Current Report Filing (8-k)

February 06 2017 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current

Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2017

THE GREENBRIER COMPANIES, INC.

(Exact name of registrant as specified in its charter)

Commission

File

No. 1-13146

|

|

|

|

|

Oregon

|

|

93-0816972

|

(State or other jurisdiction

of incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

One Centerpointe Drive, Suite 200, Lake Oswego, OR

|

|

97035

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(503)

684-7000

(Registrant’s telephone number, including area code)

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the

Form 8-K

filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement.

On January 31, 2017, The Greenbrier Companies, Inc. (the “Company” or “Greenbrier”) entered into a purchase agreement (the

“Purchase Agreement”) with Merrill Lynch, Pierce, Fenner & Smith Incorporated and Goldman, Sachs & Co. as representatives of the initial purchasers listed in the Purchase Agreement (the “Initial Purchasers”).

Pursuant to the Purchase Agreement, Greenbrier agreed to sell to the Initial Purchasers $275 million aggregate principal amount of the Company’s 2.875% Senior Convertible Notes due 2024 (the “Convertible Notes”), which

amount includes $25 million principal amount of Convertible Notes subject to the option granted to the Initial Purchasers to purchase additional notes. The option was exercised in full on February 1, 2017, and the sale of $275 million

aggregate principal amount of the Convertible Notes closed on February 6, 2017. The Purchase Agreement contains customary terms and conditions for agreements of this type, including indemnification obligations.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Purchase Agreement, a copy of which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

To the extent required by

Item 1.01 of

Form 8-K,

the information contained in (or incorporated by reference into) Items 2.03 and 3.02 of this Current Report on

Form 8-K

is hereby incorporated by reference into this Item 1.01.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

In connection with the closing of the transactions contemplated by

the Purchase Agreement, on February 6, 2017, Greenbrier sold $275 million aggregate principal amount of the Convertible Notes to the Initial Purchasers and entered into an Indenture (the “Indenture”) with Wells Fargo Bank,

National Association, as trustee (the “Trustee”). The Indenture governs the Convertible Notes and contains terms and conditions customary for transactions of this type.

The Convertible Notes bear interest at an annual rate of 2.875% payable in cash semi-annually in arrears on February 1 and August 1 of each

year, beginning on August 1, 2017. The Convertible Notes mature on February 1, 2024, unless earlier repurchased by the Company or converted in accordance with their terms prior to such date. The Convertible Notes are convertible into

shares of Greenbrier’s common stock as further described under Item 3.02 below. No sinking fund is provided for in the Indenture and Greenbrier may not redeem the Convertible Notes. The Convertible Notes are senior unsecured obligations

and rank equally in right of payment with Greenbrier’s other senior unsecured debt.

The Indenture provides that if the Company undergoes certain

types of fundamental changes prior to the maturity date of the Convertible Notes, each Convertible Note holder has the option to require the Company to repurchase all or any of such holder’s Convertible Notes for cash. The fundamental change

repurchase price will be 100% of the principal amount of the Convertible Notes to be repurchased, plus accrued and unpaid interest if any, to, but excluding, the fundamental change repurchase date all as provided for in the Indenture. The

Indenture further provides for customary events of default, which include (subject in certain cases to grace and cure periods), among others: nonpayment of principal or interest; breach of covenants or other agreements in the Indenture; defaults

with respect to certain other indebtedness; and certain events of bankruptcy, insolvency or reorganization. The Indenture also contains customary provisions regarding the payment of additional interest and special interest.

The foregoing description of the Indenture and the Convertible Notes does not purport to be complete and is qualified in its entirety by reference to the full

text of the Indenture, a copy of which is filed herewith as Exhibit 4.1 and is incorporated herein by reference, and to the form of Global Note, which is filed as Exhibit A to the Indenture.

To the extent required by Item 2.03 of

Form 8-K,

the information contained in (or incorporated by reference

into) Items 1.01 and 3.02 of this Current Report on

Form 8-K

is hereby incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The Convertible Notes were offered in the United States only to qualified institutional buyers in accordance with Rule 144A in compliance with and

reliance on a private placement exemption from registration afforded by Section 4(2) under the Securities Act of 1933, as amended (the “Securities Act”). The Convertible Notes and any common stock issuable upon their conversion

may be offered and resold only in transactions that are exempt from registration under the Securities Act and other applicable securities laws. The Convertible Notes were sold to the Initial Purchasers on February 6, 2017 for cash for 100% of

their principal amount. The Company estimates that the

2

net proceeds from the offering of the Convertible Notes were approximately $265.5 million, after deducting estimated fees and expenses of approximately $1.2 million and the discount to

the Initial Purchasers of approximately $8.3 million.

Holders of the Convertible Notes may convert all or any portion of their Convertible Notes, in

multiples of $1,000 principal amount, at their option at any time prior to the close of business on the business day immediately preceding November 1, 2023 only under the following circumstances: (i) during any fiscal quarter commencing

after the fiscal quarter ending on May 31, 2017 (and only during such fiscal quarter), if the last reported sale price of Greenbrier’s common stock for at least 20 trading days (whether or not consecutive) during the period of 30

consecutive trading days ending on the last trading day of the immediately preceding fiscal quarter is greater than or equal to 130% of the conversion price on each applicable trading day; (ii) during the five business day period after any five

consecutive trading day period (the “measurement period”) in which the “trading price” (as defined under the Indenture) per $1,000 principal amount of Convertible Notes for each trading day of the measurement period was less than

98% of the product of the last reported sale price of Greenbrier’s common stock and the conversion rate on each such trading day; or (iii) upon the occurrence of specified corporate events described under the Indenture. On or after

November 1, 2023 a holder may convert all or any portion of its Convertible Notes, until the close of business on the business day immediately preceding the maturity date, regardless of whether the foregoing conditions have been satisfied. The

Convertible Notes are convertible into shares of Greenbrier’s common stock at an initial conversion rate of 16.6234 shares of Greenbrier’s common stock per $1,000 principal amount of Convertible Notes, which is equivalent to an

initial conversion price of approximately $60.16 per share of common stock. The conversion rate is subject to customary adjustments as provided for in the Indenture.

Upon a conversion of the notes, Greenbrier may elect to pay or deliver, as the case may be, cash, shares of its common stock or a combination of cash and

shares as provided for in the Indenture.

If Greenbrier undergoes certain types of make-whole fundamental changes, then, in certain circumstances, the

Company will pay a fundamental change make-whole premium upon the conversion of the Convertible Notes in connection with such make-whole fundamental change by increasing the conversion rate on such Convertible Notes. The amount of the fundamental

change make-whole premium, if any, will be based on the price paid, or deemed to be paid, per share of the Company’s common stock in the transaction constituting the make-whole fundamental change and the effective date of the make-whole

fundamental change.

The foregoing description of the Convertible Notes does not purport to be complete and is qualified in its entirety by reference to

the full text of the Indenture, a copy of which is filed herewith as Exhibit 4.1 and is incorporated herein by reference, and to the form of Global Note, which is filed as Exhibit A to the Indenture.

To the extent required by Item 3.02 of

Form 8-K,

the information contained in (or incorporated by reference

into) Items 1.01 and 2.03 of this Current Report on

Form 8-K

is hereby incorporated by reference into this Item 3.02.

Item 8.01 Other Events.

On February 1, 2017,

Greenbrier issued a press release regarding the pricing and the increase in the offering size of the Convertible Notes. A copy of the press release is filed as Exhibit 99.1 to this report and is incorporated by reference herein.

On February 6, 2017, Greenbrier issued a press release announcing the closing of the sale of the Convertible Notes to the initial purchasers. A copy of

the press release is filed as Exhibit 99.2 to this report and is incorporated by reference herein.

Item 9.01 Financial Statements and

Exhibits

(d) Exhibits

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

4.1

|

|

Indenture dated February 6, 2017 between The Greenbrier Companies, Inc. and Wells Fargo Bank, National Association, as trustee, including the form of Global Note attached as Exhibit A thereto.

|

|

|

|

|

10.1

|

|

Purchase Agreement dated January 31, 2017 among The Greenbrier Companies, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Goldman, Sachs & Co.

|

|

|

|

|

99.1

|

|

Press release dated February 1, 2017, regarding the pricing and increase in the offering size of The Greenbrier Companies, Inc.’s 2.875% Senior Convertible Notes due 2024.

|

|

|

|

|

99.2

|

|

Press release dated February 6, 2017, regarding the closing of the sale of The Greenbrier Companies, Inc.’s 2.875% Senior Convertible Notes due 2024.

|

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

THE GREENBRIER COMPANIES, INC.

(Registrant)

|

|

|

|

|

|

|

Date: February 6, 2017

|

|

|

|

By:

|

|

/s/ Martin R. Baker

|

|

|

|

|

|

|

|

Martin R. Baker

Senior Vice President,

General Counsel and

Chief Compliance Officer

|

4

Exhibit Index

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

4.1

|

|

Indenture dated February 6, 2017 between The Greenbrier Companies, Inc. and Wells Fargo Bank, National Association, as trustee, including the form of Global Note attached as Exhibit A thereto.

|

|

|

|

|

10.1

|

|

Purchase Agreement dated January 31, 2017 among The Greenbrier Companies, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Goldman, Sachs & Co.

|

|

|

|

|

99.1

|

|

Press release dated February 1, 2017, announcing the pricing of a private offering of The Greenbrier Companies, Inc.’s 2.875% Senior Convertible Notes due 2024.

|

|

|

|

|

99.2

|

|

Press release dated February 6, 2017, announcing the closing of the sale of The Greenbrier Companies, Inc.’s 2.875% Senior Convertible Notes due 2024.

|

5

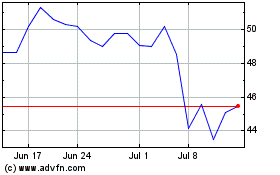

Greenbrier Companies (NYSE:GBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

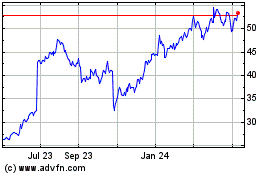

Greenbrier Companies (NYSE:GBX)

Historical Stock Chart

From Apr 2023 to Apr 2024