UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of Report (Date of earliest event reported)

|

|

May 4, 2015

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

1-6541

|

|

13-2646102

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

667 Madison Avenue, New York, N.Y.

|

10065-8087

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

(212) 521-2000

|

|

NOT APPLICABLE

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

|

On May 4, 2015, Registrant issued a press release for Loews Corporation providing information on its results of operations for the first quarter of 2015. The press release is furnished as Exhibit 99.1 to this Form 8-K.

The information under Item 2.02 and in Exhibit 99.1 in this Current Report is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information under Item 2.02 and in Exhibit 99.1 in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

(a)

|

Not applicable.

|

|

(b)

|

Not applicable.

|

|

(c)

|

Exhibit:

|

|

Exhibit Reference

|

|

|

|

|

|

| |

|

|

|

|

|

| |

Number

|

|

|

|

Exhibit Description

|

|

|

| |

|

|

99.1

|

Loews Corporation press release, issued May 4, 2015, providing information on its results of operations for the first quarter of 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

LOEWS CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: May 4, 2015

|

By:

|

/s/ Gary W. Garson

|

|

|

|

Gary W. Garson

|

|

|

|

Senior Vice President

|

| |

|

General Counsel

|

|

|

|

and Secretary

|

2

Exhibit 99.1

|

|

Contact:

|

Mary Skafidas

Investor and Public Relations

(212) 521-2788

|

NEWS RELEASE

LOEWS CORPORATION REPORTS NET INCOME OF

$109 MILLION FOR THE FIRST QUARTER OF 2015

NEW YORK, May 4, 2015—Loews Corporation (NYSE:L) today reported net income for the three months ended March 31, 2015 of $109 million, or $0.29 per share, compared to $59 million, or $0.15 per share, in the prior year period. Net income in 2014 included a loss from discontinued operations of $206 million reflecting the disposition of both HighMount Exploration & Production, LLC and CNA Financial Corporation’s annuity and pension deposit business.

Income from continuing operations for the three months ended March 31, 2015 was $109 million, or $0.29 per share, compared to $265 million, or $0.68 per share, in the 2014 first quarter. Excluding asset impairment charges of $158 million (after tax and noncontrolling interests) in 2015 at Diamond Offshore Drilling, Inc. and $55 million (after tax and noncontrolling interests) in 2014 at Boardwalk Pipeline Partners, LP, income from continuing operations, as adjusted, in 2015 was $267 million as compared to $320 million in the prior year period.

Book value per share excluding accumulated other comprehensive income (AOCI) increased to $51.18 at March 31, 2015 from $50.95 at December 31, 2014 and $49.43 at March 31, 2014.

CONSOLIDATED HIGHLIGHTS

| |

|

Three Months Ended March 31,

|

|

|

(In millions, except per share data)

|

|

2015

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

Income before net investment gains

|

|

$ |

101 |

|

|

$ |

241 |

|

|

Net investment gains

|

|

|

8 |

|

|

|

24 |

|

|

Income from continuing operations

|

|

|

109 |

|

|

|

265 |

|

|

Discontinued operations, net

|

|

|

|

|

|

|

(206 |

) |

|

Net income attributable to Loews Corporation

|

|

$ |

109 |

|

|

$ |

59 |

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.29 |

|

|

$ |

0.68 |

|

|

Discontinued operations, net

|

|

|

|

|

|

|

(0.53 |

) |

|

Net income per share

|

|

$ |

0.29 |

|

|

$ |

0.15 |

|

| |

|

March 31,

|

|

|

Year Ended

|

|

| |

|

2015

|

|

|

2014

|

|

|

December 31, 2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

Book value per share

|

|

$ |

51.98 |

|

|

$ |

50.89 |

|

|

$ |

51.70 |

|

|

Book value per share excluding AOCI

|

|

|

51.18 |

|

|

|

49.43 |

|

|

|

50.95 |

|

Income from continuing operations decreased primarily due to lower earnings at Diamond Offshore and less favorable performance of the parent company trading portfolio.

CNA’s earnings increased primarily due to higher investment income driven by limited partnerships and improved current accident year underwriting results including lower catastrophe losses, partially offset by lower realized investment gains.

Diamond Offshore’s earnings decreased primarily due to a $158 million (after tax and noncontrolling interests) asset impairment charge related to the carrying value of eight drilling rigs as well as lower rig utilization and increased depreciation expense.

Boardwalk Pipeline’s earnings increase stemmed from the impact in 2014 of a $55 million charge (after tax and noncontrolling interests) related to the write off of all capitalized costs associated with the Bluegrass project. Absent this charge, earnings decreased primarily due to the unusually cold and sustained winter of 2014 as compared to the relatively normal 2015 winter season and lower natural gas storage revenues.

Loews Hotels’ earnings increased primarily due to improved performance of recently acquired properties and higher equity income from joint venture properties.

Discontinued operations in 2014 included an impairment charge related to the sale of CNA’s annuity and pension deposit business and a ceiling test impairment charge at HighMount.

SHARE REPURCHASES

At March 31, 2015, there were 371.4 million shares of Loews common stock outstanding. During the first quarter of 2015, the Company repurchased 1.8 million shares of its common stock at an aggregate cost of $71 million. During the first quarter of 2015, the Company also purchased 0.9 million shares of Diamond Offshore’s common stock at an aggregate cost of $24 million. Depending on market conditions, the Company may from time to time purchase shares of its and its subsidiaries’ outstanding common stock in the open market or otherwise.

CONFERENCE CALLS

A conference call to discuss the first quarter results of Loews Corporation has been scheduled for today at 11:00 a.m. ET. A live webcast of the call will be available online at the Loews Corporation website (www.loews.com). Please go to the website at least ten minutes before the event begins to register and to download and install any necessary audio software. Those interested in participating in the question and answer session should dial (877) 692-2592, or for international callers, (973) 582-2757. The conference ID number is 20554874. An online replay will also be available on the Loews Corporation’s website following the call.

A conference call to discuss the first quarter results of CNA has been scheduled for today at 10:00 a.m. ET. A live webcast will be available at www.cna.com. Those interested in participating in the question and answer session should dial (888) 551-9020, or for international callers, (719) 457-2638.

A conference call to discuss the first quarter results of Boardwalk Pipeline has been scheduled for today at 9:30 a.m. ET. A live webcast will be available at www.bwpmlp.com. Those interested in participating in the question and answer session should dial (855) 793-3255 or for international callers, (631) 485-4925. The conference ID number is 21218946.

A conference call to discuss the first quarter results of Diamond Offshore has been scheduled for today at 8:30 a.m. ET. A live webcast will be available at www.diamondoffshore.com. Those interested in participating in the question and answer session should dial (800) 247-9979, or for international callers, (973) 321-1100. The conference ID number is 22913137.

# # #

ABOUT LOEWS CORPORATION

Loews Corporation is a diversified company with three publicly-traded subsidiaries: CNA Financial Corporation (NYSE: CNA), Diamond Offshore Drilling, Inc. (NYSE: DO) and Boardwalk Pipeline Partners, LP (NYSE: BWP); and one wholly owned subsidiary, Loews Hotels & Resorts. For more information please visit www.loews.com.

# # #

FORWARD-LOOKING STATEMENTS

Statements contained in this press release which are not historical facts are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters as well as the Company’s overall business and financial performance can be found in the Company’s reports filed with the Securities and Exchange Commission and readers of this release are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company’s website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of this press release. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Loews Corporation and Subsidiaries

Selected Financial Information

| |

|

Three Months Ended March 31,

|

|

|

(In millions)

|

|

2015

|

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

CNA Financial

|

|

$ |

2,342 |

|

|

$ |

2,421 |

|

|

Diamond Offshore

|

|

|

627 |

|

|

|

710 |

|

|

Boardwalk Pipeline

|

|

|

330 |

|

|

|

357 |

|

|

Loews Hotels

|

|

|

139 |

|

|

|

105 |

|

|

Investment income and other

|

|

|

30 |

|

|

|

53 |

|

| |

|

|

3,468 |

|

|

|

3,646 |

|

|

Investment gains – CNA Financial

|

|

|

10 |

|

|

|

42 |

|

|

Total

|

|

$ |

3,478 |

|

|

$ |

3,688 |

|

| |

|

|

|

|

|

|

|

|

|

Income (Loss) Before Income Tax:

|

|

|

|

|

|

|

|

|

|

CNA Financial

|

|

$ |

304 |

|

|

$ |

259 |

|

|

Diamond Offshore (a)

|

|

|

(287 |

) |

|

|

168 |

|

|

Boardwalk Pipeline (b)

|

|

|

77 |

|

|

|

23 |

|

|

Loews Hotels

|

|

|

10 |

|

|

|

5 |

|

|

Investment income, net

|

|

|

29 |

|

|

|

51 |

|

|

Other (c)

|

|

|

(38 |

) |

|

|

(34 |

) |

| |

|

|

95 |

|

|

|

472 |

|

|

Investment gains – CNA Financial

|

|

|

10 |

|

|

|

42 |

|

|

Total

|

|

$ |

105 |

|

|

$ |

514 |

|

| |

|

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable to Loews Corporation:

|

|

|

|

|

|

|

|

|

|

CNA Financial

|

|

$ |

202 |

|

|

$ |

176 |

|

|

Diamond Offshore (a)

|

|

|

(126 |

) |

|

|

69 |

|

|

Boardwalk Pipeline (b)

|

|

|

25 |

|

|

|

(18 |

) |

|

Loews Hotels

|

|

|

5 |

|

|

|

3 |

|

|

Investment income, net

|

|

|

19 |

|

|

|

34 |

|

|

Other (c)

|

|

|

(24 |

) |

|

|

(23 |

) |

| |

|

|

101 |

|

|

|

241 |

|

|

Investment gains – CNA Financial

|

|

|

8 |

|

|

|

24 |

|

|

Income from continuing operations

|

|

|

109 |

|

|

|

265 |

|

|

Discontinued operations, net (d)

|

|

|

|

|

|

|

(206 |

) |

|

Net income attributable to Loews Corporation

|

|

$ |

109 |

|

|

$ |

59 |

|

|

(a)

|

Includes an asset impairment charge of $359 million ($158 million after tax and noncontrolling interests) for the three months ended March 31, 2015 related to the carrying value of eight drilling rigs.

|

|

(b)

|

Includes a loss of $94 million ($55 million after tax and noncontrolling interests) for the three months ended March 31, 2014 to write off all capitalized costs associated with the Bluegrass project.

|

|

(c)

|

Consists primarily of corporate interest expense and other unallocated expenses.

|

|

(d)

|

See table on page six for a summary of items comprising discontinued operations for 2014.

|

Loews Corporation and Subsidiaries

Consolidated Financial Review

| |

|

Three Months Ended March 31,

|

|

|

(In millions, except per share data)

|

|

2015

|

|

|

2014

|

|

|

Revenues:

|

|

|

|

|

|

|

|

Insurance premiums

|

|

$ |

1,687 |

|

|

$ |

1,806 |

|

|

Net investment income

|

|

|

588 |

|

|

|

577 |

|

|

Investment gains

|

|

|

10 |

|

|

|

42 |

|

|

Contract drilling revenues

|

|

|

600 |

|

|

|

685 |

|

|

Other

|

|

|

593 |

|

|

|

578 |

|

|

Total

|

|

|

3,478 |

|

|

|

3,688 |

|

| |

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

Insurance claims & policyholders’ benefits

|

|

|

1,339 |

|

|

|

1,446 |

|

|

Contract drilling expenses

|

|

|

351 |

|

|

|

370 |

|

|

Other (a) (b)

|

|

|

1,683 |

|

|

|

1,358 |

|

|

Total

|

|

|

3,373 |

|

|

|

3,174 |

|

| |

|

|

|

|

|

|

|

|

|

Income before income tax

|

|

|

105 |

|

|

|

514 |

|

|

Income tax expense

|

|

|

(56 |

) |

|

|

(103 |

) |

|

Income from continuing operations

|

|

|

49 |

|

|

|

411 |

|

|

Discontinued operations, net of income tax

|

|

|

|

|

|

|

(227 |

) |

|

Net income

|

|

|

49 |

|

|

|

184 |

|

|

Amounts attributable to noncontrolling interests

|

|

|

60 |

|

|

|

(125 |

) |

|

Net income attributable to Loews Corporation

|

|

$ |

109 |

|

|

$ |

59 |

|

| |

|

|

|

|

|

|

|

|

|

Net income attributable to Loews Corporation:

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

109 |

|

|

$ |

265 |

|

|

Discontinued operations, net (c)

|

|

|

|

|

|

|

(206 |

) |

|

Net income

|

|

$ |

109 |

|

|

$ |

59 |

|

| |

|

|

|

|

|

|

|

|

|

Diluted income per share:

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.29 |

|

|

$ |

0.68 |

|

|

Discontinued operations, net

|

|

|

|

|

|

|

(0.53 |

) |

|

Diluted income per share attributable to Loews Corporation

|

|

$ |

0.29 |

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted diluted number of shares

|

|

|

373.19 |

|

|

|

388.07 |

|

|

(a)

|

Includes an asset impairment charge of $359 million ($158 million after tax and noncontrolling interests) for the three months ended March 31, 2015 related to the carrying value of eight drilling rigs.

|

|

(b)

|

Includes a loss of $94 million ($55 million after tax and noncontrolling interests) for the three months ended March 31, 2014 to write off all capitalized costs associated with the Bluegrass project.

|

|

(c)

|

See table on page six for a summary of items comprising discontinued operations for 2014.

|

Loews Corporation and Subsidiaries

Discontinued Operations Review

| |

|

Three Months Ended

|

|

|

(In millions)

|

|

March 31, 2014

|

|

| |

|

|

|

|

CNA Financial:

|

|

|

|

|

Continental Assurance Company (“CAC”) operations

|

|

$ |

7 |

|

|

Impairment loss on sale of CAC

|

|

|

(193 |

) |

|

CNA Financial – Discontinued operations, net

|

|

|

(186 |

) |

| |

|

|

|

|

|

HighMount:

|

|

|

|

|

|

Operations

|

|

|

(1 |

) |

|

Ceiling test impairment

|

|

|

(19 |

) |

|

HighMount – Discontinued operations, net

|

|

|

(20 |

) |

| |

|

|

|

|

|

Discontinued operations, net

|

|

$ |

(206 |

) |

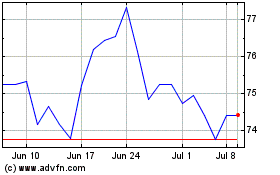

Loews (NYSE:L)

Historical Stock Chart

From Mar 2024 to Apr 2024

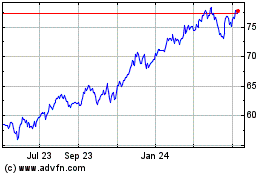

Loews (NYSE:L)

Historical Stock Chart

From Apr 2023 to Apr 2024