Takata Selling Shares in Auto Makers to Raise Cash

June 14 2016 - 2:00PM

Dow Jones News

Takata Corp. is selling shares it owns in auto makers to raise

cash as the embattled Japanese company faces mounting costs

stemming from recalls of defective air bags linked to at least 11

deaths and more than 100 injuries world-wide, said a person

familiar with the matter.

Takata's ownership stakes are currently valued at roughly $90

million. It isn't clear when Takata plans to unload the shares or

how much money it will ultimately raise.

The move comes after a Takata steering committee in May hired

Lazard Ltd. bankers to seek a cash infusion and negotiate with auto

makers on ballooning costs from recalls of tens of millions of air

bags that risk rupturing and spraying shrapnel in vehicle cabins.

Auto makers are recalling nearly 70 million air bags in the U.S.

alone.

The expected cash gains from the share sales would help pad

Takata's balance sheet in the short term as it grapples with

financial losses from the mushrooming recalls. The company also

faces possible damages from widespread lawsuits and could receive

another hefty financial penalty depending on the outcome of a U.S.

Justice Department criminal probe. Takata has said it is

cooperating with government officials.

The Japanese automotive supplier as of the end of March 2015

owned more than 2.2 million shares of Honda Motor Co., its largest

customer, according to the company's most recent annual report.

Takata also owned shares of Toyota Motor Corp., Nissan Motor

Co., Suzuki Motor Corp., Mazda Motor Corp., Mitsubishi Motors Corp.

and Subaru owner Fuji Heavy Industries Ltd., according to the

report.

Write to Mike Spector at mike.spector@wsj.com and Megumi

Fujikawa at megumi.fujikawa@wsj.com

(END) Dow Jones Newswires

June 14, 2016 13:45 ET (17:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

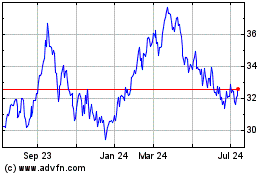

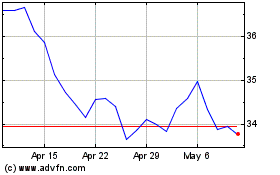

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024