140 $ 4,111 11% 1% 10% Operating Margin 54.8 % 56.2 % 55.5 % 57.5

% Income tax expense $ 1,209 $ 29 $ 1,238 $ 1,015 $ 45 $ 1,060 19%

2% 17% Effective Tax Rate 27.9 % 27.9 % 25.8 % 26.0 % Net income $

3,126 $ 78 $ 3,204 $ 2,918 $ 95 $ 3,013 7% 1% 6%

Diluted

Earnings per Share $ 2.83 $ 0.07 $ 2.90 $ 2.56 $ 0.08 $ 2.64

11% 1% 10% Note: Figures may not sum due to rounding

1

Represents effect of excluding the Special

Item relating to the termination of the U.S. employee pension plan

(Q2 2015: $79 million pre-tax, $50 million after-tax, $0.04 per

diluted share)

2

Represents effect of excluding the Special Items relating to the

U.K. merchant litigation provisions (Q2 2016: $107 million pre-tax,

$78 million after-tax, $0.07 per diluted share; Q2 2015: $61

million pre-tax, $44 million after-tax, $0.04 per diluted share)

Article 8 Impacts on Europe and

Worldwide GDV and Purchase Volume Growth Rates

Growth (Local Currency) 2015Q1 2015Q2

2015Q3 2015Q4 2016Q1

2016Q2 2016Q3 3QYTD15

FY15 3QYTD16 GDV Europe as reported 15% 16%

17% 15% 18% 14% 5% 16% 16% 12% Europe adjusted for Article 8 19%

19% 19% 17% 19% 19% 18% 19% 19% 19% Worldwide as reported

12% 13% 13% 12% 13% 11% 7% 13% 13% 11% Worldwide adjusted for

Article 8 13% 13% 13% 13% 13% 13% 11% 13% 13% 12% Purchase

Volume Europe as reported 13% 15% 15% 13% 14% 9% (2)% 14% 14% 7%

Europe adjusted for Article 8 18% 19% 18% 16% 16% 15% 16% 18% 18%

16% Worldwide as reported 12% 12% 12% 12% 12% 9% 5% 12% 12%

9% Worldwide adjusted for Article 8 13% 13% 13% 12% 12% 11% 9% 13%

13% 11%

Note:

Article 8 of the EU Interchange Fee Regulation related to card

payments, that became effective June 9, 2016, states that a network

can no longer charge fees on domestic EEA payment transactions that

do not use its payment brand. Prior to that, Mastercard collected a

de minimis assessment fee in a few countries, particularly France,

on transactions with Mastercard co-badged cards if the brands of

domestic networks (as opposed to Mastercard) were used. As a

result, the non-Mastercard co-badged volume is no longer being

included. To aid in understanding the underlying trends in

the business, the table above reflects adjusted 2015 and YTD 2016

growth rates for the impact of Article 8, by eliminating the

related co-badged volumes in prior periods.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161028005442/en/

Mastercard IncorporatedInvestor Relations:Barbara Gasper or

Jesal Meswani, 914-249-4565investor.relations@mastercard.comorMedia

Relations:Seth

Eisen, 914-249-3153Seth.Eisen@mastercard.com

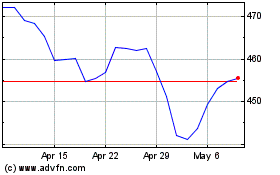

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024