UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 11, 2015 (August 11, 2015)

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

DELAWARE | | 001-33139 | | 20-3530539 |

DELAWARE | | 001-07541 | | 13-1938568 |

(State of incorporation) | | (Commission File Number) | | (I.R.S Employer Identification No.) |

| | | | |

| | 999 Vanderbilt Beach Road, 3rd Floor | | |

| | Naples, Florida 34108 | | |

| | 999 Vanderbilt Beach Road, 3rd Floor | | |

| | Naples, Florida 34108 | | |

| | (Address of principal executive offices, including zip code) | | |

| | | | |

| | (239) 552-5800 | | |

| | (239) 552-5800 | | |

| | (Registrant’s telephone number, including area code) | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On August 11, 2015, Hertz Global Holdings, Inc. (“Hertz Holdings”) and its wholly-owned subsidiary The Hertz Corporation (together with Hertz Holdings, the “Company”) conducted an earnings webcast relating to the Company's financial results for the three months ended June 30, 2015. The earnings webcast was made available to the public via a link on the Investor Relations section of the Hertz website, IR.Hertz.com and the slides that accompanied the presentation were available to the public at the time of the earnings webcast through the Company's website. Certain financial information relating to completed fiscal periods that was part of the earnings webcast is included in the set of slides that accompanied the earnings webcast, a copy of which is attached hereto as Exhibit 99.1.

The earnings webcast included certain non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the comparable measures calculated and presented in accordance with GAAP are attached hereto as part of Exhibit 99.1. The reasons why management believes that the presentation of the non-GAAP financial measures included in the earnings webcast provides useful information regarding the Company's financial condition and results of operations, and additional purposes for which management utilizes the non-GAAP financial measures, are also attached hereto as part of Exhibit 99.1.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements contained in this report, and in related comments by the Company’s management, include “forward-looking statements.” Forward-looking statements include information concerning the Company’s liquidity and its possible or assumed future results of operations, including descriptions of its business strategies. These statements often include words such as “believe,” “expect,” “project,” “potential,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts” or similar expressions. These statements are based on certain assumptions that the Company has made in light of its experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate in these circumstances. The Company believes these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company’s actual results could differ materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on Forms 10-K, 10-Q and 8-K. Among other items, such factors could include: the effect of the restatement of our previously issued financial results for the years ended December 31, 2012 and 2013 and any claims, investigations or proceedings arising as a result; our ability to remediate the material weaknesses in our internal controls over financial reporting; levels of travel demand, particularly with respect to airline passenger traffic in the United States and in global markets; the effect of our proposed separation of our equipment rental business and ability to obtain the expected benefits of any related transaction; significant changes in the competitive environment, including as a result of industry consolidation, and the effect of competition in our markets on rental volume and pricing, including on our pricing policies or use of incentives; occurrences that disrupt rental activity during our peak periods; our ability to achieve and maintain cost savings and efficiencies and realize opportunities to increase productivity and profitability; an increase in our fleet costs as a result of an increase in the cost of new vehicles and/or a decrease in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs; our ability to accurately estimate future levels of rental activity and adjust the size and mix of our fleet accordingly; our ability to maintain sufficient liquidity and the availability to us of additional or continued sources of financing for our revenue earning equipment and to refinance our existing indebtedness; our ability to integrate the car rental operations of Dollar Thrifty and realize operational efficiencies from the acquisition; our ability to maintain access to third-party distribution channels, including current or favorable prices, commission structures and transaction volumes; the operational and profitability impact of the divestitures that we agreed to undertake in order to secure regulatory approval for the acquisition of Dollar Thrifty; an increase in our fleet costs or disruption to our rental activity, particularly during our peak periods, due to safety recalls by the manufacturers of our vehicles and equipment; a major disruption in our communication or centralized information networks; financial instability of the manufacturers of our vehicles and equipment, which could impact their ability to perform under agreements with us and/or their willingness or ability to make cars available to us or the car rental industry on commercially reasonable terms; any impact on us from the actions of our franchisees, dealers and independent contractors; our ability to maintain profitability during adverse economic cycles and unfavorable external events (including war, terrorist acts, natural disasters and epidemic disease); shortages of fuel and increases or volatility in fuel costs; our ability to successfully integrate acquisitions and complete dispositions; our ability to maintain favorable brand recognition; costs and risks associated with litigation and investigations; risks related to our indebtedness, including our substantial amount of debt, our ability to incur substantially more debt and increases in interest rates or in our borrowing margins; our ability to meet the financial and other covenants contained in our Senior Credit Facilities, our outstanding unsecured Senior Notes and certain asset-backed and asset-based arrangements; changes in accounting principles, or their application or interpretation, and our ability to make accurate estimates and the assumptions underlying the estimates, which could have an effect on earnings; changes in the existing, or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations where such actions may affect our operations, the cost thereof or applicable tax rates; changes to our senior management team; the effect of tangible and intangible asset impairment charges; our exposure to uninsured claims in excess of historical levels; fluctuations in interest rates and commodity prices; and our exposure to fluctuations in foreign exchange rates.

Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit 99.1 Slides relating to the August 11, 2015 earnings webcast.

Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except as shall be expressly set forth by specific reference in a filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| HERTZ GLOBAL HOLDINGS, INC. THE HERTZ CORPORATION |

| (Registrant) |

| | |

| | |

| By: | /s/ Thomas C. Kennedy |

| Name: | Thomas C. Kennedy |

| Title: | Senior Executive Vice President and

Chief Financial Officer |

Date: August 11, 2015

2Q 2015 Earnings Call August 11, 2015 8:00am ET

2 Safe Harbor Statement Certain statements made within this presentation contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements are not guarantees of performance and by their nature are subject to inherent uncertainties. Actual results may differ materially. Any forward-looking information relayed in this presentation speaks only as of August 11, 2015, and the Company undertakes no obligation to update that information to reflect changed circumstances. Additional information concerning these statements is contained in the Company’s press release regarding its Second Quarter results issued on August 10, 2015, and the Risk Factors and Forward-Looking Statements sections of the Company’s 2014 Annual Report on Form 10-K and 2015 Quarterly Reports on Form 10-Q. Copies of these filings are available from the SEC, the Hertz web site or the Company’s Investor Relations Department.

3 *Definitions and reconciliations of these non-GAAP measures are provided at the end of the presentation. The following non-GAAP* measures will be used in the presentation: Corporate EBITDA Corporate EBITDA Margin Adjusted Pre-Tax Income Adjusted Net Income Adjusted Diluted Earnings Per Share (Adjusted EPS) Total RPD Non-GAAP Measures Net Depreciation Per Unit Per Month Net Corporate Debt Net Fleet Debt Free Cash Flow Adjusted Interest Expense

4 Today’s Agenda John Tague President & Chief Executive Officer Hertz Global Holdings Tom Kennedy Sr. EVP & Chief Financial Officer Hertz Global Holdings Business Overview John Tague Financial Results Overview Tom Kennedy Questions & Answers Session John Tague Tom Kennedy Larry Silber Larry Silber President & Chief Executive Officer Hertz Equipment Rental

5 Positioned for Improvement Improved fleet management, processes and systems helping to reverse performance trends in 2H:15 • Management assessing businesses and beginning to institute improvement plans • Disposing of high mileage vehicles • Onboarding new vehicles • Aligning fleet with profitable demand • Average vehicle mileage substantially lower • Capacity aligned heading into July peak • Fleet efficiency improving 1H:15 2H:15 • Resolving systems instability • Addressing data integrity issues • Systems fully operational, more reliable data with expanded analytical capabilities • Rolling out Dollar, Thrifty and Hertz integrated counter system in August; launched financial systems integration in July • Teams now collaborating on core set of well- defined initiatives focused on efficiency, process excellence, and service and product quality U.S. RAC

6 $200M FY:15 Cost Savings Update Potential for additional savings from technology-enabled opportunities Corporate/ Operations Overhead Freezing defined benefit pension plan Eliminating Navigation Solutions redundancies Closing unprofitable off-airport facilities Consolidating third-party IT spend Clearing non-value added IT projects Fleet Management Reducing out-of-service cycle times through process efficiencies and increased accountability Sales and Marketing Areas of savings include: Disciplined return on investment practices, including reorganizing rental car sales force Realized ~$80M of Cost Savings in 1H:15

7 Tom Kennedy CFO • FINANCIAL RESULTS • CASH FLOW REVIEW • BALANCE SHEET REVIEW

8 2Q:15 Results C * Definitions and reconciliations of these non-GAAP measures are provided at the end of the presentation. GAAP 2Q:15 Results 2Q:14 Results YoY Change Revenue $2,692 $2,830 (5%) Income before income taxes $50 $121 (59%) Net income $23 $72 (68%) Diluted earnings per share $0.05 $0.15 (67%) Diluted shares outstanding 461 465 (1%) Non-GAAP* Corporate EBITDA $379 $446 (15%) Corporate EBITDA margin 14% 16% (200 bps) Adjusted Pre-tax income $153 $216 (29%) Adjusted Net income $88 $132 (33%) Adjusted EPS $0.19 $0.28 (32%) ($ in millions, except per share amounts)

9 U.S. RAC Total Revenue 2Q:15 Note: Total RPD calculated using Total Revenue less ancillary retail car sales revenue Airport Total RPD down for Hertz brand, up for DTG brands Off-airport insurance replacement revenue as a percent of total off airport revenue increased 7 ppts YoY to 37% Average fleet increased 2% YoY, re-aligned by quarter end June 2015 airport revenue ex-fuel up, first monthly YoY increase since Sept. 2014 Airport RPD Off Airport RPD On Airport 76% of U.S. RAC Revenue Off Airport 24% of U.S. RAC Revenue Total RPD Total Total Total Total Ex Fuel Total Ex Fuel Total Ex Fuel (0.8%) 0.1% (0.5%) 0.5% (2.0%) (1.5%) Transaction Days: Total Airport Off Airport (2.4%) (2.4%) (2.5%)

10 Cautious 2H:15 Outlook U.S. RAC Depreciation Model year 2016 fleet buy not yet completed Approximately one-third of MY 2016 vehicles expected to be delivered in 2H:15 Third-party residual value forecasts are pointing to a continued moderate decline for the back half and into next year Monthly Dep. per Unit 2015 2014 1Q $ 287 $ 288 2Q $ 259 $ 259 Six Months June 30 $ 273 $ 273 Full Year $ 295-305 $ 294 FY:15E monthly depreciation per vehicle of $295-$305 may be conservative depending on residual value trends

11 International Car Rental 2Q:15 Revenue +4% YoY, excluding FX Volume +4% RPD unchanged, excl. FX, driven by mix shift toward value brands DOE + SG&A down 80bps as a % of revenue 200 basis point improvement in fleet efficiency Monthly depreciation per unit down 4% excluding FX Corporate EBITDA declined YoY due to FX and one-time items

12 HERC Revenue 2Q:15 N.A. upstream oil and gas in major markets was 11% of total rental and rental-related revenue, excl. FX N.A. upstream rental and rental-related revenue down 30% YoY, excl. FX, on substantial volume weakness and 3% pricing decline N.A. all other rental and rental-related revenue up 6%, excl. FX Note: Pricing and volume data exclude Cinelease due to the nature of that business Pricing N.A. national accounts 51% of revenue vs. 54% 2Q:14 due to expansion of local customer base Upstream oil and gas pricing pressure Volume New accounts in construction sectors and specialty and niche markets offset weakness from upstream oil and gas YoY % change Revenue* Rental Revenue* Volume Pricing WW HERC 1% 1% 2% 1% N.A. 1% 1% 3% 1% U.S. 6% 5% 4% 2% * Excludes FX impact

13 HERC Corporate EBITDA 2Q:15 Revenue improvement is a priority Expanding and diversifying customer base with focus on local accounts Decentralizing reporting structure, reorganizing sales force • Better field accountability, more focused asset management, improved customer service N.A. time utilization down 80bps; dollar utilization down 130bps Excluding energy markets, N.A. time utilization up 70bps Utilization improvement is a priority Investing to reduce out of service equipment Improving location footprint to enhance fleet sharing Increasing mix of specialty equipment for longer rental transactions WW Corporate EBITDA down $19M YoY Weakness in upstream oil and gas markets accounted for approximately $20M of decline partially offset by improvement in other categories FY:15E HERC Corporate EBITDA $575-$625M

14 HERC Key Metrics 36% 37% 39% 38% 35% 36% 38% 39% 35% 35% 1Q 2Q 3Q 4Q NA Dollar Utilization 2013 2014 2015 62% 65% 68% 66% 62% 64% 67% 68% 63% 63% 1Q 2Q 3Q 4Q NA Time Utilization 2013 2014 2015 672 615 352 2013 2014 1H:15 WW FY Gross Purchases* 534 433 259 2013 2014 1H:15 WW FY Net Fleet Purchases* * Includes non-cash purchases and sales FY:15E net fleet capex $410M to $430M Avg fleet age 41 mos vs. 42 mos. 2Q:14

15 Interest Expense Summary (millions) 2015 2014 2Q $156 $164 YTD 2Q $310 $320 2015 2014 2Q $140 $151 YTD 2Q $278 $295 Remained flat as % of Rev GAAP Interest Expense* Adjusted Interest Expense* * Net of interest income

16 Free Cash Flow 1H:15 1H:14 Chg GAAP Pretax Income $(37) $58 $(95) PP&E (non fleet) depr. exp. + amortization exp. 198 205 (7) Cash Taxes (19) (33) 14 Net Working Capital/Other (58) (221) 163 Operating Cash Flow excl. fleet depr. add-back $84 $9 $75 RAC Fleet Growth (net capex + depr. exp. & net fleet financing) 110 (542) 652 HERC Fleet Growth (net capex + depr. exp.) (101) (50) (51) PP&E Net Capital Expenditures (123) (106) (17) Net Investment $(114) $(698) $584 FREE CASH FLOW $(30) $(689) $659 ($ in millions)

17 Liquidity and Debt ($ in millions) ABL Availability: $1,027 Unrestricted Cash: 537 Corporate Liquidity: $1,564 Total net corporate debt $6.0 billion Total net fleet debt $10.7 billion Net corporate debt / LTM corporate EBITDA ratio 4.9x Corporate Liquidity at June 30, 2015

18 OUTLOOK

19 FY:15 Financial Guidance Reaffirmed Full Year 2015 Forecast Corporate EBITDA - Consolidated HGH $1,450M - $1,550M WW HERC Corporate EBITDA $575M - $625M U.S. RAC Monthly Depreciation per unit $295 - $305 U.S. RAC fleet capacity growth1 0.5% - 1.5% Net non-fleet capex $275M - $295M Effective tax rate 37% 1Excludes Advantage sublease and Hertz 24/7 vehicles 2H:15 U.S. RAC DEPRECIATION: Likely conservative, but MY2016 acquisition not yet completed, residual values estimated lower HERC Corporate EBITDA: Growth in new accounts and investments in fleet maintenance to drive utilization, partially offset by oil and gas weakness Assumes continued HERC pressure due to weak oil and gas markets; continued improvements in U.S. and International RAC businesses

Q&A

FINANCIAL INFORMATION AND OPERATING DATA

SELECTED UNAUDITED CONSOLIDATED INCOME STATEMENT DATA

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

(In millions, except per share data) | 2015 | | 2014 | | 2015 | | 2014 |

Total revenues | $ | 2,692 |

| | $ | 2,830 |

| | $ | 5,145 |

| | $ | 5,366 |

|

Expenses: | | | | | | | |

Direct operating | 1,505 |

| | 1,594 |

| | 2,913 |

| | 3,037 |

|

Depreciation of revenue earning equipment and lease charges, net | 696 |

| | 708 |

| | 1,403 |

| | 1,434 |

|

Selling, general and administrative | 295 |

| | 264 |

| | 560 |

| | 541 |

|

Interest expense, net | 156 |

| | 164 |

| | 310 |

| | 320 |

|

Other (income) expense, net | (10 | ) | | (21 | ) | | (4 | ) | | (24 | ) |

Total expenses | 2,642 |

| | 2,709 |

| | 5,182 |

| | 5,308 |

|

Income (loss) before income taxes | 50 |

| | 121 |

| | (37 | ) | | 58 |

|

(Provision) benefit for taxes on income (loss) | (27 | ) | | (49 | ) | | (10 | ) | | (56 | ) |

Net income (loss) | $ | 23 |

| | $ | 72 |

| | $ | (47 | ) | | $ | 2 |

|

Weighted average number of shares outstanding: | | | | | | | |

Basic | 459 |

| | 452 |

| | 459 |

| | 450 |

|

Diluted | 461 |

| | 465 |

| | 459 |

| | 457 |

|

Earnings (loss) per share: | | | | | | | |

Basic | $ | 0.05 |

| | $ | 0.16 |

| | $ | (0.10 | ) | | $ | — |

|

Diluted | $ | 0.05 |

| | $ | 0.15 |

| | $ | (0.10 | ) | | $ | — |

|

| | | | | | | |

Corporate EBITDA (a) | $ | 379 |

| | $ | 446 |

| | $ | 605 |

| | $ | 699 |

|

Adjusted pre-tax Income (loss) (a) | 153 |

| | 216 |

| | 156 |

| | 239 |

|

| |

(a) | Represents a non-GAAP measure, see the accompanying reconciliations included in Supplemental Schedule III. |

SELECTED UNAUDITED CONSOLIDATED BALANCE SHEET DATA

|

| | | | | | | |

(In millions) | June 30, 2015 | | December 31, 2014 |

Cash and cash equivalents | $ | 537 |

| | $ | 490 |

|

Restricted cash | 421 |

| | 571 |

|

Revenue earning equipment: | | | |

U.S. Car Rental | 9,322 |

| | 8,070 |

|

International Car Rental | 2,779 |

| | 1,904 |

|

Worldwide Equipment Rental | 2,607 |

| | 2,442 |

|

All Other Operations | 1,288 |

| | 1,237 |

|

Total revenue earning equipment, net | 15,996 |

| | 13,653 |

|

Total assets | 25,969 |

| | 23,985 |

|

Total debt | 17,682 |

| | 15,993 |

|

Net Fleet debt (a) | 10,686 |

| | 9,047 |

|

Net Corporate debt (a) (b) | 6,038 |

| | 5,885 |

|

Total equity | 2,387 |

| | 2,464 |

|

| |

(a) | Represents a non-GAAP measure, see the accompanying reconciliations included in Supplemental Schedule VI. |

| |

(b) | Fleet related to Hertz Equipment Rental Corporation is funded via Net Corporate Debt. |

SELECTED UNAUDITED CONSOLIDATED CASH FLOW DATA

|

| | | | | | | |

| Six Months Ended

June 30, |

(In millions) | 2015 | | 2014 |

Cash provided by (used in): | | | |

Operating activities | $ | 1,451 |

| | $ | 1,402 |

|

Investing activities | (3,156 | ) | | (2,248 | ) |

Financing activities | 1,769 |

| | 977 |

|

Effect of exchange rate changes | (17 | ) | | (2 | ) |

Net change in cash and cash equivalents | $ | 47 |

| | $ | 129 |

|

| | | |

Fleet growth (a) | $ | 9 |

| | $ | (592 | ) |

Free cash flow (a) | (30 | ) | | (689 | ) |

| |

(a) | Represents a non-GAAP measure, see the accompanying reconciliations included in Supplemental Schedules IV and V. |

SELECTED UNAUDITED OPERATING DATA BY SEGMENT

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

U.S. Car Rental | | | | | | | |

Transaction days (in thousands) | 34,977 |

| | 35,850 |

| | 67,014 |

| | 68,210 |

|

Total RPD (a) | $ | 45.80 |

| | $ | 46.19 |

| | $ | 46.41 |

| | $ | 47.00 |

|

Average fleet | 511,700 |

| | 502,500 |

| | 500,500 |

| | 497,000 |

|

Fleet efficiency(a) | 75 | % | | 79 | % | | 74 | % | | 77 | % |

Net depreciation per unit per month(a) | $ | 259 |

| | $ | 259 |

| | $ | 273 |

| | $ | 273 |

|

Program cars as a percentage of total average fleet at period end | 29 | % | | 16 | % | | 29 | % | | 16 | % |

Adjusted pre-tax income (loss)(in millions) (a) | $ | 174 |

| | $ | 184 |

| | $ | 244 |

| | $ | 306 |

|

International Car Rental | | | | | | | |

Transaction days (in thousands) | 12,523 |

| | 12,096 |

| | 22,298 |

| | 21,491 |

|

Total RPD (a)(b) | $ | 47.59 |

| | $ | 47.45 |

| | $ | 47.31 |

| | $ | 47.04 |

|

Average Fleet | 173,700 |

| | 172,300 |

| | 158,800 |

| | 157,000 |

|

Fleet efficiency(a) | 79 | % | | 77 | % | | 78 | % | | 76 | % |

Net depreciation per unit per month(a)(b) | $ | 207 |

| | $ | 215 |

| | $ | 218 |

| | $ | 227 |

|

Program cars as a percentage of total average fleet at period end | 46 | % | | 42 | % | | 46 | % | | 42 | % |

Adjusted pre-tax income (loss)(in millions) (a) | $ | 45 |

| | $ | 57 |

| | $ | 52 |

| | $ | 16 |

|

Worldwide Equipment Rental | | | | | | | |

Dollar utilization | 34 | % | | 35 | % | | 34 | % | | 35 | % |

Time utilization | 63 | % | | 63 | % | | 62 | % | | 62 | % |

Rental and rental related revenue (in millions) (a)(b) | $ | 352 |

| | $ | 348 |

| | $ | 689 |

| | $ | 675 |

|

Same store revenue growth, including growth initiatives (b) | (1 | )% | | 4 | % | | — | % | | 5 | % |

Adjusted pre-tax income (loss) (in millions) (a) | $ | 42 |

| | $ | 67 |

| | $ | 76 |

| | $ | 121 |

|

All Other Operations | | | | | | | |

Average fleet — Donlen | 165,600 |

| | 177,800 |

| | 167,100 |

| | 177,300 |

|

Adjusted pre-tax income (loss) (in millions) (a) | $ | 17 |

| | $ | 15 |

| | $ | 31 |

| | $ | 29 |

|

| |

(a) | Represents a non-GAAP measure, see the accompanying reconciliations included in Supplemental Schedules III and VI. |

| |

(b) | Based on December 31, 2014 foreign exchange rates. |

Supplemental Schedule I

HERTZ GLOBAL HOLDINGS, INC.

CONDENSED STATEMENT OF OPERATIONS BY SEGMENT

Unaudited

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2015 | | Three Months Ended June 30, 2014 |

(In millions) | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH | | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH |

Total revenues: | $ | 1,615 |

| | $ | 556 |

| | $ | 375 |

| | $ | 146 |

| | $ | — |

| | $ | 2,692 |

| | $ | 1,663 |

| | $ | 641 |

| | $ | 384 |

| | $ | 142 |

| | $ | — |

| | $ | 2,830 |

|

Expenses: | | | | | | | | | | | | | | | | | | | | | | | |

Direct operating | 945 |

| | 332 |

| | 214 |

| | 6 |

| | 8 |

| | 1,505 |

| | 990 |

| | 394 |

| | 210 |

| | 6 |

| | (6 | ) | | 1,594 |

|

Depreciation of revenue earning equipment and lease charges, net | 398 |

| | 101 |

| | 81 |

| | 116 |

| | — |

| | 696 |

| | 391 |

| | 124 |

| | 79 |

| | 114 |

| | — |

| | 708 |

|

Selling, general and administrative | 100 |

| | 69 |

| | 47 |

| | 8 |

| | 71 |

| | 295 |

| | 93 |

| | 63 |

| | 35 |

| | 8 |

| | 65 |

| | 264 |

|

Interest expense, net | 41 |

| | 18 |

| | 15 |

| | 2 |

| | 80 |

| | 156 |

| | 44 |

| | 25 |

| | 12 |

| | 3 |

| | 80 |

| | 164 |

|

Other (income) expense, net | (1 | ) | | — |

| | (2 | ) | | — |

| | (7 | ) | | (10 | ) | | (22 | ) | | 3 |

| | (1 | ) | | — |

| | (1 | ) | | (21 | ) |

Total expenses | 1,483 |

| | 520 |

| | 355 |

| | 132 |

| | 152 |

| | 2,642 |

| | 1,496 |

| | 609 |

| | 335 |

| | 131 |

| | 138 |

| | 2,709 |

|

Income (loss)before income taxes | $ | 132 |

| | $ | 36 |

| | $ | 20 |

| | $ | 14 |

| | $ | (152 | ) | | 50 |

| | $ | 167 |

| | $ | 32 |

| | $ | 49 |

| | $ | 11 |

| | $ | (138 | ) | | 121 |

|

(Provision) benefit for taxes on income (loss) | | | | | | | | | | | (27 | ) | | | | | | | | | | | | (49 | ) |

Net income (loss) | | | | | | | | | | | $ | 23 |

| | | | | | | | | | | | $ | 72 |

|

Supplemental Schedule I (continued)

HERTZ GLOBAL HOLDINGS, INC.

CONDENSED STATEMENT OF OPERATIONS BY SEGMENT

Unaudited

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2015 | | Six Months Ended June 30, 2014 |

(In millions) | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH | | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH |

Total revenues: | $ | 3,135 |

| | $ | 992 |

| | $ | 730 |

| | $ | 288 |

| | $ | — |

| | $ | 5,145 |

| | $ | 3,220 |

| | $ | 1,123 |

| | $ | 743 |

| | $ | 280 |

| | $ | — |

| | $ | 5,366 |

|

Expenses: | | | | | | | | | | | | | | | | | | | | | | | |

Direct operating | 1,871 |

| | 599 |

| | 422 |

| | 11 |

| | 10 |

| | 2,913 |

| | 1,898 |

| | 723 |

| | 410 |

| | 12 |

| | (6 | ) | | 3,037 |

|

Depreciation of revenue earning equipment and lease charges, net | 819 |

| | 196 |

| | 157 |

| | 231 |

| | — |

| | 1,403 |

| | 815 |

| | 238 |

| | 157 |

| | 224 |

| | — |

| | 1,434 |

|

Selling, general and administrative | 197 |

| | 125 |

| | 93 |

| | 16 |

| | 129 |

| | 560 |

| | 193 |

| | 126 |

| | 67 |

| | 16 |

| | 139 |

| | 541 |

|

Interest expense, net | 82 |

| | 34 |

| | 29 |

| | 5 |

| | 160 |

| | 310 |

| | 81 |

| | 46 |

| | 25 |

| | 7 |

| | 161 |

| | 320 |

|

Other (income) expense, net | (1 | ) | | — |

| | (3 | ) | | — |

| | — |

| | (4 | ) | | (29 | ) | | 3 |

| | (2 | ) | | — |

| | 4 |

| | (24 | ) |

Total expenses | 2,968 |

| | 954 |

| | 698 |

| | 263 |

| | 299 |

| | 5,182 |

| | 2,958 |

| | 1,136 |

| | 657 |

| | 259 |

| | 298 |

| | 5,308 |

|

Income (loss) before income taxes | $ | 167 |

| | $ | 38 |

| | $ | 32 |

| | $ | 25 |

| | $ | (299 | ) | | (37 | ) | | $ | 262 |

| | $ | (13 | ) | | $ | 86 |

| | $ | 21 |

| | $ | (298 | ) | | 58 |

|

(Provision) benefit for taxes on income (loss) | | | | | | | | | | | (10 | ) | | | | | | | | | | | | (56 | ) |

Net income (loss) | | | | | | | | | | | $ | (47 | ) | | | | | | | | | | | | $ | 2 |

|

Supplemental Schedule II

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATION OF CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

TO ADJUSTED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2015 | | Three Months Ended June 30, 2014 |

(In millions, except per share data) | GAAP | | Adjustments | | Adjusted (Non-GAAP) | | GAAP | | Adjustments | | Adjusted

(Non-GAAP) |

Total revenues | $ | 2,692 |

| | $ | — |

| | $ | 2,692 |

| | $ | 2,830 |

| | $ | — |

| | $ | 2,830 |

|

Expenses: | | | | | | | | | | | |

Direct operating | 1,505 |

| | (48 | ) | (a) | 1,457 |

| | 1,594 |

| | (59 | ) | (a) | 1,535 |

|

Depreciation of revenue earning equipment and lease charges, net | 696 |

| | — |

| (b) | 696 |

| | 708 |

| | (6 | ) | (b) | 702 |

|

Selling, general and administrative | 295 |

| | (43 | ) | (c) | 252 |

| | 264 |

| | (34 | ) | (c) | 230 |

|

Interest expense, net | 156 |

| | (16 | ) | (d) | 140 |

| | 164 |

| | (13 | ) | (d) | 151 |

|

Other (income) expense, net | (10 | ) | | 4 |

| (e) | (6 | ) | | (21 | ) | | 17 |

| (e) | (4 | ) |

Total expenses | 2,642 |

| | (103 | ) | | 2,539 |

| | 2,709 |

| | (95 | ) | | 2,614 |

|

Income (loss) before income taxes | 50 |

| | 103 |

| | 153 |

| | 121 |

| | 95 |

| | 216 |

|

(Provision) benefit for taxes on income (loss) | (27 | ) | | (38 | ) | (f) | (65 | ) | | (49 | ) | | (35 | ) | (f) | (84 | ) |

Net income (loss) | $ | 23 |

| | $ | 65 |

| | $ | 88 |

| | $ | 72 |

| | $ | 60 |

| | $ | 132 |

|

Weighted average number of diluted shares outstanding | 461 |

| | 461 |

| | 461 |

| | 465 |

| | 465 |

| | 465 |

|

Diluted earnings (loss) per share (g) | $ | 0.05 |

| | $ | 0.14 |

| | $ | 0.19 |

| | $ | 0.15 |

| | $ | 0.13 |

| | $ | 0.28 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2015 | | Six Months Ended June 30, 2014 |

(In millions, except per share data) | GAAP | | Adjustments | | Adjusted

(Non-GAAP) | | GAAP | | Adjustments | | Adjusted

(Non-GAAP) |

Total revenues | $ | 5,145 |

| | $ | — |

| | $ | 5,145 |

| | $ | 5,366 |

| | $ | — |

| | $ | 5,366 |

|

Expenses: | | | | | | | | | | | |

Direct operating | 2,913 |

| | (81 | ) | (a) | 2,832 |

| | 3,037 |

| | (104 | ) | (a) | 2,933 |

|

Depreciation of revenue earning equipment and lease charges, net | 1,403 |

| | — |

| (b) | 1,403 |

| | 1,434 |

| | (8 | ) | (b) | 1,426 |

|

Selling, general and administrative | 560 |

| | (81 | ) | (c) | 479 |

| | 541 |

| | (72 | ) | (c) | 469 |

|

Interest expense, net | 310 |

| | (32 | ) | (d) | 278 |

| | 320 |

| | (25 | ) | (d) | 295 |

|

Other (income) expense, net | (4 | ) | | 1 |

| (e) | (3 | ) | | (24 | ) | | 28 |

| (e) | 4 |

|

Total expenses | 5,182 |

| | (193 | ) | | 4,989 |

| | 5,308 |

| | (181 | ) | | 5,127 |

|

Income (loss) before income taxes | (37 | ) | | 193 |

| | 156 |

| | 58 |

| | 181 |

| | 239 |

|

(Provision) benefit for taxes on income (loss) | (10 | ) | | (71 | ) | (f) | (81 | ) | | (56 | ) | | (67 | ) | (f) | (123 | ) |

Net income (loss) | $ | (47 | ) | | $ | 122 |

| | $ | 75 |

| | $ | 2 |

| | $ | 114 |

| | $ | 116 |

|

Weighted average number of diluted shares outstanding | 459 |

| | 459 |

| | 459 |

| | 457 |

| | 457 |

| | 457 |

|

Diluted earnings (loss) per share (g) | $ | (0.10 | ) | | $ | 0.27 |

| | $ | 0.16 |

| | $ | — |

| | $ | 0.25 |

| | $ | 0.25 |

|

| |

a. | Represents the increase in amortization of other intangible assets, depreciation of property and equipment and accretion of certain revalued liabilities relating to purchase accounting. For the three months ended June 30, 2015 and 2014, also includes restructuring and restructuring related charges of $16 million and $27 million, respectively. For the six months ended June 30, 2015 and 2014, also includes restructuring and restructuring related charges of $18 million and $40 million, respectively. |

| |

b. | In 2014, represents the increase in depreciation of equipment rental revenue earning equipment based upon its revaluation relating to purchase accounting. There were no adjustments for depreciation of equipment rental revenue earning equipment in 2015. |

| |

c. | For the three months ended June 30, 2015 and 2014, primarily comprised of restructuring and restructuring related charges of $30 million and $15 million, respectively, expenses associated with the anticipated HERC spin-off transaction announced in March 2014 of $8 million and $12 million, respectively, consulting costs and legal fees related to the accounting review and investigation, expenses associated with acquisitions, integration charges and relocation expenses associated with the Company's relocation of its headquarters to Estero, Florida. For the six months ended June 30, 2015 and 2014, primarily comprised of restructuring and restructuring related charges of $53 million and $41 million, respectively, expenses associated with the anticipated HERC spin-off transaction announced in March 2014 of $17 million and $12 million, respectively, consulting costs and legal fees related to the accounting review and investigation, expenses associated with acquisitions, integration charges and relocation expenses associated with the Company's relocation of its headquarters to Estero, Florida. The three and six months ended June 30, 2015 also include costs associated with the separation of certain executives. |

| |

d. | Represents debt-related charges relating to the amortization of deferred debt financing costs and debt discounts. |

| |

e. | In 2014, primarily represents a $19 million litigation settlement received in relation to a class action lawsuit filed against an original equipment manufacturer stemming from recalls of their vehicles in previous years. |

| |

f. | Represents a provision for income taxes derived utilizing a normalized income tax rate (37% for 2015 and 2014). |

Supplemental Schedule III

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATION OF INCOME (LOSS) BEFORE INCOME TAXES

TO EBITDA, CORPORATE EBITDA AND ADJUSTED PRE-TAX INCOME (LOSS) BY SEGMENT

Unaudited

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2015 | | Three Months Ended June 30, 2014 |

(In millions) | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH | | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH |

Income (loss) before income taxes | $ | 132 |

| | $ | 36 |

| | $ | 20 |

| | $ | 14 |

| | $ | (152 | ) | | $ | 50 |

| | $ | 167 |

| | $ | 32 |

| | $ | 49 |

| | $ | 11 |

| $ | 10 |

| $ | (138 | ) | | $ | 121 |

|

Depreciation and amortization | 447 |

| | 110 |

| | 100 |

| | 117 |

| | 5 |

| | 779 |

| | 447 |

| | 135 |

| | 97 |

| | 116 |

| | 4 |

| | 799 |

|

Interest, net of interest income | 41 |

| | 18 |

| | 15 |

| | 2 |

| | 80 |

| | 156 |

| | 44 |

| | 25 |

| | 12 |

| | 3 |

| | 80 |

| | 164 |

|

EBITDA | $ | 620 |

| | $ | 164 |

| | $ | 135 |

| | $ | 133 |

| | $ | (67 | ) | | $ | 985 |

| | $ | 658 |

| | $ | 192 |

| | $ | 158 |

| | $ | 130 |

| | $ | (54 | ) | | $ | 1,084 |

|

Car rental fleet depreciation and lease charges, net | (398 | ) | | (101 | ) | | — |

| | (116 | ) | | — |

| | (615 | ) | | (391 | ) | | (124 | ) | | — |

| | (114 | ) | | — |

| | (629 | ) |

Car rental fleet interest | (43 | ) | | (16 | ) | | — |

| | (3 | ) | | — |

| | (62 | ) | | (45 | ) | | (22 | ) | | — |

| | (3 | ) | | — |

| | (70 | ) |

Car rental fleet debt related charges (a) | 8 |

| | 2 |

| | — |

| | 1 |

| | — |

| | 11 |

| | 1 |

| | 5 |

| | — |

| | 1 |

| | — |

| | 7 |

|

Non-cash stock-based employee compensation charges | — |

| | — |

| | — |

| | — |

| | 5 |

| | 5 |

| | — |

| | — |

| | — |

| | — |

| | 5 |

| | 5 |

|

Restructuring and restructuring related charges (b) | 16 |

| | 5 |

| | 6 |

| | — |

| | 20 |

| | 47 |

| | 4 |

| | 14 |

| | 2 |

| | — |

| | 11 |

| | 31 |

|

Acquisition related costs and charges | — |

| | — |

| | — |

| | — |

| | 1 |

| | 1 |

| | — |

| | — |

| | — |

| | — |

| | 2 |

| | 2 |

|

Equipment rental spin-off costs (c) | — |

| | — |

| | 7 |

| | — |

| | 1 |

| | 8 |

| | — |

| | — |

| | 6 |

| | — |

| | 6 |

| | 12 |

|

Impairment charges and write-downs (d) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 10 |

| | — |

| | — |

| | — |

| | — |

| | 10 |

|

Integration expenses (e) | — |

| | — |

| | — |

| | — |

| | 3 |

| | 3 |

| | — |

| | — |

| | — |

| | — |

| | 3 |

| | 3 |

|

Relocation costs (f) | — |

| | — |

| | — |

| | — |

| | 1 |

| | 1 |

| | — |

| | — |

| | — |

| | — |

| | 3 |

| | 3 |

|

Other extraordinary, unusual or non-recurring items(g) | — |

| | — |

| | (1 | ) | | — |

| | (4 | ) | | (5 | ) | | (16 | ) | | 3 |

| | — |

| | — |

| | 1 |

| | (12 | ) |

Corporate EBITDA | $ | 203 |

| | $ | 54 |

| | $ | 147 |

| | $ | 15 |

| | $ | (40 | ) | | $ | 379 |

| | $ | 221 |

| | $ | 68 |

| | $ | 166 |

| | $ | 14 |

| | $ | (23 | ) | | $ | 446 |

|

Non-fleet depreciation and amortization(h) | (49 | ) | | (9 | ) | | (100 | ) | | (1 | ) | | (5 | ) | | (164 | ) | | (56 | ) | | (11 | ) | | (97 | ) | | (2 | ) | | (4 | ) | | (170 | ) |

Non-fleet interest, net of interest income | 2 |

| | (2 | ) | | (15 | ) | | 1 |

| | (80 | ) | | (94 | ) | | 1 |

| | (3 | ) | | (12 | ) | | — |

| | (80 | ) | | (94 | ) |

Non-fleet debt related charges (a) | — |

| | — |

| | 1 |

| | — |

| | 4 |

| | 5 |

| | 1 |

| | — |

| | 1 |

| | — |

| | 4 |

| | 6 |

|

Non-cash stock-based employee compensation charges | — |

| | — |

| | — |

| | — |

| | (5 | ) | | (5 | ) | | — |

| | — |

| | — |

| | — |

| | (5 | ) | | (5 | ) |

Acquisition accounting (i) | 18 |

| | 2 |

| | 9 |

| | 2 |

| | 1 |

| | 32 |

| | 17 |

| | 3 |

| | 9 |

| | 3 |

| | 1 |

| | 33 |

|

Adjusted pre-tax income (loss) | $ | 174 |

| | $ | 45 |

| | $ | 42 |

| | $ | 17 |

| | $ | (125 | ) | | $ | 153 |

| | $ | 184 |

| | $ | 57 |

| | $ | 67 |

| | $ | 15 |

| | $ | (107 | ) | | $ | 216 |

|

Supplemental Schedule III (continued)

HERTZ GLOBAL HOLDINGS, INCRECONCILIATION OF INCOME (LOSS) BEFORE INCOME TAXES

TO EBITDA, CORPORATE EBITDA AND ADJUSTED PRE-TAX INCOME (LOSS) BY SEGMENT

Unaudited

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2015 | | Six Months Ended June 30, 2014 |

(In millions) | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH | | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Corporate | | Consolidated HGH |

Income (loss) before income taxes | $ | 167 |

| | $ | 38 |

| | $ | 32 |

| | $ | 25 |

| | $ | (299 | ) | | $ | (37 | ) | | $ | 262 |

| | $ | (13 | ) | | $ | 86 |

| | $ | 21 |

| | $ | (298 | ) | | $ | 58 |

|

Depreciation and amortization | 919 |

| | 214 |

| | 195 |

| | 235 |

| | 9 |

| | 1,572 |

| | 926 |

| | 259 |

| | 193 |

| | 230 |

| | 6 |

| | 1,614 |

|

Interest, net of interest income | 82 |

| | 34 |

| | 29 |

| | 5 |

| | 160 |

| | 310 |

| | 81 |

| | 46 |

| | 25 |

| | 7 |

| | 161 |

| | 320 |

|

EBITDA | $ | 1,168 |

| | $ | 286 |

| | $ | 256 |

| | $ | 265 |

| | $ | (130 | ) | | $ | 1,845 |

| | $ | 1,269 |

| | $ | 292 |

| | $ | 304 |

| | $ | 258 |

| | $ | (131 | ) | | $ | 1,992 |

|

Car rental fleet depreciation and lease charges, net | (819 | ) | | (196 | ) | | — |

| | (231 | ) | | — |

| | (1,246 | ) | | (815 | ) | | (238 | ) | | — |

| | (224 | ) | | — |

| | (1,277 | ) |

Car rental fleet interest | (86 | ) | | (31 | ) | | — |

| | (6 | ) | | — |

| | (123 | ) | | (84 | ) | | (42 | ) | | — |

| | (7 | ) | | — |

| | (133 | ) |

Car rental fleet debt-related charges (a) | 15 |

| | 4 |

| | — |

| | 2 |

| | — |

| | 21 |

| | 2 |

| | 8 |

| | — |

| | 3 |

| | — |

| | 13 |

|

Non-cash stock-based employee compensation charges | — |

| | — |

| | — |

| | — |

| | 10 |

| | 10 |

| | — |

| | — |

| | — |

| | — |

| | 13 |

| | 13 |

|

Restructuring and restructuring related charges (b) | 18 |

| | 6 |

| | 8 |

| | — |

| | 35 |

| | 67 |

| | 16 |

| | 19 |

| | 6 |

| | — |

| | 31 |

| | 72 |

|

Acquisition related costs and charges | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 8 |

| | 8 |

|

Equipment rental spin-off costs (c) | — |

| | — |

| | 16 |

| | — |

| | 1 |

| | 17 |

| | — |

| | — |

| | 6 |

| | — |

| | 6 |

| | 12 |

|

Impairment charges and write-downs (d) | 9 |

| | — |

| | — |

| | — |

| | — |

| | 9 |

| | 10 |

| | — |

| | — |

| | — |

| | — |

| | 10 |

|

Integration expenses (e) | — |

| | — |

| | — |

| | — |

| | 3 |

| | 3 |

| | 1 |

| | — |

| | — |

| | — |

| | 5 |

| | 6 |

|

Relocation costs (f) | — |

| | — |

| | — |

| | — |

| | 4 |

| | 4 |

| | — |

| | — |

| | — |

| | — |

| | 5 |

| | 5 |

|

Other extraordinary, unusual or non-recurring items (g) | (2 | ) | | — |

| | (1 | ) | | — |

| | 1 |

| | (2 | ) | | (21 | ) | | (3 | ) | | 1 |

| | — |

| | 1 |

| | (22 | ) |

Corporate EBITDA | $ | 303 |

| | $ | 69 |

| | $ | 279 |

| | $ | 30 |

| | $ | (76 | ) | | $ | 605 |

| | $ | 378 |

| | $ | 36 |

| | $ | 317 |

| | $ | 30 |

| | $ | (62 | ) | | $ | 699 |

|

Non-fleet depreciation and amortization(h) | (100 | ) | | (18 | ) | | (195 | ) | | (4 | ) | | (9 | ) | | (326 | ) | | (111 | ) | | (21 | ) | | (193 | ) | | (6 | ) | | (6 | ) | | (337 | ) |

Non-fleet interest, net of interest income | 4 |

| | (3 | ) | | (29 | ) | | 1 |

| | (160 | ) | | (187 | ) | | 3 |

| | (4 | ) | | (25 | ) | | — |

| | (161 | ) | | (187 | ) |

Non-fleet debt-related charges (a) | 1 |

| | — |

| | 3 |

| | — |

| | 7 |

| | 11 |

| | 1 |

| | — |

| | 3 |

| | — |

| | 8 |

| | 12 |

|

Non-cash stock-based employee compensation charges | — |

| | — |

| | — |

| | — |

| | (10 | ) | | (10 | ) | | — |

| | — |

| | — |

| | — |

| | (13 | ) | | (13 | ) |

Acquisition accounting (i) | 36 |

| | 4 |

| | 18 |

| | 4 |

| | 1 |

| | 63 |

| | 35 |

| | 5 |

| | 19 |

| | 5 |

| | 1 |

| | 65 |

|

Adjusted pre-tax income (loss) | $ | 244 |

| | $ | 52 |

| | $ | 76 |

| | $ | 31 |

| | $ | (247 | ) | | $ | 156 |

| | $ | 306 |

| | $ | 16 |

| | $ | 121 |

| | $ | 29 |

| | $ | (233 | ) | | $ | 239 |

|

| |

(a) | Represents non-cash charges relating to the amortization of deferred debt financing costs and debt discounts and premiums. |

| |

(b) | Represents expenses incurred under restructuring actions as defined in U.S. GAAP. Also represents incremental costs incurred directly supporting business transformation initiatives, such as transition costs in connection with business process outsourcing arrangements and incremental costs incurred to facilitate business process re-engineering initiatives that involve significant organization redesign and extensive operational process changes and consulting costs and legal fees related to the accounting review and investigation. The three and six months ended June 30, 2015 also include costs associated with the separation of certain executives. |

| |

(c) | Represents expense associated with the HERC spin-off. |

| |

(d) | For six months ended June 30, 2015, represents impairment of the former Dollar Thrifty headquarters and the impairment of a corporate asset recognized in the first quarter 2015. For the three and six months ended June 30, 2014, represents the write-off of assets associated with a terminated business relationship. |

| |

(e) | Primarily represents Dollar Thrifty integration related expenses. |

| |

(f) | Represents non-recurring costs incurred in connection with the relocation of the Company's corporate headquarters to Estero, Florida that were not included in restructuring expenses. Such expenses primarily include duplicate facility rent, certain moving expenses, and other costs that are direct and incremental due to the relocation. |

| |

(g) | Includes miscellaneous non-recurring or non-cash items. In the three and six months ended June 30, 2014, primarily represents a $19 million litigation settlement received in relation to a class action lawsuit filed against an original equipment manufacturer stemming from recalls of their vehicles in previous years. |

| |

(h) | Amounts related to the Worldwide Equipment Rental segment include depreciation of revenue earning equipment. |

| |

(i) | Represents the increase in amortization of other intangible assets, depreciation of property and equipment and accretion of revalued liabilities relating to purchase accounting. |

Supplemental Schedule IV

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURE - FLEET GROWTH

Unaudited

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2015 | | Six Months Ended June 30, 2014 |

(In millions) | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Consolidated HGH | | U.S. Car Rental | | Int'l Car Rental | | Worldwide Equipment Rental | | All Other Operations | | Consolidated HGH |

Revenue earning equipment expenditures | $ | (5,190 | ) | | $ | (1,732 | ) | | $ | (352 | ) | | $ | (717 | ) | | $ | (7,991 | ) | | $ | (3,260 | ) | | $ | (1,673 | ) | | $ | (296 | ) | | $ | (767 | ) | | $ | (5,996 | ) |

Proceeds from disposal of revenue earning equipment | 3,279 |

| | 1,111 |

| | 93 |

| | 426 |

| | 4,909 |

| | 2,114 |

| | 1,059 |

| | 89 |

| | 455 |

| | 3,717 |

|

Net revenue earning equipment capital expenditures | (1,911 | ) | | (621 | ) | | (259 | ) | | (291 | ) | | (3,082 | ) | | (1,146 | ) | | (614 | ) | | (207 | ) | | (312 | ) | | (2,279 | ) |

Depreciation of revenue earning equipment, net | 819 |

| | 159 |

| | 158 |

| | 231 |

| | 1,367 |

| | 813 |

| | 199 |

| | 157 |

| | 224 |

| | 1,393 |

|

Financing activity related to car rental fleet: | | | | | | | | | | | | | | | | | | | |

Borrowings | 4,146 |

| | 831 |

| | — |

| | 602 |

| | 5,579 |

| | 619 |

| | 720 |

| | — |

| | 420 |

| | 1,759 |

|

Payments | (2,986 | ) | | (444 | ) | | — |

| | (562 | ) | | (3,992 | ) | | (731 | ) | | (491 | ) | | — |

| | (350 | ) | | (1,572 | ) |

Restricted cash changes | 150 |

| | 12 |

| | — |

| | (25 | ) | | 137 |

| | 124 |

| | (23 | ) | | — |

| | 6 |

| | 107 |

|

Net financing activity related to car rental fleet | 1,310 |

| | 399 |

| | — |

| | 15 |

| | 1,724 |

| | 12 |

| | 206 |

| | — |

| | 76 |

| | 294 |

|

Fleet growth | $ | 218 |

| | $ | (63 | ) | | $ | (101 | ) | | $ | (45 | ) | | $ | 9 |

| | $ | (321 | ) | | $ | (209 | ) | | $ | (50 | ) | | $ | (12 | ) | | $ | (592 | ) |

Supplemental Schedule V

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURE - FREE CASH FLOW

Unaudited

|

| | | | | | | |

| Six Months Ended June 30, |

(In millions) | 2015 | | 2014 |

Income (loss) before income taxes | $ | (37 | ) | | $ | 58 |

|

Depreciation and amortization, non-fleet, net | 169 |

| | 180 |

|

Amortization of debt discount and related charges | 29 |

| | 25 |

|

Cash paid for income taxes | (19 | ) | | (33 | ) |

Changes in assets and liabilities, net of effects of acquisitions, and other | (58 | ) | | (221 | ) |

Net cash provided by operating activities excluding depreciation of revenue earning equipment | 84 |

| | 9 |

|

U.S. car rental fleet growth | 218 |

| | (321 | ) |

International car rental fleet growth | (63 | ) | | (209 | ) |

Equipment rental fleet growth | (101 | ) | | (50 | ) |

All other operations rental fleet growth | (45 | ) | | (12 | ) |

Property and equipment expenditures, net of disposals | (123 | ) | | (106 | ) |

Net investment activity | (114 | ) | | (698 | ) |

Free cash flow | $ | (30 | ) | | $ | (689 | ) |

Supplemental Schedule VI

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES - DEBT, REVENUE,

DEPRECIATION AND KEY METRICS

Unaudited

NET CORPORATE DEBT, NET FLEET DEBT AND TOTAL NET DEBT

|

| | | | | | | | | | | | | | | | | | | | | | | |

| As of June 30, 2015 | | As of December 31, 2014 |

(In millions) | Fleet | | Corporate | | Total | | Fleet | | Corporate | | Total |

Debt | $ | 11,064 |

| | $ | 6,618 |

| | $ | 17,682 |

| | $ | 9,562 |

| | $ | 6,431 |

| | $ | 15,993 |

|

Less: | | | | | | | | | | | |

Cash and cash equivalents | — |

| | 537 |

| | 537 |

| | — |

| | 490 |

| | 490 |

|

Restricted cash | 378 |

| | 43 |

| | 421 |

| | 515 |

| | 56 |

| | 571 |

|

Net debt | $ | 10,686 |

| | $ | 6,038 |

| | $ | 16,724 |

| | $ | 9,047 |

| | $ | 5,885 |

| | $ | 14,932 |

|

Supplemental Schedule VI (continued)

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES - DEBT, REVENUE,

DEPRECIATION AND KEY METRICS

Unaudited

TOTAL RPD, FLEET EFFICIENCY AND NET DEPRECIATION PER UNIT PER MONTH

U.S. Car Rental Segment

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

($In millions, except as noted) | 2015 | | 2014 | | 2015 | | 2014 |

Total RPD | | | | | | | |

Revenues | $ | 1,615 |

| | $ | 1,663 |

| | $ | 3,135 |

| | $ | 3,220 |

|

Ancillary retail car sales revenue | $ | (13 | ) | | $ | (7 | ) | | $ | (25 | ) | | $ | (14 | ) |

Total rental revenue | $ | 1,602 |

| | $ | 1,656 |

| | $ | 3,110 |

| | $ | 3,206 |

|

Transaction days (in thousands) | 34,977 |

| | 35,850 |

| | 67,014 |

| | 68,210 |

|

Total RPD (in whole dollars) | $ | 45.80 |

| | $ | 46.19 |

| | $ | 46.41 |

| | $ | 47.00 |

|

| | | | | | | |

Fleet Efficiency | | | | | | | |

Transaction days (in thousands) | 34,977 |

| | 35,850 |

| | 67,014 |

| | 68,210 |

|

Average Fleet | 511,700 |

| | 502,500 |

| | 500,500 |

| | 497,000 |

|

Advantage sublease vehicles | — |

| | (4,400 | ) | | — |

| | (7,500 | ) |

Hertz 24/7 vehicles | — |

| | (1,000 | ) | | — |

| | (1,000 | ) |

Average Fleet used to calculate fleet efficiency | 511,700 |

| | 497,100 |

| | 500,500 |

| | 488,500 |

|

Number of days in period | 91 |

| | 91 |

| | 181 |

| | 181 |

|

Average fleet multiplied by number of days in period (in thousands) | 46,565 |

| | 45,236 |

| | 90,591 |

| | 88,419 |

|

Fleet efficiency (a) | 75 | % | | 79 | % | | 74 | % | | 77 | % |

| | | | | | | |

Net Depreciation Per Unit Per Month | | | | | | | |

Depreciation of revenue earning equipment and lease charges, net | $ | 398 |

| | $ | 391 |

| | $ | 819 |

| | $ | 815 |

|

Average fleet | 511,700 |

| | 502,500 |

| | 500,500 |

| | 497,000 |

|

Depreciation of revenue earning equipment and lease charges, net divided by average fleet (whole dollars) | $ | 778 |

| | $ | 778 |

| | $ | 1,636 |

| | $ | 1,640 |

|

Number of months in period | 3 |

| | 3 |

| | 6 |

| | 6 |

|

Net depreciation per unit per month (whole dollars) | $ | 259 |

| | $ | 259 |

| | $ | 273 |

| | $ | 273 |

|

(a)Calculated as transaction days divided by average fleet multiplied by number of days in period.

Supplemental Schedule VI (continued)

HERTZ GLOBAL HOLDINGS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES - DEBT, REVENUE,

DEPRECIATION AND KEY METRICS

Unaudited

TOTAL RPD, FLEET EFFICIENCY AND NET DEPRECIATION PER UNIT PER MONTH (continued)

International Car Rental

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

(in millions, except as noted) | 2015 | | 2014 | | 2015 | | 2014 |

Total RPD | | | | | | | |

Revenues | $ | 556 |

| | $ | 641 |

| | $ | 992 |

| | $ | 1,123 |

|

Foreign currency adjustment (a) | 40 |

| | (67 | ) | | 63 |

| | (112 | ) |

Total rental revenue | $ | 596 |

| | $ | 574 |

| | $ | 1,055 |

| | $ | 1,011 |

|

Transaction days (in thousands) | 12,523 |

| | 12,096 |

| | 22,298 |

| | 21,491 |

|

Total RPD (in whole dollars) | $ | 47.59 |

| | $ | 47.45 |

| | $ | 47.31 |

| | $ | 47.04 |

|

| | | | | | | |

Fleet Efficiency | | | | | | | |

Transaction days (in thousands) | 12,523 |

| | 12,096 |

| | 22,298 |

| | 21,491 |

|

Average Fleet | 173,700 |

| | 172,300 |

| | 158,800 |

| | 157,000 |

|

Number of days in period | 91 |

| | 91 |

| | 181 |

| | 181 |

|

Average fleet multiplied by number of days in period | 15,807 |

| | 15,679 |

| | 28,743 |

| | 28,417 |

|

Fleet efficiency (b) | 79 | % | | 77 | % | | 78 | % | | 76 | % |

| | | | | | | |

Net Depreciation Per Unit Per Month | | | | | | | |

Depreciation of revenue earning equipment and lease charges, net (in millions) | $ | 101 |

| | $ | 124 |

| | $ | 196 |

| | $ | 238 |

|

Foreign currency adjustment (in millions) (a) | 7 |

| | (13 | ) | | 12 |

| | (24 | ) |

Adjusted depreciation of revenue earning equipment and lease charges, net (in millions) | $ | 108 |

| | $ | 111 |

| | $ | 208 |

| | $ | 214 |

|

Average fleet | 173,700 |

| | 172,300 |

| | 158,800 |

| | 157,000 |

|

Adjusted depreciation of revenue earning equipment and lease charges, net divided by average fleet | $ | 622 |

| | $ | 644 |

| | $ | 1,310 |

| | $ | 1,363 |

|

Number of months in period | $ | 3 |

| | $ | 3 |

| | $ | 6 |

| | $ | 6 |

|

Net depreciation per unit per month (whole dollars) | $ | 207 |

| | $ | 215 |

| | $ | 218 |

| | $ | 227 |

|

(a)Based on December 31, 2014 foreign exchange rates.

(b)Calculated as transaction days divided by average fleet multiplied by number of days in period.

WORLDWIDE EQUIPMENT RENTAL AND RENTAL RELATED REVENUE

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

(in millions) | 2015 | | 2014 | | 2015 | | 2014 |

Worldwide equipment rental segment revenues | $ | 375 |

| | $ | 384 |

| | $ | 730 |

| | $ | 743 |

|

Worldwide equipment sales and other revenue | (28 | ) | | (29 | ) | | (51 | ) | | (55 | ) |

Rental and rental related revenue at actual rates | 347 |

| | 355 |

| | 679 |

| | 688 |

|

Foreign currency adjustment (a) | 5 |

| | (7 | ) | | 10 |

| | (13 | ) |

Rental and rental related revenue | $ | 352 |

| | $ | 348 |

| | $ | 689 |

| | $ | 675 |

|

(a)Based on December 31, 2014 foreign exchange rates.

NON-GAAP MEASURES AND KEY METRICS - DEFINITIONS AND USE

Hertz Global is the top-level holding company and The Hertz Corporation is Hertz Global's primary operating company (together, the Company). The term “GAAP” refers to accounting principles generally accepted in the United States of America.

Definitions of non-GAAP measures are set forth below. Also set forth below is a summary of the reasons why management of the Company believes that the presentation of the non-GAAP financial measures included in the earnings webcast slides provide useful information regarding the Company's financial condition and results of operations and additional purposes, if any, for which management of the Company utilizes the non-GAAP measures.

Adjusted Pre-Tax Income (Loss) and Adjusted Pre-tax Margin

Adjusted pre-tax income is calculated as income before income taxes plus certain non-cash acquisition accounting charges, debt-related charges relating to the amortization and write-off of debt financing costs and debt discounts and certain one-time charges and non-operational items. Adjusted pre-tax income is important to management because it allows management to assess operational performance of our business, exclusive of the items mentioned above. It also allows management to assess the performance of the entire business on the same basis as the segment measure of profitability. Management believes that it is important to investors for the same reasons it is important to management and because it allows them to assess the operational performance of the Company on the same basis that management uses internally. Adjusted pre-tax margin is adjusted pre-tax income divided by total revenues.

Adjusted Net Income

Adjusted net income is calculated as adjusted pre-tax income less a provision for income taxes derived utilizing a normalized income tax rate of 37%. The normalized income tax rate is management's estimate of our long-term tax rate. Adjusted net income is important to management and investors because it represents our operational performance exclusive of the effects of purchase accounting, debt-related charges, one-time charges and items that are not operational in nature or comparable to those of our competitors.

Adjusted Diluted Earnings Per Share

Adjusted diluted earnings per share is calculated as adjusted net income divided by the weighted average diluted shares outstanding for the period, Adjusted diluted earnings per share is important to management and investors because it represents a measure of our operational performance exclusive of the effects of purchase accounting adjustments, debt-related charges, one-time charges and items that are not operational in nature or comparable to those of our competitors.

Average Fleet

Average Fleet is determined using a simple average of the number of vehicles at the beginning and end of a given period.

Corporate Restricted Cash (used in the calculation of Net Corporate Debt)

Total restricted cash includes cash and cash equivalents that are not readily available for our normal disbursements. Total restricted cash and equivalents are restricted for the purchase of revenue earning vehicles and other specified uses under our Fleet Debt facilities, our like-kind exchange programs and to satisfy certain of our self-insurance regulatory reserve requirements. Corporate restricted cash is calculated as total restricted cash less restricted cash associated with fleet debt.

Dollar Utilization

Dollar utilization means revenue derived from the rental of equipment divided by the original cost of the equipment including additional capitalized refurbishment costs (with the basis of refurbished assets at the refurbishment date).

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Corporate EBITDA and Corporate EBITDA Margin

EBITDA is defined as net income before net interest expense, income taxes and depreciation (which includes revenue earning equipment lease charges) and amortization. Corporate EBITDA, as presented herein, represents EBITDA as adjusted for car rental fleet interest, car rental fleet depreciation and certain other items, as described in more detail in the accompanying schedules.

Management uses EBITDA and Corporate EBITDA as operating performance and liquidity metrics for internal monitoring and planning purposes, including the preparation of our annual operating budget and monthly operating reviews, as well as to facilitate analysis of investment decisions, profitability and performance trends. Further, EBITDA enables management and investors to isolate the effects on profitability of operating metrics such as revenue, operating expenses and selling, general and administrative expenses, which enables management and investors to evaluate our business segments that are financed differently and have different depreciation characteristics and compare our performance against companies with different capital structures and depreciation policies. We also present Corporate EBITDA as a supplemental measure because such information is utilized in the calculation of financial covenants under the Company's senior credit facilities and in the determination of certain executive compensation.

Corporate EBITDA Margin is calculated as the ratio of Corporate EBITDA to total revenues and is used by the Compensation Committee to determine certain executive compensation, primarily in the form of PSUs.

EBITDA, Corporate EBITDA and Corporate EBITDA Margin are not recognized measurements under U.S. GAAP. When evaluating our operating performance or liquidity, investors should not consider EBITDA and Corporate EBITDA in isolation of, or as a substitute for, measures of our financial performance and liquidity as determined in accordance with GAAP, such as net income, operating income or net cash provided by operating activities.

Equipment Rental and Rental Related Revenue

Equipment rental and rental related revenue consists of all revenue, net of discounts, associated with the rental of equipment including charges for delivery, loss damage waivers and fueling, but excluding revenue arising from the sale of equipment, parts and supplies and certain other ancillary revenue. Rental and rental related revenue is adjusted in all periods to eliminate the effect of fluctuations in foreign currency. Our management believes eliminating the effect of fluctuations in foreign currency is appropriate so as not to affect the comparability of underlying trends. This statistic is important to our management and to investors as it reflects time and mileage and ancillary charges for equipment on rent and is comparable with the reporting of other industry participants.

Fleet Efficiency

Fleet efficiency is calculated by dividing total transaction days by the average fleet multiplied by the number of days in a period. Average fleet used to calculate fleet efficiency in our U.S. Car Rental segment excludes Advantage sublease and Hertz 24/7 vehicles as these vehicles do not have associated transaction days.

Fleet Growth

U.S. and International car rental fleet growth is defined as car rental fleet capital expenditures, net of proceeds from disposals, plus car rental fleet depreciation and net car rental fleet financing which includes borrowings, repayments and the change in fleet restricted cash. Worldwide equipment rental fleet growth is defined as worldwide equipment rental fleet expenditures, net of proceeds from disposals, plus depreciation.

Free Cash Flow

Free cash flow is calculated as net cash provided by operating activities, excluding depreciation of revenue earning equipment, net of car rental and equipment rental fleet growth and property and equipment net expenditures. Free cash flow is important to management and investors as it represents the cash available for acquisitions and the reduction of corporate debt.

Net Corporate Debt

Net corporate debt is calculated as total debt excluding fleet debt less cash and equivalents and corporate restricted cash. Corporate debt consists of our Senior Term Facility; Senior ABL Facility; Senior Notes; Promissory Notes; Convertible Senior Notes; and certain other indebtedness of our domestic and foreign subsidiaries.

Net Corporate Debt is important to management and investors as it helps measure our leverage. Net Corporate Debt also assists in the evaluation of our ability to service our non-fleet-related debt without reference to the expense associated with the fleet debt, which is collateralized by assets not available to lenders under the non-fleet debt facilities.

Net Depreciation Per Unit Per Month

Net depreciation per unit per month is calculated by dividing depreciation of revenue earning equipment and lease charges, net by the average fleet in each period and then dividing by the number of months in the period reported with all periods adjusted to eliminate the effect of fluctuations in foreign currency. Our management believes eliminating the effect of fluctuations in foreign currency is useful in analyzing underlying trends. Average fleet used to calculate net depreciation per unit per month in our U.S. Car Rental segment includes Advantage sublease and Hertz 24/7 vehicles as these vehicles have associated lease charges.

Restricted Cash Associated with Fleet Debt (used in the calculation of Net Fleet Debt and Corporate Restricted Cash)

Restricted cash associated with fleet debt is restricted for the purchase of revenue earning, vehicles and other specified uses under our Fleet Debt facilities and our car rental like-kind exchange program.

Same Store Revenue Growth/Decline

Same store revenue growth is calculated as the year-over-year change in revenue for locations that are open at the end of the period reported and have been operating under our direction for more than twelve months. The same-store revenue amounts are adjusted in all periods to eliminate the effect of fluctuations in foreign currency.

Our management believes eliminating the effect of fluctuations in foreign currency is appropriate so as not to affect the comparability of underlying trends.

Time Utilization

Time utilization means the percentage of time an equipment unit is on-rent during a given period.

Total Net Debt

Total net debt is calculated as total debt less total cash and cash equivalents and total restricted cash. This measure is important to management, investors and ratings agencies as it helps measure our gross leverage.

Total RPD

Total RPD is calculated as total revenue less revenue from fleet subleases and ancillary revenue associated with retail car sales, divided by the total number of transaction days, with all periods adjusted to eliminate the effect of fluctuations in foreign currency. Our management believes eliminating the effect of fluctuations in foreign currency is appropriate so as not to affect the comparability of underlying trends. This statistic is important to our management and investors as it represents the best measurement of the changes in underlying pricing in the car rental business and encompasses the elements in car rental pricing that management has the ability to control.

Transaction Days

Transaction days represent the total number of 24-hour periods, with any partial period counted as one transaction day, that vehicles were on rent (the period between when a rental contract is opened and closed) in a given period. Thus, it is possible for a vehicle to attain more than one transaction day in a 24-hour period.

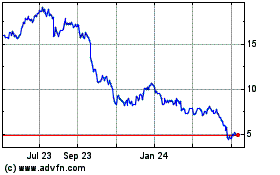

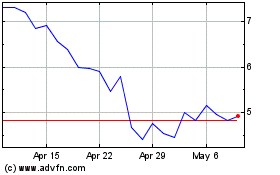

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024