UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): September 4, 2015 (September 4, 2015)

COMMUNITY HEALTH SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-15925 |

|

13-3893191 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

4000 Meridian Boulevard

Franklin, Tennessee 37067

(Address of principal executive offices)

Registrant’s telephone number, including area code: (615) 465-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure |

On September 4, 2015, Community Health Systems, Inc. (the

“Company”) issued a press release announcing the filing of a Form 10 registration statement with the U.S. Securities and Exchange Commission (the “SEC”) by Quorum Health Corporation (“QHC”), an indirect wholly-owned

subsidiary of the Company. QHC is expected to become a new publicly traded hospital company as a result of the spin-off by the Company to QHC of a group of 38 hospitals and Quorum Health Resources, LLC, followed by the distribution of the stock of

QHC to the Company’s stockholders. A copy of the press release making this announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference into this Item 7.01.

The Form 10 contains a preliminary information statement that includes, among other things, historical financial statements for QHC for fiscal

years 2012-2014 and management’s discussion and analysis of the results of operations and financial condition for such fiscal years, as well as information related to the planned spin-off of QHC, the business of QHC and other customary legal

and financial disclosures for QHC, including risk factors. The Form 10 is accessible through the SEC’s database of online corporate financial information at www.sec.gov. A copy of the Form 10 filing will also be available on the investor

relations page at www.chs.net.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

The following exhibits are furnished herewith:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Community Health Systems, Inc. Press Release, dated September 4, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: September 4, 2015 |

|

|

|

COMMUNITY HEALTH SYSTEMS, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ W. Larry Cash |

|

|

|

|

|

|

W. Larry Cash |

|

|

|

|

|

|

President of Financial Services, Chief Financial Officer |

|

|

|

|

|

|

and Director |

|

|

|

|

|

|

(principal financial officer) |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Community Health Systems, Inc. Press Release, dated September 4, 2015. |

Exhibit 99.1

COMMUNITY HEALTH SYSTEMS FILES FORM 10 REGISTRATION STATEMENT

FOR SPIN-OFF AND ANNOUNCES QUORUM HEALTH CORPORATION

EXECUTIVE LEADERSHIP

Securities

and Exchange Commission Filing is an Important Step Forward in

Plan to Create New Publicly Traded Hospital Company

FRANKLIN, Tenn. (September 4, 2015) – Community Health Systems, Inc. (NYSE: CYH) announced today that it has filed the initial Form

10 Registration Statement with the Securities and Exchange Commission (SEC) in connection with its previously announced plan to spin off Quorum Health Corporation. The spin-off transaction will create a new, publicly traded company owning or leasing

and operating 38 affiliated hospitals and related outpatient services, together with Quorum Health Resources, LLC, a subsidiary that provides management and consulting services to non-affiliated hospitals. The

filing includes detailed information about the transaction and Quorum Health Corporation’s operations and historical financial performance. The initial Form 10 filing will be updated with additional information in subsequent amendments.

Community Health Systems, Inc. also named Quorum Health Corporation’s top executives today. Thomas D. Miller will serve as chief executive officer of the

new company, and Michael J. Culotta will serve as chief financial officer.

Thomas D. Miller, Chief Executive Officer

Thomas D. Miller currently serves as president of Division V Operations for Community Health Systems and oversees the operations of affiliated hospitals in

Indiana, New Jersey, Ohio and Pennsylvania. He joined Community Health Systems in connection with the acquisition of Triad Hospitals, Inc. in July 2007. Mr. Miller has more than 30 years of experience in hospital operations and executive

management. Prior to joining Community Health Systems, from 1998 through 2007, he served as the president and chief executive officer of Lutheran Health Network in northeast Indiana, a system that has grown to include eight hospital facilities.

During the early years of his tenure at Lutheran, the health system was operated by Quorum Health Group, Inc., a predecessor of Quorum Health Resources. Mr. Miller holds a bachelor’s degree from Auburn University and a master’s degree

in hospital and health administration from the University of Alabama at Birmingham. He currently serves on the Board of Trustees of the American Hospital Association.

Michael J. Culotta, Chief Financial Officer

Michael J.

Culotta currently serves as vice president of Investor Relations for Community Health Systems. Mr. Culotta joined Community Health Systems in 2013. He is an experienced healthcare finance executive who has served as chief financial officer at

two publicly traded companies, both of which were successful spin-offs. From 2007 to 2013, Mr. Culotta was chief financial officer of PharMerica Corporation. He held the same role at LifePoint Hospitals from 2001 to 2007. Prior to that,

Mr. Culotta was a partner with Ernst & Young where he worked for 24 years. He earned his bachelor’s degree from Louisiana State University and is a Certified Public Accountant, licensed in Tennessee, Texas and Florida.

-MORE-

CYH Files Form 10 Registration Statement For Spin-Off And

Announces Quorum Health Corporation Executive Leadership

Page

2

September 4, 2015

“The filing of the Form 10 represents an important step forward in our plans to reorganize our portfolio into two strong companies that are each uniquely

positioned for future growth,” said Wayne T. Smith, chairman and chief executive officer of Community Health Systems, Inc. “We have selected capable, experienced executives to lead the new company. Tom Miller is an accomplished

healthcare executive who has contributed to the growth of our organization by strategically advancing the operational and financial performance of the hospitals in his Division. He is an entrepreneur at heart who has led the successful integration

of some of our most significant hospital acquisitions. Mike Culotta is a highly regarded healthcare executive who brings a broad range of finance and investor relations experience to Quorum Health Corporation. He has a keen understanding of hospital

operations and adeptly navigates the complexities of healthcare finance. Tom and Mike fully embrace the opportunities available to the new company, and we are confident that, with their leadership, Quorum Health Corporation can become a vibrant,

successful healthcare enterprise.”

Quorum Health Corporation will include 38 affiliated hospitals with an aggregate of 3,587 beds operating in 16

states. The majority of the hospitals in Quorum Health Corporation’s portfolio are in cities and counties having populations of 50,000 or less, and in 84% of these markets, the hospital is the sole provider of acute care services. The new

company will also include Quorum Health Resources, LLC which provides management and consulting services to approximately 150 non-affiliated hospitals across the United States. In 2014, the businesses that

will comprise Quorum Health Corporation generated net operating revenues of $2.1 billion and adjusted EBITDA of $265 million.

The spin-off transaction is

expected to qualify as a tax-free distribution to Community Health Systems, Inc. and its stockholders. It is subject to customary conditions, certain legal and valuation opinions, effectiveness of the Form 10, and final approval and declaration of

the distribution by the Community Health Systems, Inc. Board of Directors. The transaction is expected to close during the first quarter of 2016. Quorum Health Corporation intends to have its common stock authorized for listing on the New York Stock

Exchange under the symbol “QHC.”

A copy of the Form 10 Registration Statement is available on the Investor Relations page of Community Health

Systems’ website: www.chs.net.

Advisors

Credit Suisse is serving as Community Health Systems’ financial advisor, and Bass, Berry & Sims PLC and Bradley Arant Boult Cummings LLP are

serving as legal advisors to Community Health Systems in connection with the proposed spin-off.

About Community Health Systems, Inc.

Community Health Systems, Inc. is one of the largest publicly traded hospital companies in the United States and a leading operator of general acute care

hospitals in communities across the country. Through its subsidiaries, the company currently owns, leases or operates 198 affiliated hospitals in 29 states with an aggregate of approximately 30,000 licensed beds. The Company’s headquarters are

located in Franklin, Tennessee, a suburb south of Nashville. Shares in Community Health Systems, Inc. are traded on the New York Stock Exchange under the symbol “CYH.” More information about the Company can be found on its website at

www.chs.net.

-MORE-

CYH Files Form 10 Registration Statement For Spin-Off And

Announces Quorum Health Corporation Executive Leadership

Page

3

September 4, 2015

Non-GAAP Financial Measures

EBITDA is a non-GAAP

financial measure which consists of net income attributable to Quorum Health Corporation, before interest, income taxes, and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted to exclude impairment of long-lived assets, net income

attributable to noncontrolling interests, and expenses related to legal settlements and related costs. Community Health Systems believes that it is useful to present adjusted EBITDA because it clarifies for investors Quorum Health Corporation’s

portion of EBITDA generated by continuing operations. Community Health Systems uses adjusted EBITDA as a measure of liquidity. Community Health Systems has also presented Quorum Health Corporation’s adjusted EBITDA in this communication because

it believes it provides investors with additional information about Quorum Health Corporation’s ability to incur and service debt and make capital expenditures.

Adjusted EBITDA is not a measurement of financial performance or liquidity under U.S. GAAP. It should not be considered in isolation or as a substitute for

net income, operating income, cash flows from operating, investing or financing activities or any other measure calculated in accordance with U.S. GAAP. The items excluded from adjusted EBITDA are significant components in understanding and

evaluating financial performance and liquidity. This calculation of adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

The following table reconciles adjusted EBITDA, as defined, to net cash provided by operating activities as derived from the audited combined financial

statements of Quorum Health included in the Form 10.

|

|

|

|

|

| |

|

Year Ended

December 31,

2014 |

|

| |

|

(In thousands) |

|

| Adjusted EBITDA |

|

$ |

264,825 |

|

| Interest expense, net |

|

|

(92,926 |

) |

| Provision for income taxes |

|

|

(5,579 |

) |

| Deferred income taxes |

|

|

5,007 |

|

| Legal settlements |

|

|

(30,374 |

) |

| Other non-cash expenses, net |

|

|

495 |

|

| Changes in operating assets and liabilities,

net of effects of acquisitions and divestitures: |

|

|

|

|

| Patient accounts receivable |

|

|

(86,168 |

) |

| Supplies, prepaid expenses and other current assets |

|

|

(21,910 |

) |

| Accounts payable, accrued liabilities and income taxes |

|

|

12,924 |

|

| Other |

|

|

(3,250 |

) |

|

|

|

|

|

| Net cash provided by operating activities |

|

$ |

43,044 |

|

|

|

|

|

|

-MORE-

CYH Files Form 10 Registration Statement For Spin-Off And

Announces Quorum Health Corporation Executive Leadership

Page

4

September 4, 2015

Forward-Looking Statements

Certain statements contained

in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements regarding the expected timing of the

completion of the spin-off transaction, the benefits of the spin-off transaction to either Community Health Systems or Quorum Health Corporation, the tax-free treatment of the spin-off transaction, the anticipated management of the business to be

spun off, the market position of the business to be spun off and other statements that are not historical facts. Such statements are based on the views and assumptions of the management of the Company and are subject to significant risks and

uncertainties. There can be no assurance that the proposed transaction or these future events will occur as anticipated, if at all, or that actual results will be as expected. Actual future events or results may differ materially from these

statements. Such differences may result from a number of factors, including but not limited to: the timing and completion of the proposed transaction; a failure to obtain necessary regulatory approvals; a failure to obtain assurances of anticipated

tax treatment; a deterioration in the business or prospects of the Company or Quorum Health Corporation; adverse developments in the Company or Quorum Health Corporation’s markets; adverse developments in the U.S. or global capital markets,

credit markets or economies generally; the risk that the benefits of the proposed transaction may not be fully realized or may take longer to realize than expected; the impact of the proposed transaction on the Company’s third-party

relationships; the Company’s ability following completion of the spin-off to identify and acquire additional hospitals in larger and more urbanized markets with terms that are attractive to the Company and to integrate such acquired hospitals;

and changes in regulatory, social and political conditions. Additional risks and factors that may affect results are set forth in the Company’s filings with the Securities and Exchange Commission, including the Company’s most recent Annual

Report on Form 10-K. The forward-looking statements speak only as of the date of this communication. The Company does not undertake any obligation to update these statements.

Investor Contact:

W. Larry Cash, 615-465-7000

President of Financial Services and Chief Financial Officer

or

Media Contact:

Tomi Galin, 615-628-6607

Senior Vice President, Corporate Communications, Marketing and Public Affairs

-END-

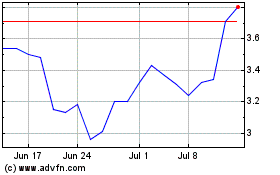

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Mar 2024 to Apr 2024

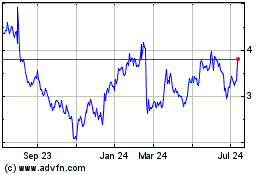

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Apr 2023 to Apr 2024