Asian Shares Rise on Robust U.S. Jobs Report

August 07 2016 - 11:40PM

Dow Jones News

Strong U.S. jobs data sent Asian stock markets higher on Monday,

with Japan's Nikkei leading gains as the yen weakened amid the

dollar's broad strength.

The Nikkei Stock Average surged 2% while Australia's S&P/ASX

200 was up 0.8%. South Korea's Kospi rose 0.2% and Hong Kong's Hang

Seng Index rose 1.1%.

Tokyo shares also received a boost from the Bank of Japan's

recent decision to increase purchases of exchange-traded funds

despite waning trading volume during the summer holidays, analysts

said.

"Because there is no summer vacation for the BOJ's buying

operations, the effects will likely be felt even larger in the

market," said Daiwa Securities Chief Technical Analyst Eiji

Kinouchi.

Nonfarm payrolls in the U.S. rose by a seasonally adjusted

255,000 in July, the U.S. Department of Labor said Friday. An

economists' survey by The Wall Street Journal had expected

employers would add 179,000 jobs. Analysts say the data signal that

the U.S. economy, while stable, isn't strong enough to signal

higher interest rates.

The upbeat U.S. data led to the dollar trading higher against

the yen, lifting the shares of major financial firms and exporters

in Japan. A weaker yen helps Japanese exports. The dollar-yen pair

was last at 102.13, up from 101.81 late Friday in New York.

Among key Japanese stocks, Toyota Motor was up 2.9% and Honda

Motor added 2.3%. Nomura Holdings rose 3.5%, while Sumitomo Mitsui

Financial Group gained 5.3%.

Separately, Japanese investors bought a net ¥ 5.45 trillion

($53.52 billion) of medium- and long-term foreign bonds in July,

the most in a month since comparable data became available in 2014,

according to the finance ministry. The data suggests investors

turned to overseas markets as the BOJ's negative interest rate

regime hurt returns.

In Australia, analysts are factoring in another rate cut in

November, after the Reserve Bank of Australia last week cut its

cash rate by a quarter of a percentage point to a record low of

1.5%, helping lift local shares.

"If September quarter inflation rate remains very low as we

expect and the [U.S.] Fed remains in ultra-gradual mode regarding

rate hikes as we also expect, then the RBA will cut again in

November," said AMP Capital Chief Economist Shane Oliver.

Traders betting on global demand will be looking closely Chinese

trade figures, due later Monday. Economists expect the nation's

exports to remain in negative territory, but improve over June's

4.8% year-over-year contraction.

Meanwhile, China's foreign-exchange reserves shrank in July,

after an uptick in June that shrugged off the impact of the U.K.

vote to leave the European Union, according to data from the

People's Bank of China.

Although the decline wasn't as sharp as expected, China shares

saw some selling pressure early Monday, with the Shanghai Composite

Index last down 0.1%.

Megumi Fujikawa, Eleanor Warnock and Pei Li contributed to this

article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 07, 2016 23:25 ET (03:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

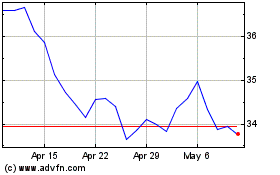

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

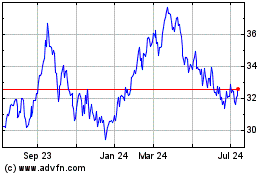

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024