Bunge Swings to Profit Though Revenue Slides

February 11 2016 - 9:10AM

Dow Jones News

Bunge Ltd. on Thursday reported it swung to a profit in the

final quarter of the year but saw a steeper-than-expected slide in

revenue on weakness in its core agribusiness as well as in its

edible oil and milling products units.

"In the fourth quarter, Bunge managed the challenging market

conditions well, leveraging our balanced global footprint to

capitalize on good soy processing margins and increased South

American grain exports," Chief Executive Soren Schroder said.

Like other companies in the agriculture space, Bunge has

grappled with softer commodity prices and weaker global demand.

DuPont Co. stepped up its cost-cutting efforts as slowing growth in

developing countries and the strengthening U.S. dollar continued to

challenge to the maker of seeds and chemicals.

Bunge, one of the world's largest traders and processors of

agricultural commodities, saw mixed profit results in its business

segments in the latest quarter.

In its core agribusiness division, earnings plummeted 15%.

Profit from edible oil and milling products plunged 28% and 42%,

respectively. Meanwhile, earnings from fertilizer rose 4.8%, while

sugar and bioenergy swung to a profit.

Over all, the company reported a profit of $203 million, or

$1.30 a share, compared with a loss of $54 million, or 43 cents a

share, a year earlier. Adjusted earnings rose to $1.49 a share from

$1.12 a year earlier.

Revenue declined 16% to $11.13 billion.

Analysts forecast adjusted earnings of $1.56 a share on $11.85

billion in revenue, according to Thomson Reuters.

Bunge shares, which have fallen 16% over the past three months,

were inactive premarket.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 11, 2016 08:55 ET (13:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

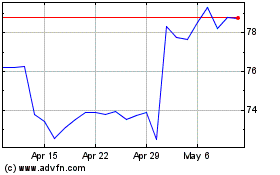

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Aug 2024 to Sep 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Sep 2023 to Sep 2024