Airline Trade Group Forecasts Record U.S. Carrier Passenger Numbers This Summer

May 18 2016 - 8:20AM

Dow Jones News

An estimated 231.1 million passengers are expected to fly on

U.S. airlines between June 1 and Aug. 31, a 4% increase from the

previous high set last summer, according to Airlines for America,

the leading trade group.

With U.S. fliers increasingly caught in long lines before

undergoing security screening at airports—and sometimes missing

their flights—the trade group called on the Transportation Security

Administration to quickly hire and train new staffers to alleviate

the screening delays that started appearing earlier this year.

"It has been a challenging spring with fliers waiting in lines

that take more than 60 to 90 minutes to get through security," said

Sharon Pinkerton, A4A's senior vice president of legislative and

regulatory affairs. She encouraged travelers to enroll in the TSA's

paid PreCheck program, which offers special lanes and quicker

screening, "as we move into another record-setting travel

season."

Airlines for America recently started a website called

ihatethewait.com, where travelers can tweet their airport locations

and complaints to @AskTSA, and share photos of their waits in

airport security lines, raising awareness of the issue and serving

as crowd-sourced information.

Over the three-month period ending Aug. 31, the trade group

expects an average of 95,500 more airline passengers a day than

last summer. That includes fliers traveling overseas on U.S.

carriers. To accommodate the record volumes, airlines will be

offering 2.78 million seats a day, an increase of more than 100,000

seats a day from last summer, the group said.

"We saw airfares fall throughout 2015 and that trend continued

in the first three months of 2016," said John Heimlich, the trade

group's chief economist. "Air travel is becoming increasingly

affordable and accessible."

First-quarter results for the 10 publicly traded U.S. airlines

resulted in pretax earnings of $4.8 billion, resulting in a 13.2%

pretax profit margin for the group. A year earlier, the pretax

margin was 11.2%. Revenue was flat in the first quarter, as a 6.7%

decline in fares offset traffic growth of 6.2%. Expenses slipped

1.5% as a 28.9% decline in fuel costs offset a 12.6% gain in labor

expenses.

The data include Delta Air Lines Inc., which dropped out of the

trade group last year over a disagreement about the lobbying

direction taken by A4A. That leaves as members nine major airlines,

including three cargo carriers.

Write to Susan Carey at susan.carey@wsj.com

(END) Dow Jones Newswires

May 18, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

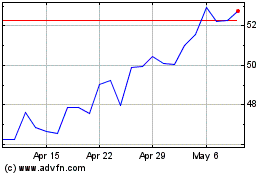

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

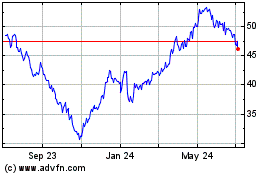

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Sep 2023 to Sep 2024