Hecla Mining Company (“Hecla”) is providing an update regarding

its investment in common shares (“Shares”) and warrants of Dolly

Varden Silver Corporation (the “Issuer”).

On July 26, 2016, Hecla’s indirect wholly owned subsidiary

1080980 B.C. Ltd. (the “Offeror”), formally terminated its

take-over offer (the “Offer”) commenced on July 8, 2016, for all of

the issued and outstanding Shares not already owned by Hecla and

its affiliates. No Shares were tendered or taken up under the

Offer.

As of July 25, 2016, Hecla, through its wholly owned subsidiary

Hecla Canada Ltd. (“Hecla Canada”), controlled 2,620,291 Shares and

1,250,000 warrants. Each warrant entitles Hecla Canada to acquire

one additional Share at a price of $0.30 per Share and is

exercisable for a period ending September 30, 2018. Assuming

exercise of only the Warrants held by Hecla Canada, Hecla owned and

controlled 3,870,291 Shares, or approximately 19.8% of the Shares

on a partially diluted basis.

As of July 26, 2016, pursuant to the ancillary rights agreement

between Hecla Canada and the Issuer made September 4, 2012 (the

“ARA”), Hecla Canada acquired from the Issuer, in a private

placement, an additional 1,857,796 Shares and 101,762 warrants

entitling Hecla Canada to acquire upon exercise one Share at an

exercise price of $0.70 per Share for a period of two years from

the date of issuance. The Shares that were acquired were purchased

at a price of $0.62 each for an aggregate purchase price of

$1,151,833.52. The warrants that were acquired were purchased at a

price of $0.43 each for an aggregate purchase price of $43,757.66.

Therefore, the total purchase price for all of the securities

acquired was $1,195,591.18.

As a consequence, Hecla, through Hecla Canada, now controls

4,478,087 Shares, 1,250,000 warrants entitling the holder to

acquire upon exercise one Share at an exercise price of $0.30 per

Share, and 101,762 warrants entitling the holder to acquire upon

exercise one Share at an exercise price of $0.70 per Share.

Assuming exercise of only the warrants held by Hecla Canada, Hecla

owns and controls an aggregate of 5,829,849 Shares, or

approximately 18.5% of the Shares on a partially diluted basis.

As a result of the termination of the Offer, the support

agreements made between Hecla Canada and each of Robert Gipson and

Nellie Gipson, who are registered and beneficial holders of in

aggregate 2,500,000 Shares and 1,250,000 warrants, have also been

terminated.

Hecla and its affiliates intend to hold their Shares and

warrants for investment purposes. Hecla and its affiliates may,

depending on market and other conditions, increase or decrease

their holdings of Shares and warrants or other securities of the

Issuer, whether in the open market, by privately negotiated

agreements or otherwise.

Hecla may also from time to time exercise its rights under the

ARA to maintain its pro-rata shareholding in the Issuer.

Hecla’s head office is at 6500 North Mineral Drive, Suite 200,

Coeur d’Alene, Idaho 83815-9408. The Issuer’s address is 970 - 800

West Pender Street, Vancouver, British Columbia V6C 2V6.

About Hecla

Founded in 1891, Hecla Mining Company (NYSE:HL) is a leading

low-cost U.S. silver producer with operating mines in Alaska, Idaho

and Mexico, and is a growing gold producer with an operating mine

in Quebec, Canada. The Company also has exploration and

pre-development properties in six world-class silver and gold

mining districts in the U.S., Canada, and Mexico, and an

exploration office and investments in early-stage silver

exploration projects in Canada.

Cautionary Note Regarding Forward-Looking Statements

Statements made or information provided in this news release

that are not historical facts, such as anticipated production,

sales of assets, exploration results and plans, costs, and prices

or sales performance are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995 and

“forward-looking information” within the meaning of Canadian

securities laws. Words such as “may,” “will,” “should,” “expects,”

“intends,” “projects,” “believes,” “estimates,” “targets,”

“anticipates” and similar expressions are used to identify these

forward-looking statements. Forward-looking statements involve a

number of risks and uncertainties that could cause actual results

to differ materially from those projected, anticipated, expected or

implied. These risks and uncertainties include, but are not limited

to, metals price volatility, volatility of metals production and

costs, litigation, regulatory and environmental risks, operating

risks, project development risks, political risks, labor issues,

ability to raise financing and exploration risks and results. Refer

to the Company’s Form 10-K and 10-Q reports for a more detailed

discussion of factors that may impact expected future results. The

Company undertakes no obligation and has no intention of updating

forward-looking statements other than as may be required by

law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160727005471/en/

Hecla Mining CompanyMike Westerlund, 800-HECLA91

(800-432-5291)hmc-info@hecla-mining.comVice President - Investor

Relations

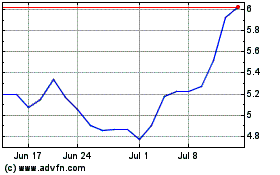

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

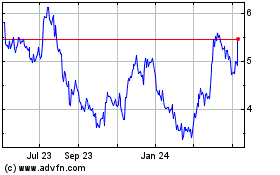

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024