UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 2, 2015

|

| | |

LEXINGTON REALTY TRUST |

(Exact name of registrant as specified in its charter) |

| | |

Maryland | 1-12386 | 13-3717318 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

One Penn Plaza, Suite 4015, New York, New York | 10119-4015 |

(Address of principal executive offices) | (Zip Code) |

| | |

| (212) 692-7200 | |

(Registrant's telephone number, including area code) |

|

|

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

___ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

___ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

___ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

___ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

Amendment to Second Amended and Restated Credit Agreement

On July 2, 2015, Lexington Realty Trust, which we refer to as the Trust, entered into the Fourth Amendment to the Second Amended and Restated Credit Agreement, which we refer to as the Credit Agreement Amendment, among the Trust and Lepercq Corporate Income Fund L.P., or LCIF, as borrowers, each of the lenders party thereto, and KeyBank National Association, or KeyBank, as administrative agent. The Credit Agreement Amendment modifies the general prohibition against declaring or making Restricted Payments (as defined in the Second Amended and Restated Credit Agreement) by adding a clause that permits the Trust to redeem or repurchase common stock of the Trust in an aggregate amount not to exceed $50 million during the term of the Second Amended and Restated Credit Agreement, as long as no default or event of default would result therefrom. The foregoing description of the Credit Agreement Amendment is qualified in its entirety by reference to the Credit Agreement Amendment attached as Exhibit 10.1 to this Current Report on Form 8-K, which we refer to as this Current Report.

Amendment to Amended and Restated Term Loan Agreement

On July 2, 2015, the Trust entered into the Fourth Amendment to the Amended and Restated Term Loan Agreement, which we refer to as the Term Loan Agreement Amendment, among the Trust and LCIF, as borrowers, each of the lenders party thereto, and Wells Fargo Bank, National Association, or Wells Fargo, as administrative agent. The Term Loan Agreement Amendment modifies the general prohibition against declaring or making Restricted Payments (as defined in the Amended and Restated Term Loan Agreement) by adding a clause that permits the Trust to redeem or repurchase common stock of the Trust in an aggregate amount not to exceed $50 million during the term of the Amended and Restated Term Loan Agreement, as long as no default or event of default would result therefrom. The foregoing description of the Term Loan Agreement Amendment is qualified in its entirety by reference to the Term Loan Agreement Amendment attached as Exhibit 10.2 to this Current Report.

Item 8.01 Other Events.

Repurchase Plan

On July 2, 2015, the Board of Trustees of the Trust authorized a repurchase plan for the repurchase of up to an aggregate of 10.0 million common shares of beneficial interest, par value $0.0001 per share, classified as common shares, and operating partnership units, inclusive of all outstanding prior authorizations. The repurchases may be made from time to time for cash in open market transactions, including through Rule 10b5-1 plans, or in privately-negotiated transactions in accordance with applicable federal securities laws. The timing and amount of the repurchases will be determined by the Trust’s management based on their evaluation of market and business conditions, share price and other factors. The repurchase plan may be suspended or discontinued at any time.

Preferred Dividend

On July 2, 2015, the Trust declared a cash dividend of $0.8125 per preferred share of beneficial interest, par value $0.0001 per share, classified as Series C Cumulative Convertible Preferred Stock, which we refer to as Series C Preferred Shares, for the quarter ending September 30, 2015. This Series C Preferred Share dividend is payable on or about November 16, 2015, to shareholders of record of Series C Preferred Shares as of October 30, 2015.

Conversion Rate Adjustment

Pursuant to the Indenture, dated as of January 29, 2007, among the Trust, certain subsidiaries of the Trust and U.S. Bank National Association, as trustee, or the Trustee, as supplemented by the Fourth Supplemental Indenture, dated as of December 31, 2008, the Sixth Supplemental Indenture, dated as of January 26, 2010, the Seventh Supplemental Indenture, dated as of September 28, 2012, the Eighth Supplemental Indenture, dated as of February 13, 2013, the Ninth Supplemental Indenture, dated as of May 6, 2013, the Tenth Supplemental Indenture, dated as of June 13, 2013, and the Tenth Supplemental Indenture, dated as of September 30, 2013, the Trust gave notice to the Trustee that the conversion rate on the Trust's 6.00% Convertible Guaranteed Notes due 2030 has adjusted, effective July 1, 2015, to a current conversion rate of 153.8603 common shares per $1,000 principal amount of the notes, representing a conversion price of $6.50 per common share.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

| |

10.1 | Fourth Amendment to Second Amended and Restated Credit Agreement, dated as of July 2, 2015, among the Trust and LCIF, jointly and severally as borrowers, KeyBank, as agent, and each of the financial institutions a signatory thereto together with their assignees. |

| |

10.2 | Fourth Amendment to Amended and Restated Term Loan Agreement, dated as of July 2, 2015, among the Trust and LCIF, jointly and severally as borrowers, Wells Fargo, as agent, and each of the financial institutions a signatory thereto together with their assignees. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| Lexington Realty Trust |

| | |

| | |

Date: July 2, 2015 | By: | /s/ T. Wilson Eglin |

| | T. Wilson Eglin |

| | Chief Executive Officer |

|

| | |

| Lepercq Corporate Income Fund L.P. |

| By: Lex GP-1 Trust, its general partner |

| | |

| | |

Date: July 2, 2015 | By: | /s/ T. Wilson Eglin |

| | T. Wilson Eglin |

| | President |

Exhibit Index

|

| |

10.1 | Fourth Amendment to Second Amended and Restated Credit Agreement, dated as of July 2, 2015, among the Trust and LCIF, jointly and severally as borrowers, KeyBank, as agent, and each of the financial institutions a signatory thereto together with their assignees. |

| |

10.2 | Fourth Amendment to Amended and Restated Term Loan Agreement, dated as of July 2, 2015, among the Trust and LCIF, jointly and severally as borrowers, Wells Fargo, as agent, and each of the financial institutions a signatory thereto together with their assignees. |

FOURTH AMENDMENT TO

SECOND AMENDED AND RESTATED CREDIT AGREEMENT

THIS FOURTH AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) is effective as of July 2, 2015, by and among LEXINGTON REALTY TRUST, a real estate investment trust formed under the laws of the State of Maryland (the “Trust”), and LEPERCQ CORPORATE INCOME FUND L.P., a limited partnership formed under the laws of the State of Delaware (“LCIF”; collectively with the Trust, the “Borrowers” and each a “Borrower”), each of the Lenders party hereto, and KEYBANK NATIONAL ASSOCIATION, as administrative agent (the “Agent”).

WHEREAS, the Borrowers, the Lenders, the Agent and certain other parties have entered into that certain Second Amended and Restated Credit Agreement dated as of February 12, 2013, as amended by that certain First Amendment to Second Amended and Restated Credit Agreement dated as of September 30, 2013, that certain Second Amendment to Second Amended and Restated Credit Agreement dated as of December 30, 2013, and that certain Third Amendment to Second Amended and Restated Credit Agreement dated as of March 28, 2014 (as amended and in effect immediately prior to the date hereof, the “Credit Agreement”); and

WHEREAS, the Borrower, the Requisite Lenders and the Agent desire to amend certain provisions of the Credit Agreement on the terms and conditions contained herein.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the parties hereto, the parties hereto hereby agree as follows:

Section 1 Specific Amendments to Credit Agreement. The parties hereto agree that the Credit Agreement is amended by deleting the word “and” at the end of clause (h) of Section 9.2., deleting the period at the end of clause (i) of Section 9.2. and substituting in its place “; and”, and adding the following clause (j) immediately after clause (i) of Section 9.2.:

“(j) the Trust may redeem or repurchase common stock of the Trust in an aggregate amount not to exceed $50,000,000.00 during the term of this Agreement.”

Section 2 Conditions Precedent. The effectiveness of this Amendment is subject to receipt by the Agent of a counterpart of this Amendment duly executed by the Borrowers and the Requisite Lenders.

Section 3 Representations. Each Borrower represents and warrants to the Agent and each Lender as follows:

(a) Authorization. Each Borrower has the right and power, and has taken all necessary action to authorize it, to execute and deliver this Amendment and to perform its obligations hereunder and under the Credit Agreement, as amended by this Amendment, in accordance with their respective terms. This Amendment has been duly executed and delivered by the duly authorized officers of each Borrower and each of this Amendment and the Credit Agreement, as amended by this Amendment, is a legal, valid and binding obligation of each Borrower enforceable against each Borrower in accordance with its respective terms except as the same may be limited by bankruptcy, insolvency, and other similar laws affecting the rights of creditors generally and the availability of equitable remedies for the enforcement of certain obligations (other than the payment of principal) contained herein or therein and as may be limited by equitable principles generally (whether in a proceeding in law or equity).

(b) Compliance with Laws, etc. The execution and delivery by each Borrower of this Amendment and the performance by each Borrower of this Amendment and the Credit Agreement, as amended by this Amendment, in accordance with their respective terms, do not and will not, by the passage of time, the giving of notice or otherwise: (i) require any Government Approvals or violate any Applicable Laws relating to any Borrower; (ii) conflict with, result in a breach of or constitute a default under the organizational documents of any Borrower or any indenture, agreement or other instrument to which any Borrower is a party or by which it or any of its properties may be bound; or (iii) result in or require the creation or imposition of any Lien upon or with respect to any property now owned or hereafter acquired by the Borrower.

(c) No Default. No Default or Event of Default has occurred and is continuing as of the date hereof nor will exist immediately after giving effect to this Amendment.

Section 4 Reaffirmation of Representations by Borrowers. Each Borrower hereby repeats and reaffirms all representations and warranties made by such Borrower to the Agent and the Lenders in the Credit Agreement and the other Loan Documents to which it is a party on and as of the date hereof with the same force and effect as if such representations and warranties were set forth in this Amendment in full.

Section 5 Certain References. Each reference to the Credit Agreement in any of the Loan Documents shall be deemed to be a reference to the Credit Agreement as amended by this Amendment.

Section 6 Expenses. The Borrowers shall reimburse the Agent upon demand for all reasonable out-of-pocket costs and expenses (including attorneys’ fees) actually incurred by the Agent in connection with the preparation, negotiation and execution of this Amendment and the other agreements and documents executed and delivered in connection herewith.

Section 7 Benefits. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns, and shall be deemed a Loan Document.

Section 8 GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS EXECUTED AND TO BE FULLY PERFORMED, IN SUCH STATE (INCLUDING, FOR SUCH PURPOSE, SECTIONS 5-1401 AND 5-1402 OF THE GENERAL OBLIGATIONS LAWS OF THE STATE OF NEW YORK).

Section 9 Effect. Except as expressly herein amended, the terms and conditions of the Credit Agreement and the other Loan Documents remain in full force and effect. The amendment contained herein shall be deemed to have prospective application only.

Section 10 Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be deemed to be an original and shall be binding upon all parties, their successors and assigns.

Section 11 Definitions. All capitalized terms not otherwise defined herein are used herein with the respective definitions given them in the Credit Agreement.

[Signatures on Next Page]

IN WITNESS WHEREOF, the parties hereto have caused this Fourth Amendment to Second Amended and Restated Credit Agreement to be executed as of the date first above written.

LEXINGTON REALTY TRUST

|

| |

By: | /s/ Joseph Bonventre |

| Name: Joseph Bonventre |

| Title: Executive Vice President |

LEPERCQ CORPORATE INCOME FUND L.P.

By: LEX GP-1 Trust, its sole general partner

|

| |

By: | /s/ Joseph Bonventre |

| Name: Joseph Bonventre |

| Title: Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

KEYBANK NATIONAL ASSOCIATION, as Agent and as a Lender

|

| |

By: | /s/ Jane E. McGrath |

| Jane E. McGrath |

| Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

WELLS FARGO BANK, N. A.

|

| |

By: | /s/ D. Bryan Gregory |

| D. Bryan Gregory |

| Director |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

PNC BANK, NATIONAL ASSOCIATION

|

| |

By: | /s/ Luis Donoso |

| Luis Donoso |

| Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

BANK OF AMERICA, N.A.

|

| |

By: | /s/ Kurt Mathison |

| Kurt Mathison |

| Senior Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

U.S. BANK NATIONAL ASSOCIATION

|

| |

By: | /s/ Gordon J. Clough |

| Gordon J. Clough |

| Senior Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

CITIZENS BANK, N.A. f/k/a

RBS CITIZENS, N.A., as a Lender

|

| |

By: | /s/ Donald W. Woods |

| Donald W. Woods |

| Senior Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

TD BANK, N.A.

|

| |

By: | /s/ Brian Welch |

| Brian Welch |

| Senior Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

CAPITAL ONE, NATIONAL ASSOCIATION

|

| |

By: | /s/ Frederick H. Denecke |

| Frederick H. Denecke |

| Senior Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

JPMORGAN CHASE BANK, N.A.

|

| |

By: | /s/ Rita Lai |

| Rita Lai |

| Senior Credit Banker |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

REGIONS BANK

|

| |

By: | /s/ John Fulton |

| John Fulton |

| Assistant Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

FIFTH THIRD BANK

|

| |

By: | /s/ Thomas Jeffery |

| Thomas Jeffery |

| Senior Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

BARCLAYS BANK PLC

|

| |

By: | /s/ Vanessa Kurbatskiy |

| Vanessa Kurbatskiy |

| Vice President |

[Signature Page to Fourth Amendment to Second Amended and Restated Credit Agreement

with Lexington Realty Trust et al.]

BRANCH BANK AND TRUST COMPANY

|

| |

By: | /s/ Ahaz Armstrong |

| Ahaz Armstrong |

| Vice President |

FOURTH AMENDMENT TO AMENDED AND RESTATED TERM LOAN AGREEMENT

THIS FOURTH AMENDMENT TO AMENDED AND RESTATED TERM LOAN AGREEMENT (this “Amendment”) is effective as of July 2, 2015, by and among LEXINGTON REALTY TRUST, a real estate investment trust formed under the laws of the State of Maryland (the “Trust”) and LEPERCQ CORPORATE INCOME FUND L.P., a limited partnership formed under the laws of the State of Delaware (“LCIF”; collectively with the Trust, the “Borrowers” and each a “Borrower”), each of the Lenders party hereto, and WELLS FARGO BANK, NATIONAL ASSOCIATION, as administrative agent (the “Agent”).

WHEREAS, the Borrowers, the Lenders, the Agent and certain other parties have entered into that certain Amended and Restated Term Loan Agreement dated as of February 12, 2013, as amended by that certain First Amendment to Amended and Restated Term Loan Agreement dated as of September 30, 2013, that certain Second Amendment to Amended and Restated Term Loan Agreement dated as of December 30, 2013 and that certain Third Amendment to Amended and Restated Term Loan Agreement dated as of March 28, 2014 (as amended and in effect immediately prior to the date hereof, the “Term Loan Agreement”); and

WHEREAS, the Borrower, the Requisite Lenders and the Agent desire to amend certain provisions of the Term Loan Agreement on the terms and conditions contained herein.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the parties hereto, the parties hereto hereby agree as follows:

Section 1 Specific Amendment to Term Loan Agreement. The parties hereto agree that the Term Loan Agreement is amended by deleting the word “and” at the end of clause (h) of Section 9.2., deleting the period at the end of clause (i) of Section 9..2. and substituting in its place “; and”, and adding the following clause (j) immediately after clause (i) of Section 9.2.:

(j) the Trust may redeem or repurchase common stock of the Trust in an aggregate amount not to exceed $50,000,000 during the term of this Agreement.

Section 2 Condition Precedent. The effectiveness of this Amendment is subject to receipt by the Agent of a counterpart of this Amendment duly executed by the Borrowers and Requisite Lenders.

Section 3 Representations. Each Borrower represents and warrants to the Agent and each Lender as follows:

(a) Authorization. Each Borrower has the right and power, and has taken all necessary action to authorize it, to execute and deliver this Amendment and to perform its obligations hereunder and under the Term Loan Agreement, as amended by this Amendment, in accordance with their respective terms. This Amendment has been duly executed and delivered by the duly authorized officers of each Borrower and each of this Amendment and the Term Loan Agreement, as amended by this Amendment, is a legal, valid and binding obligation of each Borrower enforceable against each Borrower in accordance with its respective terms except as the same may be limited by

bankruptcy, insolvency, and other similar laws affecting the rights of creditors generally and the availability of equitable remedies for the enforcement of certain obligations (other than the payment of principal) contained herein or therein and as may be limited by equitable principles generally (whether in a proceeding in law or equity).

(b) Compliance with Laws, etc. The execution and delivery by each Borrower of this Amendment and the performance by each Borrower of this Amendment and the Term Loan Agreement, as amended by this Amendment, in accordance with their respective terms, do not and will not, by the passage of time, the giving of notice or otherwise: (i) require any Government Approvals or violate any Applicable Laws relating to any Borrower; (ii) conflict with, result in a breach of or constitute a default under the organizational documents of any Borrower or any indenture, agreement or other instrument to which any Borrower is a party or by which it or any of its properties may be bound; or (iii) result in or require the creation or imposition of any Lien upon or with respect to any property now owned or hereafter acquired by the Borrower.

(c) No Default. No Default or Event of Default has occurred and is continuing as of the date hereof nor will exist immediately after giving effect to this Amendment.

Section 4 Reaffirmation of Representations by Borrowers. Each Borrower hereby repeats and reaffirms all representations and warranties made by such Borrower to the Agent and the Lenders in the Term Loan Agreement and the other Loan Documents to which it is a party on and as of the date hereof with the same force and effect as if such representations and warranties were set forth in this Amendment in full.

Section 5 Certain References. Each reference to the Term Loan Agreement in any of the Loan Documents shall be deemed to be a reference to the Term Loan Agreement as amended by this Amendment.

Section 6 Expenses. The Borrowers shall reimburse the Agent upon demand for all reasonable out-of-pocket costs and expenses (including attorneys’ fees) actually incurred by the Agent in connection with the preparation, negotiation and execution of this Amendment and the other agreements and documents executed and delivered in connection herewith.

Section 7 Benefits. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns and shall be deemed a Loan Document.

Section 8 GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS EXECUTED, AND TO BE FULLY PERFORMED, IN SUCH STATE (INCLUDING, FOR SUCH PURPOSE, SECTIONS 5-1401 AND 5-1402 OF THE GENERAL OBLIGATIONS LAWS OF THE STATE OF NEW YORK).

Section 9 Effect. Except as expressly herein amended, the terms and conditions of the Term Loan Agreement and the other Loan Documents remain in full force and effect. The amendment contained herein shall be deemed to have prospective application only.

Section 10 Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be deemed to be an original and shall be binding upon all parties, their successors and assigns.

Section 11 Definitions. All capitalized terms not otherwise defined herein are used herein with the respective definitions given them in the Term Loan Agreement.

[Signatures on Next Page]

IN WITNESS WHEREOF, the parties hereto have caused this Fourth Amendment to Amended and Restated Term Loan Agreement to be executed as of the date first above written.

LEXINGTON REALTY TRUST

|

| |

By: | /s/ Joseph Bonventre |

| Name: Joseph Bonventre |

| Title: Executive Vice President |

LEPERCQ CORPORATE INCOME FUND L.P.

By: LEX GP-1 Trust, its sole general partner

|

| |

By: | /s/ Joseph Bonventre |

| Name: Joseph Bonventre |

| Title: Vice President |

[Signatures Continue on Next Page]

[Signature Page to Fourth Amendment to Amended and Restated Term Loan Agreement

with Lexington Realty Trust et al.]

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Agent and as a Lender

|

| |

By: | /s/ D. Bryan Gregory |

| D. Bryan Gregory |

| Director |

[Signature Page to Fourth Amendment to Amended and Restated Term Loan Agreement

with Lexington Realty Trust et al.]

KEYBANK NATIONAL ASSOCIATION

|

| |

By: | /s/ Jane E. McGrath |

| Jane E. McGrath |

| Vice President |

[Signature Page to Fourth Amendment to Amended and Restated Term Loan Agreement

with Lexington Realty Trust et al.]

REGIONS BANK

|

| |

By: | /s/ John Fulton |

| John Fulton |

| Assistant Vice President |

[Signature Page to Fourth Amendment to Amended and Restated Term Loan Agreement

with Lexington Realty Trust et al.]

CAPITAL ONE, NATIONAL ASSOCIATION

|

| |

By: | /s/ Frederick H. Denecke |

| Frederick H. Denecke |

| Senior Vice President |

[Signature Page to Fourth Amendment to Amended and Restated Term Loan Agreement

with Lexington Realty Trust et al.]

PNC BANK, NATIONAL ASSOCIATION

|

| |

By: | /s/ Luis Donoso |

| Luis Donoso |

| Vice President |

[Signature Page to Fourth Amendment to Amended and Restated Term Loan Agreement

with Lexington Realty Trust et al.]

TD BANK, N.A.

|

| |

By: | /s/ Brian Welch |

| Brian Welch |

| Senior Vice President |

[Signature Page to Fourth Amendment to Amended and Restated Term Loan Agreement

with Lexington Realty Trust et al.]

BRANCH BANK AND TRUST COMPANY

|

| |

By: | /s/ Ahaz Armstrong |

| Ahaz Armstrong |

| Vice President |

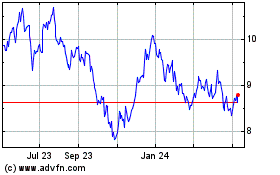

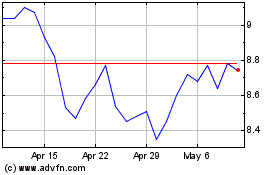

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024