Schlumberger Profit Falls as Revenue Slumps

April 21 2016 - 5:40PM

Dow Jones News

Schlumberger Ltd. said its first-quarter earnings fell 49% and

revenue tumbled as reduced spending by energy producers continued

to hurt demand.

Oil producers have slashed their capital spending plans and

halted drilling as they struggle with weak commodities prices,

which in turn has pressured oil-services companies to reduce their

costs.

In the latest quarter, "the decline in global activity and the

rate of activity disruption reached unprecedented levels as the

industry displayed clear signs of operating in a full-scale cash

crisis," Chairman and Chief Executive Paal Kibsgaard said in

prepared remarks Thursday.

"This environment is expected to continue deteriorating over the

coming quarter given the magnitude and erratic nature of the

disruptions in activity," he said, adding that "our overall outlook

for the oil markets remains unchanged."

Schlumberger is the first major oil-field services company to

report its first-quarter results. Halliburton Co. and Baker Hughes

Inc., competitors that have a pending merger deal, are set to

report on Monday and Wednesday, respectively.

The sharp decline in oil prices also has been a catalyst for

energy deals, including Halliburton's planned acquisition of Baker

Hughes. U.S. antitrust regulators recently filed suit to block that

deal, alleging the planned combination would hurt competition in

the sector.

A day after the latest quarter closed, Schlumberger completed

its acquisition of Cameron International Corp., which makes

drilling equipment and supplies maintenance equipment to

pipelines.

Revenue in Schlumberger's North America business slumped 55%.

The segment swung to a pretax operating loss of $10 million,

compared with a year earlier profit of $416 million.

For Schlumberger's operations outside North America, revenue

dropped 28%. Pretax operating earnings declined to $1.06 billion

from $1.66 billion.

Over all, Schlumberger reported a profit of $501 million, or 40

cents a share, down from $975 million, or 76 cents a share, a year

earlier. Revenue decreased 36% to $6.52 billion.

Analysts polled by Thomson Reuters expected per-share profit of

39 cents and revenue of $6.51 billion.

Mr. Kibsgaard said Schlumberger would continue to "tailor costs

and resources to activity, while remaining cautious in adding back

capacity given the unpredictable nature of the current market."

Schlumberger in January said it had reduced its workforce by an

additional 10,000 employees on expectations demand would remain

weak for the first half of this year.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

April 21, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

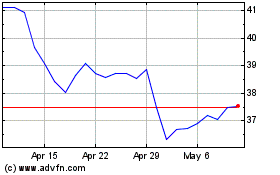

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

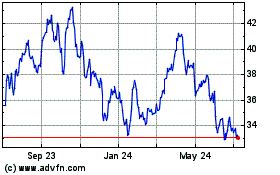

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024