Essex Prices Notes to Boost Liquidity - Analyst Blog

April 09 2014 - 9:30AM

Zacks

In order to boost its liquidity

position, Essex Property Trust, Inc. (ESS)

disclosed the pricing of 3.875% senior unsecured notes worth $400

million. In particular, the company’s operating arm, Essex

Portfolio, L.P., has priced a private placement of these notes at

99.234% of par value. The offering will close on Apr 15, 2014, upon

fulfillment of customary closing conditions.

The notes, having a yield to

maturity of 3.968%, will mature on May 1, 2024. The interest on the

notes is payable semi annually on May 1 and Nov 1, with the first

payment starting on Nov 1, 2014. This residential real estate

investment trust (REIT) expects to use the reaped proceeds from the

offering for refinancing existing senior unsecured facilities and

other corporate needs.

For Essex Property, whose cash

position stood at $53.8 million as of Dec 31, 2013, the transaction

is a strategic fit as it will strengthen its balance sheet. This

will, in turn, pave way for making accretive investments going

forward.

Notably, earlier this month, Essex

Property successfully accomplished the $16.2 billion merger with

BRE Properties. This led to the creation of a premium West Coast

pure play multifamily REIT with an equity market capitalization of

about $11.1 billion. With a solid property base, significant

geographic overlap and strong management team at Essex, this

combined entity is believed to efficiently leverage on the

attractive market fundamentals, synergies and reward shareholders

accordingly.

Essex Property is scheduled to

release its first-quarter 2014 results on May 7, after the market

closes. The Zacks Consensus Estimate for funds from operations

(FFO) for the quarter is pegged at $2.00, representing

year-over-year growth of 7%.

Essex Property currently has a

Zacks Rank #3 (Hold).

Investors interested in the

residential REIT industry may also consider Associated

Estates Realty Corporation (AEC), Preferred

Apartment Communities, Inc. (APTS) and UDR

Inc. (UDR). All these stocks carry a Zacks Rank #2

(Buy).

Note: FFO, a widely used metric

to gauge the performance of REITs, is obtained after adding

depreciation and amortization and other non-cash expenses to net

income.

ASSOC ESTATES (AEC): Free Stock Analysis Report

PREFERRED APTMT (APTS): Free Stock Analysis Report

ESSEX PPTY TR (ESS): Free Stock Analysis Report

UDR INC (UDR): Free Stock Analysis Report

To read this article on Zacks.com click here.

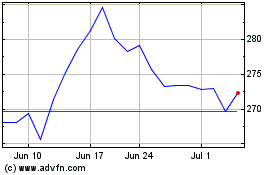

Essex Property (NYSE:ESS)

Historical Stock Chart

From Mar 2024 to Apr 2024

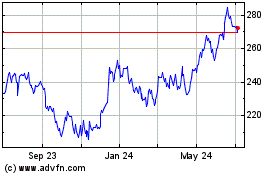

Essex Property (NYSE:ESS)

Historical Stock Chart

From Apr 2023 to Apr 2024