SunEdison to Sell Some Assets to GCL-Poly Energy -- Update

August 29 2016 - 10:19AM

Dow Jones News

By Chester Yung

HONG KONG -- GCL-Poly Energy Holdings Ltd., one of China's

largest makers of solar equipment, on Sunday said it agreed to buy

the solar materials assets of bankrupt U.S. renewable energy

company SunEdison Inc. for $150 million.

The Hong Kong-listed company said the acquisition includes

SunEdison's subsidiaries, which are SunEdison Products Singapore

Pte., MEMC Pasadena Inc. and Solaicx Inc., as well as SunEdison's

stake in a Korean joint venture, SMP Ltd. The acquisition excludes

MEMC's manufacturing facility in Pasadena, Texas.

The sale of SunEdison's solar materials business is the latest

in a series of transactions designed to raise money for creditors

of the troubled company. NRG Energy Inc. has offered a starting bid

of $144 million for a parcel of North American solar- and

wind-power projects, while an affiliate of Edison International's

SoCore Energy has offered nearly $80 million for a second parcel

going on the auction block in September, a collection of 22

commercial and industrial projects under development in

Minnesota.

Like the NRG and SoCore offers, GCL-Poly's offer will be tested

at auction, according to bankruptcy-court filings.

The solar materials business auction is slated for October,

assuming competing offers come in. SunEdison has been in talks with

potential buyers of the solar materials business for six months,

court papers say. Discussions with one prospective buyer of the

solar materials business date back two years, as SunEdison

deliberated exiting the business of making solar panels and solar

energy materials to focus on developing projects, according to

court filings.

The solar materials business involves the development and

manufacture of solar panels and solar components, using proprietary

SunEdison technology.

SunEdison sought chapter 11 protection in April amid legal and

financial trouble. Company lawyers say it is exploring a

reorganization, and it has been moving to sell off various

alternative-energy projects it built or which are under

development.

Earlier this month, SunEdison said it would seek

bankruptcy-court approval to pay up to $5.1 million in bonuses to

nine senior executives during its chapter 11 case. Many SunEdison

leaders departed when the company's problems erupted, including

former Chief Executive Ahmad Chatila.

Peg Brickley contributed to this article.

Write to Chester Yung at chester.yung@wsj.com

(END) Dow Jones Newswires

August 29, 2016 10:04 ET (14:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

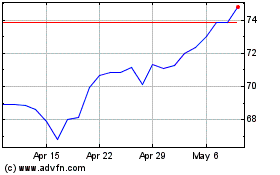

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024