General Mills Offers Gloomy Outlook -- WSJ

December 21 2016 - 3:03AM

Dow Jones News

Food giant struggles to win back customers as its sales fall

short of expectations

By Annie Gasparro

General Mills Inc. projected a grim outlook for the year, as it

struggles to win back customers who have dropped traditional,

processed foods like its Yoplait yogurt for more natural

alternatives.

Faltering sales of yogurt, Progresso soup and Pillsbury dough in

the U.S. pushed the food giant's second-quarter profit down 9%, it

said on Tuesday. It expects comparable sales for the year ending in

May to decline 3% to 4%, down from an earlier estimate of no more

than a 2% drop. Shares fell 3.4% in recent trading.

Chief Executive Ken Powell said General Mills' advertising

wasn't adequate, and it didn't come out with enough new products,

causing its sales to fall short of expectations.

Executives at the Minneapolis-based company said the industry

remains challenging, as U.S. food and beverage sales growth has

steadily eroded over the past five quarters. Industry analysts say

that suggests people are eating out at restaurants more.

Lower food costs and savings from consolidating factories and

corporate restructurings have helped General Mills and its peers

deliver impressive earnings despite softening sales for a while,

but now "sales declines are simply too much for cost savings" to

offset, according to RBC Capital Markets analyst David Palmer.

In the most recent period, General Mills' comparable U.S. retail

sales fell 6%, a steeper drop than the 0.6% seen industrywide.

Chief Operating Officer Jeff Harmening, whom insiders see as Mr.

Powell's likely successor as soon as next year, is tasked with

reviving sales.

Mr. Harmening has been focusing on yogurt, hoping that combining

Greek yogurt with "dippable" pretzels and oat bites, and making

more organic yogurt will turn around the business. U.S. retail

sales in the yogurt segment plunged 18% in the most recent

quarter.

General Mills' last major project involved removing synthetic

dyes and artificial flavors from cereals such as Trix and Cheerios,

but U.S. retail sales of cereal fell 3% during the quarter. It also

continues to focus on improving its profitability through several

cost-cutting efforts that have resulted in announced layoffs of

more than 5,500 employees, or roughly 10% of its workforce, since

mid-2014.

General Mills could benefit in the short term through corporate

tax changes if President-elect Donald Trump lowers the tax rate,

but that is still uncertain, Mr. Powell said.

"That would be a positive for us...we just have to see how it

unfolds," Mr. Powell said in an interview. From infrastructure

investments to reduced regulation, "it's really impossible to

predict how or whether they would have an impact on the consumer

food business," he added.

For the quarter ended Nov. 27, General Mills reported a profit

of $481.8 million, or 80 cents a share, down from $529.5 million,

or 87 cents a share, a year earlier.

Adjusted to exclude the divestiture of its Green Giant business

and other items, General Mills earned 85 cents a share in the

most-recent quarter.

Revenue dropped 7.1% to $4.11 billion.

--Imani Moise contributed to this article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

December 21, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

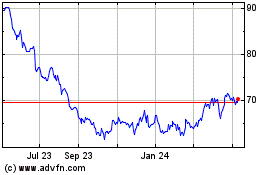

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

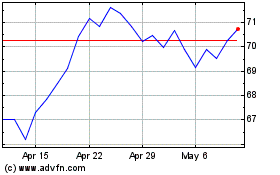

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024