Demand For Trucks Buoys Car Industry -- WSJ

November 02 2016 - 3:03AM

Dow Jones News

By Adrienne Roberts

Auto makers reported an encouraging trend for earnings in

October, posting strong retail demand for profitable light trucks

that is likely to achieve a record level even as overall car and

light truck sales are cooling off.

More than 62% of vehicles sold at dealerships during the month

were pickup trucks or sport-utility vehicles, estimates to

researcher J.D. Power, a shift sparked by fuel-efficiency gains in

heavier vehicles and cheap gasoline prices. Overall volume likely

sputtered during the month due to fewer selling days compared with

October 2015, but the annualized pace likely hit its strongest clip

in 11 months.

Actual sales data are still incomplete because Ford Motor Co.

delayed releasing its results until later in the week due to a fire

at its headquarters on Monday. But most other auto makers reported

top-line declines in October compared with the same period a year

ago, citing the disparity in selling days. Volumes for the month

were down between 4% and 5% excluding the No. 2 seller's

results.

The shift to trucks has been accelerating since late 2014,

presenting a challenge to auto makers racing to meet more stringent

fuel economy standards. Passenger cars, such as midsize sedans and

compacts, aren't popular among consumers, but regulators prize

their fuel efficiency and lower emissions.

Auto makers, however, are eager to follow the migration to

heavier vehicles, which command higher price tags and deliver

bigger profits in the U.S. at a time when several other global

markets are under pressure and development costs are rising due to

regulations and a move to more autonomous vehicles. In a report

released on Monday by the Ann Arbor, Mich.-based Center for

Automotive Research, researchers estimate every light truck sold in

the U.S. generates an average of $6,000 in operating profit for its

manufacturer.

The Detroit Three are best known for their pickup trucks, but

they are facing stiffening competition. For instance, Nissan Motor

Co.'s U.S. sales chief Judy Wheeler said light trucks in its

lineup, including the Pathfinder SUV and Titan pickup, registered

double-digit percentage sales increases in the month of October

compared with the same month last year.

The gains helped the Japanese auto maker reduce its reliance on

lower-margin cars, such as the Altima, which require higher sales

incentives relative to their sticker price. While acknowledging

Nissan still has work to do, Ms. Wheeler noted trucks rose to well

over 50% of its U.S. sales in October from 40% previously.

Industry data providers estimated a 17.9 million

seasonally-adjusted-annual-selling rate in the month, and said auto

sales would have eclipsed last year's tally on a equivalent selling

days measurement. A 17.9 million pace would fall short of the

18.1-million rate reported in October 2015, but it is one of the

strongest performances of the year and an indication 2016 will

finish on a strong note even if overall volumes fall short of last

year's record.

Tim Bergstrom, chief operating officer of dealer Bergstrom

Automotive in Wisconsin, said October was a strong month and

November should be even stronger because additional inventory is

expected to be available.

General Motors Co. said its sales overall slipped 1.7% compared

with the same time last year, a reflection of its paring of sales

to car rental companies. Fiat Chrysler Automobiles NV reported

sales tumbled 10% in the month despite a sizable increase in Ram

truck deliveries.

Toyota Motor Corp. said its sales fell 8.7%, including a 17%

decline in passenger car sales. Nissan sales declined 2.2% despite

an 11% rise in truck sales. Honda Motor Co. reported its sales fell

4.2% as car demand slipped 4.9%.

--Anne Steele contributed to this article.

Corrections & Amplifications: The headline on an earlier

version of this article incorrectly stated that Ford posted a sales

decline for October. Ford hasn't posted its October sales yet.

(END) Dow Jones Newswires

November 02, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

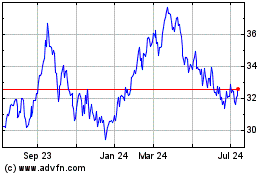

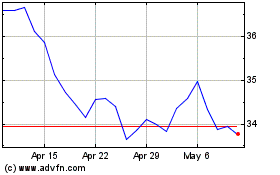

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024