As filed with the Securities and Exchange

Commission on April 28, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31,

2015

Commission file number: 001-34175

ECOPETROL S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

REPUBLIC OF COLOMBIA

(Jurisdiction of incorporation or organization)

Carrera 13 No. 36 – 24

BOGOTA – COLOMBIA

(Address of principal executive offices)

Tel. (571) 234 4000

Maria Catalina Escobar

Investor Relations Officer

investors@ecopetrol.com.co

Tel. (571) 234 5190

Carrera 13 N.36-24 Piso 7

Bogota, Colombia

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant

to Section 12(b) of the Act.

|

Title of each class

|

|

Name of each exchange on which registered:

|

|

American Depository Shares (as evidenced by American Depository Receipts), each representing 20 common shares par value COP$609 per share

|

|

New York Stock Exchange

|

|

Ecopetrol common shares par value COP$609 per share

|

|

New York Stock Exchange (for listing purposes only)

|

|

7.625% Notes due 2019

|

|

New York Stock Exchange

|

|

4.250% Notes due 2018

|

|

New York Stock Exchange

|

|

5.875% Notes due 2023

|

|

New York Stock Exchange

|

|

4.125% Notes due 2025

|

|

New York Stock Exchange

|

|

7.375% Notes due 2043

|

|

New York Stock Exchange

|

|

5.875% Notes due 2045

|

|

New York Stock Exchange

|

|

5.375% Notes due 2026

|

|

New York Stock Exchange

|

Securities registered or to be registered pursuant

to Section 12(g) of the Act: None

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of

each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

41,116,694,690 Ecopetrol common shares, par

value COP$609 per share

Indicate by check mark

if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x

Yes

¨

No

If this report is an

annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934.

¨

Yes

x

No

Indicate by check mark

whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

x

Yes

¨

No

Indicate by check mark

whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files).

N/A

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

x

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Indicate by check mark

which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

¨

U.S. GAAP

|

x

International Financial Reporting Standards as issued by the International Accounting Standards Board

|

¨

Other

|

If “Other”

has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has

elected to follow:

¨

Item 17

¨

Item 18

If this is an annual

report, indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

¨

Yes

x

No

Annual Report on Form 20-F 2015

We file our Annual Report on Form 20-F

and other information with the U.S. Securities and Exchange Commission.

We file reports, including annual reports on

Form 20-F, and other information with the SEC pursuant to the rules and regulations of the SEC that apply to foreign private issuers.

You may read and copy any materials filed with the SEC in the SEC’s public reference room at 100 F Street, NE, Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Any filings

we make are also available to the public over the Internet at the SEC’s website at www.sec.gov and at our website at www.ecopetrol.com.co.

(This URL is intended to be an inactive textual reference only. It is not intended to be an active hyperlink to our website. The

information on our website, which might be accessible through a hyperlink resulting from this URL, is not and shall not be deemed

to be incorporated into this annual report.)

Unless the context otherwise requires, the

terms “Ecopetrol”, “we”, “us”, “our” or the “Company” are used in this

annual report to refer to Ecopetrol S.A. and its subsidiaries on a consolidated basis.

References to the Nation in this

annual report relate to the Republic of Colombia (“Colombia”), our controlling shareholder. References made to

the Colombian government or the Government correspond to the executive branch including the President of Colombia, the

ministries and other governmental agencies responsible for regulating our business.

|

|

1.2

|

Forward-looking Statements

|

This annual report on Form 20-F contains forward-looking

statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These

statements are not based on historical facts and reflect our expectations for future events and results. Most facts are uncertain

because of their nature. Words such as “anticipate”, “believe”, “could”, “estimate”,

“expect”, “should”, “plan”, “potential”, “predicts”, “prognosticate”,

“project”, “target”, “achieve” and “intend”, among other similar expressions, are

understood as forward-looking statements. We have made forward-looking statements that address, among other things:

|

|

·

|

our exploration and production activities, including drilling;

|

|

|

·

|

import and export activities;

|

|

|

·

|

our liquidity, cash flow, and sources of funding;

|

|

|

·

|

our projected and targeted capital expenditures and other cost commitments and revenues; and

|

|

|

·

|

dates by which certain areas will be developed or will come on-stream.

|

Our forward-looking statements are not guarantees

of future performance and are subject to assumptions that may prove incorrect and to risks and uncertainties that are difficult

to predict. Actual results could differ materially from those expressed or forecast in any forward-looking statements as a result

of a variety of factors. These factors may include, but are not limited to, the following:

|

|

·

|

general economic and business conditions, including crude oil and other commodity prices, refining

margins and prevailing exchange rates;

|

|

|

·

|

our ability to obtain financing;

|

|

|

·

|

our ability to find, acquire or gain access to additional reserves and our ability to develop existing

reserves;

|

|

|

·

|

uncertainties inherent in making estimates of our reserves;

|

|

|

·

|

significant political, economic and social developments in Colombia and other countries where we

do business;

|

|

|

·

|

natural disasters, military operations, terrorist acts, wars or embargoes;

|

|

|

·

|

regulatory developments, including regulations related to climate change;

|

|

|

·

|

receipt of government approvals and licenses;

|

|

|

·

|

technical difficulties; and

|

|

|

·

|

other factors discussed in Section 5.1 of this document as “Risk Factors.”

|

All forward-looking statements attributed to

us are qualified in their entirety by this cautionary statement. We undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information or for any other reason. Accordingly, readers should not place undue reliance

on the forward-looking statements contained in this annual report.

|

|

1.3

|

Selected Financial and Operating Data

|

The following table sets forth, for the periods

and at the dates indicated, our selected historical financial and certain key operating data. The selected financial data has been

derived from and should be read in conjunction with, and is qualified in its entirety by reference to, our consolidated audited

financial statements, presented in Colombian Pesos.

Table 1 – Selected Operating Data

|

Operating Information

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Oil and gas production (mboed)

|

|

|

760.7

|

|

|

|

755.4

|

|

|

|

788.2

|

|

|

|

754.0

|

|

|

|

724.1

|

|

|

Proved oil and gas reserves (Mmboe)

(1)

|

|

|

1,849

|

|

|

|

2,084

|

|

|

|

1,972

|

|

|

|

1,877

|

|

|

|

1,857

|

|

|

Exploratory Wells

(2)

|

|

|

5

|

|

|

|

28

|

|

|

|

22

|

|

|

|

23

|

|

|

|

39

|

|

|

Refinery Through-put (bpd)

(3)

|

|

|

234,861

|

|

|

|

240,484

|

|

|

|

283,362

|

|

|

|

296,340

|

|

|

|

305,631

|

|

|

1P Reserves replacement ratio

|

|

|

6

|

%

|

|

|

146

|

%

|

|

|

139

|

%

|

|

|

108

|

%

|

|

|

164

|

%

|

|

|

(1)

|

For 2015 and 2014, proved reserves include natural gas royalties. Data for 2011 through 2013

excludes natural gas royalties. Data for all years excludes crude oil royalties.

|

|

|

(2)

|

Gross exploratory wells.

|

|

|

(3)

|

Refinery through-put includes Barrancabermeja, Reficar,

Apiay and Orito. The Cartagena refinery was shutdown in March 2014 to complete an expansion program. The refinery has resumed

operations and is expected to be up to full capability during the second half of 2016.

|

Financial Information

International Financial Reporting Standards

(“IFRS”)

(Expressed in millions of Colombian Pesos, except

for the net income per share and net operating income per share, which is expressed in Colombian Pesos)

Table 2 – Selected Financial Data

|

Financial Information

|

|

2015

|

|

|

2014

|

|

|

Revenue

|

|

|

52,347,271

|

|

|

|

65,971,888

|

|

|

Operating income

|

|

|

2,131,165

|

|

|

|

14,449,027

|

|

|

Net (loss) income attributable to owners of the Company

|

|

|

(7,193,859

|

)

|

|

|

5,046,517

|

|

|

Net operating income per share

|

|

|

51.8

|

|

|

|

351.4

|

|

|

Weighted average number of shares outstanding

|

|

|

41,116,694,690

|

|

|

|

41,116,698,456

|

|

|

(Loss) earnings per share (basic and diluted)

|

|

|

(175.0

|

)

|

|

|

122.7

|

|

|

Total assets

|

|

|

123,588,190

|

|

|

|

110,923,851

|

|

|

Total equity

|

|

|

43,100,963

|

|

|

|

48,534,228

|

|

|

Subscribed and paid-in capital

|

|

|

25,040,068

|

|

|

|

10,279,175

|

|

|

Number of common shares

|

|

|

41,116,694,690

|

|

|

|

41,116,698,456

|

|

|

Dividends declared per share

|

|

|

-

|

|

|

|

133

|

|

|

Total liabilities

|

|

|

80,487,227

|

|

|

|

62,389,623

|

|

Our consolidated financial statements for the

years ended December 31, 2014 and 2015 were prepared in accordance with IFRS as issued by IASB. References in this annual

report to IFRS mean IFRS as issued by the IASB. Our date of transition to IFRS was January 1, 2014. These consolidated financial

statements are our first financial statements prepared in accordance with IFRS.

Until December 31, 2014, we prepared our

audited consolidated financial statements in accordance with Colombian Government Entity GAAP issued by the

Contaduria

General de la Nación

with reconciliations to United States Generally Accepted Accounting Principles, or U.S. GAAP.

As required by IFRS 1—First Time Adoption of International Financial Reporting Standards— our financial position

and results of operations for the year ended December 31, 2014 have been restated in accordance with IFRS. Note 35 to our consolidated financial

statements contains an analysis of the presentation and disclosure effects of adopting IFRS and the effects on

equity and net income for the fiscal year ended December 31, 2014 as of January 1 and December 31, 2014. The

selected financial information for 2014 included in this annual report differs from the information we previously published

for 2014, because it is presented in accordance with IFRS for comparative purposes, as required by IFRS 1. Following our

adoption of IFRS, we are no longer required to reconcile our financial statements to U.S. GAAP.

In addition, IFRS differs in certain

significant respects from the current reporting standards as in effect in Colombia (“Colombian IFRS”) (which is the

accounting standard we use for local reporting purposes). As a result, our financial information presented under IFRS is not

directly comparable to any of our financial information presented under Colombian IFRS. For a description of the differences

between Colombian IFRS and IFRS see section

Financial Review

—

Summary of Differences between Internal

Reporting Policies and IFRS

.

Our consolidated financial statements were

consolidated line by line and all transactions and significant balances between affiliates have been eliminated. These financial

statements include the financial results of all subsidiary companies controlled, directly or indirectly, by Ecopetrol S.A. See

Exhibit 1 – Consolidated companies, associates and joint ventures, to our consolidated financial statements included in this

annual report.

As indicated in paragraphs 9 and 18 of the

International Accounting Standard 27 “Consolidated and Separated Financial Statements” we must present our financial

information on a consolidated basis as if we were a single entity, combining the financial statements of Ecopetrol S.A. and its

subsidiaries line by line, adding assets, liabilities, shareholder’s equity, revenues and expenses of similar nature, removing

the reciprocal items among members of the Ecopetrol Group and recognizing non-controlling interest. Beginning with this annual

report, we will also be presenting our operating information on a consolidated basis.

The regulations of the SEC do not require foreign

private issuers that prepare their financial statements on the basis of IFRS to reconcile such financial statements to U.S. GAAP. Accordingly, while we have in the past reconciled

our consolidated financial statements prepared in accordance with Colombian Government Entity GAAP to U.S. GAAP, those reconciliations

will no longer be presented in our filings with the SEC. We do continue to provide the disclosure required under the U.S. Financial

Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 932 “Extractive Activities—Oil and

Gas” (which we refer to as ASC Topic 932), as this is required regardless of the basis of accounting on which we prepare

our financial statements. Other than as required under ASC Topic 932, any references to accounting treatments under Colombian Government

Entity GAAP or U.S. GAAP relate solely to the application of Colombian Government Entity GAAP or U.S. GAAP to our historical consolidated

financial statements.

In this annual report, references to “US$”

or “U.S. dollars” are to United States dollars and references to “COP$,” “Colombian Peso”

or “Colombian Pesos” are to Colombian Pesos, the functional currency under which we prepare our financial statements.

This annual report translates certain Colombian Peso amounts into U.S. dollars at specified rates solely for the convenience of

the reader. Unless otherwise indicated, such Colombian Peso amounts have been translated at the rate of COP$2,743.39 per US$1.00,

which corresponds to the

Tasa Representativa Promedio del Mercado

(TRM), or Average Representative Market Exchange Rate,

for 2015. Such conversion should not be construed as a representation that the Colombian Peso amounts correspond to, or have been

or could be converted into, U.S. dollars at that rate or any other rate. On April 22, 2016, the Representative Market Exchange

Rate was COP$2,928.70 per US$1.00.

Certain figures shown in this annual report

have been subject to rounding adjustments and, accordingly, certain totals may therefore not precisely equal the sum of the numbers

presented. In this annual report a billion is equal to one with nine zeros.

|

|

2.

|

Strategy and Market Overview

|

Since the second half of 2014, international

crude oil benchmark prices have declined dramatically. From its peak in June 2014, the ICE Brent crude oil index monthly contract

price fell by more than 65% by the end of 2015, directly impacting the revenue of oil producing companies. It is believed that

the main reason behind the drop in prices is the imbalance between global supply and demand. According to estimates published by

the Energy Information Administration (“EIA”), global oil demand increased 1.03 mboepd less than supply in 2015. Although

non-OPEC supply grew 1.32 mboepd during 2015, it was at a slower pace as compared to 2014, primarily benefited from the United

States, which increased 0.95 mboepd. Additionally, OPEC surprised the market by increasing its supply by 1.06 mboepd during 2015

and global demand grew 1.35 mboepd, mainly due to lower gasoline prices and higher economic growth in OECD countries, according

to EIA.

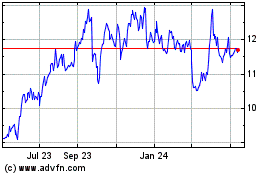

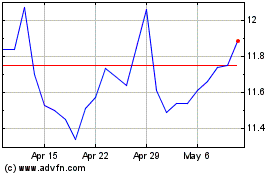

Graph 1 – ICE BRENT$/BL Year 2015

(USD/BL)

Graph 2 – Annual Growth of Oil Demand

and Supply Worldwide

(Mboepd)

Source:

Energy Information Administration (EIA), “Short Term Energy Outlook” (January 12, 2016);

PIRA Energy Group,

“World Oil Market Forecast” (December 22, 2015).

These imbalances have caused a

significant rise in global oil inventories during the past two years, with crude inventories from major OECD countries

(US/EU/JP) rising by 117 million barrels during 2015. As of December 31, 2015, global inventories were an estimated 888

million barrels, according to PIRA Energy Group. Thus, overall business sentiment points to a sustained period of low crude

oil prices i.e. in the range of US$30 per barrel – US$50 per barrel. The current environment will keep oil prices

under pressure until supply is more balanced to demand and excess inventories of crude oil are consumed.

Although international oil prices and global

demand and supply dynamics are significant factors affecting our business and financial condition, Colombia’s local economic

factors have also influenced and could continue to influence our performance given that we conduct most of our business in Colombia.

The performance of Colombia’s gross domestic

product (GDP) is one of the main drivers of fuel consumption in Colombia. According to the Ministry of Finance and Public Credit,

in 2015, Colombia’s GDP grew by 3.1% in real terms, as compared to 4.6% GDP growth in 2014, driven mainly by the performance

of the construction, retail, services and financial sectors. Despite the decrease in Colombia’s economic growth, local demand

for liquid fuels (diesel, gasoline, jet fuel and LPG) increased by 8.3% mainly due to the increase in the number of vehicles in

Colombia. The increase in the demand of liquid fuels also benefited from higher demand for gasoline and diesel following the closure

of Colombia’s border with Venezuela, as customers in that area shifted their business to Ecopetrol; and higher consumption

of thermal electricity during late 2015, due to warmer weather caused by the “El Niño” climate phenomenon, among

other factors.

Recently, the Colombian government reduced

its forecasted economic growth for 2016 from 3.5% to 3.2%, reflecting the impact of lower commodity prices, especially crude oil

prices. The most important contributors to the expected economic output expansion in 2016 will be the construction sector (+3.8%)

and the manufacturing sector (+7.5%), according to the Ministry of Finance and Public Credit. Growth in the manufacturing sector

is expected to be influenced by the full operation of our subsidiary Refinería de Cartagena S.A. (“Reficar”)

following the completion of its modernization project, expected to produce up to 10% of Colombia’s manufacturing output.

Despite these positive events, Colombia’s

economy faces significant challenges as a result of the lower crude oil prices, given that the country is a net oil exporter, and

the slow recovery of its main business and trading partners. These factors have resulted in an increase of the current account

deficit in Colombia and have placed significant pressure on the exchange rate of the Colombian Peso against the U.S. dollar.

In September 2015, the Energy and

Gas Regulatory Commission (“CREG”) for its acronym in Spanish issued the Resolution 213 that gave producers and

clients the possibility to negotiate the index that would be used to update the prices of the existing natural gas contracts.

61% of Ecopetrol’s contracts defined the Consumer Price Index of Colombia as this index. The remaining 39% used

a formula defined by CREG for those contracts in which producers and clients couldn’t reach an agreement. This

formula defined by CREG includes one component related to variations of WTI (West Texas Intermediate) and another to the

Producer Price Index of the United States.

|

|

2.1

|

Our Corporate Strategy

|

During the last decade Ecopetrol exhibited

consistent growth that led it to consolidate its position as the largest corporation in Colombia and one of the 40 largest oil

companies in the world (as reported in Energy Intelligence Top 100 2015). In May 2015 the board of directors of Ecopetrol (“Board

of Directors”) approved the 2015 – 2020 strategy, based on sustainable value creation and a more efficient operation

of Ecopetrol Group’s assets.

This strategy is aimed at fulfilling the expectations

of Ecopetrol’s shareholders while at the same time enhancing Ecopetrol Group’s environmental and compliance frameworks.

The key guidelines for this strategy are the

following:

|

|

ü

|

Seek successful exploration activity by restructuring Ecopetrol’s portfolio, achieving better

geographic diversification and decreasing risk through, with focus on high value oil and gas plays.

|

|

|

ü

|

Focus production efforts on high priority mature fields and the development of projects to improve

our recovery factor.

|

|

|

2.

|

Operational and Financial Excellence

|

|

|

ü

|

Improve processes and innovate in order to operate more efficiently.

|

|

|

ü

|

Perform under specified financial discipline parameters, making sure that the Ecopetrol Group’s

resources are invested in projects that generate value and sustainable growth.

|

|

|

ü

|

Maintain financial metrics within ranges that reflect long term sustainability, debt servicing

and cash generation capacity.

|

|

|

ü

|

Transform the organizational culture by creating a new collaborative environment and reinforcing

human talent management.

|

|

|

ü

|

Achieve comprehensive and effective project management in terms of cost and schedules from the

planning stage of a project through completion.

|

|

|

ü

|

Develop a comprehensive environmental framework, to compliment the needs of our business and communities.

|

|

|

ü

|

Enforce a strong commitment to ethics and integrity across its business relations and its labor

force.

|

To implement this strategy, during

2015 we designed and launched the 2015-2018 Transformation Program (the “Transformation Program”) comprised of eight

key axes: efficiency, exploration, recovery factor, technology, projects, portfolio management, culture and leadership, and community

relationships.

|

|

·

|

With respect to

efficiency

, Ecopetrol expects to achieve cumulative structural savings through the implementation of

best practices in processes and a focus on high-value activities.

|

|

|

·

|

With respect to

exploration,

the Company started

a plan to reinforce its technical capabilities in exploration and will launch a capacity-building technology program in order

to create sustainable value.

|

|

|

·

|

With respect to the

recovery factor

, it has structured a comprehensive program for the improvement of the current oil

recovery factor of 18%, which will maximize cash generation from current producing fields.

|

|

|

·

|

With respect to

technology

, develop business technologies to compliment the Company’s strategy and to strengthen

and streamline the Company’s information technology tools upon the capacities of

Instituto Colombiano del Petroleo

and the technical staff of the Company.

|

|

|

·

|

With respect to

project management

, the Transformation Program includes a thorough review

of the projects execution with the aim of optimizing capital allocation and ensuring that projects meet their budgets in terms

of costs, time and profitability. Lessons learned from recent megaprojects undertaken (i.e. Reficar) will be imperative.

|

|

|

·

|

With respect to

portfolio management

, the Company has a plan to generate cash by means of

a dynamic portfolio rotation program to divest non-strategic assets and equity participations. For the period 2016 – 2017,

we expect to raise funds between US$400 and US$900 million.

|

|

|

·

|

With respect to

culture and leadership

, the Transformation Program includes actions intended to foster the corporate

culture of Ecopetrol based on integrity, collaboration, creativity, care for life an operative and financial excellence; and enhance

its human talent and leadership.

|

|

|

·

|

With respect to

community relationships

, the Transformation Program includes the implementation

of a new relationship model focused on the long-term sustainability of Ecopetrol’s operations by strengthening the ability

of government entities and local organizations to foster greater prosperity in regions where Ecopetrol operates and to build safe

and environmentally sustainable environments.

|

In 2015, the Transformation Program led to

structural cost savings of approximately US$800 million vis-à-vis the original budget. The main areas where we saw cost

savings were drilling and completion, crude dilution, transport, subsurface maintenance and fluid treatment, which represented

52% of savings, and supplies, services and technology, health, safety and environment (HSE) security and research and development,

which represented 24% of savings. These savings reduced Ecopetrol’s costs of operations by 14% in 2015 as compared to 2014.

Consistent with this new

corporate strategy in the long term, in December 2015, the Board of Directors approved a U.S.$4,800 million investment plan for

the year 2016. However, the most recent review of oil price scenarios and the prioritization of the project’s portfolio

in order to protect the cash flow and the financial health of the Company led to an adjustment of the capital expenditures

for 2016, from U.S.$4,800 million to a range between U.S.$3,000 and U.S.$3,400 million. The plan aims at achieving an

annual average production of around 715 thousand barrels of oil and gas equivalent per day in 2016 of which approximately

92% would be contributed by Ecopetrol S.A. and the remaining by its subsidiaries.

U.S.$2,156 million would be invested

by Ecopetrol S.A. and U.S.$847 million by subsidiaries. 93% of the investment would be deployed in Colombia and the

remaining 7% abroad. The highest percentage of resources will be allocated to exploration and production, followed by

refining, mainly to the completion of the Cartagena refinery and the development of the transportation capacity. The detail

of the investments approved per business segment of Ecopetrol S.A. and its subsidiary companies is as follows:

Table 3 – 2016 Investment Plan

|

Business Segment

|

|

(Millions of US$)

|

|

|

% Percentage

|

|

|

|

|

|

|

|

|

Exploration

|

|

$

|

282

|

|

|

|

9.4%

|

|

Production

|

|

|

1,116

|

|

|

|

37.3%

|

|

Transportation and Logistics

|

|

|

433

|

|

|

|

14.4%

|

|

Refining, Petrochemicals, and Biofuels

|

|

|

1,135

|

|

|

|

37.8%

|

|

Others

|

|

|

34

|

|

|

|

1.1%

|

|

TOTAL

|

|

$

|

3,000

|

|

|

|

100%

|

We were formed in 1951 by the Colombian government

as Empresa Colombiana de Petróleos and began operating the crude oil fields at La Cira-Infantas, the oldest Colombian oil

field whose production started in 1918, and the pipeline that connected that field with the Barrancabermeja Refinery and the port

of Cartagena. In 1961, we assumed the direct operation of the Barrancabermeja Refinery and continued its transformation into an

industrial complex. In 1974, we acquired the Cartagena Refinery, which had been in operation since 1957.

In 1970, we adopted our first bylaws that transformed

us into a governmental industrial and commercial company administered by the Ministry of Mines and Energy. In 2003, we were transformed

from an industrial and commercial company into a state-owned corporation, and renamed Ecopetrol S.A.

Pursuant to Decree Law 1760 of 2003, we were

granted greater autonomy over our business decisions and we accelerated our exploration activities. In that year, the regulatory

responsibilities formerly on Ecopetrol were allocated from then on blocks to private and public explorers and operators on a competitive

basis. Since 2003, we have been evolving from a wholly state-owned entity to a mixed-economy company with private capital. This

process has resulted in a substantial change in the legal framework to which we are subject and in the nature of our relationship

with the Nation. We carried out our initial public offering in November 2007 when our common shares became listed on the Colombian

Securities Exchange. Our American Depository Shares were listed on the New York Stock Exchange in 2008.

The following table sets forth a list of our

material acquisitions since January 1, 2009 and the effective date as of which each acquisition has been reflected in our

operating results.

Table 4 – Material Acquisitions since

January 1, 2009

|

Company

|

|

Date

|

|

Participation

acquired in

transaction

|

|

|

Sector

|

|

Price (US$)

(1)

|

|

Offshore International

Group Inc.

|

|

February 2009

|

|

|

50

|

%

(2)

|

|

Exploration and Production

|

|

639 million

|

|

Oleoducto Central S.A. (Ocensa)

|

|

March 2009

|

|

|

24.7

|

%

(3)

|

|

Transportation

|

|

418 million

|

|

Hocol Petroleum Limited (Hocol)

|

|

March 2009

|

|

|

100

|

%

(4)

|

|

Exploration and Production

|

|

807 million

|

|

Refinería de Cartagena

S.A. (Reficar)

|

|

May 2009

|

|

|

51

|

%

(5)

|

|

Refining

|

|

545 million

|

|

Equion Energía Limited

(“Equion”)

|

|

January 2011

|

|

|

51

|

%

(6)

|

|

Exploration and Production

|

|

814 million

|

|

|

(1)

|

Includes amounts of adjustment on transaction prices.

|

|

|

(2)

|

U.S. parent of Savia Perú (formerly Petrotech Peruana S.A.).

|

|

|

(3)

|

As a result of this transaction, our ownership of Oleoducto Central S.A. (“Ocensa”)

increased to 60%.

|

|

|

(4)

|

We acquired 100% of Maurel et Prom’s interest in Hocol Petroleum Limited, whose most important

assets are Hocol S.A. and Homcol Cayman Inc. As a result of the acquisition, our ownership in Oleoducto de Colombia (“ODC”),

increased from 43.85% to 65.57%.

|

|

|

(5)

|

As a result of this transaction, we became the sole owner of Reficar.

|

|

|

(6)

|

As a result of this acquisition, our ownership increased to 72.65% in Ocensa, 73.00% in ODC, and

to 85.12% in Oleoducto del Alto Magdalena or OAM. We also obtained a 10.2% interest in Transgas de Occidente.

|

We are in the

process of selling some of our non-core shareholdings:

|

|

·

|

We currently own 3.03% of the total outstanding shares of Empresa de Energía de Bogotá.

As approved by Decree 2305 of November 13, 2014, we are authorized to offer our remaining 3.03% of total outstanding shares of

Empresa de Energía de Bogotá to the general public using the most appropriate mechanism for the volume and value

of the remaining shares. The first stage of the divestment plan took place during the second quarter of 2015, in which we placed

352,872,414 shares at COP$1,740 per share.

|

|

|

·

|

We currently own 1.23% of the total outstanding shares

of Interconexión Eléctrica S.A. (“ISA”). As approved by Decree 1800 of September 9, 2015, we are authorized

to offer our remaining 1.23% of the total outstanding shares to the general public using the most appropriate mechanism for the

volume and value of the remaining shares. Pursuant thereto, during the second auction of the second stage of the divestment plan

that took place on April 7, 2016, we placed 45,295,034 shares at COP$8,325 per share.

|

|

|

·

|

We currently own 100% of the total outstanding shares of Propilco. On January 27, 2016, the Board

of Directors of Ecopetrol approved the commencement of a divestment plan to sell Ecopetrol’s shares in Propilco. As of the

date of this annual report, the date of any potential transaction has not been established. We are in the process of obtaining

administrative and governmental authorizations to divest our entire stake in Propilco, as prescribed by law. The next step in the

process is to receive approval from the Council of Ministers of Colombia and the issuance of a Presidential Decree with the final

approval to begin the divestiture process under Law 226 of 1995.

|

|

|

·

|

We currently own 43.35% of the total outstanding shares of Inversiones de Gases de Colombia S.A.

We are currently evaluating how to divest such equity stake. As of the date of this annual report, the timing for any divestment

program has not been established.

|

|

|

3.2

|

Our Corporate Structure

|

We operate in the following business segments:

1) Exploration and Production; 2) Transportation and Logistics; 3) Refining, Petrochemicals, and Biofuels.

Our subsidiaries Refinería de Cartagena

(Reficar), Ecopetrol America Inc. and Ocensa are significant subsidiaries as such term is defined under SEC Regulation S-X.

We have a number of directly and indirectly

held subsidiaries both in Colombia and abroad. Our subsidiaries are either directly owned by us or indirectly owned by us through

one or more of our other subsidiaries. As of March 31, 2016, we have eight directly owned and 19 indirectly owned subsidiaries.

In January 2016, we organized a new wholly-owned

subsidiary, Ecopetrol Costa Afuera Colombia S.A.S., which will be responsible for offshore exploration and production activities

in Colombia. The new subsidiary seeks to develop offshore activities in Colombia, which the company currently carries out as operator

and non-operator, and take advantage of the benefits of Decree 2682/14, pursuant to which the conditions and requirements are established

for declaring the existence of Permanent Offshore Free Trade Zones.

The following table identifies our principal

operating subsidiaries, their respective countries of incorporation, and our percentage ownership in each (both directly and indirectly

through other subsidiaries), in each case as of March 31, 2016. See Exhibit 8.1 to this annual report for a complete list

of our subsidiaries, their respective countries of incorporation, and our percentage of ownership in each.

Table 5 – Our Principal Operating Subsidiaries

|

COMPANY

|

|

COUNTRY OF

INCORPORATION

|

|

OWNERSHIP %

|

|

|

Exploration and Production

|

|

|

|

|

|

|

|

Ecopetrol Óleo e Gás do Brasil Ltda.**

|

|

Brazil

|

|

|

100.00

|

|

|

Ecopetrol del Perú S.A.**

|

|

Peru

|

|

|

100.00

|

|

|

Ecopetrol Germany GmbH**

|

|

Germany

|

|

|

100.00

|

|

|

Ecopetrol America Inc.**

|

|

United States

|

|

|

100.00

|

|

|

Hocol S.A.**

|

|

Cayman Island

|

|

|

100.00

|

|

|

Equion Energía Limited

|

|

United Kingdom

|

|

|

51.00

|

|

|

Transportation

|

|

|

|

|

|

|

|

Oleoducto de los Llanos Orientales S.A. (ODL)**

|

|

Panama

|

|

|

65.00

|

|

|

Oleoducto de Colombia S.A.**

|

|

Colombia

|

|

|

73.00

|

|

|

Oleoducto Central S.A.**

|

|

Colombia

|

|

|

72.65

|

|

|

Oleoducto Bicentenario de Colombia S.A.S.**

|

|

Colombia

|

|

|

55.97

|

|

|

Cenit Transporte y Logística de Hidrocarburos S.A.S.

|

|

Colombia

|

|

|

100.00

|

|

|

Refining and Petrochemicals

|

|

|

|

|

|

|

|

Refinería de Cartagena S.A.*

|

|

Colombia

|

|

|

100.00

|

|

|

Polipropileno del Caribe S.A.*

|

|

Colombia

|

|

|

100.00

|

|

|

Compounding and Masterbatching Industry Ltda.**

|

|

Colombia

|

|

|

100.00

|

|

|

Biofuels

|

|

|

|

|

|

|

|

Bioenergy S.A.**

|

|

Colombia

|

|

|

96.21

|

|

|

Other

|

|

|

|

|

|

|

|

Black Gold Re Ltd.

|

|

Bermuda

|

|

|

100.00

|

|

|

|

*

|

Direct and indirect participation.

|

|

|

**

|

Solely indirect participation through other subsidiaries or affiliates.

|

The following organization chart illustrates

the relationships between Ecopetrol S.A. and its direct and indirect subsidiaries as of March 31, 2016.

Graph 3 – Ecopetrol Corporate Structure

|

|

(a)

|

Stock ownership of an Ecopetrol S.A.’s subordinate company.

|

|

|

(b)

|

A foreing corporation with a foreing corporation branch in Columbia.

|

|

|

(c)

|

As a result of the second auction on April 7, 2016, Ecopetrol S.A. sold 4.08% equity share in

the company ISA. The final shareholding in ISA is 1.23%.

|

The stock ownership percentage listed refers

to Ecopetrol S.A.’s direct and indirect participation. The data in this structure shows neither the whole ownership nor its

decimal figures, so they will be used only for information purposes.

The so-called shareholding (Ecopetrol S.A.’s

direct participation), affiliated, subsidiary companies are listed, as well as the stock interest of Ecopetrol S.A.’s subordinate

companies.

We are a vertically integrated oil company

with a presence primarily in Colombia, Peru, Brazil and the U.S. Gulf Coast. The Nation currently controls 88.49% of our voting

capital stock. We are among the top 50 oil and gas companies in the world based on the (Petroleum Intelligence Weekly Top 50 Ranking)

and in the top 5 in Latin America based on production volume. We are the largest corporation in Colombia as measured by revenues,

EBITDA and shareholders’ equity, and we play a key role in the local hydrocarbon market.

|

|

3.4

|

Exploration and Production

|

Our exploration and production business segment

includes exploration, development and production activities in Colombia and abroad. We began local exploration in 1955 and international

exploration in 2006. We conduct exploration and production activities directly in Ecopetrol S.A., through some of our subsidiaries,

and through joint ventures with third parties. As of December 31, 2015, we were the largest operator and the largest producer

of crude oil and natural gas in Colombia, and we maintained the largest acreage under exploration in Colombia.

|

|

3.4.1

|

Exploration Activities

|

Our exploration plan in Colombia is focused

on: (i) exploration of sites in close proximity to existing producing areas, and (ii) currently producing basins and frontier areas,

including off-shore areas primarily operated by our business partners, which we believe have the potential for large discoveries.

We strive to balance these two focuses and develop the best mix of activities for our business. In addition, our exploration strategy

for blocks, that are considered less attractive, is to look for business partners to share our interests or to sell our entire

interest.

Our exploration strategy outside of Colombia

is focused on locating prospects and establishing joint ventures with experienced operators. In order to implement this strategy,

we have a Regional Studies team that manages our New Ventures and a Global Offshore team, which is responsible for ensuring the

incorporation of contingent resources from the Caribbean Offshore in Colombia, the U.S. Gulf Coast and Brazil.

For purposes of this exploration section,

“we” refers to Ecopetrol S.A., its subsidiaries and partnerships in which Ecopetrol has an interest. Unless otherwise

stated, all figures are given before deductions for royalties.

|

|

3.4.1.1

|

Exploration Activities in Colombia

|

Currently we have exploration activities in

most of the sedimentary basins in Colombia, in which active oil and gas operations are found.

The following map shows the basins where we

are currently conducting exploration activities.

Graph 4 – Sedimentary Basins in Colombia

We conduct exploration activities in Colombia

on our own and through joint ventures with regional and global oil and gas companies.

In 2015, Ecopetrol S.A. did not acquire any

equivalent kilometers of seismic data either directly or through business partners.

Exploratory Wells

The following table sets forth, for the periods

indicated, the number of gross and net productive and dry exploratory wells drilled by us and our joint venture partners and the

exploratory wells drilled by third parties pursuant to sole risk contracts with us.

Table 6 – Ecopetrol S.A.’s Gross

and Net Productive and Dry Exploratory Wells

|

|

|

For the year ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

|

|

(number of wells)

|

|

|

COLOMBIA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owned and operated by Ecopetrol

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

(1)

|

|

|

–

|

|

|

|

3.0

|

|

|

|

4.0

|

|

|

Dry

(2)

|

|

|

1.0

|

|

|

|

9.0

|

|

|

|

2.0

|

|

|

Total

|

|

|

1.0

|

|

|

|

12.0

|

|

|

|

6.0

|

|

|

Operated by Partner in Joint Venture

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

1.0

|

|

|

|

1.0

|

|

|

|

3.0

|

|

|

Dry

|

|

|

1.0

|

|

|

|

2.0

|

|

|

|

2.0

|

|

|

Total

|

|

|

2.0

|

|

|

|

3.0

|

|

|

|

5.0

|

|

|

Operated by Ecopetrol in Joint Venture

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

1.0

|

|

|

|

–

|

|

|

Dry

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

|

–

|

|

|

|

1.0

|

|

|

|

–

|

|

|

Net Exploratory Wells

(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

0.5

|

|

|

|

4.1

|

|

|

|

5.5

|

|

|

Dry

|

|

|

1.5

|

|

|

|

10.7

|

|

|

|

3.0

|

|

|

Total

|

|

|

2.0

|

|

|

|

14.8

|

|

|

|

8.5

|

|

|

Sole Risk

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Dry

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Equion

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Dry

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Hocol

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

1.0

|

|

|

|

–

|

|

|

|

1.0

|

|

|

Dry

|

|

|

–

|

|

|

|

4.0

|

|

|

|

6.0

|

|

|

Total

|

|

|

1.0

|

|

|

|

4.0

|

|

|

|

7.0

|

|

|

Net Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

0.5

|

|

|

|

–

|

|

|

|

0.5

|

|

|

Dry

|

|

|

–

|

|

|

|

3.0

|

|

|

|

5.0

|

|

|

Total

|

|

|

0.5

|

|

|

|

3.0

|

|

|

|

5.5

|

|

|

|

(1)

|

A productive well is an exploratory well that has evidence of hydrocarbons.

|

|

|

(2)

|

A dry well or hole is an exploratory well found to be incapable of producing either crude oil or

natural gas in sufficient quantities to justify completion as a crude oil or natural gas well.

|

|

|

(3)

|

Net exploratory wells are calculated according to our percentage of ownership in these wells.

|

Ecopetrol S.A. drilled a total of three wildcat

exploratory wells in 2015. There was evidence of hydrocarbons in one well: Kronos located in the Fuerte Sur Block in the Caribbean

Offshore in Colombia, in which Ecopetrol holds a 50% working interest, in partnership with Anadarko (operator). Two wells were

dry: Calasu and Muergana Sur.

In December 2014, Ecopetrol S.A. announced

the discovery of hydrocarbons in the exploratory Orca-1 well (operated by Petrobras), in which Petrobras holds a 40% working interest,

Ecopetrol holds a 30% working interest and Repsol holds a 30% working interest, and located 40 kilometers north of the Guajira

province coast. It was the first discovery in deep water in the Caribbean Offshore in Colombia.

Our subsidiary Hocol drilled one successful

exploratory well: Bullerengue-1 located in the SSJN-1 Block and operated by Hocol who holds a 50% working interest in partnership

with Lewis Energy.

During 2015, bidding rounds were not launched

by the National Hydrocarbons Agency to offer licenses for exploratory activities in Colombia.

|

|

3.4.1.2

|

Exploration Activities Outside of Colombia

|

Our international exploration strategy is focused

on participating in bidding rounds to secure blocks available for exploration and entering into joint ventures with international

and regional oil companies. We believe exploring outside Colombia allows us to diversify our risks and improve the possibilities

of increasing our crude oil and natural gas reserves.

With respect to our seismic data outside of

Colombia, during 2015, our subsidiary Ecopetrol Brasil executed a seismic program on Ceará basin, CE-M-715 Block, having

acquired 554.71 equivalent kilometers of seismic data, in which Ecopetrol Brasil holds a 50% working interest and Chevron (operator)

holds the remaining 50%. Pursuant to their joint venture, Ecopetrol Brasil and Chevron will process the seismic data in 2016. In

addition Ecopetrol Brasil established an alliance with the Japanese company JX Nippon Oil & Gas Exploration for exploration

of the FZA-M-320 block, located in shallow waters off the Foz do Brasil basin, in the Equatorial rim of the Amazon. The joint venture

agreement established that JX Nippon would join exploration in the area with a 30% stake.

With respect to our exploratory drilling outside

of Colombia, during 2015, in association with our business partners, we have undertaken deep water exploratory drilling in the

U.S. Gulf Coast. The following table sets forth information on our exploratory drilling in the years 2015, 2014 and 2013.

Table 7 – Exploratory Drilling Outside

of Colombia

|

|

|

For the year ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

|

|

(number of wells)

|

|

|

INTERNATIONAL

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ecopetrol America Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

(1)

|

|

|

–

|

|

|

|

2.0

|

|

|

|

–

|

|

|

Dry

(2)

|

|

|

1.0

|

|

|

|

3.0

|

|

|

|

2.0

|

|

|

Total

|

|

|

1.0

|

|

|

|

5.0

|

|

|

|

2.0

|

|

|

Net Exploratory Wells

(3)(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

0.7

|

|

|

|

–

|

|

|

Dry

|

|

|

0.5

|

|

|

|

0.5

|

|

|

|

0.5

|

|

|

Total

|

|

|

0.5

|

|

|

|

1.2

|

|

|

|

0.5

|

|

|

Ecopetrol Óleo e Gás do Brasil Ltda.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Dry

|

|

|

–

|

|

|

|

–

|

|

|

|

1.0

|

|

|

Total

|

|

|

–

|

|

|

|

–

|

|

|

|

1.0

|

|

|

Net Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Dry

|

|

|

–

|

|

|

|

–

|

|

|

|

0.3

|

|

|

Total

|

|

|

–

|

|

|

|

–

|

|

|

|

0.3

|

|

|

Ecopetrol Germany

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Dry

|

|

|

–

|

|

|

|

2.0

|

|

|

|

–

|

|

|

Total

|

|

|

–

|

|

|

|

2.0

|

|

|

|

–

|

|

|

Net Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Dry

|

|

|

–

|

|

|

|

0.2

|

|

|

|

–

|

|

|

Total

|

|

|

–

|

|

|

|

0.2

|

|

|

|

–

|

|

|

Savia Perú

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

1.0

|

|

|

Dry

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

|

–

|

|

|

|

–

|

|

|

|

1.0

|

|

|

Net Exploratory Wells

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

–

|

|

|

|

–

|

|

|

|

0.5

|

|

|

Dry

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

|

–

|

|

|

|

–

|

|

|

|

0.5

|

|

|

|

(1)

|

A productive well is an exploratory well that has evidence of hydrocarbons.

|

|

|

(2)

|

A dry well or hole is an exploratory well found to be incapable of producing either crude oil or

natural gas in sufficient quantities to justify completion as a crude oil or natural gas well.

|

|

|

(3)

|

Net exploratory wells are calculated according to our percentage of ownership in these wells.

|

|

|

(4)

|

None of our international wells were dug pursuant to a sole risk contract.

|

As set forth in the table above, in 2015, our

subsidiary Ecopetrol America Inc. drilled the Sea Eagle exploratory well, in which the company has 50% working interest and our

partner Murphy (operator) holds the remaining 50%. The well was declared a dry hole.

We also added 10 blocks to our exploration

portfolio as a result of Ecopetrol America Inc.’s participation in partnership in the lease sale 235 and 246 which took place

in June, September, October and November of the year 2015.

|

|

3.4.2

|

Production Activities

|

Our consolidated average production was 760.7 thousand

boepd in 2015, an increase of 5.3 thousand boepd as compared to 2014. This increase is mainly the result of an increase in

production in the Castilla and Chichimene fields due to the entrance of new facilities and production wells, which contributed

to higher average production in 2015.

The following table summarizes the results

of our oil and gas production activities for the periods indicated:

Table 8 – Ecopetrol Group’s Oil

and Gas Production

|

|

|

For the year ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

|

|

Oil

(1)

|

|

|

Gas

|

|

|

Total

|

|

|

Oil

(1)

|

|

|

Gas

|

|

|

Total

|

|

|

Oil

(1)

|

|

|

Gas

|

|

|

Total

|

|

|

|

|

(thousand boepd)

|

|

|

Total production in Colombia

(2)

|

|

|

619.2

|

|

|

|

130.4

|

|

|

|

749.6

|

|

|

|

610.9

|

|

|

|

133.3

|

|

|

|

744.2

|

|

|

|

643.9

|

|

|

|

136.6

|

|

|

|

780.5

|

|

|

Total International production

(3)

|

|

|

7.3

|

|

|

|

3.8

|

|

|

|

11.1

|

|

|

|

8.6

|

|

|

|

2.6

|

|

|

|

11.2

|

|

|

|

7.2

|

|

|

|

0.5

|

|

|

|

7.7

|

|

|

Total production of Ecopetrol Group

|

|

|

626.5

|

|

|

|

134.2

|

|

|

|

760.7

|

|

|

|

619.5

|

|

|

|

135.9

|

|

|

|

755.4

|

|

|

|

651.1

|

|

|

|

137.1

|

|

|

|

788.2

|

|

|

|

(1)

|

Conversion between mcfpd and boepd is performed at 5,700 mcfpd to 1 boepd.

|

|

|

(2)

|

Total production in Colombia corresponds to Ecopetrol S.A., Hocol and Equion.

|

|

|

(3)

|

Total International production corresponds to Savia Perú and Ecopetrol America Inc.

|

|

|

3.4.2.1

|

Production Activities in Colombia

|

|

|

3.4.2.1.1.

|

Ecopetrol S.A.’s Production Activities in Colombia

|

For the year ended December 31, 2015,

Ecopetrol S.A. was the largest participant in the Colombian hydrocarbons industry, accounting for approximately 58% of crude oil

production (according to calculations made by Ecopetrol based on information from the National Hydrocarbons Agency) and approximately

60% of natural gas production (according to calculations made by Ecopetrol based on information from the National Hydrocarbons

Agency).

In 2015, Ecopetrol S.A. carried out development

drilling in all its producing regions in Colombia, drilling 539 development wells; 209 of those through direct operations and 330

through joint ventures. As part of an internal administrative restructuring process Ecopetrol S.A. reorganized the management of

its production activities, which allowed it to improve its control on operations, while at the same time gave it a closer and more

effective interaction with communities and partners. Beginning on July 1, 2014, Ecopetrol S.A.´s fully owned fields

were divided into three main Vice-presidencies or administrative regions:

|

|

·

|

Central Region: comprising 30 fields with active production in 2015 in the Middle Magdalena Valley

and Catatumbo regions.

|

|

|

·

|

Orinoquia Region: comprising 21 fields with active production in 2015 in the provinces of Meta,

Casanare, Arauca y Vichada.

|

|

|

·

|

Southern Region: comprising 35 fields with active production in 2015 in the provinces of Huila,

Tolima, Putumayo, Nariño and Caquetá.

|

A fourth Vice-presidency, the Vice-presidency

of Associated Assets, is responsible for all of the production activities in which a partner is involved, regardless of the location

of such activities in Colombia. The Vice-Presidency of Associated Assets is comprised of 116 fields with active production in 2015.

The map below indicates the locations of our

operations in Colombia.

Graph 5 – Locations of our Production

Operations in Colombia

Crude Oil Production

The average daily production of crude oil in

Colombia by Ecopetrol S.A. (excluding its subsidiaries), was 586.2 mbod in 2015, 6.5 mbod higher than in 2014, which represents

a year-to-year increase of 1%.

The following chart summarizes Ecopetrol S.A.’s

average daily crude oil production in Colombia by Region Vice-Presidency, prior to deducting royalties, for the periods indicated.

Table 9 – Ecopetrol S.A.’s Average

Daily Crude Oil Production in Colombia by Region Vice-Presidency

|

|

|

For the year ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

|

|

(thousand bpd)

|

|

|

Central Region Vice-Presidency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) La Cira – Infantas

|

|

|

22.9

|

|

|

|

24.6

|

|

|

|

23.5

|

|

|

2) Casabe

|

|

|

21.9

|

|

|

|

22.0

|

|

|

|

22.8

|

|

|

3) Yarigui

|

|

|

17.8

|

|

|

|

16.7

|

|

|

|

14.9

|

|

|

4) Other

|

|

|

23.7

|

|

|

|

21.0

|

|

|

|

20.3

|

|

|

Total Central Region

|

|

|

86.3

|

|

|

|

84.3

|

|

|

|

81.4

|

|

|

Orinoquía Region Vice-Presidency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) Castilla

|

|

|

122.5

|

|

|

|

104.4

|

|

|

|

112.9

|

|

|

2) Chichimene

|

|

|

78.0

|

|

|

|

56.2

|

|

|

|

53.1

|

|

|

3) Cupiagua

|

|

|

14.0

|

|

|

|

16.4

|

|

|

|

18.5

|

|

|

4) Other

|

|

|

21.1

|

|

|

|

26.0

|

|

|

|

23.8

|

|

|

Total Orinoquia Region

|

|

|

235.6

|

|

|

|

203.0

|

|

|

|

208.3

|

|

|

Southern Region Vice-Presidency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) San Francisco

|

|

|

8.1

|

|

|

|

9.2

|

|

|

|

10.0

|

|

|

2) Huila Area

|

|

|

7.8

|

|

|

|

8.2

|

|

|

|

7.9

|

|

|

3) Tello

|

|

|

4.5

|

|

|

|

4.3

|

|

|

|

4.4

|

|

|

4) Other

|

|

|

11.0

|

|

|

|

11.8

|

|

|

|

11.8

|

|

|

Total Southern Region Vice-Presidency

|

|

|

31.4

|

|

|

|

33.6

|

|

|

|

34.2

|

|

|

Associated Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1) Rubiales

|

|

|

94.3

|

|

|

|

104.3

|

|

|

|

120.0

|

|

|

2) Quifa

|

|

|

24.2

|

|

|

|

33.0

|

|

|

|

33.5

|

|

|

3) Caño Limon

|

|

|

25.6

|

|

|

|

30.0

|

|

|

|

36.4

|

|

|

4) Cusiana

|

|

|

5.2

|

|

|

|

7.0

|

|

|

|

8.8

|

|

|

5) Other

|

|

|

83.6

|

|

|

|

84.6

|

|

|

|

90.0

|

|

|

Total Associated Operations

|

|

|

232.9

|

|

|

|

258.9

|

|

|

|

288.7

|

|

|

Total average daily crude oil production Ecopetrol S.A. (Colombia)

|

|

|

586.2

|

|

|

|

579.7

|

|

|

|

612.6

|

|

Table 10 – Ecopetrol S.A. Production

per Type of Crude

|

|

|

2015

(mbod)

|

|

|

Year-on-Year ∆

(%)

|

|

|

2014

(mbod)

|

|

|

Year-on-Year ∆

(%)

|

|

|

2013

(mbod)

|

|

|

Light

|

|

|

44.6

|

|

|

|

0.2

|

%

|

|

|

44.5

|

|

|

|

(9.4

|