US Senators Propose Extending Renewable-Energy Grant Program

June 15 2010 - 8:36PM

Dow Jones News

A group of U.S. Senators Tuesday proposed extending a government

program that provides cash grants to renewable energy developers in

lieu of tax credits, a program developers have said is crucial to

keeping the market afloat.

Sens. Maria Cantwell (D., Wash.), Dianne Feinstein (D., Calif.)

and four other Democratic senators proposed extending the renewable

tax-credit Treasury grant program another two years, through 2012,

as part of a $140 billion bill to extend federal unemployment aid

and renew a host of expired tax breaks.

The renewable energy proposal, in the form of an amendment to

the "tax extender" bill, would create at least 65,000 jobs in the

solar power industry and tens of thousands of jobs in other

sectors, Cantwell and Feinstein said.

"The clean energy sector is the next frontier in jobs creation,

so we need to ensure that developers can access financing to launch

wind, solar and geothermal projects and put people to work,"

Feinstein said in a statement.

The senators said the bipartisan proposal would carry a minimal

cost and help "jumpstart" a transition in the U.S. to cleaner forms

of energy.

The renewable-energy grant program, created by the 2008 Recovery

Act, has been widely credited with keeping the U.S.

renewable-energy market solvent after the financial crisis wiped

out most sources of project financing on which developers had

depended.

Other Recovery Act programs, like expanding the Department of

Energy's loan guarantee program, also have boosted renewable energy

development. But developers and power generators have said the cash

grant program is the most vital, and extending it past 2010 is key

to ensuring that new wind and solar farms will continue to be built

across the U.S.

The program, in which the Treasury Department provides grants to

renewable energy developers for the amount that they would

otherwise get under a federal 30% investment tax credit, frees

developers from having to find a "tax equity" partner to take

advantage of the credit. Before the financial crisis in 2008, Wall

Street banks routinely provided tax equity financing for renewable

energy projects, but those sources dried up after the market

meltdown.

Extending the grant program will prevent a slowdown in U.S.

renewable energy development, said the proposal's sponsors, who

include Sens. George LeMieux (R., Fla.), Debbie Stabenow (D.,

Mich.), Jeff Merkley (D., Ore.) and Ben Nelson (D., Neb.).

The amendment also would allow municipal utilities and other

non-profit power producers that don't pay taxes to take advantage

of the program for the first time.

If the proposal succeeds, it would benefit manufacturers of

solar panels, wind turbines and other renewable energy components,

such as First Solar Inc. (FSLR), SunPower Corp. (SPWRA, SPWRB),

Suntech Power Holdings Co. Inc. (STP), General Electric Co. (GE)

and Vestas Wind Systems AS (VWS.KO), as well as renewable energy

developers such as NextEra Energy Inc. (FPL), Iberdrola Renovables

SA (IBR.MC) and E.On AG (EOAN.XE).

-By Cassandra Sweet, Dow Jones Newswires; 415-439-6468;

cassandra.sweet@dowjones.com

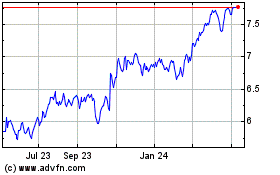

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

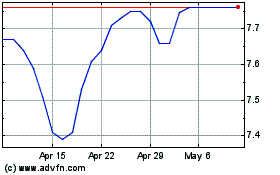

First Trust New Opportun... (NYSE:FPL)

Historical Stock Chart

From Apr 2023 to Apr 2024