Baker Hughes Lays Out Cost Cuts, Buybacks After Halliburton Deal Dies

May 02 2016 - 8:03AM

Dow Jones News

By Austen Hufford

Baker Hughes Inc. laid out a plan to cut costs and buy back

stock and debt, outlining its path forward a day after its planned

merger with Halliburton Co. was scrapped.

Baker Hughes said it would cut $500 million of costs and weigh a

restructuring of its business, while buying back $1.5 billion of

shares and $1 billion of debt. The funds for the buybacks will come

from the $3.5 billion breakup fee Baker Hughes got from Halliburton

as the deal was called off.

On Sunday, Halliburton and Baker Hughes walked away from their

merger, once valued at nearly $35 billion, after regulators on

several continents claimed it would hurt competition in the

oil-field services business.

As part of the cost-cutting efforts, the company is "taking

immediate steps to remove significant costs that were retained in

compliance with the former merger agreement" and is "evaluating

broader structural changes" to further reduce costs and improve

efficiency.

Baker Hughes also said it intends to refinance its $2.5 billion

credit facility, which expires in September.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

May 02, 2016 07:48 ET (11:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

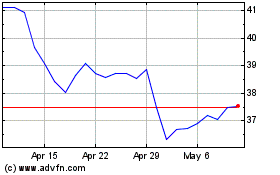

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

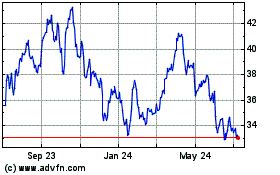

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024