Vinci, Orix Tapped to Operate Two Japanese Airports

November 10 2015 - 7:00AM

Dow Jones News

A group led by a unit of French construction company Vinci SA

and Japanese financial-services firm Orix Corp. was tentatively

selected Tuesday to operate two airports in Osaka in a 44-year

leasing deal valued at more than $13 billion.

The deal, effectively the first privatization of a major airport

operation in Japan, is part of Tokyo's efforts to tap into

private-sector capital and infrastructure expertise.

The Vinci-Orix group said it was chosen by the government-owned

company that currently runs the airports as the "preferred

negotiation right holder." The group said it expected final

documents to be completed in the next few months, with the formal

transfer of operations to take place on April 1, 2016.

The group said it would pay 37.3 billion yen ($302.9 million) a

year for operating rights plus certain revenue-sharing fees if

revenue targets are exceeded, making the deal's value at least ¥

1.64 trillion ($13.3 billion) over the 44-year period. The private

operators also must put up a deposit of ¥ 175 billion.

Vinci Airports and Orix will each hold a 40% stake in the

operating company, with companies from the Osaka region and others

taking the remaining 20%. The group plans to raise ¥ 260 billion

including bank loans to have on hand by the time it takes over

operations.

Osaka is the center of Japan's second-most-populous urban area

after the Tokyo region. The new operator is hoping to capitalize on

the surge in tourists visiting Japan, many of whom visit the

ancient capital of Kyoto near Osaka. It is targeting an increase of

more than 65% in the number of travelers by the final year of the

contract.

The two airports covered by the contract are Kansai

International Airport, completed in 1994 on an artificial island,

and Itami Airport, which serves domestic travelers. Together, they

served about 35 million passengers in the year ended March 2015.

Kansai International is popular among Asia's budget airlines, and

it has direct flights to many cities in China and Southeast

Asia.

Orix is no stranger to aviation, having run an aircraft-leasing

operation. Vinci, which faces a slow construction market at home in

France, has said it plans to expand in businesses abroad. The

company already operates airports in Cambodia, Chile, Portugal and

France.

In Japan's privatization efforts, Prime Minister Shinzo Abe's

government hopes to generate as much as $100 billion of investment

through 2022 and to improve efficiency by selling operating rights

to infrastructure, including water utilities, roads and railways.

Mr. Abe's government is on track to meet its target of 20 million

tourists by this year or next, and it is considering whether to

raise the target.

Earlier this month, government-owned Japan Post Holdings Co. and

two financial units listed shares for the first time on the Tokyo

Stock Exchange, raising some $12 billion.

Several companies in Japan and abroad expressed interest in the

Osaka-airport operating rights initially, but many dropped out

because of the large investment required or inability to build an

alliance that combined local Japanese knowledge with an

international airport operator's experience.

Megumi Fujikawa contributed to this article

Write to Kosaku Narioka at kosaku.narioka@wsj.com and Inti

Landauro at inti.landauro@wsj.com

Access Investor Kit for "VINCI SA"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=FR0000125486

Access Investor Kit for "VINCI SA"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US9273201015

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 10, 2015 06:45 ET (11:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

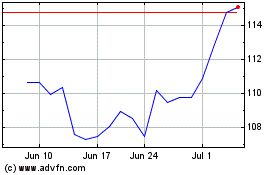

Orix (NYSE:IX)

Historical Stock Chart

From Aug 2024 to Sep 2024

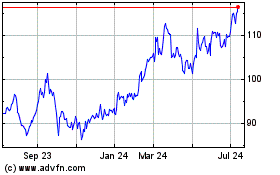

Orix (NYSE:IX)

Historical Stock Chart

From Sep 2023 to Sep 2024