Low Energy Prices Drive Greenbrier to Record Revenue

January 07 2016 - 7:40AM

Dow Jones News

Railcar maker Greenbrier Cos. reported record revenue as the low

energy prices boosted railcar orders.

But Greenbrier Chief Executive William Furman warned Thursday

that order and backlog levels will likely come down from their

"elevated energy-driven peak."

For the November quarter, Greenbrier delivered 6,900 units

compared to 4,000 units a year ago. The company said it received an

additional 2,100 railcar orders after the quarter ended.

At quarter-end, the company has a backlog of 36,000 units,

compared to 41,200 units a year before.

The Lake Oswego, Ore.-based company has been expanding its

geographic reach, most recently entering into markets in the Middle

East and South America.

For the quarter ended Nov. 30, Greenbrier reported a profit of

$69.4 million, or $2.15 a share, up from $32.8 million, or $1.01, a

year prior.

Revenue jumped 62% to $802.4 million.

Analysts polled by Thomson Reuters had forecast earnings of

$1.62 a share on $759 million in revenue.

For the fiscal year ending in August, Greenbrier reaffirmed its

projections of per-share adjusted earnings between $5.65 and $6.15

on revenue of more than $2.8 billion. The company said results will

be weighted toward the first-half of the year due to line

changeovers and product-mix changes.

Analysts, on average, were expecting earnings of $5.98 a share

on revenue of $2.72 billion.

Gross margin rose to 23% from 17.8% due to improved production

efficiencies.

Shares of Greenbrier, which have fallen 19% in the last few

months, were inactive in premarket trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

January 07, 2016 07:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

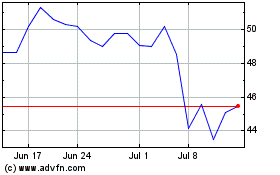

Greenbrier Companies (NYSE:GBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

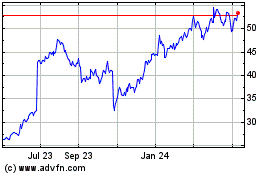

Greenbrier Companies (NYSE:GBX)

Historical Stock Chart

From Apr 2023 to Apr 2024