By Barbara Kollmeyer and Ellie Ismailidou, MarketWatch

Dollar briefly hits seven-month high

U.S. stocks marched higher in late-morning trade Tuesday, lifted

by upbeat earnings reports from giant retailers Home Depot Inc. and

Wal-Mart Stores Inc.

The better-than-expected earnings overshadowed U.S. economic

data that delivered a muddled picture of the health of the U.S.

economy, but isn't likely to deter the Federal Reserve from lifting

interest rates for the first time in nearly a decade.

The Dow Jones Industrial Average gained 98 points or 0.6% to

17,581, with a 4% rise in shares of Home Depot (HD) adding nearly

30 points to the blue-chips gauge and a 5% rise in Wal-Mart Stores

(WMT) shares contributing about 20 points.

The S&P 500 index advanced 8 points higher or 0.6% to 2,065.

Energy, off 0.1%, and utilities, down 0.6%, are the only sectors of

the S&P 500's 10 in negative territory.

Meanwhile, the Nasdaq Composite Index was up 35 points, or 0.7%,

at 5,020.

On the economic front, an October reading of the U.S.

consumer-price index, which showed the first increase in three

months, a seasonally adjusted 0.2% rise

(http://www.marketwatch.com/story/consumer-price-index-rises-in-october-for-first-time-in-3-months-2015-11-17),

fell within economists' expectations. That likely keeps a December

interest-rate hike by the Federal Reserve on the table. Core

prices, which exclude energy and food, rose 1.9%

year-over-year.

"Today's figures are very unlikely to derail a hike in

December," said Luke Bartholomew, Aberdeen Asset Management's

investment manager, in a Tuesday research note.

"It's a pretty finely balanced judgment though. Hiking with

limited evidence of inflation risks slowing the economy down too

much. While hiking only when inflation has bounced back risks not

being able to contain it," Bartholomew added.

Meanwhile, industrial production fell 0.2% in October, pulled

down mainly by a 2.5% decline in utilities and a 1.5% fall in

mining. On the positive side, the manufacturing sector showed some

improvement in October,

(http://www.marketwatch.com/story/signs-of-life-for-manufacturing-in-industrial-production-report-2015-11-17)

advancing 0.4% after two straight monthly declines.

On Monday, stocks mounted a broad rally, shaking off the

pessimism from terrorists attacks that rocked Paris, one of

Europe's most prominent cities.

The French air force carried out a second straight day of raids

(http://www.marketwatch.com/story/france-drops-more-bombs-on-islamic-state-targets-in-syria-2015-11-17)

against Islamic State stronghold of Raqqa in northern Syria early

Tuesday. But analysts weren't sure how long Wall Street and other

global stocks could hang onto a boost from higher oil prices,

especially as gains were fading.

"With key inventory data ahead and suspicions of oversupply,

momentum could be handed back to bears following 2-month lows

[that] were triggered last week," said Jonathan Sudaria, night

dealer at London Capital Group, in a note. Late Tuesday morning,

crude oil was down 1.6% to $40.91 a barrel.

Read: Why stocks are taking their cues from crude-oil prices

(http://www.marketwatch.com/story/why-stocks-are-taking-their-cues-from-crude-oil-prices-2015-11-16)

In other economic data: The National Association of Home

Builders retreated from a 10-year high in November, dipping three

points from an earlier reading of 65

(http://www.marketwatch.com/story/home-builer-sentiment-retreats-in-november-2015-11-17).

Any reading over 50 signals improvement.

Fed speakers: Dallas Federal Reserve President Rob Kaplan will

give his first major speech since taking the Fed role, on economic

conditions and Fed policy at the University of Houston at noon

Eastern. At 1:15 p.m. Eastern, Fed Gov. Jerome Powell will speak at

the Clearing House annual conference in New York. Fed Gov. Daniel

Tarullo will speak at a Brookings Institution conference at 3:30

p.m. Eastern.

Stocks to watch: Wal-Mart Stores shares climbed 4.6% after the

general retailer's fiscal third-quarter profit declined less than

expected

(http://www.marketwatch.com/story/wal-marts-stock-surges-after-profit-beats-expectations-2015-11-17),

helping offset a slight miss in revenue of $117.41 billion.

Apparel and accessories retailer TJX Cos. (TJX) shares surged

4.2% after the company reported better-than-expected third-quarter

profit and sales

(http://www.marketwatch.com/story/tjxs-stock-surges-after-profit-sales-beat-expectations-2015-11-17).

Home Depot Inc.(HD) shares rose 3.9% after the D.I.Y. retailer

backed the high-end of its previous forecast for the year

(http://www.marketwatch.com/story/home-depot-reports-solid-sales-growth-2015-11-17-6485274).

Lowe's Companies, Inc. (LOW) shares gained over 3% ahead of its

third-quarter earnings release expected Wednesday before the

opening bell.

Meanwhile, regulatory filings revealed several big hedge-fund

managers' positions in stocks in the third quarter. David Einhorn

(http://www.marketwatch.com/story/hedge-fund-titan-einhorn-boosts-apple-stake-slashes-sunedison-2015-11-16)

boosted his stake in Apple Inc.(AAPL), General Motors Inc.(GM) and

Michael Kors Holdings Ltd.(KORS). He cut holdings of SunEdison

Inc.(SUNE) and Micron Technology Inc.(MU).

Billionaire investor Carl Icahn

(http://www.marketwatch.com/story/icahn-reports-stakes-in-paypal-freeport-aig-2015-11-16)

revealed stakes in PayPal Holdings Inc.(PYPL) and Freeport-McMoRan

Inc. (FCX).

Other markets: Asian stocks closed mostly higher, though the

Shanghai Composite Index gave up gains by the finish and ended

flat. European stocks

(http://www.marketwatch.com/story/european-stocks-leap-toward-best-session-in-nearly-a-month-2015-11-17)

were set for the best session in weeks as defense and energy shares

climbed.

The dollar

(http://www.marketwatch.com/story/dollar-hits-fresh-7-month-high-against-the-euro-2015-11-17)

briefly hit a fresh seven-month high against the euro

(http://www.marketwatch.com/story/dollar-hits-fresh-7-month-high-against-the-euro-2015-11-17)

as traders bet Friday's terrorist attacks in Paris may push the

European Central Bank to loosen up on monetary policy when it meets

Dec. 3, which would open up the euro to selling pressure. Read:

Paris attacks may hit eurozone economy

(http://www.marketwatch.com/story/paris-attack-may-hit-eurozone-economy-ecbs-praet-2015-11-17)

Gold prices were marching lower as demand for haven assets fades

somewhat.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 17, 2015 11:45 ET (16:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

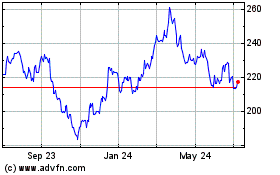

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Aug 2024 to Sep 2024

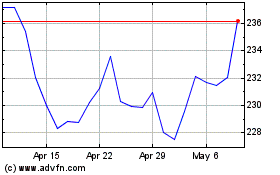

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Sep 2023 to Sep 2024