Lowe's Lowers Its Outlook -- WSJ

November 17 2016 - 3:03AM

Dow Jones News

By Austen Hufford and Paul Ziobro

Lowe's Cos. faced a slowdown in shopper visits in the recent

quarter, leading the home improvement retailer to cut its financial

forecast for the year.

Lowe's Chief Executive Robert Niblock said housing turnover and

home price appreciation haven't been as strong as they were a year

ago, and disposable income levels are also down as well. While

homeowners are still confident about upgrading and repairing their

homes, their willingness to spend isn't as robust as last year.

"It's still a very healthy industry but not to the extent that

we would've seen the numbers supporting a year ago," Mr. Niblock

said on Wednesday's earnings call.

During the quarter, sales at stores open at least a year grew

2.7%, with the number of transactions up just 0.5% while the

average order rose 2.2%. U.S. same-store sales rose 2.6%, compared

with 5% growth in the same period last year. Shares of the company

were down 3.5% to $66.60 in early afternoon trading.

The sales performance fell short of rival Home Depot Inc., which

reported on Tuesday a 5.7% increase at existing stores for the

quarter, including a 5.5% jump in the U.S. Home Depot executives

said they didn't see a slowdown in housing, pointing to

macroeconomic trends and industry surveys that still showed a

strong desire for customers to upgrade and remodel their homes.

The dip in traffic during the first two months of the quarter

dragged on profits. Lowe's said it was slow to cut back on staffing

levels to accommodate the slack demand. By October, however, sales

got a bump after it ramped up promotional levels and shifted more

marketing online, which helped draw more shoppers to stores in some

areas, including the Northeast.

In an interview, Mr. Niblock said Lowe's continues to adjust its

staffing model, to accommodate more shoppers who only go into

stores to pick up their online orders, instead of coming in and

browsing shelves of inventory in their stores. "We've got to make

sure that as the consumer is changing the ways they engage with us,

we continue to be nimble," he said.

Generally, Lowe's quarterly profit was hurt by write-downs,

including $290 million related to the winding down of an Australian

joint venture and a $76 million goodwill write-down related to its

2013 purchase of the Orchard Supply hardware chain out of

bankruptcy, which has required more work than expected. Profit fell

to $379 million from $736 million while revenue climbed 9.6% to

$15.74 billion.

The company also logged a $96 million charge related to

technology. Lowe's scrapped custom-built systems in favor of

off-the-shelf products that are cheaper and quicker to adapt. Mr.

Niblock declined to say what the systems were, but said the

retailer is focusing improving its ability to accurately present

stores' inventory to online shoppers and the ability to schedule

in-home visits by design specialists online.

For 2016, Lowe's lowered its guidance to about $3.52 a share,

below the $4.06 previously forecast. Same-store sales expectations

were also lowered to between 3% and 4%, versus a prior 4%.

Write to Austen Hufford at austen.hufford@wsj.com and Paul

Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

November 17, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

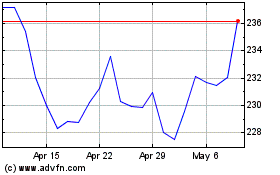

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

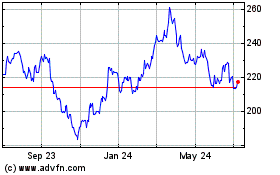

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024