Icahn Takes a Stake in Copper Giant Freeport-McMoRan

August 27 2015 - 5:40PM

Dow Jones News

By Chelsey Dulaney and John W. Miller

Activist investor Carl Icahn disclosed a stake in copper miner

Freeport-McMoRan Inc., saying its shares are undervalued and that

he plans to talk with management about its costs.

Mr. Icahn said in a securities filing released on Thursday that

he intends to have discussions with Freeport-McMoRan's board and

management about the company's capital expenditures, executive

compensation practices, capital structure and curtailment of its

"high-cost production operations."

The New York-based hedge fund executive reported holding 17.6

million Freeport shares, an 8.46% stake, and said he may seek board

representation, the filing said.

His criticisms come after Freeport-McMoRan outlined plans

earlier in the day to cut its capital-spending plans for 2016 by

29% and reduce head count at U.S. mining operations as copper

prices near six-year lows--which sent shares up 29% in the regular

trading session.

After Mr. Icahn disclosed his stake, Freeport shares climbed a

further 18% to $12.18 after hours. The stock has been beaten

down--even after Thursday's rally in the regular session, the stock

has declined 72% in the past 12 months.

Freeport said in a statement that it "maintains an open dialogue

with our shareholders and welcomes constructive input toward our

common goal of enhancing shareholder value."

Mr. Icahn is known for acquiring big stakes in companies and

agitating for changes, and has shaken up the boards of directors at

Chesapeake Energy Corp., Transocean Inc. and CVR Energy Inc., among

others.

Freeport's latest expense reductions, which could include

eliminating around 1,560 jobs, come after the Phoenix-based miner

cut its oil-and-gas spending plans earlier this month and said it

would review its mining operations.

Freeport, which has been struggling with the effect of weak

commodity prices, said it now expects capital spending of $4

billion next year, down 29% from its July estimate of $5.6 billion.

It has already pared its 2015 capital budget by about 16% since

late 2014.

It also said it would cut planned 2016 copper production by 150

million pounds, or 2.8% of the 5.4 billion pounds it had previously

forecast. Its earlier 2016 forecast called for a 29% increase in

production from current levels.

The retrenchment by Freeport, which mines copper in Arizona,

Latin America, Indonesia and the Democratic Republic of Congo, is

significant because the company had taken one of the mining world's

most bullish stances on the metal, used in pipes and wiring.

However, Freeport said on Thursday it was time to "respond

aggressively to current market conditions." Copper prices are

currently averaging $2.25 a pound, 27% lower than last year, and

"near a six-year low," the company said.

The 2016 forecasts include a 25% cut to mining spending and

reductions in copper sales and site production, including a

suspension of operations at its Miami, Ariz., mine and reductions

at its Tyrone, N.M., mine.

Freeport said it expects a 10% reduction in employees and

contractors at U.S. mining operations. As of Dec. 31, 2014,

Freeport employed 13,200 people, along with 3,400 contractors, at

its U.S. operations, according to securities filings.

Freeport earlier this month cut its oil-and-gas capital spending

views for 2016 and 2017 by $900 million to $2 billion a year. The

company maintained its expectation for $2.8 billion in energy

spending for this year. Freeport said it also would look for

strategic investors to help fund development at oil-and-gas and

mining properties.

In July, after reporting its second straight quarterly loss, the

company had said it was prepared to scale back operations if

commodity prices didn't recover

A downturn in commodity prices has hit miners across the board.

But Freeport is relatively fortunate to be mining copper and not

iron ore, the key ingredient in steelmaking, which is far more

oversupplied. And Freeport has managed to keep costs at most of its

mines far below current copper prices, helped by lower oil prices,

the strong dollar and mining in developing countries.

Josh Beckerman contributed to this article

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com and John W.

Miller at john.miller@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 27, 2015 17:25 ET (21:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

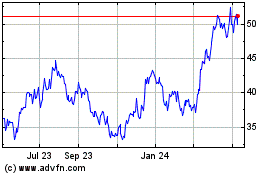

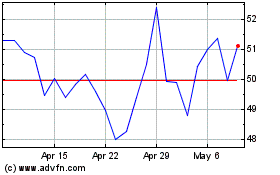

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024