By Mike Esterl

The U.S. soda industry faces its biggest threat yet in

Philadelphia, which is weighing a tax that could raise the price of

a can of Coke or Pepsi by more than half and sharply curb

consumption of sugary drinks.

Jim Kenney, who is mayor of Philadelphia, the country's

fifth-largest city, is pitching the budget measure to pay for

prekindergarten and other popular services.

That is a shift in strategy from other municipalities like El

Monte, Calif., and Telluride, Colo., that have lost taxation bids

after playing up the health benefits of scaling back on sweetened

beverages.

Philadelphia's proposed levy of 3 cents an ounce is three times

higher than in Berkeley, Calif., the first U.S. city to pass such a

measure. Philadelphia's city council plans to vote in June on the

tax, which would cover regular soda and other sugar-added beverages

including sports and energy drinks and ice tea.

The American Beverage Association, funded by Coca-Cola Co.,

PepsiCo Inc. and Dr Pepper Snapple Group Inc., has spent more than

$3 million on television and radio ads opposing the measure. A

large coalition including local retailers, restaurants and the

International Brotherhood of Teamsters oppose the tax, warning

grocery bills would soar, jeopardizing thousands of jobs and

hitting the poor the hardest.

Even without the taxes, soda drinkers are peeling off amid

concerns over rising obesity and diabetes rates. U.S. soda volumes

dropped 1.2% in 2015, the 11th straight yearly decline, and

per-capita consumption is at a three-decade low, according to

industry tracker Beverage Digest.

"The answer is not regressive taxes. The answer is, for sure,

collaborative innovation," said Coke Chief Executive Muhtar Kent at

the company's shareholder meeting last month, referring to soda

taxes in general. He cited industry efforts to introduce smaller

package sizes and lower-calorie drinks.

Yet elsewhere in the country, Oakland's city council voted this

month to put a penny-per-ounce tax on the November ballot. In San

Francisco and Boulder, Colo., residents have been collecting

signatures for a similar measure. Baltimore's city council is

considering store signs warning that sugary drinks fuel obesity,

diabetes and tooth decay. San Francisco will start enforcing a law

requiring a similar warning on billboards and other public

advertisements in July.

Mr. Kenney, Philadelphia's mayor since January, has steered

clear of health arguments for sugary-drink taxes, instead selling

his measure as an efficient way to generate nearly $100 million in

annual revenue to fund thousands of pre-K slots, new schools,

libraries, parks and recreation centers.

"I sense Americans generally and I know Philadelphians don't

like the government telling them what they should and should not

do," he said in an interview.

About 59% of Philadelphians backed the sugary drink tax in a

poll by Temple University's Institute for Survey Research published

earlier this month. The city's largest newspaper, the Philadelphia

Inquirer, also has endorsed the proposal. Residents voted

overwhelmingly last year to create a commission to pursue universal

pre-K.

In his March budget speech, Mr. Kenney said he proposed the tax

after a young inmate told him the education program at a local jail

was "the best school" he had ever attended. "There is simply

nowhere else to find this revenue," added Mr. Kenney, noting

Philadelphia already has raised property taxes four times in the

past five years.

But everyone agrees the hefty tax would alter behavior. The

beverage industry estimates Philadelphia's consumption would fall

by 79% in the first year and the mayor's office estimates a 55%

drop. The average Philadelphian consumes about 14 ounces of

sugar-added drinks a day, similar to national estimates. In Mexico,

which introduced a sugary drink tax in 2014, soda sales volumes are

rising again after initially falling. But the more modest levy only

increased prices by about 10%.

A 3-cent-per-ounce tax would raise prices by 55% to 60% on

average if fully passed to consumers, according to city and

industry estimates. Popular discounted packages of soda at

supermarkets such as 2-liter bottles and 12-packs of 12-ounce cans,

which often retail for about $2 and $4, respectively, could double

in price. Free refills at restaurants and movie theaters also could

disappear.

Passage of the tax is far from certain. Three of 17 city council

members have publicly opposed the measure and several have voiced

concerns, including President Darrell Clarke, who has said the tax

likely would have to be lowered to win enough support. Councilwoman

Blondell Reynolds Brown proposed Thursday an alternative flat tax

of 15 cents on most beverage containers. The beverage industry also

hasn't ruled out suing to try to stop the levy.

Opponents, including concerned retailers, predict consumers will

drive to neighboring counties for soda. A hefty tax would "turn

Philadelphia into probably one of the biggest black market cities

in the U.S.," predicted Harold Honickman, chairman of Honickman

Group, which distributes Canada Dry and Snapple in the city.

The soda industry has spent more than $100 million since 2009 to

defeat taxes in more than two dozen cities and states, partly by

arguing they smack of a "nanny state." Philadelphia abandoned a

proposal in 2011 after the industry contributed $10 million to a

local children's hospital.

Meanwhile, money is pouring in from the outside. Michael

Bloomberg, who tried unsuccessfully to cap portion sizes as New

York mayor, has contributed hundreds of thousands of dollars to the

local "yes" coalition. The coalition, Philadelphians For A Fair

Future, is airing TV ads arguing the tax would "help lift our

children" out of poverty.

Philadelphians Against the Grocery Tax Coalition, funded by the

beverage industry, is airing an ad showing paper dolls falling to

the ground and a voice-over warning there won't be enough money for

pre-K if sales plunge. The group said it delivered more than 25,000

letters and petitions opposing the tax to city council members

Thursday, and a protest rally earlier this month drew hundreds,

many wearing "no soda tax" T-shirts, as Teamster drivers circled in

Coca-Cola and Canada Dry trucks and honked.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

May 19, 2016 15:21 ET (19:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

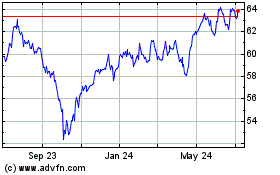

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

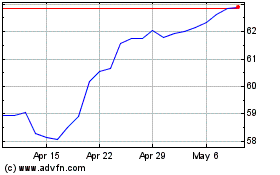

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024