UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 2, 2016

LOWE’S COMPANIES, INC.

(Exact name of registrant as specified in its charter)

|

| | | | | | |

| North Carolina | | 1-7898 | | 56-0578072 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

|

| | | |

| 1000 Lowe’s Blvd., Mooresville, NC | 28117 | |

| (Address of principal executive offices) | (Zip Code) | |

| | | |

| Registrant’s telephone number, including area code | (704) 758-1000 | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 1.01. | Entry into a Material Definitive Agreement. |

Arrangement Agreement

Lowe’s Companies, Inc., a North Carolina corporation (the “Company”), has entered into an Arrangement Agreement (“Agreement”) dated February 2, 2016 with RONA inc., a corporation incorporated under the laws of Quebec (“RONA”), and Lowe’s Companies Canada, ULC, an unlimited liability company incorporated under the laws of Nova Scotia and a wholly owned subsidiary of the Company (“Lowe’s Canada” and, together with the Company, “Lowe’s”), pursuant to which Lowe’s Canada has agreed, subject to the terms and conditions contained in the Agreement, to implement a plan of arrangement (the “Arrangement”) under Chapter XVI-Division II of the Business Corporations Act (Quebec) pursuant to which it will acquire all of the issued and outstanding common shares of RONA for a purchase price of C$24.00 in cash per common share and all of the issued and outstanding preferred shares of RONA for a purchase price of C$20.00 in cash per preferred share. The total transaction value is C$3.2 billion (US$2.3 billion). The Boards of Directors of all of the parties have unanimously approved the transactions contemplated by the Agreement.

The parties have made customary representations, warranties and covenants in the Agreement. RONA has represented and warranted to Lowe’s that, among other things, (1) RONA’s Board of Directors has received a fairness opinion from Scotia Capital Inc. that the consideration to be received by holders of common shares of RONA is fair, from a financial point of view, to such shareholders, and the consideration to be received by holders of preferred shares of RONA is fair, from a financial point of view, to such shareholders; (2) a special committee of the Board of Directors of RONA has unanimously recommended that RONA’s Board of Directors approve the Arrangement and that the RONA common shareholders and preferred shareholders vote in favor of the Arrangement; (3) RONA’s Board of Directors has resolved to unanimously recommend that the RONA common shareholders and preferred shareholders vote in favor of the Arrangement; and (4) each of the directors and certain senior executive officers of RONA have advised RONA that they intend to vote all of their common shares and preferred shares in favor of the Arrangement.

RONA has also agreed to: (a) conduct its business in the ordinary course; (b) use commercially reasonable efforts to satisfy all conditions to completion of the Arrangement; (c) use commercially reasonable efforts to obtain required third party consents; and (d) as permitted by law and its confidentiality obligations to third parties, notify Lowe’s of any material change relating to RONA and keep Lowe’s informed as to material decisions or actions required with respect to the operation of its business outside the ordinary course. Consummation of the transactions contemplated by the Agreement is conditioned upon the satisfaction of customary closing conditions, including: (A) approval of the Arrangement by two-thirds of the votes cast by RONA’s common shareholders; and (B) receipt of the approvals required under the Investment Canada Act and the Competition Act (Canada).

The Agreement also contains customary non-solicitation covenants that prohibit RONA or its representatives from soliciting an alternative acquisition proposal and require RONA to permit Lowe’s Canada to match any superior acquisition proposal.

The closing of the transactions contemplated by the Agreement is scheduled to take place five business days following the satisfaction or waiver of the closing conditions. Either party may terminate the Agreement if the closing does not occur on or before August 31, 2016 (which date may be extended by Lowe’s Canada by up to two months if the required regulatory approvals have not been obtained, provided that the failure to obtain such approvals is not primarily the result of Lowe’s failure to comply with its covenants in the Agreement); provided that no party may terminate the Agreement if the failure of the closing to occur by such time has been caused by, or is the result of, a breach by such party of any of its representations, warranties or covenants.

The Agreement contains certain additional termination rights of the parties and further provides that, upon termination of the Agreement under specified circumstances, RONA is required to pay Lowe’s Canada a termination fee of C$100 million. In addition, RONA is required to pay Lowe’s Canada a C$15 million expense reimbursement fee if the Agreement is terminated due to certain breaches of RONA’s representations, warranties or covenants.

Financing Commitment

Concurrently with the signing of the Arrangement Agreement, Lowe’s entered into a financing commitment letter with Royal Bank of Canada, Canadian Imperial Bank of Commerce, RBC Capital Markets, and CIBC Capital Markets that provides for a C$3,200 million senior unsecured bridge facility to finance the acquisition of RONA. The financing commitments of the lenders are subject to documentation and other customary conditions. Permanent financing is expected to consist of new debt.

Item 7.01. Regulation FD Disclosure.

On February 3, 2016, Lowe’s and RONA issued a joint press release announcing that they had entered into the Agreement. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated into this Item 7.01 by reference.

Additional information concerning the Arrangement is available in a slide presentation presented to investors during a teleconference on February 3, 2016. A copy of the slide presentation is attached as Exhibit 99.2 and is incorporated herein by reference.

The information in Item 7.01 of this report, including Exhibits 99.1 and 99.2, is being furnished, not filed. Accordingly, the information in Item 7.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933 unless specifically identified therein as being incorporated therein by reference. The furnishing of the information in Item 7.01 of this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company.

| |

Item 9.01. | Financial Statements and Exhibits. |

| |

99.1 | Press Release, dated February 3, 2016 |

| |

99.2 | Investor Slide Presentation, dated February 3, 2016 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| LOWE’S COMPANIES, INC. | |

| | | |

Date: February 5, 2016 | By: | /s/ Ross W. McCanless | |

| | Ross W. McCanless General Counsel, Secretary and Chief Compliance Officer | |

INDEX TO EXHIBITS

|

| | |

Exhibit No. | | Description |

99.1

99.2 | |

Press Release, dated February 3, 2016

Investor Slide Presentation, dated February 3, 2016 |

Exhibit 99.1

LOWE’S TO ACQUIRE RONA

CREATING CANADA’S LEADING HOME IMPROVEMENT RETAILER

-- Transaction valued at C$3.2 billion (US$2.3 billion) --

| |

• | Transaction unanimously approved by both companies’ Boards of Directors |

| |

• | Agreement is based on compelling strategic rationale for both companies |

| |

• | Lowe’s pledges important commitments to RONA’s key Canadian stakeholders |

| |

• | Lowe’s to locate its Canadian head office in Boucherville, Quebec; Canadian operations to be headed by Sylvain Prud’homme, President of Lowe’s Canada |

| |

• | Acquisition accelerates Lowe’s growth strategy in Canada |

MOORESVILLE, N.C., and BOUCHERVILLE, QC, February 3, 2016 - Lowe’s Companies, Inc. (NYSE: LOW) (“Lowe’s” or the “Company”) and RONA inc. (TSX: RON, RON.PR.A) (“RONA”) announced today that they have entered into a definitive agreement under which Lowe’s is expected to acquire all of the issued and outstanding common shares of RONA for C$24 per share in cash, and all of the issued and outstanding preferred shares of RONA for C$20 per share in cash. The total transaction value is C$3.2 billion (US$2.3 billion) (the “Transaction”). The offer represents a premium of 104 percent to RONA’s closing common share price on February 2, 2016 and a 38 percent premium to RONA’s 52-week high of C$17.36. Together, Lowe’s Canada and RONA stores will create Canada’s leading home improvement retailer with 2015 pro forma revenues from Canadian operations of approximately C$5.6 billion. Excluding transaction and integration costs, we anticipate the Transaction will be accretive to Lowe’s earnings in the first year following the close of the acquisition.

The Transaction has been unanimously approved by the Boards of Directors of Lowe’s and RONA and is supported by the management teams of both companies. The Transaction is expected to proceed by way of a plan of arrangement by which Lowe’s would acquire all of the outstanding shares of RONA, subject to RONA common shareholder approval and satisfaction of customary conditions, including the receipt of all necessary regulatory approvals. The RONA Board has received an opinion from Scotia Capital Inc. that the consideration to be received by RONA’s common and preferred shareholders pursuant to the Transaction is fair, from a financial point of view.

The RONA Board will recommend that RONA shareholders vote in favor of the plan of arrangement at a special meeting of shareholders expected to be held before the end of the first quarter of 2016. Further information regarding the Transaction will be included in RONA’s information circular to be mailed to RONA shareholders in advance of the special meeting. The arrangement agreement provides that RONA is subject to customary non-solicitation provisions.

“We are very excited about this transaction as it leverages the strengths of two great companies, positioning us for continued success in Canada’s over C$45 billion and growing home improvement industry. The strategic rationale of this transaction, for both companies, is very compelling,” said Lowe’s Chairman, President and CEO Robert A. Niblock.

“The transaction is expected to accelerate Lowe’s growth strategy by significantly expanding our presence in the Canadian market through the addition of RONA’s attractive business and excellent store locations across the country,” added Niblock. “Importantly, the transaction also provides Lowe’s with entry into Quebec, where RONA is the market leader and we have no presence. We have committed to maintaining RONA’s operations in Boucherville, where we will headquarter our Canadian businesses, and plan to continue to operate RONA’s multiple retail banners and distribution services to independent dealers. With our shared customer-centric values and a steadfast commitment to the Canadian market, we expect to generate significant long-term benefits for shareholders, customers, vendors, employees and the communities we serve.”

RONA’s Chairman, Robert Chevrier added, “We believe the time is right to take the next step in the evolution of the RONA family. The team at Lowe’s has presented us with an excellent plan that enables our company to maintain its brand power while at the same time leveraging Lowe’s global presence to build upon and expand our reach. With commitments made by Lowe’s to our

employees, potential new markets for Canadian manufacturers and product offerings for our independent dealers, this transaction presents the ideal opportunity for the continued growth of our company while delivering an attractive premium for our shareholders.”

The Canadian operations will be led by Sylvain Prud’homme, president of Lowe’s Canada. The senior management teams of both companies will work to assure a smooth and effective transition.

“We are pleased with the solid position we have established in key Canadian markets in recent years and the positive reception from our local customers,” said Prud’homme. “We look forward to continuing our commitment to the Canadian market and further enhancing our offering to the customers of both Lowe’s and RONA. We have great respect for RONA’s leadership team and RONA’s talented employee base and look forward to working together to take our businesses to the next level.”

Lowe’s has identified over C$1 billion of opportunities to further increase revenue and operating profitability in Canada. These include: expanding customer reach and serving a new portion of the market by applying Lowe’s expertise in certain product categories, such as appliances; enhancing customer relevance, utilizing Lowe’s strengths as a leading omni-channel home improvement company and drawing on its customer experience design capabilities; and driving increased profitability in Canada by leveraging shared supplier relationships and enhanced scale, as well as Lowe’s private label capabilities, in addition to eliminating RONA’s public company costs. Given these opportunities, Lowe’s believes there is potential to double operating profitability in Canada over five years.

Lowe’s Commitments to RONA Stakeholders in Canada

In addition to the attractive premium offered to RONA’s shareholders, Lowe’s has agreed to key commitments for RONA and its stakeholders. These include:

| |

• | to headquarter the Canadian businesses in Boucherville, Quebec; |

| |

• | to maintain RONA’s multiple retail store banners; |

| |

• | to enhance distribution services to independent dealers; |

| |

• | for RONA to continue to employ the vast majority of its current employees and maintain key executives from RONA’s strong leadership team; |

| |

• | to continue RONA’s local and ethical procurement strategy and potentially expand relationships both Lowe’s and RONA have developed with Canadian manufacturers and suppliers; and |

| |

• | to continue to support Canadian communities through RONA and Lowe’s charitable and environmental initiatives. |

Lowe’s Companies, Inc. Conference Call

Lowe’s will hold a conference call to discuss the announcement today at 8:00 a.m. EST. The conference call will be available by webcast and can be accessed by visiting Lowe’s website at www.Lowes.com/investor, clicking on webcasts, and selecting Lowe’s Companies Canada Acquisition Conference Call. Supplemental slides will be available 15 minutes prior to the start of the conference call. A replay of the call will be archived on Lowes.com/investor.

RONA inc. Conference Call

RONA will hold a conference call to discuss the announcement today at 10:30 a.m. EST. The conference call will be available by webcast and can be accessed by visiting RONA’s website at rona.ca/corporate/investors

News Conference

Lowe’s and RONA will host a joint news conference at noon today at Le Centre Sheraton Montreal Room Hémon, 1201 Boulevard René-Lévesque O, Montréal, QC H3B 2L7. Executives of both companies will be present to answer questions from the news media. An audio webcast of the news conference will be made available during the event by clicking this link and can be accessed following the event by visiting http://www.Lowes.com/investor and rona.ca/corporate/investors.

Advisors

CIBC World Markets Inc. and RBC Capital Markets are serving as financial advisors to Lowe’s in connection with the Transaction. Stikeman Elliott LLP is serving as legal counsel to Lowe’s in Canada, and Hunton & Williams LLP is serving as legal counsel to Lowe’s in the U.S. Scotia Capital Inc. is serving as exclusive financial advisor to RONA. Norton Rose Fulbright Canada LLP is serving as legal counsel to RONA.

About Lowe’s Companies, Inc.

Lowe’s is a FORTUNE® 50 home improvement company serving approximately 16 million customers a week in the United States, Canada and Mexico through its stores and online at Lowes.com, Lowes.ca and Lowes.com.mx. With fiscal year 2014 sales of US

$56.2 billion, Lowe’s has more than 1,845 home improvement and hardware stores and 265,000 employees. Founded in 1946 and based in Mooresville, N.C., Lowe’s supports the communities it serves through programs that focus on K-12 public education and community improvement projects. For more information, visit Lowes.com.

About RONA inc.

RONA inc. is a major Canadian retailer and distributor of hardware, building materials and home renovation products. RONA operates a network of close to 500 corporate and independent affiliate dealer stores in a number of complementary formats. With its nine distribution centres, RONA serves its network of stores and several independent dealers operating under other banners, including Ace, for which RONA owns the licensing rights and is the exclusive distributor in Canada. With more than 17,000 employees in corporate stores and more than 5,000 employees in the stores of its independent affiliate dealers, RONA generates annual consolidated sales of C$4.1 billion. For more information, visit RONA.ca.

Forward-Looking Statements - Lowe’s Companies, Inc.

This news release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 including those regarding the Transaction and the expected impact of the Transaction on Lowe’s strategic and operational plans and financial results. Statements including words such as “may”, “will”, “could”, “should”, “would”, “plan”, “potential”, “intend”, “anticipate”, “believe”, “estimate” or “expect” and other words, terms and phrases of similar meaning are forward-looking statements. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Such forward-looking statements include, but are not limited to, statements or implications about the benefits of the Transaction, including future financial and operating results, Lowe’s or RONA’s plans, objectives, expectations and intentions, the expected timing of completion of the Transaction, expectations for sales growth, comparable sales, earnings and performance, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, Lowe’s strategic initiatives, any statement of an assumption underlying any of the foregoing and other statements that are not historical facts. Although Lowe’s believes that the expectations, opinions, projections, and comments reflected in these forward-looking statements are reasonable, it can give no assurance that such statements will prove to be correct. A wide variety of potential risks, uncertainties, and other factors could materially affect Lowe’s ability to achieve the results either expressed or implied by these forward-looking statements including, but not limited to, changes in general economic conditions, such as the rate of unemployment, interest rate and currency fluctuations, fuel and other energy costs, slower growth in personal income, changes in consumer spending, changes in the rate of housing turnover, the availability of consumer credit and of mortgage financing, inflation or deflation of commodity prices, and other factors which can negatively affect Lowe’s customers, as well as its ability to: (i) respond to adverse trends in the housing industry, such as a demographic shift from single family to multi-family housing, a reduced rate of growth in household formation, and slower rates of growth in housing renovation and repair activity, as well as uneven recovery in commercial building activity; (ii) secure, develop, and otherwise implement new technologies and processes necessary to realize the benefits of Lowe’s strategic initiatives and enhance its efficiency; (iii) attract, train, and retain highly-qualified associates; (iv) manage its business effectively as Lowe’s adapts its traditional operating model to meet the changing expectations of its customers; (v) maintain, improve, upgrade and protect its critical information systems from data security breaches and other cyber threats; (vi) respond to fluctuations in the prices and availability of services, supplies, and products; (vii) respond to the growth and impact of competition; (viii) address changes in existing or new laws or regulations that affect consumer credit, employment/labor, trade, product safety, transportation/logistics, energy costs, health care, tax or environmental issues; and (ix) respond appropriately to unanticipated failures to maintain a high level of product and service quality that could result in a negative impact on customer confidence and adversely affect sales. In addition, Lowe’s could experience additional impairment losses if either the actual results of its operating stores are not consistent with the assumptions and judgments it has made in estimating future cash flows and determining asset fair values, or Lowe’s is required to reduce the carrying amount of its investment in certain unconsolidated entities that are accounted for under the equity method. With respect to the Transaction discussed herein specifically, potential risks include the possibility that the Transaction will be rejected by RONA’s shareholders; the possibility that even if the Transaction is approved by RONA’s shareholders, the Transaction will not close or that the closing may be delayed; the possibility that RONA’s board of directors could receive and approve a superior acquisition proposal; the failure to obtain, any necessary actions to obtain and the timing to obtain any required regulatory approvals for the Transaction or any transaction ancillary thereto; the effect of the announcement of the Transaction on Lowe’s and RONA’s strategic relationships, operating results and businesses generally; significant transaction costs or unknown liabilities; failure to realize the expected benefits of the Transaction; and general economic conditions. For more information about these and other risks and uncertainties that Lowe’s is exposed to, you should read the “Risk Factors” and “Critical Accounting Policies and Estimates” included in Lowe’s most recent Annual Report on Form 10-K to the United States Securities and Exchange Commission (the “SEC”) and the description of material changes therein or updated version thereof, if any, included in Lowe’s Quarterly Reports on Form 10-Q or subsequent filings with the SEC.

The forward-looking statements contained in this news release are expressly qualified in their entirety by the foregoing cautionary statements. All such forward-looking statements are based upon data available as of the date of this release or other specified date and speak only as of such date. All subsequent written and oral forward-looking statements attributable to Lowe’s or any person acting on behalf of Lowe’s about any of the matters covered in this release are qualified by these cautionary statements and in the "Risk Factors" included in Lowe’s most recent Annual Report on Form 10-K to the SEC and the description of material changes, if any, therein included in Lowe’s Quarterly Reports on Form 10-Q or subsequent filings with the SEC. Lowe’s expressly disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, change in circumstances, future events, or otherwise.

Forward-Looking Statements - RONA inc.

This press release includes “forward-looking statements” that involve risks and uncertainties. All statements other than statements of historical facts included in this press release, including statements regarding the prospects of the industry and prospects, plans, financial position and business strategy of RONA may constitute forward-looking statements within the meaning of the Canadian securities legislation and regulations. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe” or “continue” or the negatives of these terms, variations of them, similar terminology or the use of future tenses. More particularly and without limitation, this press release contains forward-looking statements and information concerning: statements or implications about the anticipated benefits of the Transaction to RONA, Lowe’s and their respective shareholders, including future financial and operating results, Lowe’s or RONA’s plans, objectives, expectations and intentions; and the anticipated timing for the special meeting of RONA shareholders.

In respect of the forward-looking statements and information concerning the anticipated benefits of the proposed Transaction and the anticipated timing for the special meeting of RONA shareholders, RONA has provided such in reliance on certain assumptions that it believes are reasonable at this time, including assumptions as to the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the closing of the Transaction; and other expectations and assumptions concerning the Transaction. The anticipated timing to hold the shareholder meeting may change for a number of reasons. Although RONA believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. Accordingly, investors and others are cautioned that undue reliance should not be placed on any forward-looking statements.

Risks and uncertainties inherent in the nature of the Transaction include without limitation the failure of the parties to obtain the necessary shareholder, regulatory and court approvals, or to otherwise satisfy the conditions to the completion of the Transaction, in a timely manner, or at all; significant transaction costs or unknown liabilities; failure to realize the expected benefits of the Transaction; and general economic conditions. Failure to obtain the necessary shareholder, regulatory and court approvals, or the failure of the parties to otherwise satisfy the conditions to or complete the Transaction, may result in the Transaction not being completed on the proposed terms, or at all. In addition, if the Transaction is not completed, and RONA continues as an independent entity, there are risks that the announcement of the Transaction and the dedication of substantial resources of RONA to the completion of the Transaction could have an impact on RONA’s business and strategic relationships (including with future and prospective employees, customers, dealer-owners, distributors, suppliers and partners), operating results and businesses generally, and could have a material adverse effect on the current and future operations, financial condition and prospects of RONA. Furthermore, the failure of RONA to comply with the terms of the arrangement agreement may, in certain circumstances, result in RONA being required to pay a fee to Lowe’s, the result of which could have a material adverse effect on RONA’s financial position and results of operations and its ability to fund growth prospects and current operations.

For more information on the risks, uncertainties and assumptions that would cause RONA’s actual results to differ from current expectations, please also refer to RONA’s public filings available at www.sedar.com and www.RONA.ca. In particular, further details and descriptions of these and other factors are disclosed in RONA’s Management’s Discussion and Analysis for the fiscal year ended December 28, 2014 under the “Risks and uncertainties” section. The forward-looking statements contained in this press release are expressly qualified in their entirety by the foregoing cautionary statements. RONA expressly disclaims any obligation or intention to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by applicable securities laws.

NO OFFER OR SOLICITATION

This announcement is for informational purposes only and does not constitute an offer to purchase or a solicitation of an offer to sell RONA common shares.

SOURCE: Lowe’s Companies, Inc.

Shareholder/Analyst Inquiries:

Tiffany Mason

SVP Corporate Finance & Treasurer

704-758-2033

Tiffany.L.Mason@lowes.com

Media Inquiries:

Canada:

Andrea Danielle Wong

NATIONAL Public Relations

514-686-9891

Awong@national.ca

U.S.: Connie Bryant

Director, Public Relations

704-758-2403

Connie.m.bryantbreedlove@lowes.com

SOURCE: RONA, Inc.

Shareholder/Analyst Inquiries:

Stéphane Milot

Vice President, Development, Real Estate and Investor Relations

514.599.5951

stephane.milot@rona.ca

Media Inquiries:

Valérie Gonzalo

Communications and Public Affairs

514.599.5900 ext. 5271

media@rona.ca

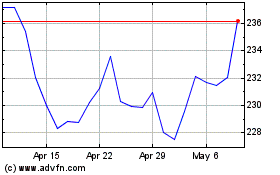

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

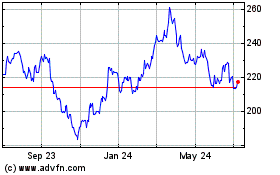

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024