EOG Resources Reports Loss on $4.1 Billion Impairment Charges

November 05 2015 - 5:37PM

Dow Jones News

By Maria Armental

EOG Resources Inc. swung to a third-quarter loss as revenue

plunged and the energy company booked more than $4 billion in

charges amid sharply lower commodity prices brought on by a global

supply glut.

Shares, down 6% this year, edged down 0.5% to $86 in after-hours

trading.

The Houston company, like most of its peers, is trying to adjust

operations as crude oil prices trade below $50 a barrel.

In the most recent period, EOG said production fell 5% from the

year earlier, adjusted for the sale of its Canadian operations,

while capital spending fell 36% from the year earlier.

EOG, spun off from the now defunct Enron Corp., has capped

capital spending for the year at $4.7 billion to $4.9 billion,

compared with the $8.3 billion it spent in 2014.

Overall, EOG reported a loss of $4.08 billion, or $7.47 a share,

compared with a profit of $1.10 billion, or $2.01 a share, a year

earlier. Excluding impairments and other items, EOG reported a

profit of two cents a share, down from $1.31 a share a year

earlier.

Revenue plunged by more than half to $2.17 billion.

Analysts surveyed by Thomson Reuters had projected a loss of 30

cents a share on $2.35 billion in revenue.

EOG carries $6.39 billion in debt and had $742.7 million of cash

as of Sept. 30.

Write to Maria Armental at maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 17:22 ET (22:22 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

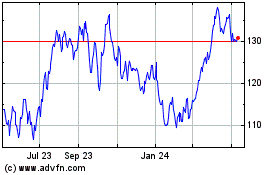

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024