Las Vegas Sands Settles SEC Charges for $9 Million

April 07 2016 - 3:00PM

Dow Jones News

Las Vegas Sands Corp. agreed to pay $9 million to settle charges

that it violated the Foreign Corrupt Practices Act, putting an end

to a five-year investigation by the U.S. Securities and Exchange

Commission.

In the agreement, Las Vegas Sands neither admitted nor denied

any of the SEC's findings.

The SEC alleged that the hotel and casino operator didn't

properly authorize or document millions of dollars in payments to a

consultant facilitating business activities in China and Macao. The

agency accused Las Vegas Sands of keeping inaccurate records and

lacking documentation for roughly $62 million in payments to the

unnamed consultant.

The consultant—internally referred to as a "beard"—acted as an

intermediary to obscure the company's role in certain business

transactions, such as the purchases of a basketball team and a

building in China, where casino gambling and team ownership by a

casino isn't permitted, according to the SEC.

Las Vegas Sands said Thursday that the projects in question were

orchestrated through a consultant whose activities under a former

company president and other former employees weren't sufficiently

monitored.

"We are pleased to have the matter resolved," Chief Executive

Sheldon Adelson said. "We will build on this experience," he said,

adding that the company "started corrective action on this

particular matter prior to the initiation of the government

investigations."

In addition to the $9 million civil penalty, the company has

agreed to retain an independent compliance consultant for two

years.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 07, 2016 14:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

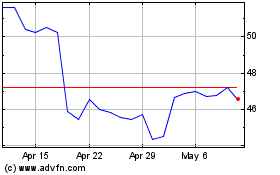

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

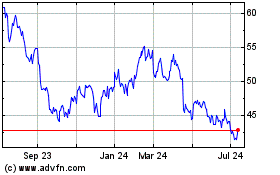

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024