GlaxoSmithKline Helped and Hurt by Sterling's Post-Brexit Fall

July 27 2016 - 11:15AM

Dow Jones News

By Denise Roland

LONDON--The sharp drop in the value of sterling triggered by

Britain's vote to leave the European Union both helped and hurt

GlaxoSmithKline PLC's second-quarter earnings, illustrating the

double-edged effect of the U.K.'s historic decision on corporate

results.

The company separately announced on Wednesday it would invest

GBP275 million ($302.1 million) to increase capacity at three of

its U.K. factories, which Chief Executive Andrew Witty said was a

vote of confidence in the face of the Brexit vote.

"The fundamental competitiveness of the U.K....remains exactly

the same today as it did before the referendum," Mr. Witty

said.

A weaker pound enhances Glaxo's financial results, as it reports

results in sterling but generates most of its revenue overseas.

That currency effect boosted core earnings per share by 21

percentage points and revenue by 7 percentage points in the second

quarter.

By the same token, a falling pound increases the value of

Glaxo's liabilities, forcing the company to take a GBP1.8 billion

write-down and post a net loss of GBP435 million.

Those liabilities include a put option held by Novartis AG

giving the Swiss drug giant the right to sell its stake in the

pair's jointly owned consumer-health-care business to Glaxo. With a

weaker pound, that stake is worth more, so it would cost Glaxo more

to acquire.

The sharp currency effects muddied an otherwise strong quarter

for Glaxo, which cheered investors by beating market expectations

on revenue and core profit, sending shares up 1.8%.

Core operating profit, a measure that strips out one-time losses

and gains, increased 36% to GBP1.8 billion, as revenue climbed 11%

to GBP6.5 billion, beating analyst forecasts of GBP1.6 billion and

GBP6.3 billion. Adjusting for currency effects, core operating

profit climbed 15% and revenue rose 4%.

Glaxo also narrowed its full-year guidance to the upper end of

earlier estimates. It now expects core earnings per share to

increase 11% to 12% in 2016, compared with 10% to 12% previously.

Mr. Witty said that adjustment reflected his "rock-solid"

confidence that the company could hit the top end of its

estimates.

Beyond the factory investment, Mr. Witty struck a further

sanguine note on the broader impact of the June 23 Brexit vote,

saying the company was "reasonably insulated" from any negative

effects.

The upbeat results suggest Glaxo is reaping the fruits of its

new structure after completing a $20 billion asset-swap deal with

Novartis early last year. The deal involved Glaxo trading its

cancer-drugs franchise for the Swiss company's vaccines business.

The U.K. drugmaker also took control of a joint venture that pooled

both companies' consumer-health-care businesses, which sell

drugstore staples such as toothpaste and painkillers.

The company said sales increased across all three divisions:

pharmaceuticals, vaccines and consumer health care. Its core

earnings growth reflected cost savings arising from the Novartis

transaction.

Glaxo backed earlier dividend guidance to say it expects to make

a full-year payout of 80 pence a share in 2016 and 2017.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

July 27, 2016 11:00 ET (15:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

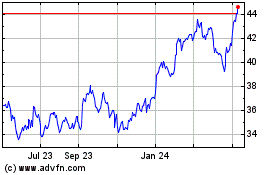

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

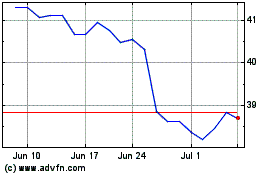

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024