UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant §240.14a-12

| |

GREATBATCH, INC. |

|

| |

(Name of Registrant as Specified In Its Charter)

|

|

| |

|

|

| |

|

|

| |

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

þ

|

No fee required.

|

| |

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

|

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

|

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

|

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

| |

|

|

| |

(5)

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials.

|

| |

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

|

|

| |

(1)

|

Amount Previously Paid:

|

| |

|

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

| |

|

|

| |

(3)

|

Filing Party:

|

| |

|

|

| |

(4)

|

Date Filed:

|

April 13, 2015

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Greatbatch, Inc. which will be held on Thursday, May 14, 2015 at 9:00 a.m., Central Daylight Time, at the company’s global headquarters at 2595 Dallas Parkway, Suite 310, Frisco, Texas 75034.

Details of the business to be conducted at the Annual Meeting are given in the enclosed Notice of Annual Meeting and Proxy Statement. Included with the Proxy Statement is a copy of the company’s 2014 Annual Report. We encourage you to read this document. It includes information on the company’s operations, markets and products, as well as the company’s audited financial statements.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted. To make it easier for you to vote, we are offering Internet and telephone voting. The instructions included on your proxy card describe how to vote using these services. Of course, if you prefer, you can vote by mail by completing and signing your proxy card and returning it in the enclosed postage-paid envelope.

We look forward to seeing you at the Annual Meeting.

Sincerely,

/s/ Bill R. Sanford

Bill R. Sanford

Chairman of the Board

/s/ Thomas J. Hook

Thomas J. Hook

President & Chief Executive Officer

GREATBATCH, INC.

2595 DALLAS PARKWAY, SUITE 310

FRISCO, TEXAS 75034

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Greatbatch, Inc.:

The Annual Meeting of Stockholders of Greatbatch, Inc. will be held at the company’s global headquarters at 2595 Dallas Parkway, Suite 310, Frisco, Texas 75034, on Thursday, May 14, 2015 at 9:00 a.m., Central Daylight Time, for the following purposes:

| |

1.

|

To elect eight directors for a term of one year and until their successors have been elected and qualified;

|

| |

2.

|

To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for Greatbatch, Inc. for fiscal year 2015;

|

| |

3.

|

To approve, on an advisory basis, the compensation of our named executive officers; and

|

| |

4.

|

To consider and act upon other matters that may properly come before the Annual Meeting and any adjournments thereof.

|

Stockholders of record at 5:00 p.m., Eastern Daylight Time, on April 1, 2015 are entitled to vote at the Annual Meeting.

By Order of the Board of Directors,

/s/ Timothy G. McEvoy

Timothy G. McEvoy

Senior Vice President,

General Counsel & Secretary

Frisco, Texas

April 13, 2015

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE ANNUAL MEETING. YOU CAN VOTE YOUR SHARES BY PROXY BY USING ONE OF THE FOLLOWING METHODS: MARK, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE POSTAGE-PAID ENVELOPE FURNISHED FOR THAT PURPOSE, OR VOTE BY TELEPHONE OR THE INTERNET USING THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. ANY PROXY MAY BE REVOKED IN THE MANNER DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AT ANY TIME PRIOR TO ITS USE AT THE ANNUAL MEETING OF STOCKHOLDERS. ANY STOCKHOLDER PRESENT AT THE MEETING MAY WITHDRAW HIS OR HER PROXY AND VOTE PERSONALLY ON ANY MATTER PROPERLY BROUGHT BEFORE THE MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 14, 2015

THE GREATBATCH, INC. 2015 PROXY STATEMENT AND 2014 ANNUAL REPORT ARE AVAILABLE AT

http://proxy.greatbatch.com

PROXY STATEMENT

TABLE OF CONTENTS

| |

Page

|

| |

|

|

Introduction

|

1

|

| |

|

|

Voting Rights

|

1

|

| |

|

|

Principal Beneficial Owners of Shares

|

2

|

| |

|

|

Company Proposals

|

2

|

|

Proposal 1 – Election of Directors

|

2

|

|

Proposal 2 – Ratification of the Appointment of Independent Registered Public Accounting Firm

|

5

|

|

Proposal 3 – Advisory Vote on Compensation of the Named Executive Officers

|

5

|

| |

|

|

Stock Ownership by Directors and Executive Officers

|

6

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

|

7

|

| |

|

|

Compensation Discussion and Analysis

|

7

|

|

Objectives of Executive Compensation Programs and 2014 Performance

Compensation Philosophy

|

7

7

|

|

Compensation Committee Practices and Procedures

|

8

|

|

Competitive Market Review

|

9

|

|

Base Salary

|

9

|

|

Annual Performance-Based Cash Incentives

|

10

|

|

Long-Term Incentives

|

11

|

|

Equity Compensation Plan Information

|

14

|

|

Compensation Recoupment Policy

Share Ownership

|

14

14

|

|

Pledging and Hedging Policy

Retirement

Change in Control Agreements

|

15

15

16

|

|

Perquisites

|

17

|

|

Employment Agreement

Severance Benefits

|

18

18

|

|

Compensation and Organization Committee Report

|

19

|

|

Compensation Risk Analysis

|

19

|

| |

|

|

Executive Compensation

|

20

|

|

2014 Summary Compensation Table

|

20

|

|

2014 Grants of Plan-Based Awards

|

22

|

|

Outstanding Equity Awards at 2014 Fiscal Year-End

|

23

|

|

2014 Stock Option Exercises and Stock Vested

|

25

|

|

Pension Benefits and Nonqualified Deferred Compensation Tables

|

25

|

| |

|

|

Corporate Governance and Board Matters

|

25

|

|

Leadership Structure of the Board

|

25

|

|

Board Independence

|

26

|

|

Enterprise Risk Management

|

26

|

|

Committees and Meetings of the Board

|

26

|

|

Executive Sessions of the Board

|

27

|

|

Board/Committee/Director Evaluations

|

27

|

|

Communications with the Board

|

28

|

|

Compensation Committee Interlocks and Insider Participation

|

28

|

|

2014 Director Compensation

|

28

|

|

Related Person Transactions

|

30

|

|

Audit Committee Report

|

30

|

| |

|

|

Stockholder Proposals

|

30

|

| |

|

|

Other Matters

|

31

|

PROXY STATEMENT

INTRODUCTION

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Greatbatch, Inc. (the “Company”) of proxies in the accompanying form for use at the 2015 Annual Meeting of Stockholders or any adjournment or adjournments thereof. The Company will bear the expense of preparing, printing and mailing this proxy statement and the proxies solicited hereby.

The 2015 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) will be held at 9:00 a.m., Central Daylight Time, on Thursday, May 14, 2015 at the Company’s global headquarters at 2595 Dallas Parkway, Suite 310, Frisco, Texas 75034. The Company’s mailing address is 2595 Dallas Parkway, Suite 310, Frisco, Texas 75034, and its telephone number is (716) 759-5600.

This proxy statement and the accompanying form of proxy are first being sent to stockholders of record on or about April 13, 2015. A copy of the Company’s 2014 Annual Report, including financial statements, has either previously been delivered or accompanies this proxy statement, but is not part of the proxy solicitation materials.

VOTING RIGHTS

Stockholders of record at 5:00 p.m., Eastern Daylight Time, on April 1, 2015 are entitled to vote at the Annual Meeting. At that time, the Company had outstanding 25,491,734 shares of common stock, $0.001 par value per share (“Common Stock”). Each share of Common Stock is entitled to one vote. An individual who has a beneficial interest in shares allocated to the Company stock fund account under the Greatbatch, Inc. 401(k) Retirement Plan (the “401(k) Plan”) is entitled to vote the shares of Common Stock allocated to that account.

Shares may not be voted at the Annual Meeting unless the owner is present or represented by proxy. A stockholder can be represented by proxy through the return of a proxy card or by utilizing the telephone or Internet voting procedures. An individual with a beneficial interest in the 401(k) Plan may give directions to the trustee of the 401(k) Plan, or its designated representative, as to how the allocated shares should be voted by returning the proxy card or using the telephone or Internet voting methods. The telephone and Internet voting procedures are designed to authenticate stockholders by use of a control number and allow stockholders to confirm that their instructions have been properly recorded. The method by which you vote will in no way limit your right to vote at the Annual Meeting if you later decide to attend in person. A stockholder giving a proxy may revoke it at any time before it is used by giving written notice of such revocation or by delivering a later dated proxy to Timothy G. McEvoy, the Company’s Secretary, at the Company’s mailing address set forth above, or by the vote of the stockholder in person at the Annual Meeting.

The presence in person or by proxy of the holders of a majority of the outstanding Common Stock will constitute a quorum for the transaction of business at the Annual Meeting. Broker non-votes, abstentions and directions to withhold authority will be counted as being present or represented at the Annual Meeting for purposes of establishing a quorum. A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because it does not have discretionary voting power on that proposal and has not received voting instructions from the beneficial owner.

Proxies will be voted in accordance with the stockholder’s direction, if any. Unless otherwise directed, proxies will be voted in favor of the election as directors of the persons named under the caption “Nominees for Director,” in favor of ratifying the appointment of Deloitte & Touche LLP (“Deloitte & Touche”) as the independent registered public accounting firm for the Company for fiscal year 2015, and in favor of approval of the compensation of the Company’s named executive officers.

The vote of a plurality of the shares of Common Stock present in person or represented at the Annual Meeting is required for the election of directors. Abstentions and broker non-votes will have no effect on the election of directors.

The affirmative vote of a majority of the shares of Common Stock cast at the Annual Meeting is required to ratify the appointment of Deloitte & Touche as the independent registered public accounting firm for the Company for fiscal year 2015. In determining whether the proposal has received the requisite number of affirmative votes, an abstention will have no effect on the vote.

Although the vote on proposal 3 (vote on compensation of named executive officers) is advisory in nature and non-binding, the affirmative vote of a majority of the shares of Common Stock cast at the Annual Meeting is required to approve the proposal. Broker non-votes and abstentions will have no effect on the vote.

PRINCIPAL BENEFICIAL OWNERS OF SHARES

The following table sets forth certain information with respect to all persons known to the Company to be the beneficial owner of more than 5% of its outstanding Common Stock as of April 1, 2015:

|

Name and Address of Beneficial Owner

|

Number of Shares

Beneficially Owned

|

Percent

of Class

|

| |

|

|

|

BlackRock, Inc.(1)

|

2,473,749

|

9.7%

|

|

55 East 52nd Street

New York, NY 10022

|

|

|

| |

|

|

|

Dimensional Fund Advisors LP(2)

|

1,991,724

|

7.8%

|

|

Building One

6300 Bee Cave Road

Austin, TX 78746

|

|

|

| |

|

|

|

The Vanguard Group, Inc.(3)

|

1,709,203

|

6.7%

|

|

100 Vanguard Boulevard

Malvern, PA 19355

|

|

|

|

(1)

|

BlackRock, Inc. filed a Schedule 13G/A on January 15, 2015. The beneficial ownership information presented is based solely on the Schedule 13G/A. The reported securities are owned by BlackRock, Inc. and its affiliated companies listed in the Schedule 13G/A.

|

|

(2)

|

Dimensional Fund Advisors LP (“Dimensional”) filed a Schedule 13G/A on February 5, 2015. The beneficial ownership information presented and information contained in this footnote is based solely on the Schedule 13G/A. Dimensional, an investment advisor registered under Section 203 of the Investment Advisers Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-advisor to certain other commingled funds, group trusts and separate accounts (the “Dimensional Funds”). In its role as investment advisor, sub-advisor or manager, Dimensional may possess investment and/or voting power over the securities of the Company that are owned by the Dimensional Funds, and may be deemed to be the beneficial owner of the shares of the Company held by the Dimensional Funds.

|

|

(3)

|

The Vanguard Group, Inc. filed a Schedule 13G/A on February 10, 2015. The beneficial ownership information presented is based solely on the Schedule 13G/A. The reported securities are owned by The Vanguard Group, Inc., Vanguard Fiduciary Trust Company and Vanguard Investments Australia, Ltd. Vanguard Fiduciary Trust Company and Vanguard Investments Australia, Ltd. are wholly owned subsidiaries of The Vanguard Group, Inc. and serve as an investment manager of collective trust accounts and Australian investment offerings, respectively.

|

COMPANY PROPOSALS

PROPOSAL 1 – Election of Directors

Shares represented by properly executed proxies will be voted, unless authority is withheld, for the election as directors of the Company of the following eight persons nominated by the Board, to hold office until the 2016 Annual Meeting of Stockholders and until their successors have been elected and qualified. Each of the nominees listed below was elected at the 2014 Annual Meeting of Stockholders.

If any nominee for any reason should become unavailable for election or if a vacancy should occur before the election (which events are not expected), the shares of Common Stock represented by the proxies will be voted for such other person, if any, as the Corporate Governance and Nominating Committee shall designate. Information regarding the nominees standing for election as directors is set forth below:

Nominees for Director

Pamela G. Bailey is 66, is Chair of the Corporate Governance and Nominating Committee, a member of the Compensation and Organization Committee, and has been a director since 2002.

Ms. Bailey has been President and Chief Executive Officer of The Grocery Manufacturers Association (“GMA”), a Washington, D.C. based trade association, since January 2009. From April 2005 until January 2009, she was President and Chief Executive Officer of the Personal Care Products Council. Ms. Bailey served as President and Chief Executive Officer of the Advanced Medical Technology Association (“AdvaMed”), the world’s largest association representing the medical technology industry, from June 1999 to April 2005. From 1970 to 1999, she served in the White House, the Department of Health and Human Services and other public and private organizations with responsibilities for health care public policy. Ms. Bailey is a director of the Reagan-Udall Foundation, a 501(c)(3) organization created by Congress to advance the mission of the Food and Drug Administration by advancing regulatory science and research. She formerly served as a director of Albertsons, Inc., MedCath Corporation, and The National Food Laboratory, Inc.

Ms. Bailey’s 40 years of health care public policy experience with both public and private organizations, including service in the White House, the Department of Health and Human Services, and as President and Chief Executive Officer of AdvaMed, gives her a unique perspective on a variety of health care-related issues. With over 20 years of chief executive officer experience at GMA, the Personal Care Products Council, AdvaMed, and other Washington-based health care trade associations, Ms. Bailey brings to the Board demonstrated management ability at senior levels. This experience, together with her experience gained as a director of Albertsons and MedCath, supports her continued service as a member of the Board.

Anthony P. Bihl III is 58, is a member of the Audit Committee, a member of the Technology Strategy and Investment Committee, and has been a director since 2011.

Mr. Bihl has been Chief Executive Officer and a member of the Board of Managers of Bioventus, LLC, a company that develops, manufactures and sells products that promote active orthopaedic healing, since December 2013. From June 2011 through June 2012, he was Group President American Medical Systems (“AMS”), a subsidiary of Endo Pharmaceuticals (“Endo”). Mr. Bihl was President & Chief Executive Officer and a director of AMS from April 2008 until Endo acquired AMS in June 2011. He served as Chief Executive Officer of Siemens Medical Solutions’ Diagnostics Division from January to November 2007, and as President of the Diagnostics Division of Bayer HealthCare from 2004 through 2006. Prior to that, Mr. Bihl served in a number of operations and finance roles at Bayer HealthCare and over a 20-year career at E.I. DuPont. He is a director and chairman of the board of Spectral Medical, Inc., a Canadian company that develops products for the diagnosis and treatment of severe sepsis and septic shock, and also serves as chair of its human resources and compensation committee. Mr. Bihl is a former director of SeraCare Life Sciences Inc.

Mr. Bihl brings 30 years of experience in the medical device industry, in operations, finance and general management roles. His extensive background and experience supports his continued service as a member of the Board.

Joseph W. Dziedzic is 46, is Chair of the Audit Committee, a member of the Compensation and Organization Committee, and has been a director since February 2013.

Mr. Dziedzic is Executive Vice President and Chief Financial Officer of The Brink’s Company, a global leader in security-related services for banks, retailers and a variety of other commercial and governmental customers. In addition to his responsibilities as Chief Financial Officer, Mr. Dziedzic is responsible for global security, global procurement, risk management and the payment services business for The Brink’s Company. Prior to joining The Brink’s Company in 2009, he had a 20-year career with General Electric where from 2006 to 2009, he was Chief Financial Officer of GE Aviation Services, from 2003 to 2006, he was Manager of Global Financial Planning and Analysis of GE Energy, and from 2000 to 2002 he was Chief Financial Officer of GE Plastics America. Prior to 2000, Mr. Dziedzic held a number of other positions of increasing responsibility with General Electric. He is a director of the YMCA of Greater Richmond.

Mr. Dziedzic has over 20 years of experience in global operations and financial and accounting matters. The depth and breadth of Mr. Dziedzic’s financial experience support his continued service as a member of the Board.

Thomas J. Hook is 52, is a member of the Technology Strategy and Investment Committee, and has been a director since 2006.

Mr. Hook has been the Company’s President and Chief Executive Officer since August 2006. Prior to August 2006, he was the Company’s Chief Operating Officer, a position to which he was appointed upon joining the Company in September 2004. From August 2002 until September 2004, Mr. Hook was employed by CTI Molecular Imaging where he served as President, CTI Solutions Group. From March 2000 to July 2002, he was General Manager, Functional and Molecular Imaging for General Electric Medical Systems. From 1997 to 2000, Mr. Hook worked for the Van Owen Group Acquisition Company and prior to that, Duracell, Inc. He is Chairman of the Board of HealthNow New York, Inc., a leading health care company in Western New York that provides quality health care services to companies and individuals in that region, and serves on its executive committee. Mr. Hook is also a director of AdvaMed.

Since joining the Company as Chief Operating Officer in 2004 and becoming President and Chief Executive Officer in 2006, Mr. Hook has directed the Company’s acquisition, integration and product development efforts, growing the business from $200 million to the more diverse $688 million medical device technology company that it is today. Mr. Hook’s knowledge of the Company’s business and his role as the Company’s President and Chief Executive Officer support his continued service as a member of the Board.

Dr. Joseph A. Miller, Jr. is 73, is Chair of the Technology Strategy and Investment Committee, a member of the Corporate Governance and Nominating Committee, and has been a director since 2003.

Dr. Miller retired in April 2012 as Executive Vice President and Chief Technology Officer for Corning, Inc., a position in which he had served since 2001. Before joining Corning in 2001, he served as Senior Vice President of E.I. DuPont de Nemours from 1999 to 2001 and held various executive positions with that company prior to that time. Dr. Miller is a director of Lightwave Logic. He is a former director of Dow Corning Corporation.

Dr. Miller has significant research and development knowledge and experience gained through his positions at Corning and E.I. DuPont. His extensive knowledge and experience gives him insight into a number of issues facing the Company and supports his continued service as a member of the Board.

Bill R. Sanford is 71, is Chairman of the Board, is a member of the Corporate Governance and Nominating Committee, and has been a director since 2000.

Mr. Sanford is Chairman of Symark LLC, a company he founded in 1979 that focuses on the development and commercialization of biosciences systems, products and services. He is Executive Founder and retired Chairman, President and Chief Executive Officer of Steris Corporation, a New York Stock Exchange (“NYSE”) listed global provider of infection and contamination prevention systems, products, services and technologies. Mr. Sanford is an active early and growth stage advisor and equity investor through Symark. He has served on the boards of KeyCorp and its KeyBank N.A. subsidiary, Cleveland Clinic, Case Western Reserve University, AdvaMed, and several other private for-profit companies, not-for-profit organizations, investment limited partnerships and venture capital firms.

Mr. Sanford is an experienced entrepreneur, senior executive, consultant, investor and board member with extensive public company, new venture, merger and acquisition, marketing and sales, turnaround and market development experience. He has both public and private company financing experience, including initial and secondary public stock offerings, structured debt financings, public stock mergers and private equity and venture capital investments. Mr. Sanford’s background and experience, including his extensive experience in the medical device industry, support his continued service as a member of the Board.

Peter H. Soderberg is 68, is Chair of the Compensation and Organization Committee, a member of the Audit Committee, and has been a director since 2002.

Mr. Soderberg is managing partner of Worthy Ventures Resources, LLC, a private investment company he founded in February 2010. He retired in January 2010 as President and Chief Executive Officer of Hill-Rom Holdings, Inc. (formerly Hillenbrand Industries), a position he held since March 2006. From January 2000 to March 2006, he was President and Chief Executive Officer of Welch Allyn, Inc., and for the seven years prior to that, Chief Operating Officer of Welch Allyn’s medical products business. Mr. Soderberg also held a number of positions over a 23-year career with Johnson & Johnson, where his final position was as president of one of its operating subsidiaries. Until his retirement, he also had served on the board of directors of Hill-Rom and AdvaMed. Mr. Soderberg currently serves as a director and senior advisor to the CEO of three privately-held medtech companies. He is a former director of St. Vincent Health System (Indianapolis), Constellation Brands, Inc. and Welch Allyn.

Having served in the roles of President and Chief Executive Officer of Hill-Rom and Welch Allyn, Mr. Soderberg has significant management experience and business understanding. Running a public company gave Mr. Soderberg front-line exposure to many of the issues facing public companies, particularly on the operational, financial and corporate governance fronts. His deep knowledge of health care policy and patient care delivery, gained through his long career in the health care industry, provides our Board with a valuable perspective on the priorities of and challenges facing our major customers. These attributes support Mr. Soderberg’s continued service as a member of the Board.

William B. Summers, Jr. is 64, is a member of the Compensation and Organization Committee, a member of the Corporate Governance and Nominating Committee, and has been a director since 2001.

Mr. Summers retired in June 2006 as Chairman of McDonald Investments, Inc., a position he had held since 1998. He also held the additional positions of President (from 1989 through 1998) and Chief Executive Officer (from 1994 through 1998) of that investment company. Mr. Summers serves on the board of directors of RPM International, Inc. and is a member of its audit committee. He also serves on the advisory boards of Molded Fiberglass Companies, MAI Wealth Advisors LLC, and IQWARE Marketing, LLC, and on the board of directors of The Rock and Roll Hall of Fame and Museum, Baldwin-Wallace University, State Troopers of Ohio, and the Convention and Visitors Bureau of Greater Cleveland, Inc. Mr. Summers previously served as chairman of the board of the National Association of Securities Dealers, as chairman of the board of the NASDAQ Stock Market, and as a director of the NYSE. He is a former director of Developers Diversified Realty, Inc., Cleveland Indians Baseball Company, and Penton Media Inc.

Through his positions with McDonald Investments, Mr. Summers gained leadership experience and extensive knowledge of complex financial and operational issues. In addition, through his service with the NASDAQ Stock Market and the NYSE and on the boards of other public companies, Mr. Summers has gained valuable experience dealing with the capital markets, accounting principles and financial reporting rules and regulations, evaluating financial results and generally overseeing the financial reporting process of large public corporations. This experience supports Mr. Summers’ continued service as a member of the Board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR

PROPOSAL 2 – Ratification of the Appointment of Independent Registered Public Accounting Firm

On the recommendation of the Audit Committee, Deloitte & Touche has been appointed by the Board as the Company’s independent registered public accounting firm for fiscal year 2015, a capacity in which it has served since 2000. Although stockholder approval is not required, the Company has determined that it is desirable to request that the stockholders ratify the appointment of Deloitte & Touche as the Company’s independent registered public accounting firm for fiscal year 2015. In the event the stockholders fail to ratify the appointment, the Board will reconsider this appointment and make such a determination as it believes to be in the Company’s best interests. Even if the appointment is ratified, the Board, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Board determines that such a change would be in the Company’s best interests. Representatives of Deloitte & Touche are expected to be present at the Annual Meeting. The representatives may, if they wish, make a statement and, it is expected, will be available to respond to appropriate questions.

The following table sets forth the aggregate fees billed by Deloitte & Touche for services provided to the Company during fiscal years 2014 and 2013:

| |

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

Audit Fees(1)

|

|

$ |

1,333,000 |

|

|

$ |

1,309,095 |

|

|

Audit-Related Fees(2)

|

|

|

30,000 |

|

|

|

- |

|

|

Total Audit and Audit-Related Fees

|

|

|

1,363,000 |

|

|

|

1,309,095 |

|

|

Tax Fees(3)

|

|

|

426,251 |

|

|

|

125,434 |

|

|

All Other Fees

|

|

|

- |

|

|

|

- |

|

|

Total Fees

|

|

$ |

1,789,251 |

|

|

$ |

1,434,529 |

|

|

(1)

|

Represent fees billed by Deloitte & Touche for services rendered for the audit of the Company’s annual consolidated financial statements and for review of the Company’s quarterly condensed consolidated financial statements.

|

|

(2)

|

Represents fees billed by Deloitte & Touche for services rendered related to the performance of their audit but are not included in (1) above.

|

|

(3)

|

Represents fees billed by Deloitte & Touche for tax compliance, planning and consulting services.

|

Audit Committee Pre-Approval Policy on Audit and Non-Audit Services. As described in the Audit Committee charter, the Audit Committee must review and pre-approve both audit and non-audit services to be provided by the Company’s independent registered public accounting firm (other than with respect to de minimis exceptions permitted by Regulation S-X, Rule 2-01(c)(7)(i)(C)). This duty may be delegated to one or more designated members of the Audit Committee with any such pre-approval reported to the Audit Committee at its next regularly scheduled meeting. None of the services described above were performed by Deloitte & Touche under the de minimis exception rule.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2015

PROPOSAL 3 – Advisory Vote on Compensation of the Named Executive Officers

As required pursuant to Section 14A of the Securities Exchange Act, the Company seeks your advisory vote on a resolution to approve the compensation of our named executive officers as disclosed in this proxy statement. Our named executive officers are the Chief Executive Officer, the Chief Financial Officer, the next three highest paid executive officers, and the former Senior Vice President, Human Resources (“Named Executive Officers”). Although your vote is advisory and will not be binding on the Board or the Company, the Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. Unless the Board modifies its policy on the frequency of future advisory votes, the next advisory vote on the compensation of our Named Executive Officers will be held at the 2016 Annual Meeting of Stockholders.

The Company’s executive compensation programs have played a material role in our ability to drive strong financial results and attract and retain a highly experienced, successful management team. We believe that our executive compensation programs are structured to support the Company’s business objectives. We closely monitor the compensation programs and pay levels of executives from companies of similar size and complexity to ensure that our compensation programs are within the norm of a range of market practices. As discussed below in the Compensation Discussion and Analysis (“CD&A”) section, the Company’s compensation for its Named Executive Officers includes the following elements:

|

·

|

Long-term equity compensation with multi-year performance based vesting. The most significant element of the Named Executive Officers equity compensation opportunity is the LTI Program for which vesting depends on the Company’s total stockholder return relative to its peer group over a three-year period.

|

|

·

|

Total cash compensation tied to performance. A significant portion of the cash compensation opportunity for the Named Executive Officers is based on the Company’s performance. As such, the cash compensation for the Named Executive Officers has fluctuated from year to year, reflecting the Company’s financial results.

|

The text of the resolution in respect of Proposal 3 is as follows:

“Resolved, that the stockholders approve, on a non-binding basis, the compensation of the Company’s Named Executive Officers as disclosed in this Proxy Statement.”

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF

THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

STOCK OWNERSHIP BY DIRECTORS AND EXECUTIVE OFFICERS

The beneficial ownership of Common Stock by each of the directors, each of the Named Executive Officers, and by all directors and executive officers as a group is set forth in the following table as of April 1, 2015, together with the percentage of total shares outstanding represented by such ownership. For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 under the Exchange Act, under which, in general, a person is deemed to be the beneficial owner of a security if that person has or shares the power to vote or to direct the voting of the security or the power to dispose or to direct the disposition of the security, or if he or she has the right to acquire the beneficial ownership of the security within 60 days.

|

Name of Beneficial Owner

|

Number of Shares

|

Percent of Class

|

|

Pamela G. Bailey(1)

|

85,531

|

|

*

|

|

Anthony P. Bihl III (2)

|

40,749

|

|

*

|

|

Joseph W. Dziedzic(3)

|

20,241

|

|

*

|

|

Thomas J. Hook(4)

|

674,597

|

|

2.6%

|

|

Dr. Joseph A. Miller, Jr.(5)

|

81,250

|

|

*

|

|

Bill R. Sanford(6)

|

134,312

|

|

*

|

|

Peter H. Soderberg(7)

|

84,206

|

|

*

|

|

William B. Summers, Jr.(8)

|

93,843

|

|

*

|

|

Michael Dinkins(9)

|

116,448

|

|

*

|

|

Mauricio Arellano(10)

|

59,072

|

|

*

|

|

Andrew P. Holman(11)

|

10,689

|

|

*

|

|

Timothy G. McEvoy (12)

|

54,046

|

|

*

|

|

Michelle Graham(13)

|

6,701

|

|

*

|

|

All directors and executive officers as a group (15 persons) (14)

|

1,483,767

|

|

5.6%

|

|

(1)

|

Includes (i) 57,505 shares Ms. Bailey has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 1,387 shares of restricted stock; and (iii) 26,639 shares directly held by her.

|

|

(2)

|

Includes (i) 30,899 shares Mr. Bihl has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 1,387 shares of restricted stock; and (iii) 8,463 shares directly held by him.

|

|

(3)

|

Includes (i) 14,491 shares Mr. Dziedzic has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 1,387 shares of restricted stock; and (iii) 4,363 shares directly held by him.

|

|

(4)

|

Includes (i) 475,693 shares Mr. Hook has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 3,682 shares allocated to his account under the 401(k) Plan; and (iii) 195,222 shares directly held by him.

|

|

(5)

|

Includes (i) 57,505 shares Dr. Miller has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 1,387 shares of restricted stock; and (iii) 22,358 shares directly held by him.

|

|

(6)

|

Includes (i) 82,534 shares Mr. Sanford has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 2,081 shares of restricted stock; and (iii) 49,697 shares directly held by him.

|

|

(7)

|

Includes (i) 57,505 shares Mr. Soderberg has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 1,387 shares of restricted stock; and (iii) 25,314 shares directly held by him.

|

|

(8)

|

Includes (i) 57,505 shares Mr. Summers has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 1,387 shares of restricted stock; and (iii) 34,951 shares directly held by him.

|

|

(9)

|

Includes (i) 85,441 shares Mr. Dinkins has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 643 shares allocated to his account under the 401(k) Plan; and (iii) 30,364 shares directly held by him.

|

|

(10)

|

Includes (i) 21,643 shares Mr. Arellano has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 3,549 shares allocated to his account under the 401(k) Plan; (iii) 13,542 shares indirectly controlled by him; and (iv) 20,338 shares directly held by him.

|

|

(11)

|

Includes (i) 7,967 shares Mr. Holman has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 546 shares allocated to his account under the 401(k) Plan; and (iii) 2,176 shares directly held by him.

|

|

(12)

|

Includes (i) 23,714 shares Mr. McEvoy has the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 2,108 shares allocated to his account under the 401(k) Plan; and (iii) 28,224 shares directly held by him.

|

|

(13)

|

Includes (i) 180 shares indirectly controlled by Ms. Graham; (ii) 159 shares allocated to her account under the 401(k) Plan; and (ii) 6,362 shares directly held by her.

|

|

(14)

|

Includes (i) 987,221 shares the directors and executive officers have the right to acquire pursuant to options exercisable currently or within 60 days after April 1, 2015; (ii) 11,725 shares allocated to their accounts under the 401(k) Plan; (iii) 13,722 shares indirectly controlled by them; and (iv) 471,099 shares directly held by them.

|

|

*

|

Less than 1%

|

Section 16(a) Beneficial Ownership Reporting Compliance. Under Section 16(a) of the Exchange Act, the Company’s directors and executive officers are required to report their beneficial ownership of the Common Stock and any changes in that beneficial ownership to the Securities and Exchange Commission (“SEC”) and the NYSE. The Company believes that these filing requirements were satisfied during fiscal year 2014. In making the foregoing statement, the Company has relied on copies of the reporting forms received by it or on the written representations from the persons required to report.

COMPENSATION DISCUSSION AND ANALYSIS

Objectives of Executive Compensation Programs and 2014 Performance

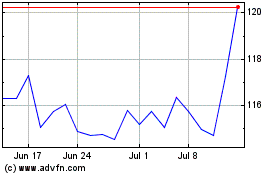

In 2014, we materially advanced our financial objective of driving mid-single digit top line revenue and double digit bottom line operating profit growth in our core business. Our revenues rose from $664 million in 2013 to $688 million, Adjusted Operating Income increased from $83 million in 2013 to $91 million, and Adjusted Earnings Per Share rose 15%, from $2.10 per share in 2013 to $2.42 per share. See “Strategic and Financial Overview” in Part II, Item 7 of our 2014 Form 10-K for a reconciliation of these adjusted amounts to those calculated in accordance with generally accepted accounting principles (“GAAP”). Total stockholder return for fiscal year 2014, measured as the increase in our stock price, was 11.1% which reflects the Company’s strong financial performance relative to our peer group which was 1.4%.

The Compensation and Organization Committee of the Board, referred to as the “Compensation Committee” in this CD&A, designs and oversees the Company’s executive compensation programs to emphasize and reward the execution of our business strategy, the achievement of corporate financial objectives, and the creation of stockholder value. Our executive compensation programs and practices have remained consistent over the past several years, and we believe our programs are aligned with the interests of our stockholders and have significantly contributed to the achievement of our business strategy.

To ensure our compensation programs are aligned with the long-term interest of our stockholders, we have adopted several governance policies that we expect our executive officers to comply with, including meaningful stock ownership guidelines, a pledging and hedging policy and a recapture or “clawback” policy that provides for the recoupment of any performance-based payouts made based on financial results that are not in compliance with any financial reporting requirement that requires restatement of the Company’s financial statements.

At our 2014 Annual Meeting, our stockholders had the opportunity to vote on the compensation paid to our named executive officers. The results of this advisory “say-on-pay” vote were overwhelmingly supportive, with almost 97% of votes cast voting in favor. Our 2015 executive compensation programs and plan design will remain substantially similar to our 2014 executive compensation programs.

Compensation Philosophy

Our compensation philosophy is to provide a competitive compensation package that will attract, retain and motivate our executives to drive the Company’s success through high performance and innovation, to link our executives’ compensation to short- and long-term performance of the Company and to align our executives’ compensation with the interests of our stockholders. The compensation programs for our Named Executive Officers are designed to be consistent with our compensation philosophy.

We have designed our compensation programs to include:

|

|

·

|

Annual Performance-Based Cash Incentives

|

|

|

·

|

Long-Term Incentives Including Stock Options and Performance Shares

|

|

|

·

|

Retirement and Change in Control Agreements

|

We expect the total compensation levels of our Named Executive Officers to be approximately between the 50th and 75th percentiles of the total compensation levels for comparable positions within our peer group if the Company achieves above market performance. This allows us to attract and retain executives who have the appropriate skill set to develop and execute our strategic plans and attain both our short- and long-term financial and strategic objectives. We believe that this approach properly incentivizes our executive officers and provides value to our stockholders through the above market financial performance of the Company. The executive compensation programs for our Named Executive Officers have been designed to allow for flexibility to respond to the evolving business environment, address individual performance and consider internal and external pay equity.

The following graphs depict the mix of cash versus equity compensation as a percentage of total direct compensation awarded to our Named Executive Officers during 2014, assuming target performance levels are achieved:

The following graphs depict the mix of fixed (base salary) versus performance (at risk, all incentive compensation) based compensation as a percentage of total direct compensation awarded to our Named Executive Officers during 2014, assuming target performance levels are achieved:

Compensation Committee Practices and Procedures

The Compensation Committee has responsibility for the Company’s compensation practices with appropriate approval and general oversight from the Board. This responsibility includes the determination of compensation levels and awards provided to the Named Executive Officers. The Compensation Committee has directly engaged Ernst & Young LLP as an independent compensation consulting firm to review the Company’s executive compensation programs and provide guidance on compensation matters and recommendations made by management. In 2014, Ernst & Young advised the Compensation Committee on the Company’s executive compensation programs. A representative of Ernst & Young was present in person or by telephone for all meetings held by the Compensation Committee during 2014.

In accordance with NYSE rules regarding the independence of compensation consultants, the Compensation Committee has considered the other services Ernst & Young provides to the Company, the amount of fees paid to Ernst & Young by the Company, Ernst & Young’s policies and procedures designed to prevent conflicts of interest, any business or personal relationship Ernst & Young may have with any member of the Compensation Committee, any stock of the Company owned by Ernst & Young, and any business or personal relationship Ernst & Young has with any of the Named Executive Officers. Following that review, the Compensation Committee concluded that Ernst & Young’s work for the Compensation Committee does not raise a conflict of interest.

The Compensation Committee is also responsible for evaluating the performance of Mr. Hook, our President & Chief Executive Officer. Performance reviews of Mr. Hook are based on his individual performance as well as on the Company’s performance during a given year. The Compensation Committee provides a recommendation for the performance review and any compensation adjustments to the Board for approval. For the other Named Executive Officers, the Compensation Committee considers input and recommendations from Mr. Hook regarding performance, base salary adjustments and annual and long-term incentive programs and award amounts. The Compensation Committee determines the final compensation for those executive officers. Grants of equity-based compensation are approved by the Compensation Committee in accordance with long-term incentive programs established by the Compensation Committee with the assistance of Ernst & Young. Although not required by our long-term incentive plans, the Board of has provided final approval on the equity-based compensation awards for our senior level executives.

During 2014, Michelle Graham (until her resignation), then Senior Vice President, Human Resources, and Timothy G. McEvoy, Senior Vice President, General Counsel & Secretary, attended meetings of the Compensation Committee to provide counsel and assistance to the Compensation Committee as needed. These executives were not present during executive sessions of the Compensation Committee or when items pertaining to their individual compensation were discussed.

Competitive Market Review

The Compensation Committee compares Company performance and compensation programs against a peer group of companies. The companies selected to be in our peer group (i) have relevant overlap with our industry, customers and products, (ii) are similar in size, and (iii) have key metrics consistent with our growth strategy. The key metrics considered in evaluating companies for our peer group are revenue size and growth rate, return on equity, net income, earnings per share growth, average gross margins and enterprise value. The Compensation Committee also took into consideration companies identified as peers of our peers, peers by our analysts and peers by governance rating firms. The Compensation Committee typically reevaluates the peer group every two to three years or sooner if acquisitions warrant or events occur such that the companies in the peer group are no longer comparable to our Company. The companies comprising our 2014 compensation peer group are as follows:

|

Analogic Corporation

|

|

Merit Medical Systems, Inc.

|

|

ArthroCare Corporation

|

|

NuVasive, Inc.

|

|

CONMED Corporation

|

|

Orthofix International

|

|

CTS Corporation

|

|

Symmetry Medical, Inc.

|

|

Haemonetics Corporation

|

|

Thoratec Corporation

|

|

Integra LifeSciences Holdings Corporation

|

|

West Pharmaceutical Services, Inc.

|

|

KEMET Corporation

|

|

Wright Medical Group, Inc.

|

|

Masimo Corporation

|

|

|

The Compensation Committee believes this is an appropriate size for a peer group in order to obtain a representative sample of our competitive market. For 2015, ArthroCare Corporation and Symmetry Medical, Inc. will be removed from our peer group due to acquisitions. The Compensation Committee intends to reevaluate our peer group for 2015.

Base Salary

We provide our senior level executives with a fixed level of cash compensation in the form of base salary that is consistent with their skill level, experience, knowledge, length of service with our Company and the level of responsibility and complexity of their position. The Compensation Committee does not use a specific formula when setting base salary for our Named Executive Officers, but our general practice is to be within 90% to 110% of the competitive market median. In addition to the factors listed above, actual base salaries may differ from the competitive market median target as a result of various other factors including relative depth of experience, prior individual performance and expected future contributions, internal pay equity considerations within our Company and the degree of difficulty in replacing the individual. Any such differences are approved by the Compensation Committee and in the case of Mr. Hook, by the Board.

The base salaries of our Named Executive Officers are reviewed by the Compensation Committee on an annual basis, as well as at the time of promotion or significant changes in responsibility. We expect the base salaries of our Named Executive Officers to generally increase in-line with any increases to the competitive median market rates. However, base salary increases are also reviewed on an individual basis and adjusted accordingly for performance.

In setting base salaries for our Named Executive Officers for 2014, the Compensation Committee reviewed and used a 2012 Ernst and Young market study related to the compensation of the Named Executive Officers, trending the data to 2014, and supplemented it with the 2014 Towers Watson Executive Compensation survey and 2013 proxy data from our peer group. The 2014 base salaries for our Named Executive Officers were compared to this data, and were adjusted for factors such as prior individual experience and performance and expected future contributions, performance of our Company, internal equity considerations within our Company and the degree of difficulty in replacing the executive.

The base salaries for our Named Executive Officers were as follows:

| |

|

2012

Base Salary

|

|

|

2013

Base Salary

|

|

|

2014

Base Salary

|

|

|

2015

Base Salary

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas J. Hook

|

|

$ |

546,000 |

|

|

$ |

700,000 |

|

|

$ |

700,000 |

|

|

$ |

721,000 |

|

|

Michael Dinkins

|

|

|

360,000 |

|

|

|

366,120 |

|

|

|

375,273 |

|

|

|

384,655 |

|

|

Mauricio Arellano

|

|

|

325,000 |

|

|

|

328,250 |

|

|

|

339,082 |

|

|

|

350,045 |

|

|

Andrew P. Holman

|

|

|

257,000 |

(1) |

|

|

280,000 |

|

|

|

288,400 |

|

|

|

315,000 |

|

|

Timothy McEvoy

|

|

|

237,000 |

|

|

|

242,925 |

|

|

|

250,213 |

|

|

|

280,000 |

|

|

Michelle Graham

|

|

|

250,000 |

|

|

|

258,750 |

|

|

|

269,100 |

|

|

NA

|

(2) |

|

(1)

|

Mr. Holman joined the Company as Vice President for Sales and Marketing on March 21, 2012.

|

|

(2)

|

Ms. Graham served as Senior Vice President for Human Resources until her resignation on September 19, 2014. She remained an employee until January 3, 2015 to assist with the transition of her departure from the Company.

|

In 2014, base salaries for the Named Executive Officers were increased to reflect a competitive market increase for companies with similar performance to ours as well as individual performance. In addition, Mr. Holman was promoted in December 2014 and was given a base salary increase from $288,400 to $315,000 based on a review of the competitive median market data and the additional responsibilities in his new role as Executive Vice President, Global Sales & Marketing.

The Compensation Committee also reviewed the base salary for Mr. McEvoy, Senior Vice President, General Counsel & Secretary. Based on the market data described above, Mr. McEvoy’s base salary was considerably below the market median. His 2014 base salary was near the 25th percentile of the market data. Mr. Hook recommended, and the Compensation Committee reviewed and approved, an increase in Mr. McEvoy’s base salary from $250,213 to $280,000, to bring him closer to the competitive market median.

Annual Performance-Based Cash Incentives

During 2014, our Named Executive Officers received cash incentive payments under our Greatbatch Growth Bonus Plan (“G2B Plan”). The objective of the G2B Plan is to provide a target level of performance-based annual cash compensation at the competitive market median, with the opportunity for above median compensation if stretch performance is achieved. Achievement at the 100% target level is deemed to be a “realistic” but challenging goal and any amount greater than the target is considered a “stretch” goal. A portion of our Named Executive Officers’ annual cash incentive payment is made in the form of shares of Common Stock contributed to their accounts under our 401(k) Plan. See further discussion regarding retirement benefits in the “Retirement” section.

The Compensation Committee sets the performance metrics for the G2B Plan generally at its first meeting each year based upon prior year performance, the Company’s plan for the current year, and the Board’s desire for continuous and meaningful performance improvement. The annual cash incentive plan awards for our Named Executive Officers are set based upon Company-wide performance metrics. Payment of annual incentive plan awards are based upon the achievement of these performance metrics and can vary significantly from year to year.

Overall funding of our G2B Plan is based upon Company-wide performance measures as recommended by the Compensation Committee and is generally approved by the Board at its first meeting each year. For 2014, the G2B Plan funding percentage was based upon two financial metrics, total revenue (25%) and adjusted operating income (75%). In addition, if the adjusted operating income threshold had not been achieved, no portion of the G2B Plan would have been funded. Once the adjusted operating income metric is achieved the plan funding begins at 50%. The Compensation Committee believes that these performance metrics are appropriate as they are relevant key metrics that drive stockholder value.

Funding of the G2B Plan is calculated in accordance with the following scale:

|

Achievement of Performance Measure

|

Funding %

|

|

Less than Threshold

|

0%

|

|

Threshold - 100%

|

50% - 100%

|

|

100% - Maximum

|

100% - 195%

|

The Compensation Committee believes that the calculation of funding and performance metrics are aligned with the Company’s strategic objective of growing revenue and profitability. The weighting between revenue and adjusted operating income puts more emphasis on profitability and is believed to be more directly aligned with the interest of stockholders.

The 2014 G2B Plan individual achievement percentages were determined as follows:

| |

Revenue (25%)

|

Adjusted OI (75%)

|

| |

|

|

|

Threshold

|

$668.9M 50.0%

|

$83.2M 50.0%

|

|

Actual

|

$687.8M 80.3%

|

$91.2M 82.0%

|

|

Target

|

$700.1M 100.0%

|

$95.7M 100.0%

|

|

Maximum

|

$727.9M 195.0%

|

$113.0M 195.0%

|

|

Weighted Average G2B Funding

|

81.6%

|

Adjusted operating income under the G2B Plan differs from operating income under GAAP as a result of the exclusion of: (i) acquisition-related charges; (ii) facility consolidation, optimization, manufacturing transfer and system integration charges; (iii) asset write-down and disposition charges; (iv) severance charges in connection with corporate realignments or a reduction in force; (v) litigation charges and gains; (vi) the impact of non-cash charges to interest expense; (vii) unusual or infrequently occurring items; (viii) design verification testing expenses incurred in connection with the development of our neuromodulation platform in 2013; (ix) gain/loss on the sale of investments; (x) the income tax (benefit) related to these adjustments and (xi) certain tax benefits/charges related to the Federal R&D Tax Credit and the consolidation of our Swiss orthopaedic facilities. All of these adjustments were reviewed and approved by the Compensation Committee. See “Strategic and Financial Overview” in Item 7, page 30 of our 2014 Form 10-K for a reconciliation of adjusted operating income to GAAP operating income.

Individual cash incentives are calculated by multiplying the funding percentage by the individual’s target bonus percent.

Total Available Award (TAA) = (Base Salary x Individual Target Bonus %) x Plan Funding %

The individual target bonus percent for our Named Executive Officers was determined by the Compensation Committee in order to provide targeted total cash compensation at the median of our competitive market. The target payout as a percentage of base salary for our Named Executive Officers is as follows:

| |

|

2014

|

|

|

2015

|

|

|

President & CEO

|

|

|

90 |

% |

|

|

90 |

% |

|

CFO

|

|

|

75 |

% |

|

|

75 |

% |

|

Mauricio Arellano

|

|

|

75 |

% |

|

|

75 |

% |

|

Andrew P. Holman

|

|

|

70 |

% |

|

|

75 |

%(1) |

|

Timothy G. McEvoy

|

|

|

65 |

% |

|

|

65 |

% |

|

Michelle Graham

|

|

|

70 |

% |

|

NA

|

(2) |

|

(1)

|

As a result of Mr. Holman’s promotion, his target bonus percent was increased to 75% based on his new level in the organization.

|

|

(2)

|

Ms. Graham is not eligible for an award in 2015 due to her resignation on September 19, 2014.

|

Illustrative Computation of 2014 cash incentive award for Thomas J. Hook:

Total Available Award =

(Base Salary ($700,000) x Individual Target Bonus % (90%)) x Incentive Plan Funding % (81.6%) = $514,080

Annual cash incentives for our Named Executive Officers are awarded pursuant to the Company’s Executive Short-Term Incentive Compensation Plan, which was approved by stockholders at our 2012 Annual Meeting in order to meet the requirements under Internal Revenue Code (“IRC”) §162(m). Under IRC §162(m), a limitation is placed on the tax deductibility of compensation to certain executives of a publicly-held corporation that exceeds $1,000,000 in any taxable year, unless the compensation meets certain requirements. Historically, our deductions for executive compensation have not been materially impacted by IRC §162(m); however in 2014, $0.6 million of compensation related to one of our Named Executive Officers was not deductible for tax purposes as it exceeded IRC §162(m) limits.

Long-Term Incentives

In addition to cash incentives, we also compensate our Named Executive Officers with long-term incentive awards (“LTI”) that are designed to align management’s performance incentives with the interests of our stockholders. The LTI program includes time- and performance-based awards that are at the competitive market median of executive officers in comparable positions in our peer group. Our Named Executive Officers receive 25% of their LTI award in time-based stock options and 75% of their award in performance-based restricted stock units. The objective of the time-based award is to provide total direct compensation, when combined with the executive’s base salary and G2B Program award at target, at the bottom quartile of our competitive market. The objective of the performance-based award is to deliver total direct compensation at the 60th percentile of our competitive market if target level performance is achieved and deliver the 75th percentile if the maximum performance level is achieved. The metric for the performance-based awards is relative total stockholder return (“TSR”) versus our peer group.

The LTI award percentage granted each year is reviewed on an individual basis and can be adjusted based on individual performance and expected future contributions. The individual award opportunity under the LTI Program is expressed as a percentage of the Named Executive Officer’s salary as follows:

| |

|

Maximum(1)

|

|

|

2015(1)

|

|

| |

|

2012

|

|

|

2013

|

|

|

2014

|

|

|

Threshold(1)

|

|

|

Target(2)

|

|

|

Maximum(3)

|

|

|

President & CEO

|

|

|

430 |

% |

|

|

430 |

% |

|

|

430 |

% |

|

|

108 |

% |

|

|

269 |

% |

|

|

430 |

% |

|

CFO

|

|

|

260 |

% |

|

|

260 |

% |

|

|

260 |

% |

|

|

65 |

% |

|

|

163 |

% |

|

|

260 |

% |

|

Mauricio Arellano

|

|

|

260 |

% |

|

|

260 |

% |

|

|

260 |

% |

|

|

65 |

% |

|

|

163 |

% |

|

|

260 |

% |

|

Andrew P. Holman

|

|

|

N/A |

(4) |

|

|

230 |

% |

|

|

230 |

% |

|

|

65 |

% |

|

|

163 |

% |

|

|

260 |

%(5) |

|

Timothy G. McEvoy

|

|

|

120 |

% |

|

|

120 |

% |

|

|

120 |

% |

|

|

30 |

% |

|

|

75 |

% |

|

|

120 |

% |

|

Michelle Graham(6)

|

|

|

230 |

% |

|

|

230 |

% |

|

|

230 |

% |

|

|

N/A |

|

|

|

N/A |

|

|

|

N/A |

|

|

(1)

|

Includes the percentage related to time-based stock options and maximum performance award.

|

|

(2)

|

Target represents TSR performance at the median of the peer group.

|

|

(3)

|

Maximum represents TSR performance at or above the 75th percentile of the peer group.

|

|

(4)

|

Mr. Holman was hired by the Company on March 21, 2012 and was not eligible for a 2012 LTI award.

|

|

(5)

|

Due to Mr. Holman’s promotion, his maximum LTI award increased to 260% based on his new level in the organization.

|

|

(6)

|

Ms. Graham was not eligible for an award in 2015 due to her resignation on September 19, 2014.

|

The 2012 LTI program matured on January 2, 2015. The TSR achieved of 129% was in the 81st percentile of our peer group and accordingly all performance awards vested at 100% of maximum on January 20, 2015.

The time based portion of the LTI Program awards was determined based upon the following formula:

Maximum Stock Option Award (MSOA) = (Base Salary x Individual Maximum Award %) x 25%

Non-Qualified Stock Option Grant = (MSOA) ÷ Grant Date Black-Scholes Value

We utilize the Black-Scholes option pricing model to estimate the fair value of stock options granted for financial statement reporting purposes as allowed under GAAP. See Note 11 of the Notes to the Consolidated Financial Statements contained in Item 8 of our 2014 Form 10-K for further explanation of the assumptions and methodology for determining the fair value of stock options granted.

The time-based portion of the LTI awards vest in three equal annual installments on the last day of each fiscal year, beginning in the year of grant. This portion of the LTI award is issued in the form of non-qualified stock options to provide a balance between the amount of stock options and full-value awards provided to our executive officers and to align their interests with those of stockholders.

The performance-based LTI awards, granted 100% in restricted stock units, are determined based upon the following formula:

Maximum Performance Award (MPA) = (Base Salary x Individual Maximum Award %) x 75%

Restricted Stock Unit Grant = MPA ÷ Grant Date Closing Stock Price

The performance metric for these awards is TSR relative to our peer group for a three-year performance period. In measuring TSR, the peer group is set at the award date and does not change unless a peer group company is acquired, in which case that company is removed entirely from the performance measurement period. Relative TSR was selected as the Compensation Committee believed it most closely aligns the interests of our executive officers’ with those of stockholders and, since this is a long-term measure, drives appropriate risk taking. LTI performance awards will vest at the end of the three-year performance period as follows:

|

TSR Performance Rank

|

Vesting Amount

|

|

25th Percentile

|

5.3% of MPA (Threshold Shares(1))

|

|

25th Percentile - 75th Percentile

|

Calculation between Threshold and Maximum Shares

|

|

75th Percentile and above

|

100% of MPA (Maximum Shares)

|

|

(1)

|

Payment at threshold would generally result in compensation that was slightly above the 25th percentile of the peer group, thus aligning pay with performance.

|

Illustrative Computation of 2014 LTI Program Award for Thomas J. Hook:

Maximum Time Award (MTA) = ($700,000 x 430%) x 25% = $752,500

Non-Qualified Stock Option Grant = ($752,500) ÷ $16.30 = 46,149 stock options

Maximum Performance Award (MPA) = ($700,000 x 430%) x 75% = $2,257,500

Restricted Stock Unit Grant = $2,257,500 ÷ $43.78 = 51,564 restricted stock units

Threshold Performance Award (TPA) = (($700,000 x 430%) x 75%) x 5.333% = $120,392

Restricted Stock Unit Grant = $120,392 ÷ $43.78 = 2,750 restricted stock units

In addition to the LTI Program, our executive officers may receive additional equity-based compensation at the date of hire, upon promotion, for special recognition or upon a significant change in responsibility. These awards are used as a recruiting and retention tool. These grants are typically made in the form of restricted stock units. In 2014, none of our Named Executive Officers received an additional equity grant.

Our long-term incentive compensation plans and awards are designed and administered by the Compensation Committee in collaboration with management and subject to general oversight by the Board. Historically, we have granted associates long-term incentive compensation in the form of non-qualified and incentive stock options, restricted stock and restricted stock units. Annual long-term awards are approved in December, and are effective on the first day of the new fiscal year. The Compensation Committee and Board typically meets at least five times per year based upon a schedule determined several months in advance. Accordingly, the proximity of any awards to earnings announcements or the release of material non-public information would be coincidental. All stock options are issued with strike prices that are equal to the value of our closing stock price on the grant date.

Upon the death or disability of an associate, all outstanding stock option awards immediately vest and all outstanding performance-based restricted stock units immediately vest at the target level applicable to such performance-based awards. All vested stock options expire at various times following the event, no later than one year, based upon the terms of the plan they were awarded from. In the event that an associate’s employment is terminated by the Company without cause, a pro-rata portion of such associate’s performance-based restricted stock units that were awarded more than one year before the date of termination will remain outstanding. These awards will continue to be eligible for vesting based on the Company’s attainment of the performance goals applicable to such awards.

For associates who meet the eligibility requirements for retirement, all outstanding stock option awards immediately vest and a pro-rated portion of outstanding performance-based restricted stock units held by such associate continue to be eligible for vesting based on the Company’s attainment of the performance goals applicable to such awards. See further discussion regarding retirement benefits in the “Retirement” section.

In the event of a change in control, as defined in the applicable award plan or agreement, unless determined otherwise by the Compensation Committee, all unvested stock option awards granted will immediately vest, but only the portion of unvested performance-based restricted stock units that would have vested under the original plan design will immediately vest. While our plans provide for single trigger vesting, our Change in Control agreements with our Named Executive Officers require both a Change in Control and termination of employment for our Named Executive Officers. See further discussion regarding change in control benefits in the “Change in Control Agreements” section.

Tax deductions for awards under our LTI plans may be limited in the future under IRC §162(m). The Compensation Committee considers the potential non-deductibility of stock incentive awards under IRC §162(m) when setting award levels. The Compensation Committee believes that our long-term incentive programs are properly designed to incentivize and retain senior management, which is in the best interest of stockholders even if IRC §162(m) limits are periodically exceeded and the tax deductions are limited.

Equity Compensation Plan Information

The following table provides information regarding the Company’s equity compensation plans as of January 2, 2015:

|

Plan Category (As of January 2, 2015)

|

|

Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights

|

|

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

|

|

|

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

|

|

| |

|

(a)(1)

|

|

|

(b)

|

|

|

(c)(2)

|

|

|

Equity compensation plans approved by security holders

|

|

|

2,374,332 |

|

|

$ |

25.16 |

|

|

|

908,945 |

|

|

Equity compensation plan not approved by security holders

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Total