Japanese Car Makers Brace for Brexit -- WSJ

June 28 2016 - 3:03AM

Dow Jones News

By Megumi Fujikawa

TOKYO -- Concerns grew Monday over the impact on Japanese auto

makers from Britain's vote to leave the European Union,

particularly Nissan Motor Co. because of its heavy investment in

U.K. auto production.

Nissan shares fell 2.5% in Tokyo trading on Monday, after a

decline of more than 10% Friday, when news of the British

referendum result landed in the middle of Tokyo trading hours.

Toyota Motor Corp. shares fell 1.7% Monday after a nearly 9%

decline Friday.

Executives of Toyota, Nissan and other top Japanese companies

huddled with government officials at the industry ministry in Tokyo

to discuss "Brexit" scenarios.

"We will carefully analyze various aspects of the matter, given

that there are still many uncertain factors," said Shigeru

Hayakawa, a Toyota senior managing officer, after the meeting.

Nissan, Toyota and Honda Motor Co. produce about half of all

vehicles made in the U.K. each year. Most of the U.K.'s auto output

is exported, and more than half of the exports go to EU nations,

according to the U.K. automotive industry's trade organization.

Nissan has invested GBP3.7 billion ($4.9 billion) in the U.K.,

where it has a plant in the northeastern city of Sunderland that

produced nearly 500,000 vehicles in 2015. Toyota's total investment

is more than GBP2.2 billion.

Nissan declined to comment on the referendum result, although it

had been outspoken about its desire for the U.K. to remain in the

EU. It took legal action when a group favoring "Leave" used the

Japanese auto maker's logo in promotional material.

Honda said it planned to produce a new model of its popular

Civic within the country as scheduled. "We continue to prepare for

the production launch of the 10th generation Civic from our Swindon

plant," it said.

The biggest danger for the Japanese auto makers, as with other

companies that manufacture in Britain for export, is the

possibility that Brexit would lead the EU to raise tariffs on

British goods. Currently, plants such as Nissan's in Sunderland

enjoy preferential terms on exports to EU nations such as Germany

because Britain is an EU member.

Japanese companies with European headquarters in the U.K. may

transfer them to other European nations, or even wind down their

European businesses altogether, said Daisuke Iijima, an official at

market-research firm Teikoku Databank. Of 1,380 Japanese companies

that have operations in the U.K., around 50 are in auto-related

areas, he said.

Higher tariffs could force British auto plants to pay more to

procure auto parts, said Daisuke Yamaguchi, a director at Japan

External Trade Organization's business research department

overseeing Europe. And depending on the terms of Britain's

departure from the EU, Japanese auto makers might have to seek

visas for immigrant workers from other EU nations who can currently

travel freely to Britain.

The Brexit vote sent the yen sharply higher against the U.S.

dollar and the pound, with investors viewing the Japanese currency

as a haven. That is a particular problem for Japanese auto makers,

which get most of their sales outside of Japan. They had seen

profits surge on the weak yen in recent years, which inflated the

value in yen of the dollars and euros they earned abroad.

Reflecting the potential Brexit impact, Nomura Securities'

analyst Masataka Kunugimoto downgraded his estimate for the

combined operating profit of the seven major Japanese auto makers

for the year ending March 2018. He now expects Yen4.15 trillion

($41 billion) in operating profit versus an earlier estimate of

Yen5.07 trillion.

However, Mr. Kunugimoto predicted Britain and the EU would agree

to divorce terms that would limit the damage to Japanese auto

makers. "We think the risk is relatively small given the high

volume of automobile trading between the U.K. and the EU and the

negative impact for both sides from higher tariffs and changes in

regulations," he said.

Write to Megumi Fujikawa at megumi.fujikawa@wsj.com

(END) Dow Jones Newswires

June 28, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

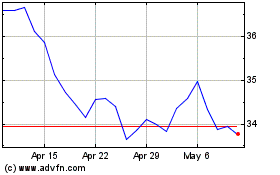

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

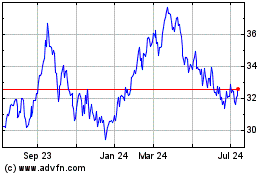

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024