Lockheed Martin Facing Twin Pressures on F-35 Price

January 12 2017 - 10:53AM

Dow Jones News

By Doug Cameron

As President-elect Donald Trump's nominee as defense secretary,

retired Marine Corps Gen. James Mattis, started his confirmation

hearing Thursday, Lockheed Martin Corp. executives were sitting

down again with Pentagon officials to thrash out terms for the next

multi-billion dollar batch of 90 F-35 combat jets.

Mr. Trump this week again took aim at the cost and delays to the

Pentagon's most expensive weapons program, briefly denting defense

stocks that have wavered since he unleashed a series of tweets in

December against the F-35, as well as the Boeing Co. jets that will

serve as Air Force One .

While Mr. Trump has already wrestled personal commitments from

the chief executives of both companies over the cost of the F-35

and Air Force One, and pledged to remain closely involved,

contracting experts said he has no formal power to negotiate

deals.

His interventions could even open the Pentagon to legal

challenges from defense companies, as the officials who negotiate

deals have legal independence from the Pentagon hierarchy and

lawmakers.

"The president doesn't have the authority just by fiat to

negotiate a contract or the terms of a contract," said Sandy Hoe, a

veteran contract lawyer at Covington & Burlington LLP in

Washington, D.C.

Statutory authority rests with the 30,000, mostly civilian staff

which negotiate military deals, a group that's been a focus of

Pentagon-led reform efforts over the past six years to improve

their skills.

Even Lt. Gen. Chris Bogdan, the military head of the F-35

program who met with Mr. Trump in late December, lacks the official

authority, which rests with a member of the Senior Executive

Service on his team who carries a civilian rank akin to that of a

general.

Lockheed and other big F-35 contractors including Northrop

Grumman Corp. and BAE Systems PLC have invested in efforts to cut

the cost of the plane, but investors are concerned Mr. Trump's

moves will erode profit margins that are already under

pressure.

Bethesda, Md.-based Lockheed has pledged to raise margins on the

F-35 to the 10%-plus level of existing jets such as the F-16 from

what analysts estimate is around 8%. Northrop executives have said

margins on the program are not where they want them to be. The F-35

already accounts for 23% of Lockheed sales, a level that's also set

to rise as production expands.

"New attention from President-elect Trump and adverse pricing on

subsequent contracts could keep F-35 margins below the company

average for longer than expected," said RBC Capital Matt McConnell

as he initiated coverage of Lockheed Martin this week.

The civilian F-35 negotiators and Gen. Bogdan were already at

loggerheads with Lockheed even before Mr. Trump's intervention.

More than a year of talks failed to secure agreement only on the

price of the last batch jets. So the Pentagon in November imposed a

deal worth $6.1 billion covering 57 jets, pricing the F-35A model

used by the Air Force at $102 million apiece, some 4% lower than

the previous bundle of planes.

Gen. Bogdan said in late December that he expects the next batch

now under negotiation to be 6% to 7% cheaper than the last. That

would take the price of each plane below $100 million in

current-year dollars for the first time, on track with the

Pentagon's existing plan for them to cost around $85 million apiece

by 2019 in then-year dollars.

The F-35 program office declined to comment on Gen. Bogdan's

meeting with the president-elect or the latest Lockheed talks, but

said it continued to target the lower price outlined in

December.

Lockheed has until the end of the month to launch a legal

challenge against the price imposed by the Pentagon for the last

batch of jets. The company declined comment.

Mr. Trump's continuing focus on the defense sector has seen the

sector give up around half of their post-election rally when shares

reached record levels on investor expectations that defense budgets

were set to rise more quickly. Lockheed opens the sector

fourth-quarter earnings' season on Jan. 24.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

January 12, 2017 10:38 ET (15:38 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

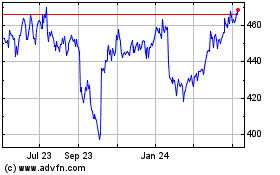

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

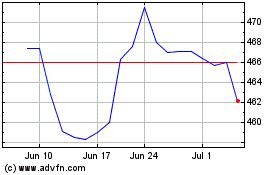

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Sep 2023 to Sep 2024